RANKING & REVIEWS

TOP RANKING ROBO ADVISORS IN CANADA

Top Robo Advisors in Canada Ranking & Reviews

Until rather recently, if you were interested in investing or trading stocks, you either took it upon yourself or hired a financial advisor. There was no such thing as a Canadian robo advisor.

Compared to the resources utilized by Canadian robo advisors, doing the job yourself hardly compares, and hiring a financial advisor not only requires a huge investment, but it can also be expensive.

In recent years, robo advisors in Canada have emerged as a more convenient, more affordable, and for many, a more effective option. These online stock trading platforms utilize varying degrees of automation, adding the “robo” adage.

Some robo advisors in Canada are fully-automated, and a computer-generated portfolio is offered based upon criteria input by the client. Other Canadian robo advisors offer a streamlined online interface, supported by real people behind the scenes.

Not everyone has the time, desire, and knowledge to understand the market and know how to manage their investments. More importantly, not everyone wants to.

For these reasons, AdvisoryHQ’s research team has taken our signature methodology and applied it to Canadian robo advisors. We have pored through service offerings, rates, company values, procedures, and other Canadian robo advisor reviews so that you don’t have to.

The result is our in-depth review of the best robo advisors in Canada, presented below.

Award Emblem: Top 8 Best Canadian Robo Advisors

Top 8 Best Canadian Robo Advisors | Brief Comparison & Ranking

Top Canadian Robo Advisors | Highlighted Features | Ratings |

| BMO SmartFolio | Competitive industry features & services | 5 |

| ModernAdvisor | Free 30-day, no-risk trial | 5 |

| Nest Wealth | Personalized, expert approach | 5 |

| Portfolio IQ | Dynamic programs & pricing plans for lower net worth investors | 5 |

| WealthBar | Simple, personalized setup process | 5 |

| Wealthsimple | Energetic marketing & appeal towards millennial investors | 5 |

| Invisor | Flat-rate pricing structure treats all accounts equally | 3 |

| ShareOwner | Transparent, flexible pricing | 3 |

Table: Top 8 Best Canadian Robo Advisors | Above list is sorted by rating

What Kinds of Fees are Charged by a Canadian Robo Advisor?

With an average Management Expense Ratio (MER) of 2.3 percent from traditional advisors, it’s no wonder that Canadian robo advisors are rising in popularity.

Despite the various fees charged by robo advisors in Canada, it’s likely that these fees will still be incrementally lower than the national average.

Each robo advisor in Canada will charge a different rate for different services. Usually, there is a monthly “account” fee which is billed as a flat rate and includes your basic portfolio services.

After that, some Canadian robo advisors charge a fee for every trade or transaction within your portfolio. These fees may be separate or included in your service package, varying anywhere from one cent to $10.

Other fees and commissions may apply to your transactions depending on the company you choose and the amount you invest. Always ask your advisor for an upfront itemization of what your fees will be.

Best Canadian Robo Advisors

What Should I Ask Before Signing up with Canadian Robo Advisors?

When using the services of a Canadian robo advisor, sometimes it’s not always possible to have a conversation with the person in charge of your portfolio.

Other times, there’s someone standing by to answer your questions. If the opportunity is present, some things you may want to know about include:

- Are they affiliated with any other brokers or institutions? (Affiliation is not always a bad thing)

- Do they work based upon commission?

- Where will your money be held?

- How many people will be handling your financial information?

- What are the stipulations should you decide to cancel your services?

These questions offer a good starting point when evaluating Canadian robo advisors, and the conversation should develop from there.

It may also help to look at related Canadian robo advisor reviews beforehand to get a better handle on the practices and procedures for a specific advisor.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking of the Best Canadian Robo Advisors

Below, please find a detailed review of each advisor on our list of best Canadian robo advisors. We have highlighted some of the factors that allowed these robo advisors in Canada to score so high in our selection ranking.

Click on any of the names below to go directly to the review section for that firm.

Click below for previous years’ rankings:

- 2016 Ranking: Top 6 Best Robo Financial Advisors in Canada

- 2017 Ranking: Top 6 Best Robo Financial Advisors in Canada

BMO SmartFolio Review

BMO SmartFolio is a personal investing solution that offers affordable ETF portfolios which are completely customizable to meet your individual investing needs.

As a hybrid Canadian robo advisor, BMO provides a great solution for consumers looking for a healthy mix of intelligent robo investing and expert input from financial professionals.

SmartFolio has a team of portfolio managers working behind the scenes, combining professional expertise with advanced robo investing in Canada.

With over $300 billion in assets under management propelled by over 300 years of combined professional industry expertise, BMO considers itself to be an expert in the Canadian robo advisor industry.

Key Factors That Enabled BMO SmartFolio to Rank as a Best Robo Advisor in Canada

Below, please find a list of key characteristics that allowed BMO SmartFolio to rank so highly in our robo advisor review.

Aligned Industry Features

As a hybrid Canadian robo advisor, BMO SmartFolio offers clients competitive features to enhance the investing experience. Investors can benefit from the following advantages:

- Affordable, diversified ETF portfolios

- Input goals to track progress

- Hands-free investing

- Access from anywhere, on any device

Annual Pricing

At BMO, pricing is simple and affordable. Investors can open an account with as little as $5,000, with all trading costs covered by advisory fees.

Pricing for this hybrid Canadian robo advisor is split between two types of fees: the Management Expense Ratio and the advisory fee.

All ETFs have management fees and expense ratios included in their price, called the Management Expense Ratio (MER). According to BMO, the MER is likely to be a weighted average between 0.20-0.35 percent of the total investment amount.

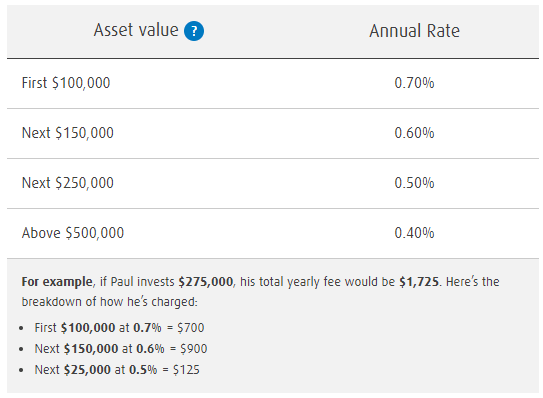

Canadian robo advisory fees for BMO operate on a sliding scale depending on the total amount invested, shown in the image below:

BMO SmartFolio Rates

Currently, BMO is holding a promotion for new clients that sign up by January 3, 2018, offering to manage the first $15,000 without advisory fees through March 2019.

BMO SmartFolio Rating Summary

If you’re looking for a robo advisor in Canada that provides customer service and advice from actual people, BMO is a great fit.

They also offer competitive features, keeping BMO SmartFolio as one of the best Canadian robo advisors on the market.

However, compared to the other top Canadian robo advisors on our list, BMO has some of the highest annual rates, especially for investors with $100,000 or less. What makes BMO SmartFolio one of the best robo advisors in Canada is their effort to circumvent high annual rates through promotional offers.

For smaller investors, having the first $15,000 managed for free can make a huge difference in the effectiveness of their portfolio—or whether they choose to invest at all—earning BMO SmartFolio a 5-star rating.

High net worth investors should certainly consider BMO SmartFolio, but without a promotional period, investors with less assets to set aside may want to consider a more affordable option.

See Also: Top Betterment Competitors | Review of Betterment Alternatives & Sites Like Betterment

Invisor Review

With less than ten team members, Invisor is a small Canadian robo advisor with a large outreach and even bigger value proposition.

Founded in 2014, Invisor seeks to simplify investing and help Canadians reach their financial goals and dreams as soon as possible.

Licensed as a portfolio manager in twelve provinces, Invisor is a best robo advisor in Canada for its dedication to making expert advice both accessible and affordable for a diverse range of investors.

Key Factors That Enabled Invisor to Rank as a Best Robo Advisor in Canada

The following is a listing of key factors that allowed Invisor to rank as one of the top robo advisors in Canada.

Wide Range of Portfolios

Constructed by Invisor, iShares (BlackRock), and Vanguard, this top robo advisor in Canada offers seven different portfolios to suit a wide range of investing styles and preferences. These include:

- Safety—Aims to preserve capital and provide steady returns

- Conservative Income—Relatively stable income and limited short-term volatility

- Balanced Income—Provides stable income with some growth and fluctuation

- Balanced—Seeks growth with some fluctuation for potentially higher returns in the long-run

- Balanced Growth—Seeks growth through exposure to moderate fluctuations for potentially higher returns in the long-run

- Growth—Seeks growth through exposure to moderate-high fluctuations

- All Equity—Aggressive growth accomplished by larger fluctuations to generate higher returns

Insurance Products

For investors that are also interested in exploring options for life insurance, Invisor is a great fit.

This Canadian robo advisor offers insurance solutions from some of the most trusted companies in the country, guiding investors towards the best life, disability, and critical illness insurance.

After a quick needs analysis, investors can see a quick quote and comparison— and if approved, Invisor provides a fully online purchasing experience, making it easy for those who need it to get life insurance.

Flat Pricing Structure

Compared to other robo advisors in Canada, Invisor has one of the simplest pricing structures. Investors can expect a flat advisory fee of 0.50 percent, regardless of their total account balance.

Invisor also has no account minimum, meaning that even smaller net worth investors can start using this Canadian robo advisor and growing their savings.

While this annual fee does not take into account management expenses charged by ETF fund managers, it’s rare to find a robo advisor in Canada that does not impose an account minimum, which provides huge benefits for investors who are just getting started.

Additionally, Invisor also offers their own satisfaction guarantee—if, within the first six months, you decide that this Canadian robo advisor is not for you, Invisor will refund all their fees with no questions asked.

Best Robo Advisor in Canada

Invisor Rating Summary

Although Invisor may be a small Canadian robo advisor, their investing services and products are anything but.

Both low and high net worth investors can choose from a diverse array of portfolios to suit their unique preferences, take advantage of flat-rate annual fees, and even purchase life insurance.

While portfolios are rebalanced according to each investor’s financial plan, it is unclear as to whether Invisor implements tax-loss harvesting, which can have a significant impact on a portfolio’s performance.

Invisor still maintains a spot on our list of the best robo advisors in Canada, but due to a lack of clarity on their full range of portfolio services, this Canadian robo advisor earns a 3-star rating overall.

Don’t Miss: TradeKing vs. OptionsHouse – Rankings & Review

ModernAdvisor Review

ModernAdvisor keeps a simple, yet effective philosophy for robo investing in Canada: give investors access to high-quality, low-cost investment advice, regardless of what their net worth may be.

With a focus on transparent, affordable, and expert financial advice, ModernAdvisor is one of the best robo advisors in Canada for new investors to consider partnering with.

Key Factors That Enabled ModernAdvisor to Rank as a Best Robo Advisor in Canada

Interested in finding out what made ModernAdvisor rank so highly on our robo advisor review? The following are key factors that allowed ModernAdvisor to rank as one of the top robo advisors in Canada.

The ModernAdvisor Advantage

There are a few advantages that investors have when partnering with ModernAdvisor, including:

- Low-Cost Portfolios—The average portfolio comes with fees between 0.5-0.75 percent, helping investors keep more of their earnings

- Growing with the Market—Portfolios are constantly adjusted to keep pace with market conditions, as well as to cater to individual risk preferences

- Fiduciary—ModernAdvisor acts as a fiduciary for clients, meaning they are legally obligated to always act in investors’ best needs

- Simplicity—No commissions, no hidden fees, and no conflicts of interest

- On-Demand Access—The investing dashboard is accessible on mobile or desktop, with customer service available by phone, email, or online chat

Risk-Free Trial

ModernAdvisor is the only Canadian robo advisor on our list that provides new investors with a free, no-risk trial of their services.

New account holders can choose to sign up for a free 30-day trial, in which ModernAdvisor will build a portfolio that fits your needs, and open a trial account with $1,000 of their money.

Once the trial period is over, any gains from the trial portfolio are yours to keep once you create an account. If the portfolio doesn’t make any money, you can get another month of service for free.

None of the competing Canadian robo advisors offer this type of trial period, making ModernAdvisor exceptionally competitive among the best robo advisors in Canada.

Pricing

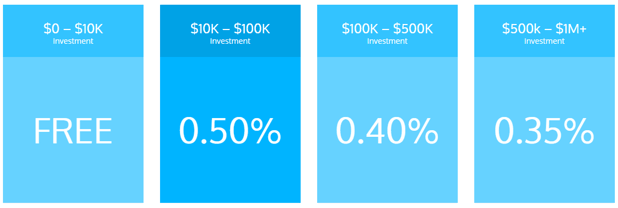

In addition to offering the first month of robo investing in Canada for free, ModernAdvisor also offers free investing for all accounts below $10,000.

After that point, fees vary between 0.50-0.35 percent, depending on the total amount invested.

With the first month for free, no charge on investments under $10,000, and low fees for all investments afterwards, ModernAdvisor is certainly one of the most affordable robo advisors in Canada.

ModernAdvisor Fees

ModernAdvisor Rating Summary

ModernAdvisor offers a wide range of client-facing benefits for investors, regardless of their total net worth.

They also provide Socially Responsible Portfolios for investors that prefer to support ventures that take social, environmental, and corporate responsibility into account.

With low fees, a free trial, and a stern focus on transparency and growth, ModernAdvisor earns a 5-star rating, ranking the firm among the best robo advisors in Canada.

Related: Vanguard Robo Advisor – Ranking | Vanguard Personal Advisor Services Review

Nest Wealth Review

Nest Wealth is Canada’s first subscription-based investment service, providing consumers with a completely new kind of Canadian robo advisor.

Services are driven by smarter technology, tested investment principles, and client-driven services.

Consumers interested in diving into robo investing in Canada will find plenty of options with Nest Wealth, providing a seamless and fully customized experience.

Key Factors That Enabled Nest Wealth to Rank as a Top Robo Advisor in Canada

Below, you will find a list of the key factors that made it possible for Nest Wealth to rank as a best Canadian robo advisor this year.

The Nest Wealth Advantage

As a client of this top Canadian robo advisor, you receive a whole suite of personalized services backed by a dedicated team of professionals who have your best interest in mind.

However, there are even more benefits to a relationship with Nest Wealth, and they include:

- Sophisticated Advice—Investments are organized to inspire and support growth

- Time-Saving Process—This robo advisor in Canada takes an advantaged approach to manage your money better, saving you time in the long run

- Lower Fees—Nest Wealth offers affordable options to preserve your profits

- Diversification & Automatic Rebalancing—Portfolios are globally diversified and rebalanced when necessary to minimize risk and yield higher returns

- Transparency & Constant Access—Investors can review their portfolio 24/7 through a simple, easy-to-navigate format

Asset Options

Nest Wealth has laid the foundation for investors to create and build asset classes that provide both short and long-term benefits. Focus is placed on maintaining a diversified portfolio which will offer growth as well as protection.

Some of the asset classes offered by this top robo advisor in Canada include:

- Emerging market equities

- U.S. equities

- Domestic equities

- Real-return bonds

- Real estate and cash

- Government-fixed income

- International equities

Pricing at a Glance

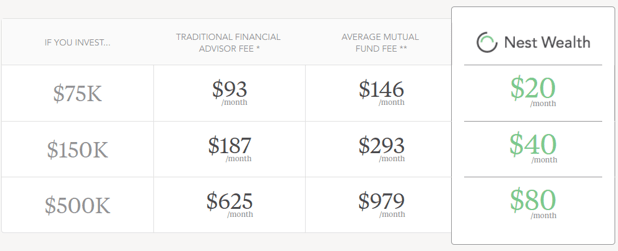

Nest Wealth offers subscription pricing that starts with as little as $20 per month and tops out at $80 per month, regardless of how high your account balance is. Rates also vary depending on how much you will invest.

When your portfolio is rebalanced, you are charged a fee of $9.99 per trade, but Nest Wealth will cover any annual expenses exceeding $100. Once you’ve reached that point, the remainder of your trade fees are covered.

Lastly, Nest Wealth offers a fairly low average Management Expense Ratio of 0.13 percent.

Nest Wealth Fees

NestWealth Rating Summary

Investing with a subscription-based service provides a great opportunity for investors to save money on annual rates and fees, making Nest Wealth one of the best robo advisors in Canada to consider partnering with this year.

For example, let’s say that you are investing $75,0000 with another Canadian robo advisor under an annual rate of 0.7 percent. This means that your annual fees would be $525.

Conversely, investing that same amount with Nest Wealth would generate only $240 in fees, freeing up nearly $300 each year.

It’s hard to beat their pricing structure, no matter what investment tier—choosing a subscription-based robo advisor in Canada is going to save you money while you invest, earning Nest Wealth a 5-star rating.

Popular Article: Vanguard vs. Fidelity | Detailed Comparison, Reviews, Competitors & Fees

Portfolio IQ Review

Portfolio IQ, an online wealth management service offered by Questrade, aims to give the power of wealth management to those who may not exactly be wealthy.

As a client, you can take advantage of great features, such as ultra-low fees, customized portfolios, and no minimum account sizes.

Key Factors That Enabled Portfolio IQ to Rank as a Best Robo Advisor in Canada

Listed below are the key characteristics that enabled Portfolio IQ to be rated as one of the top Canadian robo advisors.

Save More as You Earn

EFT-based portfolios are a favorite at Portfolio IQ, and that’s because they are a great way to keep costs down while still getting the job done.

For example, the following graph depicts how much you can save after 5 years by utilizing Portfolio IQ’s EFT-based approach:

Portfolio IQ’s ETF-based Approach

Along with low-cost ETFs, this robo advisor in Canada offers drastically lower fees than traditional advisors, saving as much as 30 percent in annual fees versus a traditional, globally balanced mutual fund.

Portfolio Options

Portfolio IQ has 5 portfolio options, each one with a varying degree of risk versus return.

Portfolios are carefully balanced to weigh your fixed income EFTs with your equity EFTs to create a situation that works for you and offers real results.

Portfolio types offered by this best Canadian robo advisor include:

- Conservative Income Portfolio: Low-risk tolerance

- Income Portfolio: Low to medium-risk tolerance

- Balanced Portfolio: Medium-risk tolerance

- Growth Portfolio: Medium to high-risk tolerance

- Aggressive Growth Portfolio: High-risk tolerance

Pricing on a Sliding Scale

As one of the top robo advisors in Canada, Portfolio IQ tries to make investing as affordable as possible, charging annual management fees based on total investment amounts, detailed in the table below.

Portfolio IQ Account Balance | Portfolio IQ Annual Management Fees |

| $2,000-$99,999 | 0.7% |

| $100,000-$249,999 | 0.6% |

| $250,000-$499,999 | 0.5% |

| $500,000-$999,999 | 0.4% |

| $1,000,000+ | 0.3% |

Investors can begin with less than $2,000 without management fees, though their balance will be held in cash and will not be invested until more money is deposited.

To help investors better understand pricing, Portfolio IQ offers a handy sliding bar graph to help potential investors determine whether using their Canadian robo advisor services makes good financial sense for them.

Portfolio IQ Rating Summary

Portfolio IQ provides a wide range of benefits for Canadian investors, including tax-efficient features, a variety of portfolios, active account management, and a focus on low-cost ETFs.

They also provide significant value through the myFamily program, allowing investors to pool their accounts to get everyone to a lower pricing tier quicker.

Although funds won’t actually be invested until the $2,000 mark is reached, this unique approach allows lower net worth investors to begin their own investment savings account, working over time to create a portfolio.

With a commitment to making investing affordable and accessible, Portfolio IQ earns a 5-star rating as one of the best robo advisors in Canada to consider this year.

Read More: What Is a Robo Advisor? Everything You Should Know About Robo Advisors (Definition)

ShareOwner Review

ShareOwner stands at the head of its class as a robo advisor in Canada that allows investors to build a fully customized, automatically reinvesting portfolio for stocks and ETFs.

Clients can take a multitude of different approaches, from a self-service portfolio to a completely automated and preselected group of stocks and ETFs compiled by professional staff.

Key Factors That Enabled ShareOwner to Rank as a Top Robo Advisor in Canada

See below for a list of important factors that allowed ShareOwner to rank as one of the top Canadian robo advisors.

The ShareOwner Model Portfolio

Not everyone wants to invest their time and effort in creating and managing an investment portfolio, or spend the money to hire a pricey financial advisor.

As a result, ShareOwner offers automated and fully customizable account services, portfolio ideas, and Model Portfolios that allow clients to get the benefits of investing without the time and hassle.

Benefits include:

- Low-cost, well-diversified portfolios

- Both active and index trading

- Optimized asset allocation

- Automated accounts

- Portfolio rebalancing

- Reduced costs

Stocks & ETFs

ShareOwner offers diversity with over 400 Canadian and U.S. large company growth stocks and over 50 ETFs.

Dividend reinvestment is automatic for all stocks and ETFs, and a pooled trading service allows for buying and selling on a specific schedule.

For those who are considering investing in stocks and ETFs, this Canadian robo advisor provides a full listing of available securities online, promoting transparency for consumers considering robo investing in Canada.

Small Commissions with Superior Service

ShareOwner allows you to order portfolios with 5, 10, 20 or more stocks in a single transaction with a flat commission rate of $40 per order.

For Model Portfolio accounts under $100,000, ShareOwner charges only 0.50% of your annual account balance as a fee. For accounts over $100,000, this best robo advisor in Canada charges a flat rate of $40 per month.

Although general account fees still apply, these flexible terms can help you build a customized portfolio through benefits like:

- No per trade, rebalancing, account, advisory, or inactivity fees

- Dollar-based purchases, including fractional shares

- Automatic monthly purchase and dividend reinvestment plans

- Automatic portfolio rebalancing

- No minimum balance

ShareOwner Rating Summary

With a unique, client-facing pricing structure and a wide range of securities to choose from, ShareOwner certainly offers valuable investing services as a top Canadian robo advisor.

Ultimately, however, when compared to competing Canadian robo advisors, the ShareOwner website is significantly outdated, earning the company an overall 3-star rating.

With more consumers depending on the Internet for information than ever, having an updated, welcoming website is crucial for robo advisors in Canada.

Refreshing and rebranding their website could easily boost their rating in our robo advisor review, along with their company brand, potentially attracting a new wave of investors in the process.

Related: WiseBanyan Review | Robo Comparison (Wisebanyan vs Betterment)

WealthBar Review

WealthBar is a full-service Canadian robo advisor with a mission to help every Canadian create their brightest possible future.

The premise is simple; low-cost investing partnered with real financial advice from expert financial advisors.

A wide range of portfolios and services make this a great option for those looking for something a little more intuitive than a basic portfolio.

Key Factors That Enabled WealthBar to Rank as a Best Robo Advisor in Canada

Below, please find a few key factors that enabled WealthBar to be rated as one of the top Canadian robo advisors.

The Investment Process

When WealthBar takes on your financial plan, this top robo advisor in Canada employs a consistent, time-proven approach, striving to create portfolios that reflect unique financial objectives.

Our robo advisor review found that WealthBar adheres to a 5-step process, detailed below:

Research

ETFs are identified to be included in your portfolio, and classes are selected to create a delicate balance between short-term volatility and long-term performance.

Optimize

This best robo advisor in Canada qualitatively optimizes each asset class to determine the appropriate weight ratio.

Select ETFs

ETFs are efficient and generally cost very little. In every case, ETFs are chosen as best in class to enhance your portfolio.

Monitor

Portfolios are continuously monitored, automatically rebalanced, and adjusted as necessary for growth.

Advise

Your financial advisor is always there for you, ready to answer questions, make recommendations, and help you make better use of your tax efficient accounts.

WealthBar Fees That Fit Your Goals

As a client, the more you invest, the more access you have to expert financial advice in areas of life that impact you the most. Account features are free to clients investing up to $5,000.

After that, fees range from 0.60% to 0.35%, decreasing as your investment total goes up. For investors with $25,000 in their portfolio, this equates to $10 a month.

WealthBar’s fees are inclusive of transaction costs, administrative fees, and there are no hidden commissions, so you can invest with peace of mind alongside this best Canadian robo advisor.

WealthBar Rating Summary

With a minimum account balance of $1,000 and the first $5,000 managed for free, WealthBar is one of the most accessible robo advisors in Canada, making it possible for all levels of investors to experience expert portfolio management.

Their comprehensive dashboard allows investors to see a complete financial picture, including returns, balances, fees, and more on Android and iPhone, making it easy to stay up-to-date.

With a slick interface, affordable fees, and comprehensive tools, WealthBar is one of the best robo advisors in Canada, earning them a full 5-star rating.

Don’t Miss: How TradeKing Advisors Is Revolutionizing Investing (TradeKing Advisors Reviews)

Wealthsimple Review

Wealthsimple is Canada’s largest robo advisor, with over $750 million in assets under management and offices in Toronto, New York City, and London.

What began as a Canadian fintech startup has blossomed into a burgeoning, successful Canadian robo advisor, expanding financial services into the U.S. in 2017.

As its name indicates, Wealthsimple believes that investing should be simple, smart, and low-cost.

With a personalized approach and instant access to everything that’s important to you, Wealthsimple is one of the best robo advisors in Canada to consider this year.

Key Factors That Enabled Wealthsimple to Rank as a Top Robo Advisor in Canada

Interested in learning why Wealthsimple ranked so highly on our robo advisor review? The following is a listing of key factors that allowed Wealthsimple to earn a spot among the top Canadian robo advisors.

Socially Responsible Investing (SRI)

For clients who want to make investments with a sound peace of mind, Wealthsimple offers Socially Responsible portfolios and ETFs.

It’s a great way to use your investments to support a specific cause that you are passionate about, adding a new dynamic to investing, and making Wealthsimple stand out among other Canadian robo advisors.

A few examples of the investments included in these SRI portfolios and ETFs include:

- Companies that achieve greater levels of senior leadership gender diversity

- Bonds issued by municipalities to support local initiatives

- Global stocks with a lower carbon exposure than the broader market

- Cleantech innovators in the developed world

Energetic & Generational Appeal

Investing in stocks, bonds, and ETFs is not commonly considered a financial strength for millennials. Wealthsimple is out to demystify investing, cultivate interest, and most of all, to have fun while doing it.

Their online magazine demonstrates this commitment to energy and appeal to a millennial generation, with titles such as:

- “The Winner of MasterChef Canada Explains How a Terrible Accident Made Her a Pathological Saver”

- “The World’s Most Famous Sword Swallower on Becoming the World’s Most Famous Sword Swallower”

- “Why Handbags are the Penny Stocks of Your Closet”

- “How to Invest in Legos and Make a Bazillion Dollars”

This energetic, generational appeal allows Wealthsimple to tap into an age bracket that may have never thought about investing otherwise.

Smart investing should be done when you’re young—but financial education never has to be stuffy or boring.

With energy, motivation, and determination, the professionals at Wealthsimple have created a space where anyone can invest, regardless of age or financial situation.

Wealthsimple’s Investment Pricing & Fees

Wealthsimple prides itself on offering fees lower than the industry average. For example, they have a $0 account minimum and don’t charge any trading, account transferring, or rebalancing fees.

With Wealthsimple, investing costs a fraction of what traditional advisors charge. At 0.5%, an account balance of $10,000 would save $5,783 over a 20-year timespan.

The opportunity to save money on fees can certainly make a big difference in both the long and short term, particularly for young investors who are not high net worth individuals.

Wealthsimple Rating Summary

For consumers that want a simple, effective, hands-off way to invest, Wealthsimple is a great fit.

Their Socially Responsible Investments are particularly unique, setting Wealthsimple apart from other robo advisors in Canada and earning the firm a 5-star rating.

Additionally, Wealthsimple’s advisory fees are extremely competitive compared to other robo advisors in Canada, making this millennial-forward advisor one of the best Canadian robo advisors.

Popular Article: How Personal Capital is Revolutionizing Personal Finance and Investment Management

Conclusion – Best Canadian Robo Advisors

Now that you’ve had the opportunity to examine our list of Canadian robo advisor reviews, the next thing to consider is how involved you would like to be in the process.

If you would simply like to answer a few questions and receive a completely customized and automated portfolio, any of the Canadian robo advisors on our list will serve you well.

However, if a hands-on approach seems like more of your thing, many of the top rated Canadian robo advisors will allow you to have more control over what criteria your portfolio is structured around, what goes in it, and how it is managed.

Regardless of where you stand on the spectrum, make sure you decide your level of commitment and use this as your guide to find the best robo advisor in Canada for you.

Utilizing the services of a Canadian robo advisor can be a simple, streamlined, and rewarding process. As you begin a relationship with a robo advisor in Canada, just remember to remain focused, plan for the long term, and use robo advisor reviews to fully evaluate each option.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://www.bigstockphoto.com/image-82252127/stock-photo-analyzing-investment-charts-with-laptop

- https://www.bmo.com/smartfolio/fees/

- https://invisor.ca/who-we-are/

- https://www.modernadvisor.ca/pricing

- https://www.nestwealth.com/

- http://www.questrade.com/portfolio-iq

- https://blog.wealthbar.com/meet-the-new-wealthbar/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.