Comparison Review: Betterment vs. Wealthfront vs. Vanguard

Since the beginning of investing and commerce, we have needed people (financial advisors and investment managers) to manage our investment portfolios.

However, with the nascent rise of the robo advisor, investors can now easily cut human financial advisors out of the wealth management equation with a few simple clicks of a mouse.

What is a robo advisor, and just how much trust should the average investor place in them? Which are some of the better automated wealth management service providers? How can you decide between Betterment vs. Wealthfront?

What do robo advisor reviews say about Betterment vs. Wealthfront, Betterment vs. Vanguard, or Wealthfront vs. Vanguard?

For a little extra guidance, check out our comparison below of Betterment vs. Wealthfront vs. Vanguard.

These three automated online personal management services claim to put the power back in the hands of investors while taking all the work out of them.

Before diving into robo advisor reviews, it may be helpful to review robo advisors and their history (or skip directly to detailed reviews).

Robo Advisor Review: History & Definition

Prior to being made available for public use, only professional financial advisors had access to robo software. Such software helped financial advisors track and reallocate client assets according to presets agreed upon between advisor and client.

In this way, robo advisor software gave advisors the freedom to take on more clients or increase face-to-face consultations without the burden of micromanaging their client portfolios.

This trend would remain for some time even as the Internet’s role in consumer investments and wealth management began growing substantially more than a decade ago.

Given consumers’ longstanding reluctance to share personal information on the Internet, however, the slow growth of robo software is unsurprising in retrospect.

Fortunately, recent history has shown that said reluctance is waning fast in light of the many advantages offered by automated wealth management.

Robo advisors started appearing on the personal investing scene in a direct-to-consumer model back in 2008. By the time 2010 rolled around, several companies had entered the robo market, seeking to automate the management and rebalancing of client portfolios.

Early on, robo software was mainly programmed to calculate investment allocations based on user goals and target dates.

The robo advisor software provided a hands-off approach to investing wherein users gave robo advisors the authority to reinvest their assets according to fluctuating market conditions.

One of the early drawbacks of these programs was that they were limited by the number and types of asset classes in which users could invest.

However, the past five years have seen a steadily growing list of automated investment types that make robo advisors more attractive to an increasingly broad range of investors.

Not only that, but today’s online investing atmosphere is more relaxed than ten years ago. Robo advisors have subsequently grown in popularity concurrent with the public’s willingness to share personal details on the Internet.

Combined with the growing sophistication of robo-advisor software toward a more comprehensive suite of features, it becomes clear why automated wealth management programs have been on the rise over the past seven years.

See Also: Best Robo Advisors (Comparison and Ranking Reviews

Comparison Review List

The list below is sorted alphabetically (click any of the names below to go directly to the detailed review section):

High Level Comparison Table

Robo Advisor Reviews & Comparison | Pricing | Minimum Balance Requirement |

| Betterment | 0.25%-0.50% annually | $0-$250 |

| Vanguard | $2-$25 per trade 0.30% annually | $1,000 for investing $50,000 for advisement |

| Wealthfront | 0.25% for assets over $10,000 | $500 |

Table: The above list is sorted alphabetically

Betterment vs. Wealthfront vs. Vanguard Review

It’s difficult to compare Betterment vs. Vanguard, or Wealthfront vs. Betterment in an apples-to-apples way.

That’s because each company has tweaked its services and emphases in such a manner that they do not focus on the same goals, the same audience, or the same investments.

While there are not a great many variables, they would likely impact users’ ROIs differently, thus rendering strict comparison impossible.

Comparison Factors

In the end, deciding which service is best boils down to individual user preference, user experience, the user’s specific goals, the fees they are comfortable paying, and their favored approach in reaching their investment goals.

That last factor—the user’s favored approach—can differ markedly between the three companies and the user’s account parameters.

Despite the difficulty engendered by these differences, there are many facets of Wealthfront, Betterment, and Vanguard that can still be singled-out for across-the-board comparison.

However, potential users should be advised to do their homework and determine which robo advisor meshes best with their own personal philosophies, needs, and goals.

Don’t miss: Personal Capital Review – How This Top Robo Advisor is Revolutionizing Money Management

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Investment Philosophy – Betterment vs. Vanguard vs. Wealthfront

Each of these three robo-financial advisors operates according to the Modern Portfolio Theory (MPT), wherein asset allocation is distributed across a variety of asset classes in order to maximize risk while minimizing loss.

The split between stocks and bonds is typically set at the moderate risk level of 90/10, although each service allows users to recalibrate their risk tolerance in the later stages of the process should they so choose.

All three companies provide exchange traded funds (ETFs). In this way, they have very similar approaches.

Differences in Investment Options

When contrasting Wealthfront vs. Vanguard or Wealthfront vs. Betterment, one of the minor differences that pops up is that Wealthfront does not include an option for U.S. bonds, while Vanguard and Betterment do.

As a sort of workaround, however, Wealthfront does make use of a municipal bonds ETF.

One big difference between the three is how they handle personal financial advisement. Recently, Betterment has reinvigorated their services, enabling investors to get personalized human advice for an additional fee.

Wealthfront represents a shift away from the blended model of robo & human financial advisement.

As a purely automated software system, Wealthfront believes that “Software is Better Than People,” and combines automated investments and expert digital advice within one convenient platform.

On the other hand, those who opt for Vanguard’s Personal Advisor Services enter into a partnership with a personal advisor. As a supplement to investment software, a Vanguard personal advisor can provide professional planning and coaching, though the minimum investment requirement is $50,000 for this service.

To that end, Vanguard’s financial advisors will help track asset performance while issuing scheduled portfolio updates to users.

Betterment Review

Betterment provides a fast, simplified sign-up process from the very first page of a streamlined and intuitive interface.

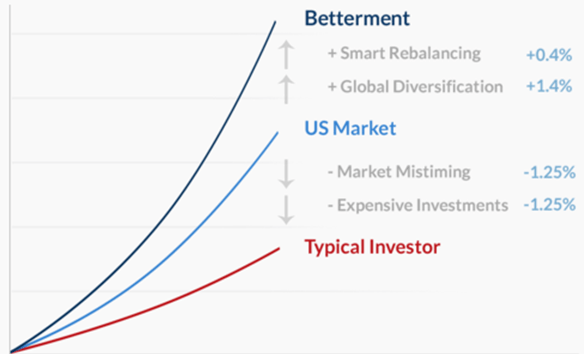

Betterment advertises that their robo software helps generate returns that are 2.9% higher than the average robo advisor.

Betterment Review: Process & Methodology

Users are asked their age, retirement status, and annual income amount. After entering this info, Betterment lets users preview a list of goals, such as Safety Net, Retirement, and General Investing.

Each goal option comes with a dropdown box that explains Betterment’s approach to that particular goal, including allocation percentages from inception through retirement and beyond.

Image Source: Betterment

Prioritizing Goals

Users then prioritize these goals by choosing which they’d like to focus on first. Based on this selection, Betterment provides a snapshot of their recommended strategy.

For instance, when a user prioritizes retirement, our robo advisor review found that a dropdown box will unveil a target amount that Betterment believes is necessary to comfortably retire based on the user’s age and income.

Betterment will then average the user’s annual retirement income based on the retirement target amount. Additionally, Betterment will preview the percentage of allocations between stocks and bonds, the details of which, as mentioned previously, are finalized later in the sign-up process.

Choosing Accounts

Users choose which account type they’d like to utilize in reaching their retirement goals. Choices include Regular (Taxable), Traditional IRA, Roth IRA, and SEP IRA.

The target amount and annual retirement income will vary depending upon the user’s account preference, as will the investment allocation percentage between stocks and bonds.

Continuing on, our robo advisor review found that the user arrives at a page wherein Betterment’s strategy is parsed into more concrete terms.

Allocations are outlined and can include diversification between U.S. Total Stock Market, U.S. Large Cap Value, Developed Markets, Municipal Bonds, and more.

Final Considerations

When comparing Betterment vs. Wealthfront, Betterment strives to provide maximum value through detailing pertinent features to allow users to accomplish their financial goals.

With no minimum balance requirements, Betterment is poised to be a great investing tool for those who are perhaps investing for the first time.

These investing tools include low fees, smart rebalancing, tax loss harvesting, and short-term capital gain avoidance, among others.

Vanguard Review

Vanguard strives for client-ownership in their investments, meaning that investors own their funds and funds own Vanguard.

With no stockholders or outside owners, their focus is on providing funds at cost and allowing investors to keep more of their returns.

Mutual funds and ETFs through Vanguard are, on average, 82% less than industry standards. For those considering Wealthfront vs. Vanguard, Betterment vs. Wealthfront, or Vanguard vs. Betterment, this is an ideal feature.

Vanguard Review: Process & Methodology

Vanguard has one landing page that directs users to sister sites based on their needs, including pages for:

- Personal Investors

- Retirement Plan Participants

- Institutional Investors

- Financial Advisors

- Non-U.S. Investors

Opening a Vanguard Account

When it comes to opening a new account, potential investors are asked to choose between a variety of different investment accounts, all corresponding to four core categories:

- Retirement: Traditional IRA, Roth IRA, Rollover IRA, or Variable Annuity

- General Investing: Individual Account, Joint Account, or Trust Account

- Minor: 529 College Account or Custodian (UGMA/UTMA)

- Business: 401(k), SEP-IRA, SIMPLE IRA

Users also have the option of rolling over a previous investment account, or having the Vanguard robo software assist them in choosing the best account for them.

Our Vanguard review found that the 5-10 minute process of opening a Vanguard account will require new users to enter basic biographical information such as name, address, SSN, and birthdate, current employer’s name and address, along with bank account and routing numbers for transferring money.

After this process is complete, new users submit an e-signature to finalize the process. From there, they are directed to sign-up for online access to their Vanguard account.

Vanguard vs. Betterment & Wealthfront vs. Vanguard

When comparing Betterment vs. Wealthfront vs. Vanguard, Vanguard’s site is admittedly the least intuitive and streamlined of the three.

Nearly every page features significantly more reading and scrolling, although the inputting process does prove to be more stripped of clutter than the general information pages.

Another downside is that Vanguard places the bulk of biographical and financial history inputting upfront, thereby delivering a customized plan much later in the process when compared with Betterment and Wealthfront.

The differences continue when it comes to how the three companies arrange information.

Wealthfront, in particular, boasts a site that minimizes scrolling by condensing data into quick, readable summaries that still manage to be informative.

Betterment Review and Analysis

An additional method of streamlining involves embedding clear yet non-intrusive links beside graphs, charts, and summaries. Scrolling over the links creates pop-up blurbs that explain the related data pieces in greater detail.

Final Considerations

As the largest manager of mutual funds and the second largest ETFs provider in the world, Vanguard’s site will most likely be considered more extensive, more appealing, and more intuitive to a seasoned investor who doesn’t need to have their hand held through the research and sign-up phase of the process.

It’s worth noting that, out of the three firms in this robo-advisor review, Vanguard is the least automated. If you are looking for an automated investment service, you would be better off choosing Betterment or Wealthfront.

For a 0.30% fee of annual assets under management and a $50,000 account minimum, the Personal Advisor Services are available –but this is a personal partnership with an actual advisor, rather than automated software.

That said, if you choose not to enroll in Vanguard Personal Advisor Services, there are plenty of tools and features that keep Vanguard as a competitive investing service, even if it is not automated.

Features like automatic investing, electronic banking, mobile access, and investing tools are all great ways to manage your investments without enlisting the help of an actual advisor.

By comparison, green investors will find the other two companies more newbie-friendly, particularly Betterment.

Related: Detailed Betterment Review – Returns, Fees, and All You Need to Know

Wealthfront Review

As a top robo software, Wealthfront aims to change the entire investing industry, creating a different, better, investor-centric service.

In fact, according to a company representative, in 2017 Wealthfront became the only company to offer both investment management and financial planning fully through software.

For those considering Betterment vs. Wealthfront, or Wealthfront vs. Vanguard, the ability to receive financial advice exclusively online may be a unique selling point.

Wealthfront Review: Process & Methodology

Wealthfront’s home page starts users off with two options: choosing to invest with Wealthfront, or exploring all investment options.

Our robo advisor review found that these options were brief, explanatory, and offered a wealth of valuble information for potential investors.

Invest with Wealthfront

By choosing Invest with Wealthfront, users are invited to enter their personal information and kickstart their investment journey.

To get a better handle on investor preferences, this process involves the following questions:

- Primary reason for investing

- What you are looking for in a financial advisor

- Age

- Annual pre-tax income

- Dependents

- Total value of cash & liquid investments

- General questions on investment preferences & habits

When a choice is selected, a dropdown dialogue gives the user a brief line or two of insight into how Wealthfront plans to meet said objective. The user is not limited to one selection and may choose all that apply.

They also ask questions that paint a picture of the user’s financial health and goals, including total value of cash and liquid investments, preference toward maximizing gains or minimizing losses, and loss avoidance strategies.

Investment Mix

When the above fields have been inputted, Wealthfront calculates and displays the user’s personalized investment plan.

This plan includes a choice between a “Taxable Investment Mix” and a “Retirement Investment Mix.”

Each investment mix is translated into a horizontal bar graph that shows the user’s asset allocation percentages without clutter or confusion. Beneath each bar is a dropdown box that explains why the asset type was chosen along with the rationale for selecting the assets.

Users can also manipulate the risk tolerance dial up or down, and Wealthfront will respond by recalibrating the respective investment mixes accordingly.

Explore Your Options

If a user chooses not to sign up for a Wealthfront account right away, you can explore your options to see a comprehensive overview of each type of account offered by this robo software.

To make it easy for potential investors to identify where they fit in, Wealthfront splits its investment options into three separate categories:

- Invest your Savings: Individual Accounts, Joint Accounts, Trust Accounts

- Plan for Retirement: Traditional IRA, Roth IRAs, 401(k) Rollovers, SEP IRAs

- Save for College: 529 College Savings Plan

Not only is it extremely user-friendly and aesthetically pleasing, but the level of transparency and detail should satisfy users who wish to perform due diligence prior to investing with Wealthfront.

Even if none of these options seem to fit, Wealthfront aims to assist investors as much as possible. Anyone who is curious about Wealthfront can receive a tailored recommendation by answering a few questions through the Wealthfront robo software if they are unsure.

Wealthfront projects the performance of these investments along with a historical performance metric based on index information and past performance of the particular investments.

Final Considerations

All told, when comparing Betterment vs. Wealthfront, or Wealthfront vs. Vanguard, Vanguard has developed an incredibly practical, empowering interface that better informs the user, emboldens their decision-making, and allows them easier freedom of movement prior to finalizing their account.

The ability to successfully manage investments and use financial planning services exclusively online is sure to be a big draw for potential investors.

Individual Features – Wealthfront vs. Betterment vs. Vanguard

After reviewing the process and methodologies for each robo software, it’s time to compare the unique, individual features of Betterment, Vanguard, and Wealthfront.

First, let’s discuss the similiarties and differences between Betterment vs. Wealthfront.

Betterment vs. Wealthfront

When it comes to comparing Wealthfront vs. Betterment, both Betterment and Wealthfront boast a broad suite of similar features, listed below.

Similarities Between Betterment vs. Wealthfront

- Accounts ranging from Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Trusts, Non-profits, Individual, and Joint

- Depending on the user’s risk profile and type of account, the user may have the capability to customize their asset allocation

- Tax loss harvesting to minimize taxes

- Automatic portfolio rebalancing adjusts the user’s investment allocation any time it moves out of its target allocation range

- Automatic transfer of money into the user’s account on a pre-set schedule

Differences Between Wealthfront vs. Betterment

Despite their many similarities, however, there are some substantial differences between Betterment vs. Wealthfront:

- Betterment does not require an initial deposit to open an account

- Wealthfront requires $500 to open an account

- Betterment sports low annual fees for all investment levels, ranging from 0.25%-0.50%.

- Wealthfront will manage the first $10,000 for free

- Betterment’s SmartDeposit features will conduct automatic deposits in the event that the user’s bank balance reaches a predetermined threshold

- Wealthfront’s Tax-Optimized Direct Indexing helps larger taxable accounts avoid further tax losses

- Betterment provides comprehensive financial tools and calculators for members and non-members alike, like the RetireGuide Calculator to assist users in planning for retirement based on current savings

Differences in Wealthfront vs. Vanguard & Betterment vs. Vanguard

Comparing Wealthfront or Betterment to Vanguard reveals a host of features that differ from the first two companies, including:

- Vanguard’s Personal Advisor Service can manage individual or joint taxable brokerage accounts along with traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and revocable trusts

- Vanguard accounts are covered by SIPC insurance up to $500,000 and by Lloyd’s of London up to $50,000,000 per account

- Vanguard Brokerage Services uses self-clearing on each trade and transaction

- Vanguard is the most expensive robo advisor of the three, requiring a $50,000 minimum to participate in Vanguard Personal Advisor Services

- In addition to their automated service, Vanguard assigns each account to a live financial advisor

- Vanguard offers all Personal Advisor Services clients access to their Admiral class mutual funds that feature low fees and no minimums

On a final yet significant note, unlike both Betterment and Wealthfront, Vanguard does not offer tax loss harvesting.

Popular Article: How Personal Capital Revolutionized Robo Advisory, Portfolio, and Personal Finance Management

Free Wealth & Finance Software - Get Yours Now ►

Better Business Bureau – Betterment vs. Wealthfront vs. Vanguard

Betterment is not BBB accredited, and at the time of this review, has one negative review on the BBB, with an overall rating of “B-.”

Likewise, Wealthfront is not BBB accredited, and while this robo software company does have one negative review, the BBB awarded the company an overall “A-“.

However, comparing Vanguard to Betterment and Wealthfront reveals 76 total complaints against Vanguard that have been registered directly with the BBB over the last three years.

The majority of these complaints center around “Problem with Product/Services.”

Most customers either said Vanguard did not make a good-faith effort to resolve their disputes, or that they were unhappy with Vanguard’s proposed resolution. All of these disputes have been closed and no disputes are outstanding.

Despite the negative reviews and complaints on the BBB, Vanguard has nevertheless maintained an “A” rating with the BBB.

Conclusion – Vanguard vs. Wealthfront vs. Betterment

As mentioned earlier, there’s no true way to uniformly compare Betterment vs. Vanguard vs. Wealthfront.

Each of these robo advisors brings a different approach to the table that will skew the user’s results in one direction or another.

However, one thing many reviews agree upon is that, when comparing Betterment vs. Wealthfront or Betterment vs. Vanguard, Betterment will appeal to newer or low net-worth investors.

Experienced users will have no need for the simplified and automated asset allocation, and individuals of higher net worth will want greater flexibility in diversifying their investments.

Wealthfront appears to cover the middle ground of the three, operating a more streamlined interface to help less-experienced investors. Still, the sophistication of their process, while of definite quality, could prove to be information overload for anything but the intermediate or experienced investor.

Likewise, Vanguard’s process will appeal to high net-worth individuals and other investors who are likely better-versed in personal investing or who require a human go-between to help maximize ROI.

On the subject of prohibitive costs, Wealthfront wins for affordability. It helps that they keep their fees low anyway, but what pushes them ahead of the other companies in this review is the fact that users don’t pay fees on their first $10,000 invested.

What truly makes Wealthfront stand out in our Betterment vs. Wealthfront vs. Vanguard review is that Wealthfront provides better long-term savings, making Wealthfront the most affordable robo software in the end.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.