Top 2022 Free Budgeting & Money Management Software

(Personal Capital Review)

Intro: Top Ranking Free Money Management Software (Personal Capital Review)

Identifying the best personal finance, budgeting, and money management software based on which platform you use the most (PC, mobile, Mac, tablet, online, etc.) can be a daunting undertaking, especially due to the sheer number of finance and budgeting related software that is available today.

But Personal Capital’s free personal finance and budgeting software for US consumers seems to be gearing up to be one of the most powerful and easy to use personal finance software for individuals, and it is revolutionizing how consumers manage their money today.

Personal Capital Finance Software for Individuals

Founded in 2009 by Bill Harris (previous CEO of PayPal), the Personal Capital Finance & Budgeting Software has been designed to be a highly advanced, powerful, and free personal finance software for budgeting, portfolio, and money management for all devices and platforms (online, desktop, iPhone, Mac, Samsung, Android, Windows, iPad, tablets, etc.).

Personal Capital is ranked #18 on CNBC’s list of top innovations, alongside Uber, Airbnb, SpaceX, and Dropbox.

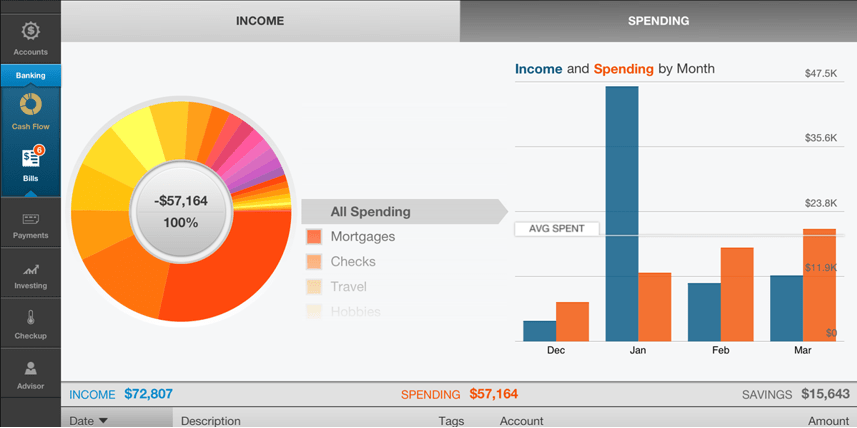

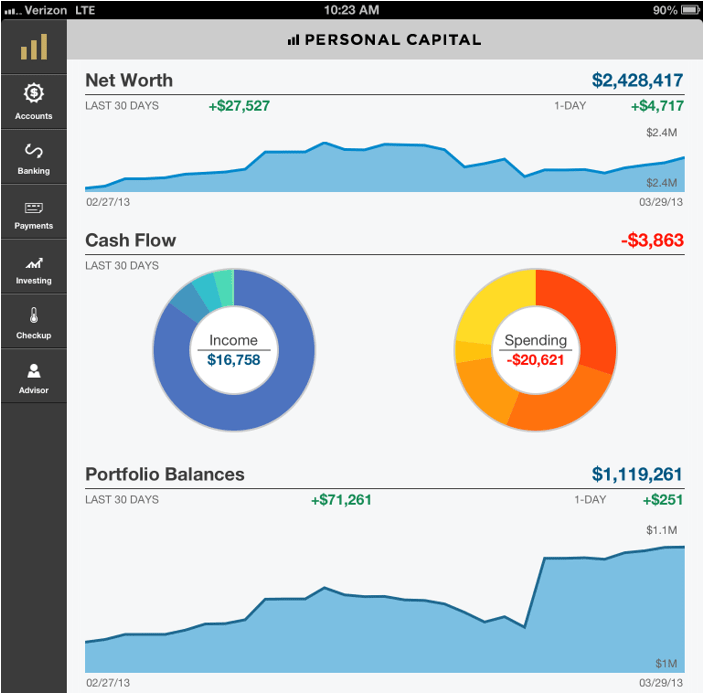

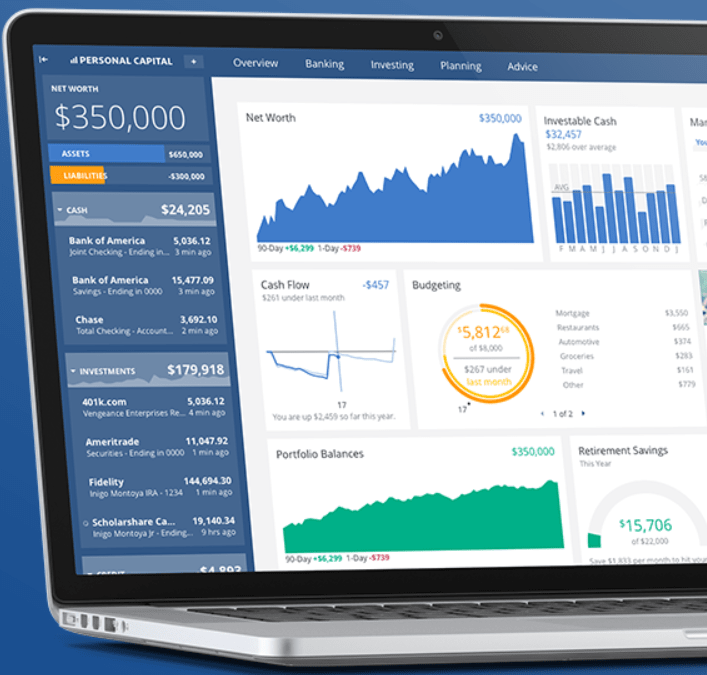

Most people find it difficult to track what they are saving and spending on a month per month basis. One of the most popular capabilities of the Personal Capital finance software is that it allows you to see a 360 view of your entire financial situation in real time (money coming in and going out, expenses that are coming due in the near future, your combined assets, and many more). It’s like having your own personal financial manager.

360-View of Your Finances

Key Factors Why This Software is Rated so Highly

Comprehensive Wealth Building and Money Management Flexibility

This free financial software allows you to easily manage your entire financial situation from one secure place – so you can reach your goals faster. From building wealth and budgeting to planning for your financial and retirement future, it makes managing your money a snap.

Use this finance software to develop your long-term financial strategy – calculate your net worth, set a budget, manage investment accounts, and plan for retirement.

Using this software, you can track your daily, weekly, and monthly spending and expenses. See where you are spending money the most. See where you can save. Quickly identify areas where you might be wasting money. You can see and run reports on all your debit, credit card, checking, and savings account transactions, as well as every automated or manually scheduled payment.

All of these can easily be viewed in your dashboard.

Income and Spending By Month

Click Here to Get This Software: Top 2022 Finance Tool

(Available only to U.S. consumers)

With Personal Capital’s dashboard application, you can quickly link all your accounts—and get a real-time view of your transactions at every point in time.

The personal finance software puts you in the driver’s seat of your financial future. When you register for Personal Capital, you’ll have free access to these powerful wealth management features, plus the firm’s award-winning dashboard.

This personal budget software can also quickly and effectively generate spending and income reports. In addition, you can set spending targets for certain expenses, which makes it super easy to track everything.

Get to Know Your Money

Over 1.4 million people use Personal Capital to track over $350 billion!

Click Here – Try Personal Capital Today (60 Seconds Sign up)

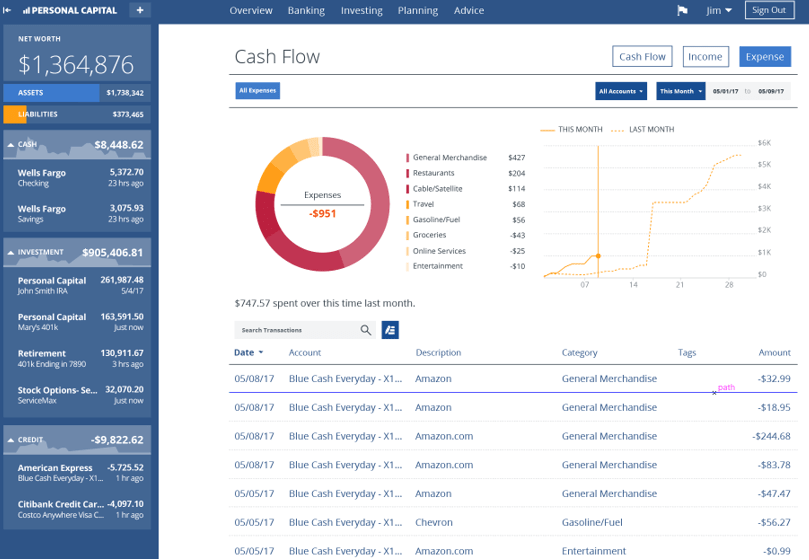

A Top Budgeting Tool

Using Personal Capital’s Cash Flow Analyzer tool, you can easily create a budgeting plan that comes with real-time tracking features. The Cash Flow Analyzer tool also has advanced capabilities that allow you to zero in on problem budgeting areas and find places to save.

Image Source: Personal Capital

Personal Capital also allows you to stay on track when it comes to managing your budget, paying your bills, and meeting your financial goals, making it the best personal budget software to consider.

This best personal finance software application makes it easy to see your recently paid, pending payments, and past payment information. You’ll also see upcoming bills that are due, the minimum amount due, and the total amount outstanding.

Device Compatibility

What about mobile and desktop device capability? Personal Capital is one of the best budget apps for desktop, iPad, iPhone, Mac, Android, Samsung Galaxy, Microsoft devices, BlackBerry, and online users. Using Personal Capital allows you to monitor and manage your financial transactions from anywhere, anytime.

Investments

If you have investable assets, Personal Capital allows you to see how well your investments are performing and, most importantly, see how your investments could be doing better.

Linked to your Personal Capital dashboard is an Investment Checkup tool that examines your investments and provides objective advice on how your portfolio could potentially achieve even higher returns now and in retirement.

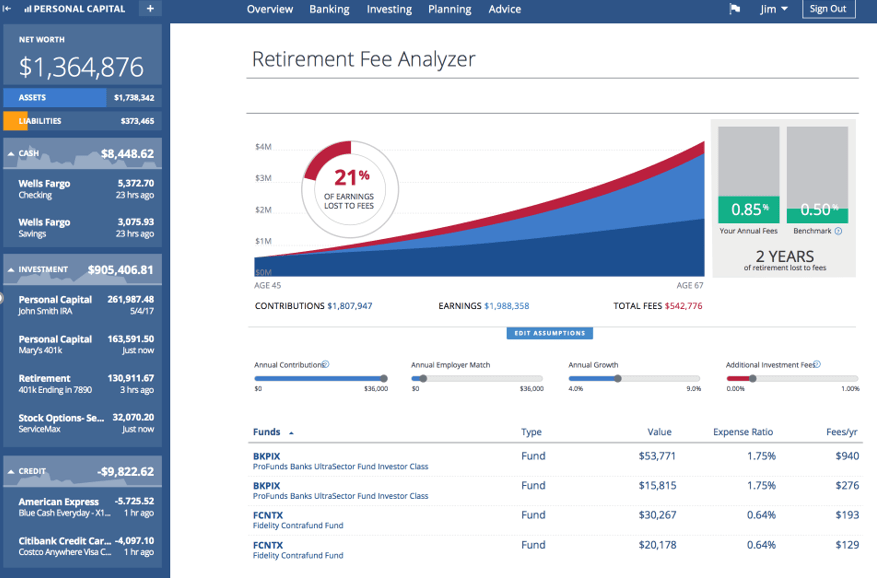

See How Fees Impact Your Retirement

Also included on your dashboard is another very important tool called the Retirement Fee Analyzer tool.

You could be losing thousands in hidden fees in your mutual fund, investing, retirement, and other invested accounts. Financial institutions charge annual fees (including custodial fees, inactivity fees, etc.) on mutual funds and other assets. Over time, these fees add up and can dramatically reduce your lifetime savings.

With the Retirement Fee Analyzer tool, you can quickly see how fees impact your retirement.

Analyze your holdings with the Fee Calculator, and get projections on how these hidden management fees may be costing you, and taking a large chunk off your retirement savings.

For additional information on Personal Capital’s Investment Checkup, sign up for a Personal Capital account.

Sign Up Process

To sign up for this free personal finance software, you’ll need to provide your email address, a strong password, and a cell phone number. The mobile number is used for security validation.

Click to Open Your Personal Capital Account

(Available only to U.S. consumers)

After signing up, the next step will be to link the accounts you would like to track.

To link these accounts, you’ll need to provide log-in information (see the below section on security for information on how Personal Capital protects you and your information). The log-in information you enter will be the same ones you use to log into your online bank accounts (checking, savings, etc.), credit cards, mortgages, expense accounts, and whatever financial accounts you want to track.

Linking your accounts is a very easy process. You simply click a small plus arrow, specify the account type you want to link, and enter your log-in information.

Security: How Secure & Safe is the App?

Like most financial and personal finance apps, Personal Capital is a read-only application, which means they are unable to transfer or remove funds from your accounts.

The software basically “reads” and aggregates your financial information, and then groups the information into categories for tracking and monitoring purposes.

You can’t move funds between–or out of–any account using Personal Capital. And neither can anyone else. The website’s encryption is rated A by the world-renowned Qualys SSL Labs, a stronger rating than most major banks or brokerages have. The company uses ECDHE key exchange for Perfect Forward Secrecy and does not allow SSLv3, RC4, or other insecure protocols or ciphers.

Their servers prefer to only allow highly secure TLS 1.2 protocol and also support TLS 1.1 and TLS 1.0.

(Available only to U.S. consumers)

Lastly, in regards to security, here is what the firm has to say about third-party security audits and testing:

- Personal Capital operates under the Securities and Exchange Commission (SEC) jurisdiction and is audited for compliance with SEC cybersecurity regulations.

- We also use Verisign and other state-of-the-art security solutions and practices to protect our site.

- WhiteHat Security performs around-the-clock security testing on our site.

- Our iOS apps have passed the rigorous AppSecure certification process by NowSecure.

How Does Personal Capital Make Money?

If the software is free, how does the company make money? The personal finance app is free to use for tracking your finances and investments, budgeting, and money management.

However, the company also has financial advisors that you can choose to use for financial planning and investing if you wish. They charge fees for these financial advisory services.

Quick Signup – Join Personal Capital Today

(Available only to U.S. consumers)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.

Image Sources:

- BigStock.com

- Personalcapital.com

- Pixabay.com