Getting the Best Mortgage Rates in Florida (10-15-30-Year Fixed, 5/1, 7/1 ARM, or Jumbo Loans)

FL Mortgage Rates and Loans for Fair, Good, Great, and Best Credit Scores

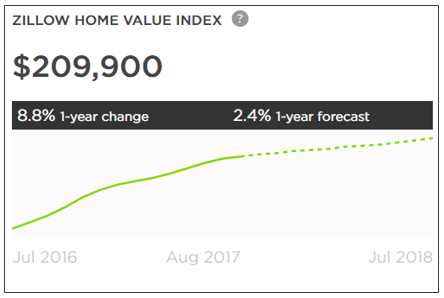

Average home prices in Florida have gone up 8.8% over the past year, with median home prices around $210,000, according to data from Zillow.com (see below). Zillow also predicts that prices will rise by about 2.4% within the next year.

Florida Home Prices & Values

With the Atlantic sea on one side and the Gulf of Mexico on the other, Florida has hundreds of miles of beaches, which is one reason it is called the “Fishing Capital of the World.” That’s also another reason why over the last couple years the Florida housing market has been on the rise.

So, are you in the market to buy a home in Florida? Or are you interested in refinancing an existing Florida mortgage loan?

Refinancing a loan or buying a home in Orlando, Jacksonville, Miami, Fort Lauderdale Tampa, St. Petersburg, Hialeah, Tallahassee, Port St. Lucie, or any other city in Florida will be one of the most important purchases you will ever make, either as your primary home or as an investment (where you wait for the home price to rise, and then you sell it).

Taking the time today to find the best Florida home mortgage rates is key to saving money in the long-term. Most importantly, comparing current loans being offered by mortgage lenders in Florida, before you purchase your home, is critical because today’s Florida mortgage rates are constantly changing.

Current Mortgage Rates in Arkansas | Best AR Mortgages for Good-Excellent Credit Borrowers

Best Refinance & Purchases Loan Rates Today | Lower Interest Rate Payments

Which Florida City Are You Located in?

If you are a Florida based resident with a good, great, or excellent credit score, the mortgage loan amount and rate that will be offered to you depends on some key factors, including the city in which the house is located, as well as how much down payment you are putting on the house, the overall requested loan amount, the value of the house, the mortgage type (15-year, 30-year, 7/1 ARM, VA, etc.), the amount of current debt that you owe, and your credit score.

Most mortgage lenders in Miami Beach, Jacksonville, Daytona Beach, Miami, Tampa, Orlando, St. Petersburg, Hialeah, Tallahassee generally require a mortgage down payment of around 20%.

Free Personal Finance and Investing Software

How Much House Can You Afford Today?

Largest Cities in the State of Florida

Below is a list of the largest cities in Florida, as well as their respective population count. As noted in the section above, the city in which the house you want to buy is located in is a key factor used by Florida mortgage lenders in determining the interest rate that will be offered to you.

Largest Florida Cities by Population Rank

| Florida Cities | Pop |

| Jacksonville | 880,619 |

| Miami | 453,579 |

| Tampa | 377,165 |

| Orlando | 277,173 |

| St. Petersburg | 260,999 |

| Hialeah | 236,387 |

| Tallahassee | 190,894 |

| Port St. Lucie | 185,132 |

| Cape Coral | 179,804 |

| Fort Lauderdale | 178,752 |

| Pembroke Pines | 168,587 |

| Hollywood | 151,998 |

| Miramar | 138,449 |

| Gainesville | 131,591 |

| Coral Springs | 130,059 |

| Clearwater | 114,361 |

| Miami Gardens | 113,058 |

| Lehigh Acres | 110,244 |

| Palm Bay | 110,104 |

| Pompano Beach | 109,393 |

| Brandon | 108,287 |

| West Palm Beach | 108,161 |

| Lakeland | 106,420 |

| Davie | 101,871 |

| Spring Hill | 101,709 |

| Boca Raton | 96,114 |

| Sunrise | 93,734 |

| Plantation | 92,706 |

| Miami Beach | 91,917 |

| Deltona | 90,124 |

| Alafaya | 85,167 |

| Palm Coast | 85,109 |

| Largo | 83,065 |

| Town ‘n’ Country | 82,219 |

| Melbourne | 81,185 |

| Riverview | 79,886 |

| Deerfield Beach | 79,764 |

| Fort Myers | 77,146 |

| Kendall | 76,267 |

| Boynton Beach | 75,569 |

| Lauderhill | 71,626 |

| Weston | 70,015 |

| Kissimmee | 69,369 |

| Homestead | 67,996 |

| Delray Beach | 67,371 |

| Pine Hills | 66,906 |

| Daytona Beach | 66,645 |

| The Villages | 66,083 |

| Tamarac | 65,199 |

| North Port | 64,274 |

| Wellington | 63,900 |

| Jupiter | 63,813 |

| North Miami | 62,139 |

| Port Orange | 61,105 |

| Poinciana | 59,927 |

| Palm Harbor | 59,769 |

| Coconut Creek | 59,405 |

| Kendale Lakes | 59,354 |

| Ocala | 59,253 |

| Sanford | 58,605 |

| Doral | 57,947 |

| Margate | 57,870 |

| Tamiami | 57,195 |

| Sarasota | 56,610 |

| Port Charlotte | 56,434 |

| The Hammocks | 55,713 |

| Bradenton | 55,687 |

| Fountainebleau | 55,596 |

| Bonita Springs | 54,198 |

| Pensacola | 53,779 |

| Palm Beach Gardens | 53,778 |

| Pinellas Park | 52,137 |

Data Source: Wikipedia

Taxes and Insurance Excluded from the Florida Mortgage Terms

Home loan terms (APR and payment info) often do not include amounts for Florida taxes or insurance premiums that are required by the state of Florida.

As such, your monthly payment amount will be greater after Florida taxes and insurance premiums have been calculated and included by the lender.

Map of the State of Florida

Key Requirements for Buying a Home in Florida

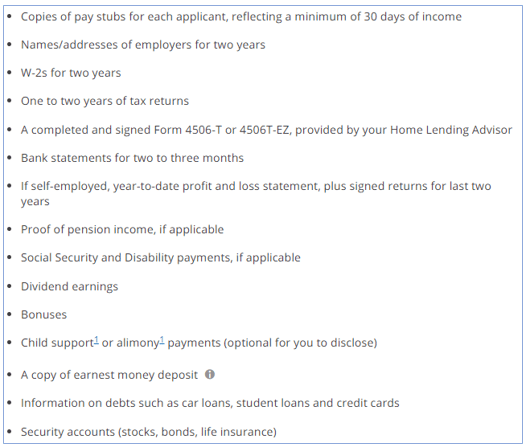

When applying for a Florida mortgage loan, you’ll want to keep this list of home buying requirements in mind:

- Get your financial documents in order. When you apply for a loan, you typically need to provide quite a bit of information. This paperwork allows your lender to verify your income and assets.

- Everyone listed on the loan application must provide their individual financial information

- Get your down payment ready (~20% of the loan amount)

- Maintain a good to excellent credit score (pay down some of your credit card balances)

- Save some extra funds for your closing cost (for any additional last minute expenses)

- Figure out which loan type you need: a conventional mortgage loan (30-year mortgage – which is the most common, 10-year, 15-year, 20-year mortgage) or an adjustable-rate mortgage (5/1, 3/1, 7/1 ARM)

Mortgage Rates & Loans Calculator

Retirement Calculator Tool | Retirement Income Calculator

Needed Documents for a Mortgage Loan Application

According to Chase bank, below are the most common mortgage loan paperwork and documents that you’ll need to gather when applying for a mortgage loan.

Home Loan Types Offered by Lenders in Florida

Home lenders and originators that provide mortgage loans in Florida provide a wide range of conventional and adjustable-rate loan types, including those listed below.

Conventional mortgage loans in Florida:

- 10-year mortgage loans

- 15-year mortgage loans

- 20-year mortgage loans

- 30-year mortgage loans

A conventional mortgage loan in Florida is a loan that has a fixed-interest rate that won’t change throughout the life of the loan. A “conventional” (also referred to as a conforming) mortgage conforms to established industry and regulatory guidelines based on size of the loan and your financial situation. Terms for these conventional loans typically range from 10 to 30 years.

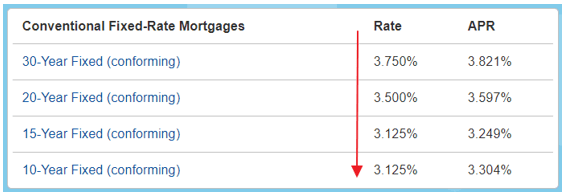

Shorter-termed 10-, 15-, 20-year fixed-rate mortgage normally have lower interest rates than the longer 30-year fixed mortgage loan. For example, below is a conventional mortgage rate table from U.S.Bank’s website that shows reduced rates for 20>15>10-year loans.

These shorter-termed 10-, 15-, and 20-year Florida loans can help you pay off your home faster and build equity more quickly. However, your monthly payments (interest and principal) will be higher than with a 30-year loan. The 10-, 15-, and 20-year fixed-rate mortgages are especially popular for refinancing.

Adjustable-rate mortgages in Florida include:

- 5/1 ARM

- 7/1 ARM

- 3/1 ARM

Personal Loan Calculator | Calculate Your Loan Payments

Best Online Brokers – Comparison | Get the Best Online Trading Account for You

Conclusion – Getting a Loan from Mortgage Companies in Florida

As we conclude this guide on finding and selecting the best mortgage rates and loans in Florida, it is important to note that there are many important factors that go into choosing the best mortgage lenders in Florida.

Use the information within this article as a starting point for your own research in finding the best mortgage lender in Florida that is best for you.

Remember that a lot is at stake, and the time you take in doing your research can reap immense benefits to you in the long-run when it comes to buying a home in Florida or refinancing an existing Florida mortgage loan.

Best CD Rates Today | CD Rates: National High Yield

Best Savings & Money Market Account (MMA) Rates Today | Comparison

Florida Mortgage Rate Tables Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image Sources:

- https://www.zillow.com/fl/home-values/

- https://www.google.com/maps/place/Florida/

- https://www.chase.com/personal/mortgage/home-mortgage/financing-home/application-documents

- https://www.usbank.com/home-loans/mortgage/conventional-fixed-rate-mortgages.html

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.