2021-2022 RANKING & REVIEWS

BEST FINANCIAL ADVISORS IN INDIANAPOLIS, INDIANA

Finding the Best Wealth Management Firm & Financial Advisor in Indianapolis for our 2021-2022 Ranking

Indianapolis is one of the most populous cities in the Midwest. It’s also home to many top financial advisors and wealth management firms.

An Indianapolis financial advisor works to bring order to the sometimes chaotic world of finances. These firms have professionals with years of experience in balancing risk, reward, and wealth growth to help clients reach their financial goals.

But finding an Indianapolis wealth management firm can be challenging. There are multiple options and not all firms are created equal. Some Indianapolis financial planners hold themselves to a higher standard of transparency and always put the client’s best interests first.

This is the type of Indianapolis financial planner that AdvisoryHQ looks for when we compile our rankings of top financial advisors in the US, Canada, and the UK. Our goal is to give those searching for the best financial advisors a trusted place to start.

For this ranking, we’ve looked for financial planners in Indianapolis that are innovative, client-centric, and uphold high ethical standards.

For each top-rated financial planner in Indianapolis on our list, we’ve highlighted what makes it stand out, its fee structure, and why the firm is one of the best Indy has to offer.

Award Emblem: Top 10 Best Financial Advisors in Indianapolis

Top 10 Best Financial Advisors in Indianapolis, IN | Brief Comparison & Ranking

| Top Indianapolis Financial Advisors | 2021-2022 Ratings |

| Avalon Wealth Advisory | 5 |

| Bedel Financial Consulting, Inc. | 5 |

| Buckingham Strategic Wealth | 5 |

| Castle Wealth Advisors, LLC | 5 |

| Column Capital | 5 |

| Deerfield Financial Advisors, Inc. | 5 |

| Halter Ferguson Financial, Inc. | 5 |

| Market Street Wealth Management Advisors, LLC | 5 |

| Ronald Blue Trust | 5 |

| Valeo Financial Advisors, LLC | 5 |

Table: Top 10 Best Wealth Management Firms in Indianapolis | Above list is sorted by rating

Considerations When Choosing a Financial Advisor in Indianapolis

There are some short-cuts to helping narrow down a list of potentials to find your perfect Indianapolis financial advisor.

Knowing which factors to look at first, can help you more quickly arrive at the perfect choice when at first glance many Indianapolis wealth management firms may look the same.

Does the Indianapolis Financial Planner Have a Minimum Investment?

You can save yourself a lot of time by looking first at the clientele type a firm works with. This is often where it will list any minimum investment levels. Some Indianapolis financial planners work with clients of all wealth levels. Others only work with wealthy individuals with $1 or $2 million to invest.

What’s the Fee Structure?

Financial planners in Indianapolis can be fee-only or fee-based. Fee-only means that the firm’s advisors don’t accept any outside commissions or incentives from companies that sell financial products.

A fee-based financial planner in Indianapolis may accept commissions from the sales of financial products. Many fee-based firms also become fiduciaries to counteract any conflict of interest. A fiduciary is legally obligated to act in the client’s best interest.

Best Financial Advisor in Indianapolis, Indiana

What Specialties or Key Services are Offered?

Many wealth management firms in Indianapolis specialize in a variety of financial planning areas. One may work mainly with retirees or those planning for retirement, while another may offer special services for business owners or women.

Check any potential financial advisor’s website to see if there are specialty services that match your client profile and financial needs.

What Technology Features Does the Firm Have?

Some Indianapolis financial advisors will have website portals for clients, and others will have their own mobile apps.

If digital tools and access to your account is important, make sure to ask about the technology available to a firm’s clients to connect to their accounts and their Indianapolis financial advisor.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2021-2022 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Best Indianapolis Wealth Management Firms

Below, please find the detailed review of each firm on our list of 2021-2022 top Indianapolis financial planners. We have highlighted some of the factors that allowed these best financial advisors in Indianapolis to score so high in our selection ranking.

Click on any of the names below to go directly to the review section for that firm.

- Avalon Wealth Advisory

- Bedel Financial Consulting, Inc.

- Buckingham Strategic Wealth

- Castle Wealth Advisors, LLC

- Column Capital

- Deerfield Financial Advisors, Inc.

- Halter Ferguson Financial, Inc.

- Market Street Wealth Management Advisors, LLC

- Ronald Blue Trust

- Valeo Financial Advisors, LLC

Click below for previous years’ rankings:

- 2019 Review: 10 Best Indianapolis Financial Advisors & Wealth Management Firms

- 2018 Review: 10 Best Indianapolis Financial Advisors & Wealth Management Firms (+ 1 to Avoid)

- 2017 Review: Top 10 Best Financial Advisors in Indianapolis

- 2016 Review: Top 10 Best Financial Advisors in Indianapolis

See Also: Best Financial Advisors in San Diego, CA

Avalon Wealth Advisory Review

Avalon Wealth Advisory is a top-rated fee-only Indianapolis financial planner that is also a fiduciary. For each client, the firm creates a distinct financial blueprint to help them reach their financial objectives.

This financial planner in Indianapolis offers investment planning, financial planning, family business planning, risk management, retirement planning, and more for a wide variety of clients.

Key Factors That Enabled Avalon Wealth Advisory to Rank as One of the Top Wealth Management Firms in Indianapolis, IN

Robust Range of Services

You have several service options available when working with the expert Indianapolis financial advisors at Avalon. The range of support choices adds to convenience and cost savings.

To meet the always-evolving needs of its clients, Avalon Wealth Advisory provides the following financial services:

- Investment Advisory

- Retirement Planning

- Family Business Planning

- Estate Planning

- Planning for the Unexpected

- Risk Management

- Education Planning

Each service from this Indiana financial planning firm is completely tailored for each client. Advisors take time to learn about a client’s unique needs, goals, and financial experiences prior to crafting their distinct financial blueprint.

Client-Centric Commitment

As a fee-only financial advisor in Indianapolis, Avalon only receives compensation directly from clients and not any third parties.

Not only does this practice eliminate the inherent conflicts of interest that often come from commission-based models, but it also creates a strong foundation of trust and fosters transparency.

The client-centric philosophy at Avalon is seen throughout each interaction the firm’s team has with clients. Each Indianapolis financial advisor is committed to:

- Building long-term relationships with clients

- Providing the best quality of service

- Tailoring financial services to unique client needs

- Accommodating the most convenient times and locations for client meetings

- Working as a team and respecting the talents and experience of other advisors

- Offering custom solutions for each client

- Fair service pricing

Rating Summary

Avalon Wealth Advisory makes it a mission to prepare each client for the unexpected and help them create a strong financial plan that’s resilient and will facilitate achieving their dreams.

This Indianapolis wealth management firm is also committed to ongoing excellence and being industry leaders, with many of its team members holding certifications, such as Certified Financial Planner™ (CFP®).

With a highly experienced team and a strategic, customized approach, Avalon Wealth Advisory scores a 5-star rating. This is one of the best Indianapolis financial planners to consider for your financial management needs.

Don’t Miss: Top Financial Advisors in Charlotte & Asheville, NC

Bedel Financial Consulting, Inc. Review

Bedel Financial Consulting, Inc. pledges that “your financial success comes first” and backs this up with a fiduciary commitment and fee-only structure. This top financial advisor in Indianapolis serves high-net-worth families, busy professionals, and other affluent clients.

These financial planners in Indianapolis, have been assisting clients since 1989 and have a track record of stability, strength, and security. The firm is also one of the top 25 women-owned Registered Investment Advisors (RIA) in the U.S.

Key Factors That Enabled Bedel Financial Consulting, Inc. to Rank as a Top Indianapolis Financial Planner

Balanced, Comprehensive Strategy

To give clients a holistic and comprehensive experience, Bedel Financial takes a symmetrical approach to financial health, integrating financial planning and investment management.

Each client benefits from an experienced team of financial planning and investment management experts working on their strategy. This holistic approach is designed to cover all aspects of a client’s financial life to ensure all are working towards the same goals.

You know you’ll be serviced by a highly qualified team when working with these Indianapolis financial advisors because the staff at Bedel Financial consists of both CFP® and CFA professionals.

Bedel Financial Consulting | Top-Rated Indianapolis Financial Planner

Tailored Services

The Bedel Financial Consulting team helps clients understand and plan for their future through a highly tailored process. Advisors take time to get to know each client and their distinct financial goals so they can create the best plan for success.

The firm’s services cover financial areas such as:

- Comprehensive Wealth Management

- Retirement Planning

- Investment Management

- Young Affluent Professionals

- Multi-Generational Planning

This Indianapolis wealth management firm also has different levels for minimum investments based upon client category. These are as follows:

- Young Affluent Professionals (Age 25-40): No minimum investable asset level

- Wealth Accumulators (Age: 40-55): $500,000 minimum

- Approaching Retirement (Age: 55+): $1,000,000 minimum

Rating Summary

Bedel Financial Consulting is committed to ensuring each client has a financial plan that is customized to meet their life and financial goals for the future. Its holistic approach and client categories are set up to cater to each person’s individual needs.

With financial services that span all generations and a strong fiduciary commitment, Bedel Financial Consulting is one of the best financial advisors in Indianapolis to consider. We’ve scored the firm with 5-stars.

Related: Best Wealth Management Firms in Florida

Buckingham Strategic Wealth Review

Buckingham Strategic Wealth is a top-rated fiduciary, fee-only financial planner in Indianapolis, IN that creates a team of financial excellence around each client.

This nationwide financial advisor has over 40 offices throughout the U.S. The approach of these financial planners in Indianapolis is based on a firm commitment to always do what is in its clients’ best interests.

Key Factors That Enabled Buckingham Strategic Wealth to Rank as One of the Best Financial Advisors in Indianapolis

Broad Range of Financial Services

Buckingham Strategic Wealth works with a variety of clients that include individuals and families, institutions, plan sponsors, and dental practice owners. It offers multiple financial services to each group, designed to be fully integrated.

This is one of the largest wealth management firms in Indianapolis, which allows it to offer a broad range of services, including:

- Wealth Management

- Business valuations

- Portfolio Construction

- Retirement Planning

- Wealth Transfer & Legacy Goals

- Tax Planning

- Insurance Policy Evaluation

- Fixed Income Portfolio Creation

- College Savings Plans

- Multigenerational Wealth Coordination

- Charitable Gift Planning

- Coordination with Other Consultants (CPA, etc.)

Services for Dental Practice Owners

Certain Indianapolis financial advisors have specialties that make them a perfect fit for specific client types. Buckingham is fully experienced in understanding the different layers of responsibility that come with managing a dental practice.

This top Indianapolis wealth management firm offers dental practice owners a cross-disciplinary and multifaceted plan that includes several areas of their business and personal financial needs, including:

- Debt management

- Investments

- Wealth

- Accumulation and capital assets

- Tax planning

- Retirement planning

- Transition planning

Rating Summary

Buckingham Strategic Wealth has a business model that’s based upon building a strong team of financial experts around each client to help them achieve their financial goals and dreams.

The firm uses an evidence-based investment philosophy and a holistic approach. These, as well as its client commitment and other positive attributes, have earned Buckingham Strategic Wealth a 5-star rating. This is a top financial advisor in Indianapolis to consider.

Castle Wealth Advisors, LLC Review

Castle Wealth Advisors, LLC offers family office and business succession planning services, along with financial and tax management. The firm is a fiduciary and has been a fee-only Indianapolis financial planner since 1973.

Serving clients around the country, this financial advisor in Indianapolis pulls together three separate areas of services to offer a robust set of financial services to generations of families.

Key Factors That Enabled Castle Wealth Advisors, LLC to Rank as a Top Indianapolis Wealth Management Firm

The Value of Three in One

Castle Wealth Advisors® brings a unique value to the table that you won’t find at many other Indianapolis financial advisors. Clients benefit from the power of its three separate divisions:

- Castle Financial Group®: As the oldest company in the family, Castle Financial Group® is the “architect,” designing financial blueprints to protect and grow wealth. This division handles taxes, gifting, estates, business succession, and retirement for clients in all 50 U.S. states.

- Castle Investment Advisors®: This division is an SEC-registered investment advisory firm. It oversees personal assets, charitable trusts, pensions, retirement assets, and private family foundations to help clients invest wisely.

- Castle Valuation Group®: Preparing business valuations for closely-held companies is the key objective of this division. It works with both public and private companies through a thoughtful and strategic approach.

Castle Wealth Advisors, LLC | Top-Rated Indianapolis Financial Advisor

Business Succession Planning

For business owners contemplating selling or passing on their business to the next generation, this Indianapolis financial planner and its team can ensure a fluid transition.

Castle Wealth Advisors specializes in assisting business owners with achieving their definition of success when it comes to selling or passing down their company. Services include (but are not limited to):

- Business valuation

- Developing a succession plan

- Tax-efficient strategies

- Reviewing documents with your attorney

- Preparing a detailed transition report

- Estimating retirement income

Rating Summary

For families looking for a strong financial advisor in Indianapolis to help them grow and protect their wealth, Castle Wealth Advisors is an excellent option. The firm specializes in customized family office services and has a long track record of success.

With a broad range of integrated financial services and a focus on trust and transparency, Castle Wealth Advisors, LLC earns a 5-star rating and is one of the best financial advisors in Indianapolis to consider.

Popular Article: Top Financial Advisors in Houston, TX

Column Capital Review

With a highly credentialed team and a full suite of services, Column Capital is a top-notch Indianapolis wealth management firm. This is a fee-only, fiduciary advisor that works with high-net-worth individuals and families.

This Indianapolis financial planner takes an integrated approach that includes financial planning, investments, and tax planning and maintains a focused client base so advisors can provide exceptional service.

Key Factors That Enabled Column Capital to Rank as One of the Best Financial Advisors in Indianapolis

Comprehensive Wealth Planning Approach

A holistic financial plan includes an understanding of your goals, your current cash flow, your retirement plans, and your tax situation. Without all those areas working together, a financial plan can’t be as strong as it should be.

Column Capital’s approach to wealth management integrates three key processes: investment management, financial planning, and income tax planning. The firm’s holistic approach ensures all three areas are working in harmony to fulfill your financial plans.

People can often overlook tax obligations that could drastically cut their earnings or the wealth they put aside for their heirs. This team of Indianapolis financial planners works with you on tax mitigation strategies that allow you to keep more of your money.

Investment Management Process

Column Capital takes a client-centered approach to the investment process. Its advisors don’t try to gamble with the market, but instead, take a strategic approach. This allows clients to capture maximum after-tax returns and balance risk levels.

Through a combination of experience, knowledge, research, and technology, this Indianapolis financial advisor helps clients with portfolios that are resilient in the face of unpredictability in the market.

This is accomplished by:

- Reviewing and prioritizing goals and objectives

- Establishing a target asset allocation

- Preparing an Investment Policy Statement

- Implementing customized investment strategies

- Reviewing and evaluating a portfolio on a continuous basis

Column Capital has a highly credentialed and experienced team that believes in a fully integrated financial strategy that’s tax efficient. Additionally, the firm has been ranked by InvestmentNews as a top 10 fee-only registered investment advisor.

With a client-centric philosophy and a fully holistic approach to wealth management, Column Capital is one of the best financial planners in Indianapolis for high-net-worth individuals and families to consider. We’ve scored the firm with 5 stars.

Deerfield Financial Advisors, Inc. Review

Deerfield Financial Advisors, Inc. is a fee-only, fiduciary wealth management firm and financial planner in Indianapolis. The firm also has an additional office in Chicago.

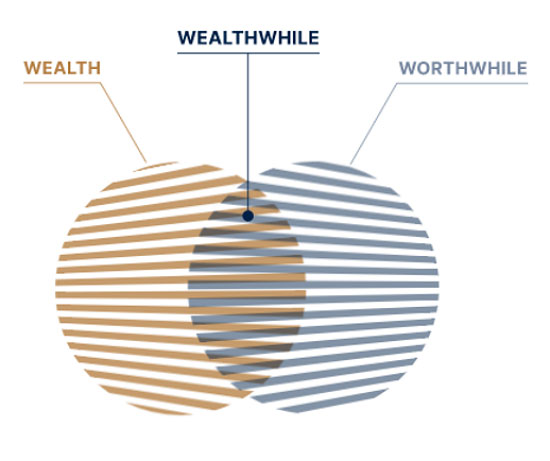

This top Indianapolis wealth management firm offers a unique approach that it calls “Wealthwhile,” which is a focus on where your wealth and more worthwhile causes intersect.

Key Factors That Enabled Deerfield Financial Advisors, Inc. to Rank as a Top Financial Advisor in Indianapolis

Fiduciary, Fee-Only Approach

Offering clients trust, transparency, and a pledge to put their best interests ahead of all else, Deerfield Financial Advisors does not accept outside commissions or any third-party incentives as a fee-only Indianapolis financial planner.

All compensation comes directly from clients, ensuring that the firm maintains objectivity and avoids potential conflicts of interest that can come from a commission-based structure.

In the financial industry, the fiduciary standard is the gold standard of trust and transparency, two key elements in any strong financial planning relationship. Clients of Deerfield Financial Advisors can rest easy knowing that the firm is completely focused on each client’s financial well-being.

Deerfield Financial Advisors | Top Indianapolis Wealth Management Firm

Wealthwhile Clients Served

Deerfield works with four distinct client types that it describes under four key service areas:

- Wealthwhile Exec

- Wealthwhile Women

- Wealthwhile Health

- Wealthwhile Law

These experienced Indianapolis financial advisors work with executives and business owners and can asst them with complex finances. The firm’s executive planning services offer things like: A holistic portfolio strategy, design of income generation strategies, optimization of executive compensation packages, and more.

Wealthwhile Women includes services tailored to the distinct financial needs of women, which can often be overlooked by the financial industry.

For those professionals in the healthcare arena, Wealthwhile Health incorporates services that match the complexities of this profession and guide those in private practice, academic medicine, or the pharmaceutical or biotech industries towards financial success.

Deerfield’s fourth service area is focused on lawyers and those in the legal profession and is designed to offer services distinct to this group, such as making recommendations for optimizing a law firm’s benefits, and more.

Rating Summary

Deerfield Financial Advisors is a firm unique from many other best financial advisors in Indianapolis in that it looks at client group needs first, and then tailors its financial solutions around them.

With a completely personalized and strategic approach and dedicated team, Deerfield Financial Advisors scores a 5-star rating as one of the top Indianapolis financial advisors to consider.

Read More: Best Wealth Management Firms in Chicago, IL

Halter Ferguson Financial, Inc. Review

Serving individuals and families in Central Indiana since 1986, Halter Ferguson Financial, Inc. is a fiduciary and fee-only Indianapolis financial planner.

The firm’s advisors have a goal to give clients confidence and freedom through expert wealth management and financial planning support. Halter Ferguson offers several personalized systems that are all designed to work together to help clients reach their objectives.

Key Factors That Enabled Halter Ferguson Financial, Inc. to Rank as One of the Best Financial Advisors in Indianapolis

9 Powerful Financial Systems

Halter Ferguson Financial offers a full suite of nine personalized systems that are designed to work together to help clients achieve financial confidence, wealth growth, and success.

The main goal of these top-rated advisors is to help you stop worrying about money and enjoy your life.

These nine financial systems include:

- The Financial Framework

- Customized Financial Blueprint

- Periodic Wealth Check-Up

- Personalized Risk Assessment

- Personal Financial Website

- Future-Proofing Tactics

- Alignment

- Wealth By Multiplication

- Fiduciary Promise

Financial Planning Services

Halter Ferguson doesn’t take a “cookie-cutter” approach to create financial plans. These Indianapolis financial planners provide tailored solutions based on both quantitative and qualitative data, to establish a strong foundation for the future.

Like any strong financial plan, it will be flexible, integrated, and reviewed regularly to reflect personal and market environment changes. Planning services include:

- Discovery: Learning about your goals and finances

- Design: Connecting your values, goals, and priorities to the numbers

- Alignment: Optimizing investments for your goals

- Implementation: Exploring alternatives and committing to a plan

- Follow-Through & Support: Ongoing help with questions and support

The main goal for advisors at Halter Ferguson is to see you succeed. The firm’s detailed and customized financial planning approach ensures that each client has a plan tailored to their needs and that can be adjusted as their goals or economic climate change.

With a robust offering of financial systems and a dedication to client success, Halter Ferguson Financial scores a 5-star rating. This is one of the best financial advisors in Indianapolis to consider for your financial planning needs.

Market Street Wealth Management Advisors, LLC Review

Market Street Wealth Management Advisors, LLC is a uniquely different financial advisor in Indianapolis. The firm states that its advisors aren’t salespeople, they’re coaches, and this fee-only advisor backs that up with a fiduciary commitment.

This top-rated Indianapolis financial advisor keeps things simple when it comes to wealth management, offering straightforward, pressure-free advice.

Key Factors That Enabled Market Street Wealth Management Advisors, LLC to Rank as One of the Top Indianapolis Financial Advisors

The Market Street Difference

Market Street has its own unique set of core values and philosophies that guide its advisors and their work with clients in helping them protect and grow wealth. These values help this firm stand out.

Below are some of the key philosophies that set this firm apart from other top Indianapolis wealth management firms:

- We Aren’t Salespeople. We’re Coaches: Market Street advisors take the time to carefully coach each client towards a winning strategy

- We Believe in the Power of Collaboration: Advisors are dedicated to working together and with clients to create personalized solutions that work

- Our Clients Are Family: Each financial management relationship is built to maintain long-term financial health through multiple stages of life, and clients are seen as family

Business Retirement Plan Consulting Services

Administering a company retirement plan is a large undertaking. Market Street Wealth can remove some of the burden by offering expert advice and standing with you as co-fiduciary for your plan.

Through the use of independent Third-Party Administrators (TPAs), these Indianapolis financial advisors put an emphasis on fund architecture and fee transparency.

Employee education to increase plan participation is also an area where Market Street can provide support.

Market Street Wealth Management Advisors | Top Indianapolis Financial Planner

Rating Summary

Market Street Wealth Management Advisors offers a welcoming, zero-pressure environment for Indianapolis wealth management and financial planning services. This makes it a top choice for those that want financial services to be as easy as possible.

With a collaborative team of professionals and a custom, streamlined approach, Market Street Wealth Advisors is a top financial advisor in Indianapolis to consider. We’ve rated the firm with 5 stars.

Don’t Miss: Best Financial Advisors in Tampa & St. Petersburg, FL

Ronald Blue Trust Review

Ronald Blue Trust, a division of Thrivent Trust Company, is a fee-only, fiduciary Indianapolis wealth management firm that’s completely unique. The firm adheres to and integrates biblical wisdom when offering expert financial advice.

This top-rated Indianapolis financial planner serves approximately 9,500 clients in all 50 U.S. states and has five divisions and 16 offices throughout the country.

Key Factors That Enabled Ronald Blue Trust to Rank as a Top Indianapolis Financial Advisor

Five Distinct Divisions

Clients benefit from personalized services delivered through five distinct divisions. Each one is tailored to a different client type.

To meet the unique needs of each client, Ronald Blue Trust maintains the following niche divisions of financial management:

- Private Wealth: As the largest of the five, this division offers comprehensive planning services to clients with an investable net worth starting at $1 million.

- The Family Office: Focusing on the complex needs of multiple generations, this division helps families with multiple financial needs. Clients typically have a net worth beginning at $25 million.

- Professional Athlete: This division is designed to help pro athletes and their families build and retain wealth during a traditionally shorter career span.

- Everyday Steward®: This division focuses on clients of all types, from those who are at the beginning of their careers to those planning retirement. These clients generally have a net worth of up to $1 million.

- Business Consulting: Business owners looking to enhance purpose and value can work with this division of Ronald Blue Trust to faithfully steward their companies.

Managing Your Investments

The expert advisors at Ronald Blue Trust don’t only create a roadmap to meet financial goals, they craft a strategy that will increase the probability that your goals and dreams will be reached.

This top-rated financial advisor in Indianapolis does not use random benchmarks. Its experienced team utilizes a Principled Reasoning approach through:

- Environment: The principles of Uncertainty and Instability inform risk management and reinforce the value of saving money.

- Growth: The principles of Human Productivity, Leadership, and Governance uncover insights on how and where asset growth will most likely appear.

- Valuation: The principle of Inherent Value allows your Indianapolis financial advisors to analyze various asset types to craft a disciplined and customized portfolio.

Rating Summary

For over 40 years, Ronald Blue Trust has been helping its clients achieve their financial goals using biblical wisdom and a personalized approach. Its separate divisions are designed to address the specific needs of multiple client types.

With a dedication to bringing value and guiding clients towards a lifetime of financial success, Ronald Blue Trust solidifies its 5-star rating as one of the best financial advisors in Indianapolis to consider.

Valeo Financial Advisors, LLC Review

Valeo Financial Advisors, LLC is a top-rated fee-only Indianapolis wealth management firm that makes a strong fiduciary commitment to clients for fee transparency.

This financial advisor in Indianapolis offers a wide range of services and serves clients in over 40 states. It also uniquely limits the number of clients each advisor has to 40, to ensure a high level of personal service.

Key Factors That Enabled Valeo Financial Advisors to Rank as a Top Indianapolis Financial Planner

One Transparent Fee

Valeo believes in being completely transparent about its service fees. You’ll find the firm’s fee schedule listed prominently on its site for review.

This top Indianapolis financial advisor charges just one fee that’s based on a client’s net worth. This fee covers both financial planning and investment management services.

The firm’s simple and straight-forward fee structure is as follows:

- First $6,000,000 – 0.40% of net worth

- Next $6,000,000 – 0.20% of net worth

- Over $12,000,000 – 0.10% of net worth

Comprehensive Wealth Management

Clients have a full range of wealth management services to pick from when working with Valeo. Advisors offer objective and independent guidance that’s focused on the client’s best interests.

The many integrated services offered by these expert Indianapolis financial advisors include:

- Income Tax & Cash Flow

- Risk Management

- Education Funding

- Investments

- Estate Planning

- Retirement

Best Financial Advisors in Indianapolis 2021-2022

With some Indianapolis wealth management firms, you need to pay separately for all these different services, but not at Valeo. The firm’s policy of one transparent fee covers all your investment management and other financial planning needs.

Rating Summary

As part of delivering quality financial guidance to clients, Valeo Financial Advisors has a comprehensive development plan for talent, which allows it to continue a high-level of client service over time.

With a commitment to making wealth management as easy as possible and a personalized approach, Valeo Financial Advisors earns a 5-star rating. This is one of the best financial advisors in Indianapolis to consider for your future financial planning.

Popular Article: Top Wealth Management Firms in Los Angeles, CA

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – 2021-2022 Best Indianapolis Financial Advisors

One unique aspect of these top Indianapolis financial advisors is that these firms are all about customizing the wealth management and financial planning experience.

Many of them start with the client type first, then tailor services to meet those distinct needs. This helps ensure that clients have a financial strategy with the best chance of success.

We would recommend that after reviewing the wealth level minimums, you check client specialties for each financial advisor in Indianapolis on this list to further narrow down your options.

Many of these Indianapolis financial planners offer free initial consultations to give potential clients a chance to learn more about the firm and see if it’s a good fit for them.

This is a perfect time to also gain some insight into how the firm would approach your wealth management and financial planning strategy, which may be just what you need to land on the perfect choice.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://pixabay.com/photos/indianapolis-indiana-city-urban-1888215/

- https://www.bedelfinancial.com/multigenerational-planning

- https://www.castle3.com/contact-us

- https://deerfieldfa.com/

- https://mswma.com/about/meet-the-team

- Microsoft 365 Clip Art Image(s) (Bing images licensed under the Creative Commons license system.)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.