Intro: Finding the Top 10 Best Financial Advisors in New Jersey for Wealth Planning

Finding the best financial advisor for your unique financial needs can be an intimidating task, especially if you haven’t worked with a New Jersey wealth manager before. It takes a lot of trust to open up to someone about your finances (the good, the bad, and the ugly) and implement advice that directly impacts your financial well-being.

New Jersey financial advisors can help point you in the right direction and guide you on a path to a better financial future. A financial advisor’s experience and knowledge go well beyond what most of us typically have, and their expertise can be a great asset to your life.

Award Emblem: Top 10 Best Financial Advisors in New Jersey

Not all NJ financial advisors provide the same types of services, and some will be better attuned to your needs than others. Some of the qualifications you’ll want to look for when selecting the best NJ financial planning firm for your needs are:

- Transparency

- Strong values

- Services that match your needs

- A good reputation

- A client profile that you fit into

- Fee structure

- Complementary initial meeting

We’ve compiled a list of the best NJ wealth management firms and the best NJ financial advisors in 2021-2022 to give you a starting point in your search and put you on track towards reaching both your short and long-term financial goals.

AdvisoryHQ’s Top 10 Best NJ Financial Advisors | Brief Comparison & Ranking

| Best Financial Advisors in New Jersey | 2021-2022 Ratings |

| Baron Financial Group | 5 |

| Eagle Rock, A Greenberg and Rapp Company | 5 |

| HFM Investment Advisors | 5 |

| Highland Financial Advisors, LLC | 5 |

| Lighthouse Financial Advisors, Inc. | 5 |

| Modera Wealth Management | 5 |

| Mullooly Asset Management, Inc. | 5 |

| Novi Wealth Partners | 5 |

| Pathstone | 5 |

| SAGEbroadview | 5 |

Table: Top 10 Best Financial Advisors in New Jersey | Above list is sorted by rating

See Also: Best Financial Advisors in Seattle & Bellevue, WA

Finding Best NJ Financial Advisors: What Questions Should I Ask?

When you are first beginning your search for the best financial advisor in NJ, you’re going to see there are a lot of different firms to choose from. So many in fact, that it can be difficult to know where to begin and how to narrow down the field.

We’ve got several questions that can help you identify the top New Jersey wealth management firm that best fits your particular needs. By asking yourself these questions as you’re browsing the following list of firms, you can avoid being overwhelmed and can better make an informed decision.

What are my main financial goals?

Are you trying to save towards retirement? Do you have a large estate that you need a financial planner in NJ to help you manage? Perhaps you’re saving for a child’s education?

Different New Jersey financial advisors have different specialties, so you’ll first need to identify what your needs are, and then see if their specialties match your goals.

AdvisoryHQ’s Selection of Best Financial Advisors in New Jersey

How much money do I have to invest?

Certain wealth management firms in NJ will have minimum limits on the investable assets of their clients. For example, some companies work mainly with high-net-worth individuals while others welcome clients of any income level.

Look for any asset minimums when you’re evaluating financial advisors in New Jersey in order to quickly disqualify any firms that aren’t a good fit for you and your situation.

How many types of financial services do I need?

Some financial planners in NJ offer additional services such as accounting and tax management. Others may offer a smaller range of services.

Think about the full range of financial planning and wealth management needs you have. Would you benefit from some tax assistance? Are you looking for someone that understands family businesses and how ownership is transferred?

The range of services offered by a financial planner in NJ is another point to consider that can help you narrow down your options.

Is the firm fee-only or fee-based?

It’s important to know whether a top-ranking NJ wealth advisor operates under a fee-only or fee-based structure. One offers less potential for conflict of interest than the other.

Fee-only NJ financial advisors do not accept outside commissions from third parties selling financial products. This helps ensure that the advice you receive is completely unbiased.

On the other hand, fee-based NJ wealth managers may accept outside commissions, which could lead to a conflict of interest. Look for any fee-based firms to also be fiduciaries. Fiduciaries have a legal obligation to always act in the best interest of their clients.

Don’t Miss: Ranking of Top Financial Advisors in Franklin, Memphis, & Nashville, TN

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2021-2022 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Best NJ Wealth Management Firms

Below, please find a detailed review of each firm on our list of 2021-2022 best wealth management firms in NJ. We have highlighted some of the factors that allowed these NJ financial advisors to score so high in our ranking.

Click on any of the names below to go directly to the review for that firm.

- Baron Financial Group

- Eagle Rock, A Greenberg and Rapp Company

- HFM Investment Advisors

- Highland Financial Advisors, LLC

- Lighthouse Financial Advisors, Inc.

- Modera Wealth Management

- Mullooly Asset Management, Inc.

- Novi Wealth Partners

- Pathstone

- SAGEbroadview

Click below for previous years’ rankings:

- 2019 Review: 10 Best Financial Advisors in New Jersey

- 2018 Review: Top 10 Best Financial Advisors in New Jersey

- 2017 Review: Top 10 Best Financial Advisors in New Jersey

Related: Best Wealth Management Firms in Tampa & St. Petersburg, FL

Baron Financial Group Review

Baron Financial Group is a financial planner in NJ that is committed to making a positive difference in their clients’ lives. This New Jersey financial advisory firm strives to help you unlock and achieve your financial ambitions by looking beyond the numbers in your bank.

Baron Financial is an independent, fee-only NJ financial advisor that serves all types of clients, including individuals and families, organizations, retirees, women, and families with special needs. They are located in Fair Lawn, New Jersey with an additional office in Sarasota, FL.

This NJ wealth management firm works to simplify the complex areas of your financial life and help you chart a successful path to the future.

Key Factors That Enabled Baron Financial Group to Rank as One of the Best Financial Advisors in New Jersey

Client Expertise & Customized Services

As one of the best financial advisors in New Jersey, Baron Financial Group specializes in serving the following types of clients:

- Retirees

- Individuals & Families

- Women

- Families with Special Needs

- Organizations

What truly makes this NJ financial advisor stand out is their focus on providing customized services for women and families with special needs, as detailed below.

Best Financial Advisors in New Jersey

Women

To provide the best possible financial services for women, this top financial advisor in NJ is dedicated to helping women pursue their dreams on their own terms. They also understand that women have unique financial needs that benefit from expert guidance to prepare for life events like:

- Planning for retirement

- Creating a career

- Investing in personal goals

- Caring for children

- Accounting for life’s unexpected turns

- Entering divorce or widowhood

- Caring for elderly parents

- Caring for family needs

- Launching a business

This commitment to providing valuable financial services for women has paid off—Baron Financial Group has been awarded the Women’s Choice Award seal illustrating their empowerment of women.

Families with Special Needs

Baron Financial Group recognizes that families caring for special needs individuals have unique—and often complex—financial goals and needs.

Coordinating a financial plan between special needs family members and their caretakers isn’t always easy, which is why finding an experienced NJ financial advisor is crucial.

To best benefit these families, this financial advisor in NJ offers the following services:

- Comprehensive financial planning

- Knowledge of eligibility requirements for disability & government programs

- Planning for legal, education, care management, residential, benefits management, & income tax needs

Expert Asset Management

As one of the top financial advisors in NJ, Baron Financial Group is committed to crafting customized portfolios to help every client reach their financial goals, which means using an expert approach to asset management.

For this financial planner in NJ, asset management is accomplished through what they call “The Seven Essentials for Portfolio Strategy Success,” which includes:

1. Diversifying across asset classes

2. Objective security selections

3. Individual bond selections

4. Rebalancing

5. Capitalizing on institutional pricing

6. Maximizing tax efficiency

7. Behavioral discipline

A unique aspect of the firm’s approach is its commitment to behavioral discipline, or what they call making “decisions based on merit, not emotions.”

This includes choosing to hire—or replace—investment managers and fund managers based on research and analysis to find the best long-term fit, rather than making decisions based upon emotions.

This focus on long-term growth and data-driven analysis makes Baron Financial Group one of the best financial advisors in NJ for residents to consider.

Rating Summary

Baron Financial Group’s client-centric approach makes them one of the best financial advisors in New Jersey. This NJ wealth manager operates with the utmost integrity and transparency – and puts their client’s financial aspirations first and foremost.

If you like a straightforward and no-nonsense approach to financial planning, then this top NJ wealth management team will be a top choice for you.

With a fiduciary commitment and a desire to help their clients of all wealth levels achieve financial freedom, Baron Financial Group scores a 5-star rating as one of the top wealth management firms in NJ for 2021-2022.

Eagle Rock, A Greenberg and Rapp Company Review

Eagle Rock, a Greenberg and Rapp Company is dedicated to helping their clients solve needs across a variety of areas including estate planning, business continuation, personal income protection, and investment management.

Based in East Hanover, New Jersey, Eagle Rock also has additional offices in New York City, Seattle, and Ft. Lauderdale.

The firm’s specialty is providing financial guidance to high-net-worth individuals and families. This fee-based wealth management firm offers innovative solutions for often complex client needs.

Key Factors That Enabled Eagle Rock, a Greenberg and Rapp Company to Rank as One of the Best Financial Advisors in New Jersey

The M Financial Difference

As a top financial advisor in NJ, Eagle Rock is part of the nation’s premier financial services distribution organization, M Financial Group. This group is uniquely suited to serve ultra-affluent individuals and Fortune 1000 companies.

Some of the hallmarks of this New Jersey wealth management firm that make them a great fit for the needs of the wealthy include an innovative approach, track record of success, and broad range of tailored financial solutions.

When it comes to those in the high-net-worth category, they often have a unique set of financial planning requirements that differ from those at other wealth levels.

Some of the services that this top NJ financial advisor offers to their highly affluent clientele are as follows:

- Disability and long-term care insurance

- Employee benefits

- Fixes and variable annuities

- Investment advisory services

- Life insurance

- Life settlements with respect to existing insurance contracts

- Mutual funds and private investment funds

- Securities and brokerage services

Best NJ Wealth Management Firms in 2021-2022

Long-Term Future Planning

When you’re planning for wealth or asset transitions in the future, whether that’s an estate or a family business, it’s wise to have the expertise of a top financial advisor in New Jersey as a guide to ensure the best strategy.

Eagle Rock advisors can play a vital role in addressing all your financial, philosophical, and emotional needs when it comes to financial planning in both emergent situations and for the long term.

Business Continuation

One area of focus for this top financial advisory firm in New Jersey is to help business owners make plans for continuing their legacy after they’ve retired or moved on. Considerations for business continuity can include sudden/unexpected death, disability of an owner or key decision-maker, or natural disaster.

Eagle Rock advisors act as a trusted resource and strategists to help businesses plan for resiliency in all types of potential scenarios.

Estate Planning & Wealth Transfer

Another long-term planning need for wealthy individuals that these NJ wealth managers can assist with is estate planning and transition.

Their expertise offers the assurance of future financial security for you and your family for generations to come. The team will help guide you through delicate wealth transfer planning that eliminates unnecessary taxes and expenses.

Rating Summary

For those in the high-net-worth category looking for a financial advisor that has the expertise needed to handle increasingly complex financial needs, Eagle Rock is one of the best financial advisors in New Jersey to consider.

As a Greenberg and Rapp Company, their team is known for innovation and extraordinary client service that goes beyond mere satisfaction.

With a streamlined approach and experience that delivers tailored financial services to meet individual and family goals, Eagle Rock easily earns a 5-star rating as a top New Jersey financial advisor to consider working with in 2021-2022.

Popular Article: Top Financial Advisors in New York, NY

HFM Investment Advisors Review

HFM Investment Advisors is a top-rated New Jersey financial advisory firm that works to empower clients financially through both coaching and discipline. The firm is based in Glassboro, NJ, and serves clients in South Jersey and the Greater Philadelphia area.

The firm is an independent, fiduciary, fee-based NJ wealth management firm with a goal of helping its clients lead more productive lives. HFM puts client financial education at the center of its philosophy. These NJ wealth managers believe that the right financial knowledge can help clients avoid common investment and financial planning mistakes.

Key Factors That Enabled HFM Investment Advisors to Rank as One of the Best Financial Advisors in New Jersey

360° Process

As a top financial advisor in NJ, HFM works to set its clients up for success, no matter what their unique financial plan entails.

In order to do this, HFM Investment has created a 360° Process to provide its clients with a complete picture of their finances.

This 360° Process entails 6 important steps:

1. Inquiry Call: Initial call to discuss client’s current situation and assess if HFM may be a good fit.

2. Discovery Meeting: Detailed review of the client’s financial situation to set up goals and determine how exactly HFM would be able to help.

3. Connection Call: Connects client’s accounts to HFM’s portal so the client can go to one place to get a holistic overview of their finances.

4. Strategy Meeting: Sets up a timeline and actionable recommendations that will help the client work towards their goals.

5. Check-in-Meeting: Meeting to discuss the client’s progress and address any obstacles they may have run into.

6. Annual Review: Comprehensive annual review to evaluate and adjust based on what’s been going on in the client’s life.

Best Financial Advisors in NJ

Honest Approach to Retirement

The thought of retirement can be intimidating. And keeping on track throughout life of ups and downs can make retirement planning difficult for many.

Clients saving for retirement with HFM benefit from a straightforward, honest approach, which includes asking questions like:

- What if Social Security pays less than expected?

- What if one spouse—or both—needs a long-term care facility?

- When can I afford to stop working?

- Can our income keep up with inflation?

With so many unforeseen costs and life events, planning for a successful retirement can be challenging, but this top financial advisor in New Jersey can help make it easier.

Rating Summary

By emphasizing education and accountability, HFM Investment Advisors takes a unique approach to wealth management. This team of NJ wealth managers believes that the more informed a client is about investing and finances, the better the future they’ll be able to craft for themselves.

For these reasons, we’ve scored HFM with 5-stars in our biannual ranking of Best Financial Advisors in NJ.

HIGHLAND Financial Advisors, LLC Review

HIGHLAND Financial Advisors, LLC is based in Wayne, NJ, and has been serving the distinct financial needs of high-net-worth families and individuals since 1987. By proudly adhering to Real Fiduciary™ Practices that include loyalty, due care, and good faith, HIGHLAND is deeply dedicated to putting its clients’ needs above anything else.

This independent, fee-only NJ financial advisor takes a team-based approach to provide its clients the full advantage of a collaborative and creative team with varying areas of expertise.

Key Factors That Enabled HIGHLAND Financial Advisors, LLC to Rank as One of the Best Financial Advisors in New Jersey

Fee-Only & Fiduciary Advisor

As an independent, fee-only NJ financial advisor, HIGHLAND is committed to offering trusted financial advice, not selling financial products.

This means that they do not receive any outside commissions from third parties for selling financial products, and they do not sell insurance. This gives HIGHLAND’s customers the added peace of mind that the firm’s only incentive is the success of their clients.

Fiduciary Commitment

In addition to the firm’s fee-only services is the fiduciary commitment that all HIGHLAND advisors have taken.

As fiduciary, HIGHLAND advisors have a legal duty to avoid any conflicts of interest and pursue the best financial guidance for each and every client.

This commitment shows that HIGHLAND puts client trust and transparency first and foremost in everything they do, making them one of the best financial advisors in New Jersey to consider.

The Person is the Plan®

As one of the best financial advisors in New Jersey, HIGHLAND believes that financial planning is not just about your money – it’s also about your life. With that in mind, this team of NJ wealth managers strives to set clients up for success as early as possible, by creating thoughtful and personalized financial plans.

This proprietary process is called “The Person is the Plan®,” and it includes the following steps:

- Achieving Your Goals—Clients and advisors work together to discover, explore, and clarify financial needs in order to design a plan for retirement, income tax, and investments.

- Protecting Your Lifestyle—Advisors discuss potential risks and make recommendations on plans with an appropriate level of coverage to protect their clients’ lifestyles.

- Planning Your Legacy—Clients are guided and educated on how to reach their financial goals along with any trusts, wills, or estate planning needs.

- Meeting Your Unique Needs—As needed, your advisor will provide additional financial planning services such as college planning, business planning, and even executive benefits planning.

Best Financial Advisors in New Jersey

Rating Summary

For affluent families and individuals, HIGHLAND Financial Advisors in NJ has the expertise to handle a number of your complex financial needs. They also operate under a high standard of fiduciary best practices that instills trust in their clients.

With a team-based approach and a strong dedication to creative problem-solving, HIGHLAND scores a solid 5-star rating and is an excellent choice for a New Jersey financial advisor that serves clients nationwide.

Read More: Ranking of Best Wealth Management Firms in Miami & Coral Gables, Florida

Lighthouse Financial Advisors, Inc. Review

Founded in 1999, Lighthouse Financial Advisors, Inc. is a top New Jersey financial advisor based in Red Bank, NJ with a talent for strategic investing and identifying simple catalysts for the creation of long-term wealth.

As a fee-only, fiduciary NJ wealth management firm, this NJ financial advisor does not have any inherent conflicts of interest that come with accepting commissions.

Lighthouse Financial Advisors welcomes clients of all investment levels and, unlike many others, does not have any minimum asset requirements.

Key Factors That Enabled Lighthouse Financial Advisors, Inc. to Rank as One of the Best Financial Advisors in New Jersey

Wide Range of Services

As one of the best financial advisors in New Jersey, LFA offers a variety of financial services to their clients, which makes them a convenient financial planning firm to work with.

The main services that Lighthouse offers fall under these 6 categories:

- Basics

- Scorecard

- Cash Management

- Goals

- Financial Independence

- Risk Management

Best Financial Advisors in New Jersey

Here is an example of the multiple services they provide to clients:

- Portfolio Analysis/Net Worth

- Record Keeping & Spending Plan

- Mortgage Review/Refinance Analysis

- Debt Management, Reduction & Leverage

- Education Planning

- Financial Independence Planning/Retirement Analysis

- Estate Planning

- Rollovers, Pension Plans, Annuities

- Goal Setting

- Investment Implementation

- Life Insurance/Other Insurance Analysis

- Tax Planning/Tax Projection

- Tax Preparation

- Review Employee Benefits

- Financial/Life/Small Business/Entrepreneurial Coaching

Canon of Ethics

For many investors, finding a trustworthy and principled NJ financial advisor is the best way to ensure that their funds are held responsibly and their financial future is in good hands.

As a value-driven financial advisor in NJ, Lighthouse Financial Advisors operates under a Canon of Ethics, which includes the following aspects:

- As a fiduciary, LFA puts its clients’ needs above all else.

- All agreed-upon work will be completed in a timely and prompt manner.

- As fee-only advisors that do not accept commissions, LFA will act objectively.

- LFA will continuously strive to evolve, innovate, and update its services.

- LFA advisors will maintain the highest level of professional integrity.

- All client information is held confidentially to the extent allowed by law.

Rating Summary

Lighthouse Financial Advisors, Inc. is a financial advisor in New Jersey that welcomes all levels of wealth, allowing those just starting out investing to gain expert guidance as well as those who are more seasoned investors.

This distinctly client-focused financial advisory firm is guided by their clients’ hopes, dreams, and desires, with a dedication to helping them achieve a financially fulfilled life.

With an exceptional level of dedication to their clients and a welcoming atmosphere, Lighthouse Financial Advisors stands out as one of the best wealth management firms in NJ. It scores a 5-star rating in our 2021-2022 Ranking of Best Financial Advisors in NJ.

Modera Wealth Management Review

Founded in 1983, Modera Wealth Management is a top financial advisor in New Jersey with a drive to deliver services with compassion and expertise. Apart from their office in Westwood, NJ, the firm also has additional locations in Massachusetts, North Carolina, Georgia, and Florida.

This fee-only NJ wealth management firm works with individuals, families, trusts, institutions, and philanthropic organizations who typically have at least $1 million in investment assets.

Key Factors That Enabled Modera Wealth Management to Rank as One of the Best Financial Advisors in New Jersey

Investment Philosophy

Modera Wealth Management takes a long-term approach to all investments, working closely with clients to foster relationships and encourage portfolio growth through strategic planning and responding proactively to market conditions.

As defined by this NJ wealth management firm, MWM’s investment philosophy includes a focus on protection. This firm believes that those who have acquired assets over time should have proper protection throughout ups and downs in the market to ensure their wealth is maintained and nurtured.

Modera Wealth Management’s core guiding principles include:

- A Holistic Approach: The team at MWM understands that while managing your investments is often a large part of your financial plan, it’s not the only part.

- Individualized Recommendations: These top NJ financial advisors base their personalized advice on your goals, time horizon, and risk tolerance.

- Globally Diversified Portfolios: Using research-based methodologies that balance expected returns with risk, the firm works to minimize portfolio taxes and keep overall costs low.

Modera Wealth Management – Top NJ Wealth Advisors

Comprehensive Financial Planning

As a top NJ financial advisor, Modera Wealth Management works to simplify what can often be an overly complicated process of financial planning. The company offers a wide array of services, taking a holistic approach to address all areas of a client’s financial life.

The relationship-building process at this financial planning firm in New Jersey includes two formal discussions per year to monitor and review your financial strategy. However, you don’t have to wait for these meetings to ask questions. Modera invites clients to touch base with them whenever they like by phone, email, or visiting in person.

Modera’s client care includes:

- A collaborative and personalized approach

- Support for your goals based on decades of experience and research

- Finding and mitigating potential risks

- Complete transparency about fees and services

- Regular communications to keep you involved and up to date

Rating Summary

Modera Wealth Management is a top-rated NJ financial advisor that provides the unique combination of the one-on-one attention of a boutique firm and the financial expertise and resources of a larger wealth management firm.

Modera’s commitment to personalized solutions and to always putting the client’s needs first once again solidifies its 5-star rating as one of the best financial advisors in New Jersey to consider partnering with in 2021-2022.

Related: Top Financial Advisors & Wealth Management Firms in Florida

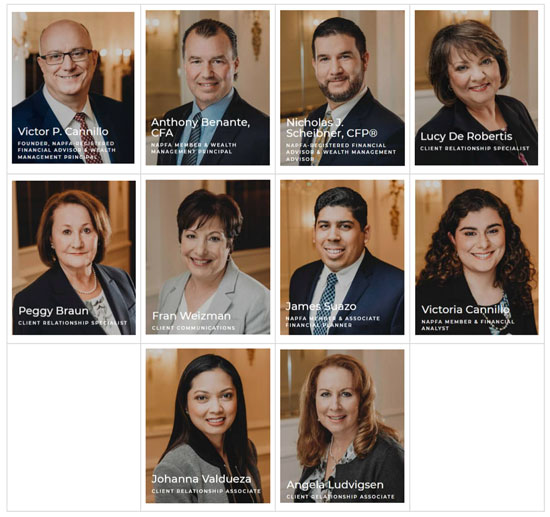

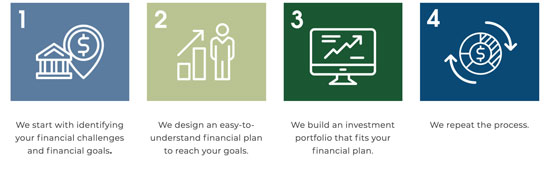

Mullooly Asset Management, Inc. Review

Mullooly Asset Management, Inc. focuses on providing a uniquely different financial advisory experience that puts the needs of their clients at the center of everything they do. Serving individuals and families since 2002, this NJ wealth management firm is committed to being transparent in everything they do.

Based in Wall Township, NJ on the Jersey Shore, this family-owned business is one of the top fee-only investment advisors in New Jersey.

Key Factors That Enabled Mullooly Asset Management, Inc. to Rank as One of the Best Financial Advisors in New Jersey

Fiduciary Standard & Fee-Only Services

When you’re looking for a reliable and trustworthy financial planner in NJ, you’re often going to decide who to work with based on whether or not they have taken a fiduciary oath.

Mullooly Asset Management operates underneath the fiduciary standard, meaning that they are legally obligated to fully disclose all information and act in their clients’ best interests at all times.

New Jersey’s Top Financial Advisors 2021-2022

Fee-Only

In addition to their fiduciary standard, Mullooly Asset Management has made a commitment to offering fee-only financial services.

Clients can take comfort in the fact that this top financial advisor in New Jersey maintains fee-only practices and philosophies, meaning that the firm does not accept any commissions, kickbacks, or incentives for the sales of any financial products.

A fee-only structure means clients can rest assured that they are receiving transparent, unbiased advice, as the firm’s success is defined by each client’s individual success.

Investment Management Process

One unique aspect of the investment management process at Mullooly Asset Management is the focus on collaboration and teamwork.

At this top NJ financial advisory firm, the small advisory team meets each morning to take stock of and discuss economic and market data pertinent to their clients’ portfolios. This includes reviewing their investment research and position.

This emphasis on real-time monitoring ensures that financial strategies are dynamic and fluid enough to accommodate changes in the market.

This collaborative approach also applies to the client-advisor relationship at Mullooly. As one of the best financial advisors in New Jersey, Mullooly Asset Management is committed to keeping in close communication with clients and helping them with their long-term goals.

Rating Summary

It’s not often that you can find the warmth and years of continuity that come from a family-owned and operated financial advisory firm, which is something that makes Mullooly Asset Management stand out among other wealth managers in New Jersey.

While this may be a smaller team, many clients appreciate the more personalized service they receive from working with a close-knit team, and many families have worked with them throughout multiple generations.

By keeping the focus on trust, integrity, and transparency – and also by offering a personalized experience – Mullooly Asset Management easily scores a 5-star rating as another top financial advisor in NJ for 2021-2022.

Novi Wealth Partners Review

Founded in 1998, Novi Wealth Partners is an NJ wealth management firm based in Princeton that serves clients both locally and nationally.

This fee-only wealth management firm in New Jersey offers comprehensive investment management, financial planning, retirement planning, tax planning, and estate planning services while also offering concierge-level wealth management.

Key Factors That Enabled Novi Wealth Partner to Rank as One of the Best Financial Advisors in New Jersey

Comprehensive Financial Planning

By adopting a holistic approach, this team of NJ wealth managers aims to establish each client’s unique goals and help them determine what needs to be done in order to reach those goals successfully.

Novi Wealth Partners’ comprehensive approach consists of the following steps:

- Establish Goals – Advisors work to discover what the client’s financial goals are.

- Data Gathering – The client receives clarity and knowledge regarding their own unique financial situation.

- Education & IPS – This step ensures that the client has made the best decisions based on their personal investment plan.

- Presentation of Analysis – A comprehensive & well-thought-out assessment and action plan is presented that will help guide the client to their goals.

- Implementing Solutions – Implementation of the client’s personalized plan.

- Proactive Monitoring – Continuous prudent and responsible monitoring of the client’s financial situation takes place.

Top Financial Advisors in NJ

Investment Management

By designing each portfolio with their clients’ best interests in mind, Novi Wealth Management always ensures that their customers are set up for success.

This wealth manager in NJ works with clients to ensure that strategic asset allocation, asset location, and logic build the foundation for a unique investment plan that helps clients grow and hold onto wealth.

As fiduciary financial advisors, the team at Novi Wealth Management creates custom investment plans that are tailored to each client’s financial needs while also helping them focus on elements that add value.

All investments are founded on Novi’s 5 Core Principles:

- Markets Work

- Global Diversification

- Managing Risk & Behavior is Essential

- Portfolio Design Matters Most

- Tax-Efficient, Cost-Effective Implementation

By meeting regularly and providing quarterly performance reports, this wealth planning firm in New Jersey makes sure that clients stay informed and have a holistic understanding of their finances.

Rating Summary

As a fiduciary, Novi Wealth Management aims to always stay true to its deeply rooted values and bring value and peace of mind to its clients.

By holding themselves to a fiduciary standard and striving to give their clients a greater sense of well-being and freedom, these NJ wealth managers have proved that they deserve a place in our 2021-2022 ranking.

Offering a plethora of customized services and educational articles and media, Novi Wealth Management is clearly working to give its clients a better understanding of their financial lives.

For all of the aforementioned reasons, we’ve awarded Novi with a 5-star rating.

Don’t Miss: Best Wealth Management Firms in Ohio

Pathstone Review

As an independent, partner-owned advisory firm in New Jersey, Pathstone provides objective advice to families, family offices, and select nonprofit institutions.

With the goal of helping its clients create, manage, preserve, and grow wealth across generations, this financial advisory firm in New Jersey provides smart solutions that withstand the test of time.

Apart from their office in Englewood, NJ, Pathstone has ten additional locations across the US.

Key Factors That Enabled Pathstone to Rank as One of the Best Financial Advisors in NJ

Family Office

Each family has its unique needs and requirements, so family offices are created with just that in mind – and this is where Pathstone strives. This NJ financial advisory firm offers comprehensive in-house services and solutions that are customized for each individual family’s specific needs.

Built to address all the interconnected investment, income tax, estate planning, and risk management decisions, Pathstone’s family offices aim to deliver and measure results across many generations.

Regardless of what your family goals are, this wealth management firm in New Jersey uses a plethora of resources and services to help your family reach your goals.

Some of the services offered by Pathstone’s Family Office include:

- Advisory Services

- Administration

- Financial Planning

- Financial Reporting

- Estate Planning

- ESG & Impact

- Tax Planning

- Philanthropy

- Property Management

- Insurance & Risk Management

- …and more!

2021-2022 Top Financial Advisors in New Jersey

HerPath

HerPath is Pathstone’s initiative which was founded on a belief that when women become more empowered in their financial matters, this newfound confidence also carries over to other areas of their lives.

By creating dedicated tools and strategies, Pathstone aims to help women successfully navigate through a variety of financial situations. HerPath also gives female clients an opportunity to connect with other women who are facing similar opportunities and challenges.

HerPath provides:

- A structured community setting for women to learn from each other and grow.

- A safe environment for clients to ask any wealth-related questions and address any issues they may be facing.

- A great opportunity to connect with other women through facing similar opportunities and challenges.

- A place to explore and share new ideas.

- A space to promote women in the wealth management industry.

Rating Summary

Pathstone’s dedication to working with a diverse client base gives them a unique opportunity to truly understand all the techniques and solutions that work best.

By always being open to new ideas and striving to continuously improve, this financial planning and wealth management firm in New Jersey looks out for its clients both now and well into the future.

With a plethora of family-related services and a focus on empowering women in wealth management, Pathstone has deserved a 5-star rating on our 2021-2022 Ranking of Financial Advisors in NJ.

SAGEbroadview Review

With a mission to help professionals unclutter their financial lives, SAGEbroadview is a top financial advisor in New Jersey with offices in Morristown, NJ, Farmington, CT, and Burlington, MA. This team of financial advisors also works virtually across the country.

This fee-only NJ wealth management firm is “tax-centric,” offering expert financial life planning and portfolio management services that help clients stay the course financially, no matter what surprises life throws at them.

Key Factors That Enabled SAGEbroadview to Rank as One of the Best Financial Advisors in New Jersey

Niche Focus on Busy Professionals

Not all financial advisors in NJ are prepared to handle the unique financial challenges encountered by busy professionals and business executives such as taxes, employee benefits, and stock options. But this is an area in which SAGEbroadview truly excels.

As a top financial advisor in New Jersey, SAGEbroadview specializes in serving the needs of both rising and established professionals in the following areas:

- Corporate Executives/Managers

- Medical Professionals

- Attorneys

- Small Business Owners

- Entry-Level Careers

SAGEbroadview’s niche focus on both young and established professionals makes this team one of the best financial advisors in New Jersey for those climbing the corporate ladder and looking for guidance through an array of personal and business-related financial challenges.

2021-2022’s Top NJ Wealth Management Firms

Financial Planning That’s as Unique as You Are

SAGEbroadview, one of the best financial advisors in New Jersey, does not believe that financial solutions should be “cookie-cutter” style. Each and every client is unique, and all solutions are customized to each client’s distinct needs, goals, and lifestyle.

This top NJ financial advisor’s services are organized into 6 distinct areas:

- Get Organized – At this session, the team at SAGEbroadview uses digital tools to build your Net Worth Dashboard as a base for crafting your financial plan.

- Discovery – The discovery process with SAGEbroadview is designed to be an enjoyable “get to know you” session where your advisors can understand your hopes, dreams, and overall financial picture.

- Analyze, Recommend & Make It Happen – This is where a team of experts formulates a full-bodied plan and recommends strategies across a wide spectrum of planning areas including retirement planning, income tax, insurance, education, and more.

- Design & Manage Investments – Another team of expert NJ financial advisors will craft and manage a mindful investment strategy designed to be low-cost and tax-efficient.

- Regularly Review Progress – Your progress towards your financial goals is monitored and reviewed with you regularly.

- Assist Along the Way – When something new comes up such as buying or selling your house, a new job offer, or a new marriage or baby, your trusted team of NJ financial advisors at SAGEbroadview is there for you.

Rating Summary

With a clear focus on the specific financial needs being juggled by business professionals, SAGEbroadview is a great option for many corporate employees and executives looking for an honest and trustworthy New Jersey financial advisor.

These NJ financial advisors also limit their client load in order to better provide personalized attention to each client.

The above qualities, along with their expertise and positive track record, earn SAGEbroadview a 5-star rating as one of the best financial advisory firms in NJ to work with in 2021-2022.

Popular Article: Top Financial Advisors in Boston, MA

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – 2021-2022 Best Financial Advisors in New Jersey

New Jersey offers a wealth of expert top financial advisors to meet the needs of any family or individual. From high-net-worth families to young professionals, and those nearing retirement on the Jersey Shore, you can find an excellent option among these top 10.

Once you’ve reviewed all the amazing NJ advisors in our 2021-2022 ranking, it’s time to narrow down your options for a wealth management firm that will help you chart a successful financial path. Ideally, you’ll want to meet with 3-4 of them to get a feel for how good a fit they are for your needs before you commit.

When choosing the best financial planner in NJ or partnering with an NJ wealth management firm, keep in mind the questions we mentioned earlier. You may even want to bookmark this page so you can refer to these questions later and make sure that you’ve covered them during the initial meeting.

By identifying upfront your unique financial requirements and dreams and goals for the future, you’ll be well-equipped to locate the best financial advisor in New Jersey that can help you make them a reality. Best of luck!

Image sources:

- https://pixabay.com/photos/atlantic-city-new-jersey-city-4000163/

- https://baron-financial.com/about

- https://greenbergandrapp.com/

- https://hfmadvisors.com/

- https://www.highlandplanning.com/how-we-help/

- https://lfadvisors.com/work/

- https://www.moderawealth.com/

- https://mullooly.net/

- https://www.pathstone.com/smart/

- https://sagebroadview.com/our-approach-2/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.