Getting the Best Mortgage Loans & Rates in North Carolina (10-15-30-Year Fixed, 5/1, 7/1 ARM)

According to Investopedia, the median home price in North Carolina was $149,500 last year, and prices are rising.

As home prices continue to increase, so do the closing costs associated with purchasing a home. On average, new homeowners can expect to pay nearly $2,000 in closing costs alone.

For an in-depth analysis of the average closing costs in North Carolina, click here to go directly to our “Average Closing Costs in North Carolina” section.

Refinancing or buying a home in Charlotte, Raleigh, Greensboro, Durham, Winston-Salem, Fayetteville, Wilmington, or any other city in North Carolina represents an extremely important—and expensive—commitment.

Taking the time to find the best North Carolina mortgage rates before you commit is key to saving money throughout the life of the loan.

Current Louisiana Mortgage Rates | Best Louisiana Mortgages for Good-Excellent Credit Borrowers

Which North Carolina City Are You Located in?

North Carolina mortgages for residents with good, best, and excellent credit scores will have varying NC mortgage rates depending on a variety of factors.

Factors that influence North Carolina mortgage rates include the city of residence, the down payment amount, total loan amount, the condition of the home, the borrower’s credit score, and more.

Most North Carolina mortgage lenders in Durham, Raleigh, Wilmington, Greensboro, Winston-Salem, and other cities require a down payment of around 20 percent. See below for a list of the ten largest cities in North Carolina.

Top North Carolina Cities | Population (2016) |

| Charlotte | 842,051 |

| Raleigh | 458,880 |

| Greensboro | 287,027 |

| Durham | 263,016 |

| Winston-Salem | 242,203 |

| Fayetteville | 204,759 |

| Cary | 162,320 |

| Wilmington | 117,525 |

| High Point | 111,223 |

| Greenville | 91,495 |

Source: Google

Average Closing Costs in North Carolina

Finding the best mortgage rates in North Carolina is a great way to decrease both long-term and immediate costs associated with buying a home. For NC residents, this is particularly important, since closing costs in the state are slightly higher than the national average.

For example, many homebuyers in North Carolina can expect to pay between 3-4 percent of the total home’s value in closing costs alone.

While specific costs will depend on local pricing and individual transaction details, see below for an approximate estimate of average closing costs for North Carolina mortgage loans:

- $713 in attorney’s fees for settlement

- $620 for a property survey

- $421 for an appraisal

- $125 for a home inspection

- $75 for document preparation

- $100 in postage and courier services

- $75 for tax services

- $21 for a credit report

- $10 for flood certifications

Current Mortgage Rates in Colorado for Good – Excellent Credit Borrowers

Current Mortgage Rates for WI | Top Wisconsin Mortgage Rates for Good-Best Credit

Good, Great, or Excellent Credit Score for North Carolina Mortgages

Most home lenders that provide competitive North Carolina mortgage rates use the FICO credit score to determine whether a borrower is trustworthy. These scores range between 300-850, with North Carolina mortgage lenders considering borrowers with lower scores as bigger financial risks.

Mortgage rates in NC will typically use the following range of FICO scores:

- 300 – 629 is considered a bad credit score

- 630 – 689 is considered a fair credit score

- 690 – 719 is considered a good credit score

- 720 – 850 is considered an excellent credit score

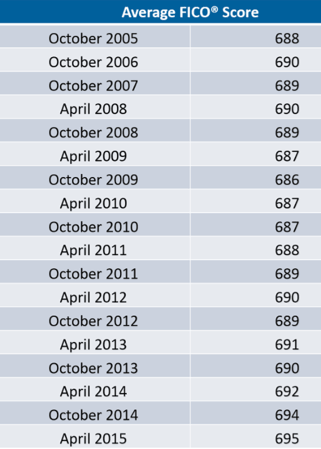

See the table below for the average FICO score from 2005-2015. According to CNBC, as of this year, the average score is at an all-time high of 700.

Current Maryland Mortgage Rates | MD Mortgage Rates & Refinance Rates for Good-Best Credit

Current Mortgage Rates | GA Mortgage Rates for Good & Best Credit

Conclusion – Finding a Top Mortgage Loan for a Home in North Carolina

Finding great mortgage rates in NC may take time, but the payoff is certainly worth the effort. As you are searching for the best mortgage rates in North Carolina, you may want to ask yourself the following questions:

- Do the best North Carolina mortgage rates come from banks or credit unions?

- Can I get better North Carolina refinance rates or North Carolina mortgage loans from online-only lenders?

- Which lenders offer competitive NC mortgage rates in Cary, Greensboro, Raleigh, Durham, Wilmington, or Winston-Salem?

Ultimately, finding the best mortgage rates in NC is a combination of long-term affordability and partnership. No matter what North Carolina mortgage lender you choose, it’s important to partner with a financial institution that you trust and are comfortable working with for the next few decades.

There are plenty of ways to identify the best North Carolina mortgage lender, including the types of fees they charge, their quality of customer service, what sort of support they offer North Carolina mortgage borrowers, and how competitive their North Carolina mortgage rates are.

Current MA Mortgage Rates | Best Massachusetts Mortgage Rates Today

Current Mortgage Rates in Indiana | Best Indiana Home Loan Rates for Good Credit

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://www.pinterest.com/pin/336784878358200243/?lp=true

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.