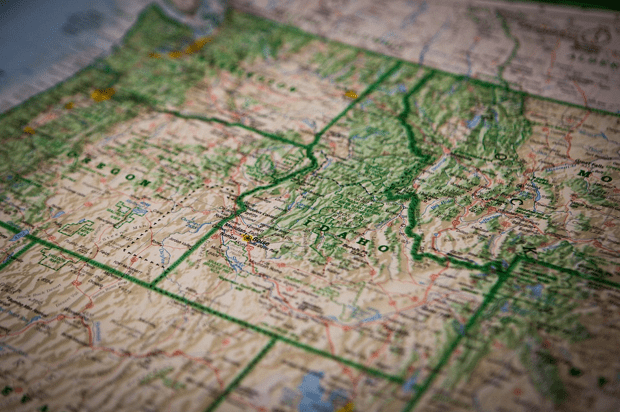

The Best Mortgage to Get as a First Time Home Buyer in Idaho

Idaho home values are on the rise, a trend which is predicted to continue throughout the next year.

According to Zillow, the median home value is currently $195,700, marking a significant increase of 10.3 percent within the past year.

Experts predict that home values will continue to rise by as much as 3.8 percent in 2018, which may be challenging for a first-time home buyer in Idaho hoping to get a competitive mortgage rate.

With accelerated home values, finding the best Idaho first time home buyer loan is crucial for Idaho first time home buyers to ensure that homeownership remains affordable over the long-term.

First Time Home Buyers in Arkansas | Best Loans for Arkansas First Time Home Buyers

First Time Home Buyers in Hawaii | Best Rates & Programs for Hawaii First Time Home Buyers

Hidden Costs for Idaho First Time Home Buyers

Most mortgage lenders in Idaho will disclose additional closing costs in Idaho that come within the first stages of homeownership.

To ensure that the first few months of homeownership are as manageable as possible, first time home buyers in Idaho should be prepared for these costs before signing off on a mortgage.

While researching your options for Idaho first time home buyers, it’s helpful to consider the following “hidden costs” of mortgage rates:

- Mortgage application fees (typically 1-2 percent of the total purchase price)

- “Good faith deposit” (helps the seller know that you intend to buy)

- Down payment (20 percent of the total mortgage)

There are also closing costs in Idaho to consider, which can include a wide range of expenses from:

- Mortgage points

- Attorney’s fees

- Inspections or surveys

- Title insurance

- Escrow deposit

- City recording fees

Although all mortgages are subject to differences depending on loan amount, location, appraisal, etc., Investopedia estimates that the average closing costs for Idaho first time home buyers come to $1,682.

Best Mortgage Rates for First Time Home Buyers in FL | Best Florida First Time Home Buyer Loans

First Time Home Buyers in North Carolina | Best Loans for North Carolina First Time Home Buyers

First Time Home Buyer Programs in Idaho

Aside from the mountains of paperwork and lists of financial jargon, many first time home buyers in Idaho find that saving towards a down payment is a significant financial hurdle.

Thankfully, there are plenty of first time home buyer programs in Idaho that are meant to help contribute down payment assistance in Idaho.

Below, we have listed a few local first time home buyer programs in Idaho that a first time home buyer in Idaho may be able to benefit from.

- Good Credit Rewards Program—First time home buyers in Idaho with a minimum score of 640 can combine Good Credit Rewards with another lending product

- Affordable Housing Loan Program—Provides up to $35,000 in financing for Idaho first time home buyers that build or purchase a home in Boise

- Self Help Opportunity Program—Offers up to $20,000 in down payment assistance in Idaho for homeowners that build 15 percent of their home

Depending on eligibility requirements, Idaho first time home buyers may also be eligible for other types of first time home buyer programs available throughout the country, listed below.

- FHA Loan—Issued by the Federal Housing Authority with smaller down payments and lower credit requirements

- FHA 203(k)—Allows first time home buyers in Idaho to include renovation funds for fixer-upper homes

- USDA Loan—Offered by the U.S. Department of Agriculture for homes in certain rural areas

- VA Loan—For active-duty military members, veterans, and surviving spouses

- Energy Efficient Mortgage—Designed to help first time home buyers in Idaho create an energy-efficient home

First Time Home Buyers in Maryland | Best Loans for MD First Time Home Buyers

Conclusion – Getting the Best Mortgage as a First Time Home Buyer in Idaho

Purchasing a home for the first time can be an incredibly exciting time. After all, an Idaho first time home buyer loan marks an important milestone in the transition from renting to homeownership.

As a first time home buyer in Idaho, don’t forget to ask yourself the following questions throughout the process:

- Do I have enough in savings to cover additional Idaho first time home buyer costs?

- Do I qualify for down payment assistance in Idaho?

No matter whether you’re ready to start house hunting or simply exploring your possibilities, understanding your options can make a world of difference when taking out your first Idaho first time home buyer loan.

First Time Home Buyers in Georgia | Best Mortgage Rates for Georgia First Time Home Buyers

Current Mortgage Rates in Delaware | DE Mortgages for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image source:

https://pixabay.com/en/guide-idaho-map-navigation-1836539/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.