Getting the Best Mortgage Rates in Philadelphia

If you’re in the market to purchase a home in Philadelphia, you may be surprised to hear that the average cost of Philadelphia real estate is $179,500 according to Zillow.

These rising costs mark an increase of 6.8 percent throughout the past year, with Zillow experts predicting an additional increase of 3.1 percent in 2018.

Whether you’re planning on applying for Philadelphia home loans or looking to refinance existing Philadelphia mortgages, you’ll want to make sure you are fully prepared before you start talking with Philadelphia mortgage lenders.

Current Mortgage Rates in Phoenix, Arizona | Phoenix Home Loans for Good-Excellent Credit

Best San Antonio Mortgage Rates | Current Mortgage Rates in San Antonio, TX

Mortgage Loan Types in Philadelphia

Lenders that provide competitive loans and mortgage rates in PA provide both conventional and adjustable rate loan types. A few examples of conventional Philadelphia mortgages include:

- 10-year mortgage loans

- 15-year mortgage loans

- 20-year mortgage loans

- 30-year mortgage loans

Conventional fixed-interest rate loans are popular choices for Philadelphia mortgages for two reasons. First, as a fixed-interest rate Philadelphia home loan, the interest will stay at the same rate.

Second, this type of Philadelphia mortgage uses established industry and regulatory guidelines based on loan size and individual finances. Conventional Philadelphia mortgages typically fall between 10-30 years.

Philadelphia mortgages with shorter terms (10-20 years) are good ways to pay your home off faster and build equity. However, it’s important to note that the monthly payments for these will be much higher.

Mortgages with 10, 15, or 20-year terms are popular choices for consumers that want to refinance existing Philadelphia mortgage rates.

Adjustable rate Philadelphia mortgages include:

- 5/1 ARM

- 7/1 ARM

- 3/1 ARM

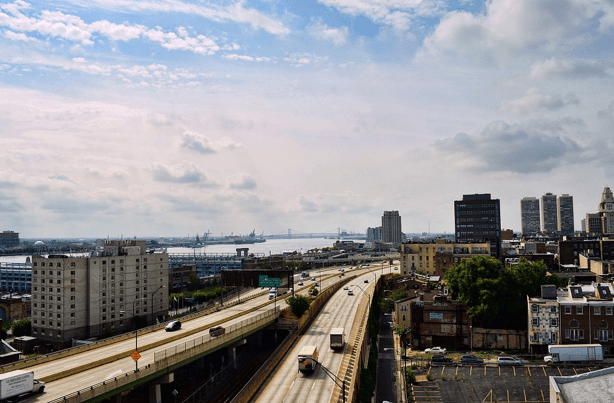

Philadelphia, PA

Current Mortgage Rates in San Diego | Best Offers & Rates for San Diego Home Loans

Current Mortgage Rates in San Francisco | Best Rates & Offers for San Francisco Mortgages

Types of Philadelphia Mortgage Lenders

Today, borrowers have plenty of options when choosing between Philadelphia mortgage lenders for a variety of lending and refinancing needs.

Rates, terms, and overall affordability can vary greatly from one lender to the next, which makes exploring multiple options key when looking for the best Philadelphia mortgage rates.

Banks

If you have an existing relationship with a local bank, you may want to check their mortgage rates in Philadelphia.

Having a positive lending relationship with a brick-and-mortar bank is great for those who prefer to discuss Philadelphia home loans in person.

With stricter requirements, however, new borrowers may have difficulty getting good Philadelphia mortgage rates from large banks, especially when dealing with less than ideal credit.

Online Lenders

Many borrowers find that online banks have the most flexible Philadelphia mortgage rates and terms.

Philadelphia mortgage lenders offering competitive mortgage rates in Philadelphia online include online-only banks, lending companies, or even peer-to-peer lending platforms.

Not only are online applications easier to fill out, but they also tend to have the quickest response rates, meaning that you could potentially get an answer on mortgage rates in Philadelphia within hours.

Credit Unions

If you are a member of a credit union—or are eligible to become one—this can be a great resource for affordable mortgage rates in Philadelphia.

Because they tend to have lower operating costs, a mortgage from a credit union often has competitive rates and flexible terms, providing a great resource for manageable Philadelphia mortgage rates.

Current Mortgage Rates in San Jose | Best Offers & Rates for San Jose Home Loans

Best CD Rates in Puerto Rico | 1-Month to 5-Year Puerto Rico CDs

Conclusion – Getting Great Philadelphia Home Loans

Purchasing a home in Philadelphia can be an exciting time. For many, buying a home represents change, renewal, progress, and the pride of ownership.

Not surprisingly, taking out a mortgage can also be an expensive time, particularly when it comes to mortgage rates in Philadelphia.

Understanding your options for Philadelphia mortgage rates or Philadelphia refinance rates is crucial. No matter what mortgage rates in Philadelphia you choose, you’ll want to ensure that a home loan or refinance sets you up for financial success over the long run.

After all, a mortgage will stick with you for the next few decades, making it crucial for each potential homeowner to find the best Philadelphia mortgage rates.

Best CD Rates in Washington, DC | 1-Month to 5-Year DC CDs

First Time Home Buyers in Virginia | Best Rates for Virginia First Time Home Buyers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image source:

https://pixabay.com/en/philadelphia-highway-pennsylvania-224467/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.