The Rise of the Robo-Advisory Machines (TradeKing Advisors Review)

There was a time, not so long ago, when the only way you could invest and build portfolios was by walking into your bank and having a financial advisor assist you.

That all changed with the advent of online discount brokerages, where individuals took control of their own investment decisions, buying and selling equities, ETFs, bonds, mutual funds, and other financial products by themselves.

Today there is a new disruptive force called robo-advisors, a force that has changed the paradigm for retail investing, and TradeKing Advisors is among the leaders of that pack.

This TradeKing Advisors review takes an in-depth look at TradeKing Advisors, what it offers to its clients, and how it is different from other robo-advisors like Betterment, Wealthfront, Personal Capital, and FutureAdvisor.

How Robo-Investing is Changing the Dynamics of Investing

Robo-advisors leverage client information and algorithms to develop automated portfolio allocation and investment recommendations tailored to the individual clients.

TradeKing Advisors in particular has taken the daunting and expensive task of working with a financial advisor and streamlined it into a personalized, online, and affordable experience.

Image Source: Is robo-investing the future?

Intro: Solid Beginnings (TradeKing Review)

Individuals who participated in the last disruptive wave of retail investing, by opening discount brokerage accounts, will be familiar with the TradeKing brand.

Established in 2005, award-winning self-directed brokerage TradeKing quickly dominated the field with their signature low rates, great customer reviews, stellar customer service, and powerful online investment tools.

TradeKing clients loved the do-it-yourself (DIY) investing approach. Before, retail investors often knew which securities they wanted to invest in; all they needed were the right investing tools and technologies to do it. And that’s exactly what the TradeKing discount brokerage platform provided–in spades!

But not every investor can manage their investments on their own:

- What if you are an investor who isn’t savvy enough to navigate the complexities of what to buy and when to sell?

- And even if you did understand all there is to investing on your own, what if you just didn’t have the time?

- What about those investors who don’t have huge sums to invest, and who don’t like the high management fees charged by traditional brokerages/investment managers? Where do they go?

TradeKing’s solid beginnings in the discount brokerage world set the stage for the company to address those specific concerns through yet another disruptive initiative launched in May 2014: the TradeKing robo-advisor platform.

Leveraging the same award-winning, “customer-first” focus that has been applauded by independent market influencers like SmartMoney and Barron’s, and using state-of-the-art technologies, TradeKing Advisors enables investors to put their investments on auto-pilot.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The New World of Investing (TradeKing Advisors Reviews)

We’ll continue this TradeKing Advisors review by taking a look at the company’s business model and investor platform.

Because of the type of audience being targeted, ideally, a winning robo-advisory model needs to have three primary ingredients to be successful.

It needs to be:

- Simple

- Efficient

- Cost effective

The TradeKing robo-advisor model includes all of these characteristics. It is also unique in the sense that it allows legal entities, such as sole proprietorships, partnerships, LLCs and corporations to create accounts.

In producing this TradeKing advisor review, we reached out to Foster Whitney, head of partnership marketing for TradeKing.

Ms. Whitney underscored three very important ingredients that make the TradeKing business model so successful:

- Great products – which have brought institutional-level investing tools to retail investors

- Great pricing – which has put professional money management within reach of retail investors that have as little as $500 to start investing

- Great customer care – which has been acknowledged by many industry watchers as one of the best in the industry

Here’s how TradeKing’s robo-advisor works:

- You answer eight questions online to about your risk tolerance, investment objectives and investment time horizon.

- You then choose one of the recommended model portfolios, comprising of Exchange Traded Products (ETPs) from Horizon Investments, Inc., which has been created by Ibbotson Associates, Inc.

- Next, you’ll need to create your account online and fund it…and you’re all done!

As part of this TradeKing Advisors review, we also took a closer look at the underlying portfolio construction strategy used by this particular robo-advisory service, which largely revolves around the use of Exchange Traded Products (ETPs).

The TradeKing robo-advisor model uses low-cost Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs) to construct highly effective portfolios for its clients, based on the specific investment objectives and time horizons of each investor.

The model is based on two types of portfolios:

- Core Portfolios, which include domestic and foreign fixed income securities, equities, and real estate-related assets, and require a minimum investment of $500 before the portfolios are built.

- Momentum Portfolios, which are created to capture market momentum, and require a minimum investment of $5,000 before the portfolio is built.

Each portfolio is designed to fit the needs of specific individual investor and carries varying levels of fees based on assets under the company’s management.

While the Core portfolio aims to deliver returns that are in sync with an underlying index, the Momentum portfolio is designed to pursue slightly more aggressive returns.

As a TradeKing advisor client, you also have the option to choose a Core portfolio with Risk Assist®, a unique approach to risk management that limits down-side exposure during perceived market declines.

Each of these TradeKing Advisors portfolios offers five different “flavors” for investors to choose from: Conservative, Moderate, Moderate Growth, Growth, and Aggressive Growth. As investors slide up on the risk spectrum, the investment model alters the weighting of the portfolios to include more “risky” ETF’s into the mix.

The company actively manages and rebalances individual accounts as necessary, in order to ensure that the portfolios are always in line with target allocations attributed to each model portfolio.

In general, as a TradeKing advisor account holder, you’ll have significant control over most aspects of your individual accounts. Using highly intuitive online tools and resources, clients can ensure that they continually keep their personal data updated as they undergo significant changes to their personal and financial status. The TradeKing Robo advisor intelligent model then uses those inputs to make appropriate investment decisions on behalf of the account holder.

One interesting aspect of this model is that you can get portfolio recommendations even before you set up your account and fund it!

You do the investing, TradeKing Advisors does the managing!

How Safe Is TradeKing Advisors?

So, how safe should investors feel about handing over their savings to TradeKing Advisors, an entity that operates almost exclusively online?

Very safe! And here’s why:

- TradeKing Advisors is an SEC-registered investment advisor, which means it operates within a strictly government-regulated framework.

- The company’s partnership with Ibbotson Associates, Inc., an SEC-registered entity that is a fully-owned subsidiary of Morningstar, Inc., adds high levels of credibility to the asset allocation, portfolio construction, and monitoring services offered to clients.

- The TradeKing robo-advisor team comprises of key individuals who bring a wealth of hands-on experience to the business, initially in the discount brokerage arena, and now in the online robo-advisory business.

- Mainstream financial media like The Wall Street Journal, SmartMoney, Forbes, Barron’s, MarketWatch, The New York Times, and others have each featured stellar TradeKing advisor reviews as part of their robo-advisory coverage.

- As an investor, you would like to place your money only with a company that has the backing of strong and stable investors, and one that is likely to be around for years to come. TradeKing Advisors has in place solid long-term investor partnerships with some of the world’s leading venture capitalists and investment houses, including Velocity Capital, OCA Ventures, Battery Ventures, and The Quick Family.

While putting this TradeKing Advisors review together, we found that younger investors, particularly millennials, are often skeptical about how the investment world works, and whether they can even trust someone else with their life savings.

In a piece titled “Financial Advisers Don’t Care About Millennials, and the Feeling Is Mutual,” Bloomberg went into great details at exploring why this was so.

Prospective investors from this demography may often find themselves “locked out” from receiving the attention of top professional portfolio managers. That’s because they lack the types and volumes of resources that such professionals typically manage for their clients.

The TradeKing Advisors platform has been designed to provide a safe and productive experience to investors of all stripes. In the words of TradeKing Co-founder Richard Hagen, TradeKing Advisors helps:

“…to solve that disconnect by making professionally managed portfolios accessible to more people at all stages of their life at an affordable price.”

As a disruptive force, TradeKing robo-advisor is challenging some of the entrenched players to step up their game and make investing more accessible and more affordable for investors with as little as $500 to invest.

Taking Their Own Medicine

Many investment advisory firms offer advice to clients with one objective: to generate revenue for themselves, their investors, and shareholders.

They are legally not bound to ensure that the advice offered is appropriate for you, their client. And there lies a huge conflict of interest.

Image Source: TradeKing Advisors Reviews

With TradeKing Advisors, things are different!

The company’s SEC-registration legally binds them into a “fiduciary” relationship with you. So what does that mean for you as a TradeKing advisor client?

In the company’s own words:

“As a fiduciary, TradeKing Advisors endeavors to put the interests of its clients first, and it is important to mention that any benefit received by our firm through a custodian does not depend on the amount of brokerage transactions directed to that custodian.”

When it comes to providing impartial, objective, and conflict-of-interest free advice, to prove that their interests are aligned with yours, the company takes its own investment medicine–the very same they prescribe to clients.

Using recommendations in the 5 Core and 5 Momentum portfolios, TradeKing Advisors invests its own funds in its own account. The firm and/or its related persons or agents receive no preferential treatment over a client, putting the company squarely on the same side as its account holders.

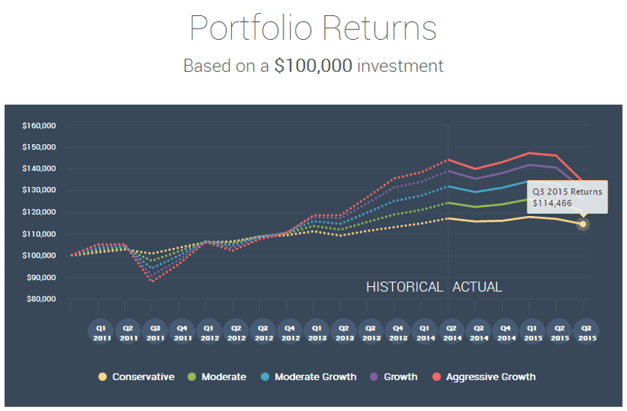

Proof Is in the Performance (TradeKing Advisors Review)

Of course, judgement on the efficacy of any investment service provider, whether a full-service brokerage firm or an online service like TradeKing robo-advisor, has to be made on the basis of value provided to clients.

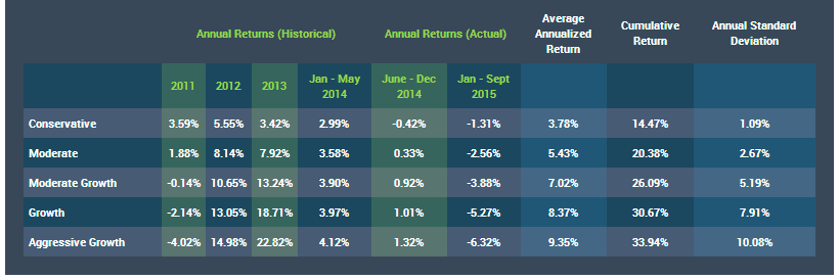

This TradeKing Advisors review took an objective look at how the various portfolios fared; based on the company’s performance track record as of Q3 2015, the investor value creation has been pretty exceptional.

Image Source: TradeKing’s Performance

A quick review of the company’s performance is enough to convince even the most skeptical of investors that there may be something to the wave of robo-investing after all.

TradeKing Advisors account holders have managed to secure solid double-digit cumulative returns across all five of the company’s investment portfolios.

A $100,000 investment with the company’s conservative portfolio would be worth $114,466, yielding a cumulative return of 14.47%. If you were of a more aggressive mindset, your $100K would be worth $133,940 as of September 2015–up by an enviable 33.94%. These numbers are proof positive that investors have been well rewarded for placing their trust (and money!) in the company.

Is It All Rosy?

Some TradeKing Advisors reviews online point to the fact that the TradeKing’s robo-advisory platform is excessively restrictive. For instance, you may not be allowed to place trades in your managed accounts.

We believe this criticism is unfair, primarily because a “discretionary managed account” is primarily about letting the advisory firm make those decisions for you.

In producing this TradeKing Advisors review, however, we would be remiss in not highlighting some aspects of the service over which many account holders have expressed some degree of reservation:

- What do you do if you want to change from one portfolio to another portfolio after your money has been invested?

- And what recourse do you have if you don’t like how the portfolio is performing and want to close your account?

As of the time of writing this TradeKing Advisors review, the answer to both those questions is fairly straight-forward: “Just call TradeKing Advisors’ Client Services Desk at 800-425-3205.”

TradeKing also does not offer investors the ability to take advantage of tax loss harvesting–a feature that some of its competitors offer. Granted, the company likely has solid reasons for implementing its “call for help” policy, or from staying away from features not currently offered (though they may be offered in the future).

Free Wealth & Finance Software - Get Yours Now ►

The Future Looks Bright for TradeKing Advisors

While conducting research for this TradeKing Advisors review, there was some breaking news about the future of the company that flashed across the wires.

TradeKing Group, which includes TradeKing Advisors, recently agreed to be acquired by Ally Financial. According to TradeKing’s website, in the near future the TradeKing robo-advisor clients can also expect to have:

“…access to its {Ally’s} full set of banking products, including Interest Checking, Money Market Accounts, Online Savings Accounts and several CD options.”

With Ally’s track record of groundbreaking financial products featuring no minimum deposit, no monthly maintenance fees, and competitive rates, the Ally-TradeKing deal throws the doors open to a whole new future for existing and new clients of TradeKing Advisors.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.