2020-2021 RANKING & REVIEWS

BEST FINANCIAL ADVISORS IN NYC

2020-2021’s Top NYC Financial Planning Firms & New York Financial Advisors

As the epicenter of the U.S. financial markets, New York City has no lack of financial advisors to choose from if you’re looking to build an investment portfolio or find expert asset management in New York.

But with so many options, finding a top NYC financial advisor to trust with your money can be challenging. It can take quite a while to sift through all the New York wealth management firms and sort the great from the mediocre.

With an expert financial advisor in New York guiding you, your money can multiply and help you reach future dreams.

So, where do you start?

AdvisoryHQ uses a comprehensive review system to rank the top financial advisors throughout the country ever two years. This list of the best financial advisors in NYC can save you hours of research time.

Below, you’ll find a summary of each of the best NYC financial advisors. We’ll note whether the firm is fee-only or fee-based, and why each made our list.

If you’ve been looking for some help with your money, these top New York investment firms can give you the jump-start you need for a healthier financial future.

Award Emblem: Top 12 NYC Financial Planners & Wealth Managers

Award Emblem: Top 12 NYC Financial Planners & Wealth Managers

Top 12 Best NYC Financial Advisor | Brief Comparison & Ranking

| Best Financial Advisors in New York City | 2020-2021 Ratings |

| Altfest Personal Wealth Management | 5 |

| Francis Financial | 5 |

| Frisch Financial Group | 5 |

| Joel Isaacson & Co. | 5 |

| KLS Professional Advisors Group, LLC | 5 |

| MainStreet Financial Planning Inc. | 5 |

| Stash Wealth | 5 |

| TAG Associates | 5 |

| Wealthspire Advisors | 5 |

| William Jones Wealth Management | 5 |

| Grandfield & Dodd, LLC | 3 |

| HFH Planning Inc. | 3 |

Table: Top 12 Financial Advisors in New York City | Above list is sorted by rating

See Also: Best Financial Advisors in Boston, MA

What Should I Consider When Choosing a Financial Advisor in NYC?

When you begin comparing wealth management firms in NYC, it can be hard to know what sets each apart.

But, while they will provide several core services that are similar, there are some distinguishing differences you can look for.

Zeroing in on those factors will help you find your perfect NYC wealth management partner.

What Type of Clients Do They Work With?

Some wealth management firms in New York City will have a minimum investable asset level. Others will work with all wealth levels.

You’ll also find that one New York financial advisor may specialize in a certain type of client, such as physicians, while another may work with those nearing retirement.

Look for the type of clientele a firm works with to see if you fit that description.

2020-2021 Top NYC Financial Planning & Investment Firms

Is the NYC financial planner Fee-Only or Fee-Based?

It’s important to know if an NYC financial planning firm is earning commissions from a third party (fee-based) or is only paid through client fees (fee-only). This impacts the objectivity of investment recommendations.

If New York asset management firms are fee-based and accept commissions, look for the firm to also be a fiduciary. Fiduciaries are legally obligated to always put the client’s best interests first.

What Range of Services are Offered?

Are you looking for New York family office services? Do you wish you could have your taxes done at the same firm as your portfolio management?

Not all NYC financial advisors offer the same range of additional financial services. Look over service listings carefully to find ones that match what you may need now or in the future.

Don’t Miss: Top Financial Advisors & Wealth Management Firms in Dallas, TX

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2020-2021 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Best Financial Advisors in NYC

Below, please find the detailed review of each firm on our list of 2020-2021 best NYC financial advisors. We have highlighted some of the factors that allowed these wealth management firms in New York to score so high in our selection ranking.

Click on any of the names below to go directly to the review section for that firm.

- Altfest Personal Wealth Management

- Francis Financial

- Frisch Financial Group

- Joel Isaacson & Co.

- KLS Professional Advisors Group, LLC

- MainStreet Financial Planning Inc.

- Stash Wealth

- TAG Associates

- Wealthspire Advisors

- William Jones Wealth Management

- Grandfield & Dodd, LLC

- HFH Planning Inc.

Click below for previous years’ rankings:

- 2019 Ranking: Top 10 Best Financial Advisors in New York, NY

- 2018 Ranking: Top 9 Best Investment Advisors in New York, NY

- 2017 Ranking: Top Rated Financial Planners in New York

- 2016 Ranking: Best Financial Advisors & Investment Firms in NY

Related: Reviews of Best Financial Advisors & Wealth Management Firms in Wisconsin

Altfest Personal Wealth Management Review

Founded in 1983 with the goal of bringing a personal and objective touch to wealth management, Altfest Personal Wealth Management is one of the top NYC financial planners to consider. The firm offers the benefit of both quantitative knowledge and qualitative understanding.

As a pioneer in fee-only financial planning and asset management in New York, Altfest puts clients over profits. The firm’s advisors emphasize listening to their clients so they can craft an action plan that’s completely customized.

Key Factors that Enabled Altfest Personal Wealth Management to Rank as a Top NYC Financial Planning Firm

An Experienced Team

The team at this top NYC financial planning firm has over 30 financial professionals, including financial advisors, planners, managers, and directors.

The diversity of backgrounds in multiple fields, such as science and psychology, gives this New York wealth management firm a robust base of industry knowledge.

These top financial advisors in New York have an impressive range of industry certifications, including:

- CFP®

- CFA

- CPA

- MBA

- MS

- PFS

- PhD

Altfest’s Custom Services

Altfest guides clients in multiple stages of life, professions, and financial situations. The New York financial advisors at this firm personalize their financial planning and investment approach to match each client’s distinct needs.

Some of the client types that this NYC wealth management firm serves with custom services include:

- Business Owners

- Dentists

- Emerging Professionals

- Executives

- Physicians

- Pre-Retirees & Retirees

- Widows & Widowers

- Women

Altfest takes a value-oriented approach to provide financial planning services, making it a standout among New York investment firms. Its goal for each client is to seek portfolio growth while reducing risk.

Founded on an objective and client-focused approach and offering a wide range of financial services, Altfest Personal Wealth Management scores a 5-star rating. This is one of the best NYC financial advisors to consider partnering with in 2020-2021.

Francis Financial Review

Individual attention, transparency, and independent advice are three cornerstones that Francis Financial was founded on. This top-rated financial advisor in NYC has been serving clients since 2002.

The firm is an independent, fee-only New York financial advisor. Making each client feel well taken care of in every aspect of their financial life is one of the firm’s driving missions.

Key Factors that Enabled Francis Financial to Rank as One of the Best Financial Advisors in NYC

Thoughtful Approach to Life Transitions

Whether you’re dealing with the loss of a loved one, going through a career change, or handling any other big life transition, Francis Financial can help guide you with sound financial advice. The firm is very attentive to clients and offers financial peace of mind, which can be especially important in the midst of emotional turbulence.

The attention to client care at Francis Financial is notable among New York asset management firms. Advisors can help you plan, grow, and protect assets through several transitional events, including:

- Loss of Loved One

- Divorce

- Inheritance

- Retirement

- Career Change

Top Financial Advisor in New York City | 2020-2021 Ranking

Plan, Grow, Protect® Approach

In keeping with its philosophy of simple and elegant advice, Francis Financial has a 4-step process called the Plan, Grow, Protect® Approach. It’s designed to enable tailored financial solutions.

This NYC financial planner’s approach incorporates the principals of learning and listening, as well as finding clients the best financial options to grow their wealth.

The four steps include:

- Discovery

- Life Financial Plan

- Tailored Investment Plan

- Progress Meetings

Rating Summary

For clients seeking a boutique firm with a personal touch, Francis Financial will be a great option among wealth management firms in NYC. Its core tenants include taking great care of clients and ensuring they have tailored solutions.

With expertise in transition guidance and an award-winning team of professionals, Francis Financial is awarded a 5-star rating as one of the best financial advisors in NYC to consider partnering with in 2020-2021.

Popular Article: Top Wealth Management Firms in Portland, OR

Frisch Financial Group Review

Frisch Financial Group is a top-rated financial advisor in NYC that emphasizes exceptional service and personalized financial guidance. It has served individuals, families, business owners, and executives for over two decades.

The firm is a fee-only NYC wealth management provider that believes in always putting the client’s best interest first. The firm’s advisors clarify, organize, and consolidate several financial instruments in order to create a comprehensive “big picture” for their clients.

Key Factors that Enabled Frisch Financial Group to Rank as a Top Financial Advisor in NYC

Evolutionary Financial Planning

The NYC financial planners at Frisch understand that smart financial planning is a process that evolves over time. You’re won’t just get a leather-bound portfolio to put on a shelf. Rather, you’ll get a dynamic financial strategy that will evolve along with your life.

The financial planning process at this firm is time-considerate, yet also digs deep into your needs, risk profile, and goals. The process used by these New York financial advisors begins with people, not numbers.

Specialized Client Expertise

This top New York financial advisor notes that there are three distinct types of clientele that can benefit from its specialized expertise. Frisch Financial offers solutions for these groups that they may not find at other wealth management firms in NYC.

If you’re in one of these groups, you may want to look at this top New York wealth management firm for an introductory meeting.

The groups that can especially benefit from the expertise at Frisch include:

- Small business owners (especially family-owned businesses)

- Senior executives of large corporations

- Families who are committed to leaving a legacy

Frisch Financial Group believes in offering intelligent wealth management that is customized for your life. The firm also provides investor education resources to help clients make well-informed financial decisions.

With the goal of protecting and preserving wealth, while also providing clear guidance in complex financial situations, Frisch Financial Group earns a 5-star rating. It is one of the top wealth management firms in New York to consider partnering with in 2020-2021.

Joel Isaacson & Co. Review

With a focus on the “big picture” and a commitment to spending quality time with every client, Joel Isaacson & Co. is one of the top New York investment firms. It offers sophisticated planning combined with highly integrated tax strategies.

This fee-only NYC financial advisor specializes in working with high-net-worth individuals and families, business owners, executives, and entrepreneurs. A holistic strategy is designed by coordinating multiple professionals within your financial orbit.

Key Factors that Enabled Joel Isaacson & Co. to Rank as One of the Best Financial Advisors in NYC

Independent and Fee-Only Status

With an independent and transparent structure, Joel Isaacson & Co. emphasizes objective advice that is always in the client’s best interest. As one of the top fee-only wealth management firms in New York, advisors know that when clients do well, they do well.

These experienced NYC financial advisors believe that good financial management is not about selling products, but rather helping clients achieve their dreams.

Being an independent firm means that Joel Isaacson & Co. is not part of any large institutional firm, allowing them to be completely objective in providing clients with the best possible advice.

Best Financial Advisors in NYC

Integrated Tax Strategies

Joel Isaacson & Co. stands out among other NYC financial planning firms due to its highly integrated tax strategies. When tax planning is well integrated into a financial plan, it can mitigate the overall tax burden and help identify opportunities for growth.

The experts at this top NYC wealth management firm work to free you from overpayments and fees that can add up quickly.

Integrated tax services include:

- A thorough review of tax planning opportunities

- Proactive quarterly and annual tax planning

- Preparation of federal and state income tax filings

Rating Summary

Joel Isaacson & Co.’s holistic approach to financial planning and wealth management makes them a top choice for clients wanting to minimize their tax burden and maximize their returns. It is one of the top financial advisors in New York City for high-net-worth individuals.

With a passion for helping clients achieve financial success and a detailed approach, Joel Isaacson & Co. is awarded a 5-star rating as one of the best New York asset management firms to consider partnering with in 2020-2021.

Read More: Best Wealth Management Firms in Pittsburgh, PA | Ranking

KLS Professional Advisors Group, LLC Review

With a culture of technical excellence, KLS Professional Advisors Group is a top-rated NYC financial advisor that was founded in 1989 on the principal of providing completely objective financial advice. Earning trust and loyalty by adding value is a driving mission for this firm.

This fee-only NYC financial planning firm is one of the largest in the country by assets under management, but they maintain a relatively small ratio of clients to advisors. This allows the firm’s advisors to give personalized attention to each client.

Key Factors that Enabled KLS Professional Advisors Group to Rank as One of the Top Financial Advisors in New York

Fee-Only, Open Architecture Design

Because KLS is a fee-only NYC financial advisor, clients receive the benefit of completely unbiased and objective advice. The firm does not receive compensation from any third parties.

An open architecture design means that the NYC financial advisors at KLS have no proprietary products they’re trying to sell. This gives them the freedom to tap multiple financial products and investment vehicles to find the perfect fit for your portfolio.

Technical Excellence

As a top financial advisor in New York, NY, KLS ensures its team is well versed in a wide variety of financial planning areas. This ensures clients are receiving the best guidance possible, integrating all areas of their financial life into their planning.

Each NYC financial advisor at the firm is trained to be an expert in:

- Financial Decision Making

- Insurance

- Investment Management

- Retirement Planning

- Tax Planning

- Trust and Estate Planning

Rating Summary

KLS is one of the top financial advisors in New York to consider if you’re looking for complete financial management that incorporates everything from insurance planning to investment decision making. The firm provides truly holistic wealth management.

With an experienced and thoughtful team and a comprehensive approach, KLS Professional Advisors Group scores a 5-star rating as one of the best firms to consider in 2020-2021 for asset management in New York City.

MainStreet Financial Planning Review

MainStreet Financial Planning serves a diverse population of clients around the country, including individuals, families, and businesses. As a top-rated NYC financial planner, the firm does things a little differently, offering comprehensive financial service packages.

As a fee-only NYC financial planner, the firm puts the client front and center. This includes offering informative content like a podcast, articles, videos, and even online financial courses.

Key Factors that Enabled MainStreet Financial Planning to Rank as One of the Top NYC Financial Planning Firms

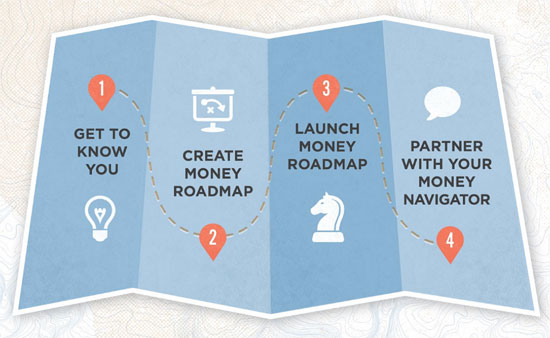

Easy 4-Step Process

If you’re new to financial planning, the process can seem complicated, but this New York financial advisor tries to make it as simple as possible.

The firm’s Money Roadmap is made to empower clients to take control of their financial life so they can start the path to achieving their dreams.

The 4-step process laid out by this New York wealth management firm is as follows:

- Get to Know You

- Design Money Roadmap

- Launch Money Roadmap

- Partner with Your Money Navigator

Top-Rated NYC Financial Advisors

Comprehensive Pricing Packages

MainStreet Financial Planning makes it easy for just about anyone to get expert financial guidance. The firm’s transparent fee structure offers package pricing that includes standard services, with additional support if clients need it.

Those new to financial planning will find the packages flexible and easy to understand. This package pricing is a unique feature that you won’t find at many financial advisors in New York.

Pricing for customized baseline Money Roadmap:

- Individuals: $3,200

- Couples/Family: $4,200

Ongoing Navigation/Support:

- Bronze level: $1,900/year

- Silver level: $2,200/year

- Gold level: $3,800/year

Rating Summary

If you’ve ever found NYC financial planners to be intimidating or confusing, then you’ll definitely want to take a look at MainStreet Financial Planning. The firm’s simplified process makes it easy for businesses and individuals alike to gain better control of their financial futures.

With a focus on client education and a welcoming approach, MainStreet Financial Planning solidifies its 5-star rating as one of the best financial advisors in NYC to consider working with in 2020-2021.

Related: Rankings of Top Financial Advisors & Wealth Management Firms in Los Angeles

Stash Wealth Review

Stash Wealth is a New York investment firms unlike any other. The firm throws old models out the window to make expert financial planning and management accessible and relevant for 20 and 30-somethings.

This top-rated NYC financial advisor offers fee-only services through its Stash Plan™. It takes a “no BS” approach to wealth management and is uniquely aligned with the new generations that are currently building their wealth.

Key Factors that Enabled Stash Wealth to Rank as One of the Best Financial Advisors in New York City

Financial Planning for H.E.N.R.Y.s™

A friendly acronym coined by Stash Wealth is “High Earners, Not Rich Yet,” or H.E.N.R.Y.s™. This team of top NYC financial advisors offers a virtual experience that reimagines wealth management for this group to make it affordable, relevant, and convenient.

Stash Wealth’s mission is to make financial planning more attainable for the new generation of earners, allowing them to enjoy their lifestyle now while also saving for the future.

Stash Plans®

In keeping with the firm’s target audience of 20 and 30-somethings, this top financial advisor in NYC keeps its investment management options straightforward and accessible.

Stash Wealth has two levels of its Stash Plan® to put clients on the right financial path. Each one comes with a flat-rate, one-time fee.

- Stash Plan® for Individuals – $1,497

- Stash Plan® for Couples – $1,997

While Stash Wealth has a clientele focus that’s narrower than most wealth management firms in New York, it has a completely original style. The firm knows its audience well, and it shows in how the firm has reimagined what financial planning can look like.

With a dynamic team of expert financial advisors and a goal to help create new millionaires, Stash Wealth is awarded a 5-star rating. It is one of the top financial advisors in New York to check out in 2020-2021 if you’re a young professional.

TAG Associates Review

Founded in 1983 to offer a personalized touch for the needs of wealthy individuals, families, endowments, and foundations, TAG Associates is one of the top New York family office and wealth management firms.

The firm does not specifically state whether it is fee-only or fee-based; however, its ADV notes, “TAG receives no fees, directly or indirectly, from investment managers or investment funds… Nor does it accept any indirect payments from other professionals it may hire on behalf of its clients.”

This would point to TAG being fee-only; however, we always recommend that you confirm fee structure before contracting with any New York financial advisors.

Key Factors that Enabled TAG Associates to Rank as One of the Best NYC Financial Advisors

Comprehensive New York Family Office Services

Affluent families often have more complicated finances. TAG’s services for families help take the complexities off their shoulders and free them from time-consuming management activities.

Those looking for the best New York family office services will find the range of help provided by TAG to be quite robust. Some of the firm’s standard services for families include:

- Financial Management

- Administrative Services

- Tax Planning

- Philanthropic Giving

- Estate and Trust Services

- Consolidated Reporting

Personalized Attention

Tag Associates works to deliver the utmost in personalized attention and service to its clients. This is why this NYC financial advisor has a team of 70 professionals that serve approximately 110 clients.

Clients of this top NYC financial planning firm have a dedicated team serving their needs. Clients receive a relationship manager as well as an experienced group of professionals with investment management and family office expertise.

Rating Summary

Delivering a high level of attention and a concierge-like experience, TAG Associates is one of the best financial advisors in NYC to consider if you have complicated financial needs that require an expert touch.

With customized solutions and a level of attention you won’t often find when looking for asset management in New York, TAG Associates earns a 5-star rating. This is one of the top NYC financial planning firms and New York family offices to consider in 2020-2021.

Popular Article: Best Financial Advisors in Phoenix & Scottsdale

Wealthspire Advisors Review

Wealthspire Advisors is a new NYC financial advisor formed through a partnership between Sontag Advisory and Bronfman Rothschild. The firm is dedicated to putting clients’ aspirations first and making a positive difference in their lives.

This is a fee-only financial advisor in New York with 13 office locations throughout the U.S. While the firm generally works with clients that have $1 million in invested assets, it offers a digital advisor platform for those who cannot yet commit to that level of investment.

Key Factors that Enabled Wealthspire Advisors to Rank as One of the Top NYC Financial Advisors

Strategic Investment Philosophies

When you work with Wealthspire, you can feel secure in the fact that its advisors aren’t going to just chase the latest market trends or try to “time the market.” These expert NYC financial advisors take a more strategic approach.

What you can expect from your team of financial advisors at Wealthspire is an investment philosophy that incorporates:

- Sufficient diversification

- Strategic asset allocation

- Passive strategies

- Turnover kept to a minimum

- Straightforward and transparent portfolio planning

NYC Financial Planning Firms to Consider in 2020-2021

Wealth Pathways Digital Advisor Platform

One standout offering that Wealthspire has is its Wealth Pathways digital advisor. This is a convenient investment option that you won’t find at many other New York asset management firms.

Wealth Pathways is designed to be more than just a robo-advisor, offering clients a tailored plan, not just a one-size-fits-all template. Some of the features of this digital platform include:

- A dedicated advisor (who is a Certified Financial Planner™)

- Goal-oriented planning

- Digital reporting tools

- Net worth and performance reporting

- Automatic rebalancing

- Virtual meetings

- Custom app for mobile account access

Rating Summary

Wealthspire believes in creating the perfect client experience through individualized planning, whether in person or through its digital platform. Its strategic approach to investing helps build portfolios that are designed for resiliency.

With a focus on impact investing and a wide range of client resources designed to empower financial confidence, Wealthspire Advisors scores a 5-star rating as a top NYC financial advisor to consider in 2020-2021.

William Jones Wealth Management Review

Offering a high level of service and portfolio managers with an average of 35 years of experience, William Jones Wealth Management is one of the best financial advisors in NYC for those looking for skill and expertise.

As a fee-only NYC financial advisor, William Jones has been focused on preserving and growing client wealth since 1988. One of the tenants of the firm is complete loyalty and commitment to its clients.

Key Factors that Enabled William Jones Wealth Management to Rank as One of the Best Financial Advisors in New York

Tailored, Client-Centered Solutions

Because this New York wealth management firm does not cross-sell third party investment products, clients are assured their portfolio is exclusively crafted with their needs and goals in mind.

The firm does not use cookie-cutter models, each client portfolio is completely customized, and it incorporates best-in-class investment products. Each financial strategy is focused on the comprehensive needs of each individual investor.

Providing Focus and Clarity

Finances can often seem complicated. The team at William Jones works to bring focus and clarity to financial planning so clients can more easily reach their future life goals.

The NYC financial planning professionals at this firm deliver strategic recommendations based upon their expertise and understanding of each client’s specific needs. Things like time horizon, risk tolerance, and liquidity needs are all taken into consideration.

William Jones has a uniquely experienced team of portfolio experts and combines that with an emphasis on personalization. These top financial advisors in New York City have a comprehensive approach that can put clients at ease.

With uncompromised recommendations and a client-centric philosophy, William Jones Wealth Management earns a 5-star rating as a top NYC financial advisor to consider partnering with in 2020-2021.

Grandfield & Dodd, LLC Review

Offering personalized investment counsel to individuals, families, and trusts, Grandfield & Dodd is a top New York financial advisor. Their goal is to preserve and enhance the real purchasing power of its clients.

It is not clear after reviewing the firm’s website what its fee structure is. However, its ADV does state, “Our management fees do not include any fees or commissions charged by third parties in connection with our advisory services.”

We always recommend confirming whether a firm is fee-only or fee-based prior to working with them.

Key Factors that Enabled Grandfield & Dodd to Rank as One of the Best Financial Advisors in NYC

Independent, Client-Focused Approach

This financial advisor in NYC is completely independent, allowing its advisors to give their clients the best, conflict-free advice on how to meet their financial goals. The firm is not affiliated with any banks, brokers, dealers, or other financial institutions.

This independent status allows Grandfield & Dodd to serve its clients with completely unbiased recommendations that are always made in the client’s best interests.

Valuation & Diversification

The seasoned team at Grandfield & Dodd understands that valuation is a critical component of any financial strategy. Advisors also recognize that different types of businesses will have different valuation criteria.

Avoiding risk and unnecessary concentration is also something these NYC financial advisors work to integrate into each client’s financial management plan. This is done through proper diversification.

Grandfield & Dodd emphasizes ongoing communication to ensure investment decisions are aligned with clients’ needs at all times. The firm’s advisors also incorporate tax considerations and family wealth planning for an integrated strategy.

Two factors that led to Grandfield & Dodd being given a 3-star rating as a top NYC financial advisor were the lack of transparency about its fee structure and the lack of detailed information about its services.

With those items addressed, the firm could easily score a higher rating in the future.

HFH Planning Inc. Review

HFH Planning is a top-rated NYC financial planning firm dedicated to offering completely unbiased guidance to individuals of all income levels. The firm takes an integrated approach, consulting with other financial professionals as needed.

The firm is a fee-only NYC financial planner that’s been serving clients with conflict-free advice since 1993.

Key Factors that Enabled HFH Planning Inc. to Rank as One of the Top Financial Advisors in New York

A Customized Process

This top-rated NYC wealth management firm takes a customized approach when it comes to financial planning and wealth management. No cookie-cutter models here.

At HFH Planning, formulating a tailored financial plan consists of the following:

- Initial Consultation and Data Gathering

- Identification of Issues

- Goal Setting

- Examination of Alternatives

- Implementation

- Review/Revision

Wide Range of Services

Financial management firms that offer a wide variety of services save clients both time and money. This also ensures an integrated wealth management plan that takes things like taxation into consideration.

With HFH Planning, clients enjoy the following range of services:

- Asset Allocation

- Estate Planning

- Retirement Planning

- Risk Management

- Tax Planning vs. Tax Preparation

- Cash Flow Analysis

- College Cost Planning

- Health Care Planning

- Tax Preparation

Rating Summary

HFH Planning takes a straight-forward and uncomplicated approach to wealth management. Its unique pricing structure using hourly rates is one that enables those at all income levels to benefit from expert financial guidance.

While the firm has a wide range of financial offerings, several of the services are not fully described. The firm’s website is also a bit outdated when compared with other NYC financial advisors. Thus, we’ve awarded HFH Planning a 3-star rating. Addressing those areas could easily increase the firm’s score in the future.

Don’t Miss: Top Ranked Best Financial Advisors in Minneapolis, MN

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – 2020-2021 Top 12 Best Financial Advisors in New York, NY

There’s one thing for certain – NYC financial planning firms are as diverse as New Yorkers themselves. From those steeped in tradition with years of experience to those forging an entirely new type of financial management, you’re sure to find a partner that fits your needs in NYC.

When it comes to your financial future, it’s important to evaluate all your options well. So, we recommend choosing a few of the best financial advisors in NYC on this list and scheduling a “meet and greet” to learn more about them.

Once the search is over, you can focus on working with your new professional advisor to craft a plan that enables you to reach your future goals and dreams.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image Sources:

- https://unsplash.com/photos/_T35CPjjSik

- https://francisfinancial.com/

- https://www.joelisaacson.com/media/filebase/JICO-2020-Winter-Newsletter.pdf

- https://www.mainstreetplanning.com/services/money-roadmap/

- https://tagassoc.com/about-us/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.