Getting the Best Mortgage Rates in Idaho (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Idaho home values are on the rise, a trend which is predicted to continue throughout the next year.

According to Zillow, the median home value is currently $195,700, marking a significant increase of 10.3 percent within the past year.

Experts predict that home values will continue to rise by as much as 3.8 percent in 2018, which may be challenging for a first-time home buyer hoping to get a competitive mortgage rate in Idaho.

With accelerated home values, finding manageable ID mortgage rates is crucial for potential homeowners in Idaho to ensure that homeownership remains affordable over the long-term.

Current & Best Mortgage Rates in Michigan for Good Credit

Best CD Rates in PA | Pittsburgh, Philadelphia & Other Pennsylvania Cities

Which Idaho City Are You Located in?

When it comes to finding the best Idaho mortgage rate, there are plenty of factors to consider, especially for a first-time home buyer in Idaho.

For many Idaho mortgage lenders in Boise, Nampa, Idaho Falls, Twin Falls, Meridian, Lewiston, and other cities in Idaho, the location of the home will play a large role in what type of Idaho mortgage rates are available.

This means that homes across the state could have varying mortgage rates based on the individual city, neighborhood, and the condition of the home itself.

While you are evaluating current mortgage rates in Idaho, it may be worthwhile to check the rates for neighboring cities to explore other ID mortgage rates that could potentially be more affordable over the long run.

See the table below for a list of some of the largest cities in the state offering a wide range of Idaho mortgages.

| Top Idaho Cities | Population (2016) |

| Boise | 223,154 |

| Meridian | 95,623 |

| Nampa | 91,382 |

| Idaho Falls | 60,211 |

| Pocatello | 54,746 |

| Caldwell | 53,149 |

| Couer d’Alene | 50,285 |

| Twin Falls | 48,260 |

| Lewiston | 32,872 |

| Post Falls | 31,865 |

| Rexburg | 28,222 |

| Moscow | 25,322 |

Source: Google

Key Requirements for Idaho Home Loans

Before you apply for Idaho home loans, you’ll want to complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for Idaho mortgages before choosing between the best mortgage rates in Idaho for you, exploring both conventional (10, 15, 20, or 30-year) and adjustable rate mortgages (5/1, 3/1, 7/1 ARM).

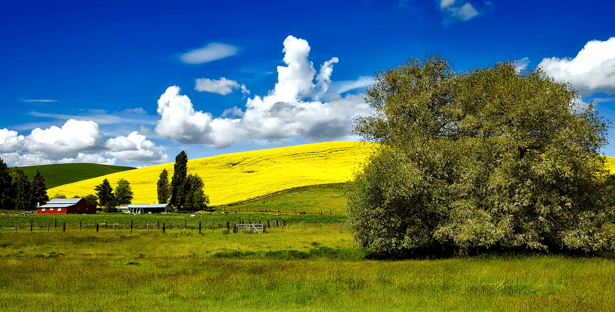

Panorama View of a Farm in Idaho

Best CD Rates in Ohio for People with Good & Great Credit

Best CD Rates in California for Good Credit (1-Month to 5-Year CDs)

Additional Considerations for Idaho Mortgage Rate Tables

When searching for the best Idaho mortgage rate for you, there are a few additional pieces of information to keep in mind.

If you have a good, great, or excellent credit history and you are seeking an Idaho mortgage rate for a loan totaling over $424,100, some lenders may be able to provide more favorable terms and a different mortgage rate in Idaho.

For this reason, it’s important to confirm any Idaho mortgage rates and terms for specific amounts before making a commitment.

Additionally, it’s also important to keep in mind that APR and payment information often does not include state-specific taxes or required insurance premiums.

As such, you should expect that the cost of Idaho mortgages will be greater when taxes and insurance products are added.

Best CD Rates in Texas for Good-to-Great Credit

Best CD Rates in Houston and Dallas, TX

Conclusion – Finding a Top Mortgage Loan for a Home in Idaho

Purchasing a home can be an exciting time—for many homeowners, it marks change, renewal, progress, and the pride of ownership.

Not surprisingly, purchasing or refinancing a home can also be an expensive time, particularly when it comes to Idaho mortgage rates and refinance rates in Idaho.

Understanding Idaho mortgage rates and Idaho refinance rates is the best way to ensure that a mortgage or refinance sets you up for financial success over the long run.

After all, Idaho home loans are meant to last for decades, making it crucial for each homeowner to find the best Idaho mortgage rates.

Best CD Rates in Florida for Good-to-Great Credit

Best Wyoming Mortgage Rates | Top WY Mortgage & Refinance Rates for Good-Excellent Credit Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image source:

https://pixabay.com/en/idaho-farm-panorama-fields-meadow-1602027/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.