Getting the Best Mortgage Rates in Maryland (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Are you in the market to buy a home in Maryland? Are you looking to refinance an existing Maryland mortgage loan?

If so, now may be the best time to do it. As mortgage rates in Maryland continue to decrease, more homeowners are applying for new loans and mortgage refinances.

In fact, at the time of this writing, new mortgage applications had increased by 4 percent, while refinance applications rose by 11 percent.

Before refinancing or buying a home in Baltimore, Frederick, Silver Spring, Hagerstown, Annapolis, Bowie, Rockville, Salisbury, Gaithersburg, or any other city in Maryland, you’ll want to make sure you are up-to-date on the current Maryland mortgage rates.

Current Montana Mortgage Rates | MT Refinance Rates & Mortgages for Good-Excellent Credit Borrowers

Which Maryland City Are You Located in?

When it comes to finding the best Maryland mortgage rates, there are plenty of factors to consider. For many Maryland mortgage lenders, the location of the home will play a large role in what type of Maryland mortgage rates are available.

This means that homes in Baltimore, Silver Spring, Frederick, Gaithersburg, Rockville, Bowie, Hagerstown, and other cities could have varying mortgage rates in Maryland based on the individual city, neighborhood, and the condition of the home itself.

While you are searching for the best Maryland mortgage rates, it may be worthwhile to check the rates for neighboring cities to explore other mortgage rates in Maryland that could potentially be more affordable over the long run.

See the table below for a list of some of the largest cities in the state offering a wide range of Maryland mortgage lenders.

| Top Maryland Cities | Population (2016) |

| Washington, D.C. | 681,170 |

| Baltimore | 621,849 |

| Silver Spring | 71,452 |

| Frederick | 70,060 |

| Gaithersburg | 67,776 |

| Rockville | 66,940 |

| Bowie | 58,393 |

| Hagerstown | 40,452 |

| Annapolis | 39,148 |

| Salisbury | 33,114 |

Source: Google

Needed Documents for a Maryland Mortgage Loan Application

According to Chase bank, below are the most common mortgage loan paperwork and documents that you’ll need to gather when applying for a Maryland mortgage loan.

- Paystubs reflecting at least 30 days of income

- Names/addresses of employers for the past two years

- W-2 records for the past two years

- 1-2 years of tax returns

- Completed and signed form 4506-T or 4506T-EZ

- 2-3 months of bank statements

- Year-to-date profit and loss statements and signed returns for past two years (if self-employed)

- Proof of pension income, if applicable

- Social Security and Disability payments, if applicable

- Dividend earnings

- Bonuses

- Child support or alimony payments (optional disclosures)

- Copy of earnest money deposit

- Any information on debts like car loans, student loans, or credit cards

- Security accounts (stocks, bonds, life insurance)

Current Mortgage Rates in Maine | Home Loans in Maine for Good-Excellent Credit Borrowers

Current Mortgage Rates in West Virginia | Best WV Home Loans for Good-Excellent Credit Borrowers

Good, Great, or Excellent Credit Score for a Maryland Mortgage Loan

Most Maryland mortgage lenders use a FICO score to determine if a Maryland-based borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

When applying for Maryland mortgage rates, FICO scores for borrowers generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

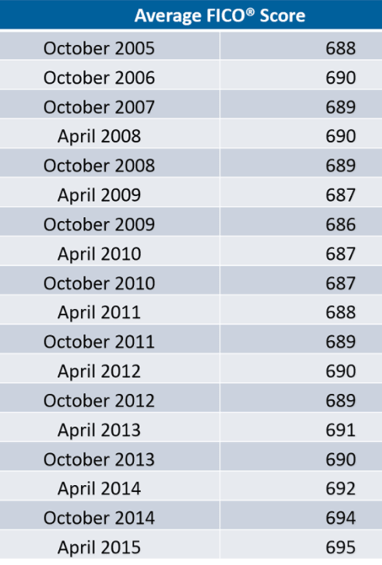

If you are curious about the average credit score, please refer to the below table of FICO scores from 2005-2015. According to CNBC, as of this year, the average score is now 700.

Current Mortgage Rates in Utah | Best Utah Mortgage Rates for Good-Excellent Credit

Current Mortgage Rates in Nevada | Best Nevada Mortgage Rates for Good-Excellent Credit Borrowers

Conclusion – Finding a Top Mortgage Loan for a Home in Maryland

Purchasing a home in Maryland can be an exciting time. For many, buying a home represents change, renewal, progress, and the pride of ownership.

Not surprisingly, purchasing or refinancing a Maryland mortgage can also be an expensive time, particularly when it comes to MD mortgage rates.

Understanding your options for Maryland mortgage rates and Maryland refinance rates is crucial—no matter what mortgage rates in Maryland you choose, you’ll want to ensure that a Maryland mortgage or refinance sets you up for financial success over the long run.

After all, a Maryland mortgage will stick with you for the next few decades, making it crucial for each potential homeowner to find the best Maryland mortgage rates.

Current Mortgage Rates in Nebraska | Best Home Loans in Nebraska for Good-Excellent Credit Borrowers

Current Mortgage Rates in New Mexico | Best NM Mortgage Rates for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/home-for-sale-house-estate-sale-2409037/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.