Current Mortgage Rates for First Time Home Buyers in Arizona (Rates, Fees, & Payments)

While homes in the dry, warm Arizona climate may have traditionally been thought of as for retirees-only, the state’s dynamic economic growth has boosted demand from first time home buyers in AZ.

As reported in Forbes, cities like Phoenix and Flagstaff are experiencing strong growth in healthcare, retail, and the large finance sector. In fact, Phoenix is growing so quickly that “jobs are being added at twice the national rate.”

With an economic increase across the state, it’s a good time for AZ first time home buyers considering the possibility of buying a house in Arizona.

Of course, first time home buyers in AZ will want to explore all options for mortgage rates, terms, and requirements to ensure that a home loan sets them up for financial success.

First Time Home Buyers in Alabama | Best Rates, Terms, & Programs for Alabama First Time Home Buyers

Down Payment Assistance in AZ

Aside from the mountains of paperwork and lists of financial jargon, many first time home buyers in Arizona find that money is the biggest challenge when obtaining a Arizona mortgage.

Thankfully, there are plenty of AZ first time home buyer programs that can provide down payment assistance in AZ.

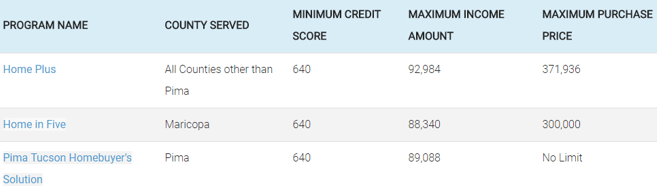

See the image below for a few of the most popular programs offering down payment assistance in AZ, including credit score, income, and purchase price requirements.

In addition to the programs listed above for down payment assistance in AZ, there are a few other AZ first time home buyer programs that first time home buyers in AZ may be able to benefit from:

- FHA Loan—Issued by the Federal Housing Authority with smaller down payments and lower credit requirements

- FHA 203(k)—Allows first time home buyers in Arizona to include renovation funds for fixer-upper homes

- USDA Loan—Offered by the U.S. Department of Agriculture for homes in certain rural areas

- VA Loan—For active-duty military members, veterans, and surviving spouses

- Energy Efficient Mortgage—Designed to help first time home buyers in Arizona create an energy-efficient home

- Native American Direct Loan—A type of VA loan that helps Native American veterans purchase homes on federal trust lands

- Good Neighbor Next Door Program—Sponsored by HUD, this program provides aid for law enforcement officers, firefighters, emergency medical technicians, and teachers from pre-k through 12th grade

Tips for First Time Home Buyers in Arizona

Buying a home is equal parts exciting and nerve-wracking. After all, purchasing a home is one of the most significant financial decisions that you will ever make.

First time home buyers in AZ have plenty of new procedures and paperwork to be prepared for, which can certainly make the process confusing.

Below, please find a set of tips to help make the process of buying a house in Arizona as straightforward and simple as possible first time home buyers in Arizona.

- Take the time to explore different neighborhoods to find the right location

- Prioritize your preferences like condition, location, size, neighborhood, and price

- Be prepared to make sacrifices on your conditions as a first time home buyer in Arizona

- Discuss your options with a lending professional to get exact numbers on your budget, monthly Arizona home loan cost, and closing costs

- Be prepared to accept defects and make your own renovations later on

- Take the time to educate yourself about the local real estate market

- Get prequalified for a first time home buyers’ in AZ mortgage before talking to a seller

Grand Canyon, AZ

First Time Home Buyers in Missouri | Best MO First Time Home Buyer Mortgages & Rates

First Time Home Buyers in Kentucky | Best Loans for Kentucky First Time Home Buyers

Conclusion – Finding the Best Mortgages for First Time Home Buyers in AZ

Once you know what type of mortgage for a first time home buyer in Arizona you are interested in, you should start evaluating lenders to find the best rates and terms.

Just as with any other shopping experience, it’s important to weigh your options and compare multiple offers for AZ first time home buyer loans to ensure that you are getting the best deal possible.

Affordable and manageable mortgages for first time home buyers in Arizona are determined not just by monthly payments, but also by interest rates and mortgage terms.

Before buying a house in Arizona, take the time to shop around until you find the best AZ first time home buyer loan for your financial needs.

First Time Home Buyers in Wisconsin | Best Loans for Wisconsin First Time Home Buyers

Best Mortgage Rates in North Carolina | New Homes & Refinance Rates

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- http://www.arizonadownpaymentassistance.com/down-payment-programs/

- https://pixabay.com/en/grand-canyon-canyon-arizona-2491980/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.