Getting the Best Mortgage Rates in Delaware (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Are you in the market to buy a home in Delaware? Are you looking to refinance an existing Delaware mortgage rate?

Regardless of whether you are refinancing or buying, you’ll want to make sure that you get the best possible Delaware mortgage rates.

Investing in real estate in Wilmington, Dover, Newark, Middletown, Milford, or any other city in Delaware will become one of the biggest financial decisions of your life. Of course, it will probably also be one of the most expensive.

Your total DE mortgage cost will depend on a variety of factors, including the total amount of the loan, interest rates, down payment, terms, and even your credit score.

One of the best ways to proactively keep Delaware mortgages manageable is to secure the best mortgage rates.

Not only can a great DE mortgage rate lower your financial burden and promote good financial health, but it can also help you save money over the total life of the loan.

Current Mortgage Rates in North Dakota | Mortgage Rates in ND for Good-Excellent Credit Borrowers

Best Mortgage Rates in Puerto Rico | Home Loans in Puerto Rico for Good-Excellent Credit Borrowers

Key Requirements for Buying a House in Delaware

Before you apply for a Delaware mortgage loan, you’ll want to complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for Delaware mortgages before choosing between the best mortgage rates in Delaware for you.

Newark, DE

Current Mortgage Rates in New Hampshire | NH Mortgage Rates for Good-Excellent Credit Borrowers

Good, Great, or Excellent Credit Scores for Mortgage Rates in Delaware

Most Delaware mortgage companies that offer competitive DE mortgages use a FICO score to determine if a Delaware-based borrower is creditworthy or not.

Because your credit score plays a large role in the kind of DE mortgage rate you will receive, it’s worth taking the time to look over your credit before applying for the best Delaware mortgage rates.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

FICO scores generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

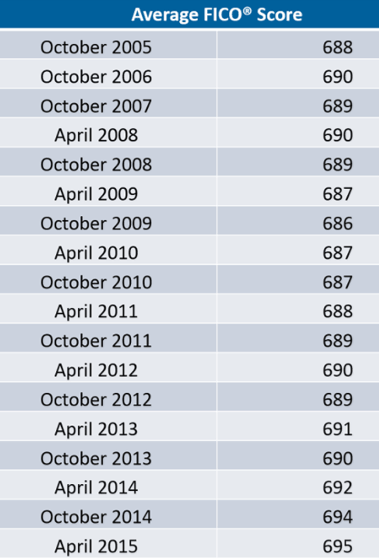

If you’re curious about the average credit score, see the table below for average FICO scores from 2005-2015.

According to CNBC, as of this year, the national average is 700—and according to ValuePenguin, Delaware borrowers come in at 665.

Additional Considerations for Delaware Mortgage Rates

These refinance rates are offered by Delaware mortgage companies and out-of-state lenders who provide competitive mortgage rates in Delaware.

When searching for the best Delaware mortgage rate for you, there are a few additional pieces of information to keep in mind.

If you have a good, great, or excellent credit history and you are seeking a Delaware mortgage rate for a loan totaling over $424,100, some lenders may be able to provide different terms and a different mortgage rate in Delaware.

For this reason, it’s important to confirm any Delaware mortgage rates and terms for specific amounts before making a commitment.

Additionally, it’s also important to keep in mind that the APR and payment information does not include state-specific taxes or required insurance premiums.

As such, you should expect that your monthly Delaware mortgage payment will be greater when taxes and insurance products are added.

Current Mortgage Rates in Kansas | Best KS Mortgage Rates for Good-Excellent Credit Borrowers

Current Mortgage Rates in Hawaii | Best Hawaii Mortgage Rates for Good-Excellent Credit Borrowers

Conclusion – Finding a Top Mortgage Loan for a Home in Delaware

Finding great mortgage rates in Delaware may take time, but the payoff is certainly worth the effort.

As you search for the best Delaware mortgage rates, you may want to ask yourself the following questions:

- Can I get a better DE mortgage rate from a bank or a credit union?

- What are the Delaware refinance rates and Delaware mortgage rates like from online-only lenders?

- Does my Delaware mortgage rate come with flexible, sustainable terms over the life of the loan?

Ultimately, finding the best Delaware mortgages comes from a combination of long-term affordability and partnership.

No matter what DE mortgage lender you choose, it’s important to partner with a financial institution that you trust and are comfortable working with for the next few decades.

There are plenty of ways to identify the best provider of Delaware mortgage rates, including fees, quality of customer service, and how competitive their DE mortgages are.

Current Mortgage Rates in Idaho | ID Mortgage Rates for Good-Excellent Credit Borrowers

Current Montana Mortgage Rates | MT Refinance Rates & Mortgages for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/newark-delaware-town-street-248044/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.