RANKING & REVIEWS

BEST FINANCIAL ADVISORS IN GREENSBORO, CHAPEL HILL, & WINSTON-SALEM, NC

Top Financial Advisors in Greensboro, Chapel Hill & Winston-Salem, North Carolina for 2021-2022

No matter where you are on the path towards achieving your life goals, when it comes to financial management many people can use the help of an experienced wealth management firm. Financial advisors can help you make sense of the markets and create a strategic path to your future dreams.

The biggest challenge with finding the right Greensboro, Chapel Hill, or Winston-Salem financial planning firm to work with is how to sort through multiple firms to find one with the attributes and services that best fit your needs.

Many of those living in Chapel Hill and the Piedmont Triad region (Greensboro, Winston-Salem, and High Point) are looking for trusted financial advisors that can help them plan for important life transitions and events – from retirement to educational funding, and growing their nest egg through smart investments.

If you’ve never worked with a North Carolina wealth advisor, you may be wondering:

- Do they work with my level of investable assets?

- What is their track record with investment portfolios?

- Do they offer additional services like insurance or tax planning?

- How much do financial planning services cost in North Carolina?

Narrowing down the list to your best candidates can take a lot of time and effort, especially if you’re not sure what to look for in a top North Carolina financial advisory firm.

AdvisoryHQ aims to make the search phase easier by reviewing hundreds of firms throughout the country and providing lists of the best financial advisors in select geographical areas.

For our 2021-2022 ranking of the best financial advisors in the Chapel Hill, Greensboro, and Winston-Salem area, we’ve selected and rated the top 10 firms. We’ve included things like fee structure, financial philosophy, and what makes each firm stand out.

After reviewing this list of the top 10 financial advisors in the Winston-Salem, Chapel Hill, and Greensboro areas, you should be in a much better position to find a financial advisor you can trust who will fit your needs and future financial goals.

Award Emblem: Top 10 Financial Advisors in North Carolina

Top 10 Financial Advisors in Greensboro, Chapel Hill & Winston-Salem | Brief Comparison & Ranking

| Financial Advisors in North Carolina | 2021-2022 Ratings |

| Delegate Advisors | 5 |

| Maestro Wealth Advisors | 5 |

| Old Peak Finance | 5 |

| Salem Investment Counselors | 5 |

| Stearns Financial Group (SFG) | 5 |

| Triad Financial Advisors | 5 |

| Woodward Financial Advisors | 5 |

| Blue Rock Wealth Management | 3 |

| DMJ Wealth Advisors, LLC | 3 |

| Eton Advisors | 3 |

Table: 10 Best Financial Advisors in Greensboro, Chapel Hill & Winston-Salem, NC | Above list is sorted by rating

See Also: Best Financial Advisors in San Antonio and New Braunfels, TX

Fee-Based vs Fee-Only North Carolina Financial Planners | What’s the Difference?

When you start to research financial advisors in Greensboro, Chapel Hill, or Winston-Salem, you’ll run across two terms that may sound fairly similar, but mean very different things: “fee-only” and “fee-based.”

What do those terms mean and which type of wealth management firm in North Carolina should you choose?

Fee-Only Financial Advisors

When an NC wealth management firm states they are fee-only, it means their compensation is earned ONLY from client fees. They do not accept any outside commissions or incentives from 3rd parties for selling financial products.

Because a fee-only advisor’s sole source of income comes from their clients, this structure minimizes the natural conflicts of interest that can accompany the recommending and selling of investment products when incentives are involved.

Top-Rated Financial Advisors in Greensboro, Chapel Hill, & Winston-Salem, NC

A financial advisor in Greensboro, Winston-Salem, or Chapel Hill that uses a fee-only structure is in a better position to act solely in the best interests of their clients.

Fee-Based Financial Advisors

On the other hand, financial planning firms in North Carolina that are fee-based are free to accept commissions or incentives from companies whose financial products they recommend and sell to investors.

Because a fee-based structure does create a potential conflict of interest, many fee-based investment firms are also fiduciaries, which often offsets the potential for conflict.

Both fee-based and fee-only firms can be fiduciaries. As fiduciary, financial advisors in Winston-Salem, Greensboro, or Chapel Hill, NC take on a legal obligation to fully disclose any conflicts of interest and are required to put the best interests of their clients ahead of their own at all times.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2021-2022 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review— Best Wealth Management Firms in Greensboro, Chapel Hill, & Winston-Salem, NC

Below, please find a detailed review of each firm on our list of 2021-2022 best wealth management firms in Greensboro, Chapel Hill, and Winston-Salem, NC. We have highlighted some of the factors that allowed these financial advisors in North Carolina to score so high in our selection ranking.

Click on any of the names below to go directly to the review section for that firm.

- Delegate Advisors

- Maestro Wealth Advisors

- Old Peak Finance

- Salem Investment Counselors

- Stearns Financial Group (SFG)

- Triad Financial Advisors

- Woodward Financial Advisors

- Blue Rock Wealth Management

- DMJ Wealth Advisors, LLC

- Eton Advisors

Click below for previous years’ rankings:

- 2019 Review: 10 Best Financial Advisors in Greensboro, Chapel Hill & Winston-Salem, NC

- 2018 Review: Top 10 Best Financial Advisors in Greensboro, Chapel Hill & Winston-Salem, NC

- 2017 Review: Top 9 Financial Advisors in Greensboro, Chapel Hill, & Winston-Salem, NC

- 2016 Review: Top 10 Financial Advisors in Greensboro, Chapel Hill, and Winston-Salem, North Carolina

Don’t Miss: Ranking of Financial Advisors in Tampa & St. Petersburg, FL

Delegate Advisors Review

Founded in 2012, Delegate Advisors is an independent financial advisor in Chapel Hill, NC with an additional office in San Francisco, CA. As strong believers in patient but flexible capital, the firm specializes in helping families improve and simplify their financial lives.

This top-rated wealth management firm in North Carolina is a fee-only fiduciary, which ensures that clients receive completely unbiased advice with their best interests in mind.

Key Factors that Enabled Delegate Advisors to Rank as a Top Financial Advisor in Chapel Hill, NC

Delegate Advisors Difference

When it comes to selecting the top North Carolina financial advisors to work with, one of the best ways to identify the best firms is by looking at the firm’s philosophical and ethical principles.

Delegate Advisors adheres to the following set of values:

- Looking at the Horizon: Financial plans are tailored to the distinct needs of each client, and always focused on achieving long-term goals.

- Patient but Flexible Capital: These Chapel Hill financial advisors will keep your money on a stead-fast path while also remaining open to new opportunities.

- Believing in the Golden Rule: The firm is dedicated to maintaining transparency, trust, and accountability every step of the way.

- Taking Your Time: Rather than rush through financial decisions, Delegate Advisors prefers to check and double-check to minimize mistakes and ensure your financial plan is thoroughly thought through.

- Reduce the Noise: Client’s existing portfolios are evaluated to improve efficiency, cost-effectiveness, and ease of management.

Best Financial Advisors in Chapel Hill, NC

Clear Investment Philosophy

The investment philosophy at Delegate Advisors is comprised of a set of clear, core principles that may sound simple, but have deep impacts on financial strategy and sustainability.

These top-rated Chapel Hill financial advisors hold the following principles as part of their investment philosophy:

- All costs matter

- Great ideas can come from anywhere

- Patient but flexible capital is key

- There is no risk like not understanding risk

- Common sense should be more common

- Know when to walk away

Rating Summary

With a straightforward and comprehensive approach, the team at Delegate Advisors works to make wealth management as simple as possible while infusing their clients’ portfolios with sound investment principles.

With an experienced team, a wide range of services, and a commitment to trust and transparency, Delegate Advisors easily solidifies their 5-star rating as one of the best financial planners in North Carolina to consider partnering with in 2021-2022.

Related: Review of Best Financial Advisors & Planners in Atlanta, GA

Maestro Wealth Advisors Review

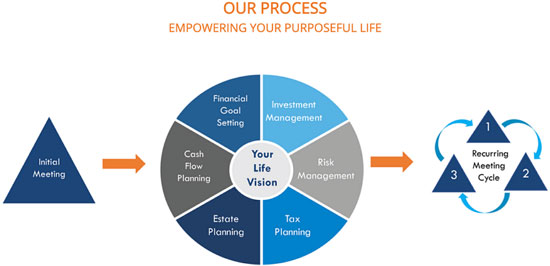

Maestro Wealth Advisors is a full-service, independent financial advisor in Winston-Salem, NC with a satellite office in Greensboro. It’s been helping clients answer difficult questions about their financial future since 2009.

The firm offers investment advisory services through Retirement Wealth Advisors (RWA), a fee-only Greensboro and Winston-Salem wealth management firm. Maestro Wealth Advisors does not state whether their firm is fee-based or fee-only.

We always suggest confirming the fee structure before hiring a financial services firm.

Key Factors that Enabled Maestro Wealth Advisors to Rank as One of the Top Financial Advisor in Winston-Salem, NC

Wide Range of Financial Services

Financial goals are subject to change and evolve over time, so for many people, finding a Greensboro financial advisor that can adapt their services accordingly is a key component of long-term financial stability.

The financial advisors at Maestro provide an array of financial services to support their clients’ financial goals at every stage of life:

- Financial Goal Planning: Identifying your unique financial goals and the steps you need to take to reach them.

- Investment Asset Management: Managing your assets based on your unique individual financial goals, preferences, and personal risk tolerance.

- College Funding: Exploring the best options for the funding of higher education & identifying the best college savings plans for you and your family.

- Income Planning & Analysis: Identifying predictable sources of income and developing a customized retirement plan.

- Tax Efficient Real Estate Liquidations: Assisting with the sale of businesses, investment properties, or vacation homes by facilitating 1031 exchanges to help minimize the tax burden and maximize the sales.

- Tax Planning: Structuring your assets to minimize any future tax implications.

- Social Security Analysis: Answering questions about Social Security, such as the best time to file, receiving spousal benefits, and more.

- Estate & Legacy Planning: Creating a plan to effectively transfer assets to the next generation and beyond.

- Retirement Planning: Developing a comprehensive retirement plan by listening to and understanding each client’s retirement vision, adjusting it to your specific needs, and finally executing it.

Retirement Planning – Winston-Salem Financial Advisors

WealthGuard™

To keep clients up to date on their financial progress, the team at Maestro Wealth Advisors provides access to WealthGuard™, a powerful and easy-to-use account monitoring system.

WealthGuard™ allows clients to track all their accounts from one dashboard, monitoring components like asset allocation and overall performance.

Clients are notified by either email or text message should any changes occur, making it easy to stay on top of portfolio performance on a daily basis.

Rating Summary

With a whole host of educational resources on their website, Maestro Wealth Advisors is a great fit for those who want to know everything they can about financial management and investing.

With a wide range of services, a specialty in retirement planning, and a holistic approach, Maestro Wealth Advisors scores a 5-star rating as one of the top financial advisors in Winston-Salem, NC to consider partnering with in 2021-2022.

Popular Article: Top Wealth Management Firms in Houston, TX

Old Peak Finance Review

Old Peak Finance is a Chapel Hill, North Carolina firm that believes no two clients are alike and provides financial solutions tailored to each individual client. This financial advisory works with busy executives, expatriates, and retirees seeking to achieve their unique financial goals.

This fee-only financial advisor in Chapel Hill is also a fiduciary, taking on a legal commitment to always act in their client’s best interests and be completely transparent with unbiased advice.

Key Factors that Enabled Old Peak Finance to Rank as One of the Best Financial Advisors in Chapel Hill, NC

Real Financial Planning®

When you’re entrusting an NC financial advisor with your money, you want to know everything there is to know about the process. Old Peak Finance’s signature Real Financial Planning® program aims to do just that.

Efficient financial planning considers all facets of a client’s life and integrates them for a complete financial plan.

Chapel Hill Financial Advisors – Real Financial Planning®

Old Peak Finance provides comprehensive wealth management services for clients in Chapel Hill, including:

- Financial Goal Planning: Creating a financial plan for retirement, future education funding, starting a business, or other financial goals.

- Investments: Analyzing current investments, their performance, and strategizing for the future.

- Tax Planning: Identifying opportunities to minimize tax expenses and use tax-efficient strategies.

- Estate Planning: Analyzing current estate plan for risk areas.

- Analysis of Insurance Needs: Identifying whether you have too little (or too much) insurance coverage.

Making a Difference

Old Peak Finance is a unique financial advisory firm in Chapel Hill, NC. Apart from providing comprehensive financial advisory services, this firm stands out in its commitment to creating positive change in the community.

Every year, Old Peak Finance asks its clients to recommend a non-profit charity. Based on the clients’ choices, the firm then makes donations to each recommended charity. This is the firm’s way of expressing gratitude to its clients.

Over the years, Old Peak Finance has made donations to over 100 non-profit charities – both local, national, and global.

Rating Summary

Old Peak Finance offers its clients a strong foundation of trust and transparency. This team of fee-only, fiduciary, Chapel Hill financial advisors makes a strong commitment to do right by their clients.

With an integrated investment approach, a comprehensive strategy, and a mission to help clients achieve financial success, Old Peak Finance earns a 5-star rating as one of the best Chapel Hill financial advisors to consider partnering with this year.

Salem Investment Counselors Review

Founded in 1979, Salem Investment Counselors is a Winston-Salem wealth management firm with a second office in Durham, NC. The firm prides itself on its fiduciary duty to clients and provides completely unbiased financial advice.

This fee-only financial advisor’s ADV states that “Salem’s fees are exclusive of brokerage commissions, transaction fees, and other related costs and expenses…” and “Salem shall not receive any portion of these commissions, fees, or charges.”

Key Factors that Enabled Salem Investment Counselors to Rank as One of the Best Financial Advisors in Winston-Salem, NC

Diverse, Talented Team

Clients of Salem Investment Counselors have the advantage that comes with a large team of diverse backgrounds and skillsets, including banking, law, accounting, taxation, investment analysis, real estate, and venture capital.

The team of North Carolina financial planners at Salem Investment Counselors also holds multiple industry and professional designations, including:

- CFA – Chartered Financial Analyst

- MBA—Master of Business Administration

- CPA—Certified Public Accountant

All core members of the SIC investment team have achieved the CFA designation.

With a wide array of professional backgrounds, and advisors holding a variety of designations, clients can trust that their financial health is in expert hands with these Winston-Salem financial managers.

Top Financial Planning Firms in Winston-Salem, NC

Investment Management Philosophy

Investors looking for solid portfolio management in Winston-Salem will appreciate this firm’s investment approach. With expertise in selecting investments throughout the real estate, energy, and venture capital industries, the North Carolina financial advisors at Salem concentrate on building a portfolio foundation with common stocks that include:

- Established companies with above-average growth prospects

- Small and medium-sized companies that are selling at prices that do not reflect their long-term potential

- Companies in industries that are undergoing consolidation

For fixed-income investing, these advisors maintain an approach that minimizes risk, only considering high-quality issues that fall within the short-term to immediate-term maturity range.

Rating Summary

Salem Investment Counselors is a great option for clients looking for a disciplined investing approach that looks at long-term, sustainable gains while minimizing risk.

With an experienced team, a fiduciary commitment, and a mission to help clients enjoy financial well-being, Salem Investment Counselors solidifies a 5-star rating as one of the best financial advisors in Winston-Salem, NC to consider partnering with in 2021-2022.

Read More: Best Financial Advisors in Iowa (Des Moines, Davenport & Ames)

Stearns Financial Group (SFG) Review

Stearns Financial Group (SFG) is a top-rated financial advisor in Greensboro and Chapel Hill, NC that offers forward-thinking services. This team of financial advisors aims to empower each client’s life through financial confidence and clarity.

The firm is a fee-only North Carolina financial advisor that prides themselves on their in-depth financial planning using a multi-scenario approach. Stearns Financial serves clients throughout the U.S. and overseas.

Key Factors that Enabled Stearns Financial Group to Rank as One of the Best Greensboro & Chapel Hill Financial Advisors

Focus on Women in Transition

Women often have unique financial needs due to factors such as longer lifespans, prolonged careers, and taking time away from the workforce to build a family.

As a top-rated Chapel Hill and Greensboro wealth management firm, SFG maintains a special focus on empowering women financially and nurturing their financial literacy to help them effectively handle finances through a variety of life transitions such as:

- Divorce & New Beginnings

- Financial Literacy as Awareness

- Loss of Spouse

- Philanthropy

- What-If Scenario Planning

- Sudden Money Events

- Transition Planning

Specialty Financial Planning

Financial planning helps you put your money to work funding future dreams and goals, such as retirement, traveling, and funding your children’s educations.

But sometimes, you need expert advice when life takes a sharp turn in an unexpected direction. A financial advisor in North Carolina can review your finances with an objective eye and determine what can be adjusted to keep your financial future on track.

This Greensboro and Chapel Hill financial advisor offers the following areas of specialty:

- Business Owners

- Intelligent Aging

- Life Transitions

- Retirement Readiness

- Sudden Money

- Women

The North Carolina financial advisors at SFG can also help you answer questions like:

- Are my investments set up in the best way?

- Will I outlive my money?

- Do I need long-term insurance?

- Will my estate plan work?

- Is aging in a retirement community a better option?

Top Financial Advisors in Greensboro and Chapel Hill, NC

Top Financial Advisors in Greensboro and Chapel Hill, NC

Rating Summary

Stearns Financial Group helps clients through the financial challenges that come in all stages of life. For clients that want a financial partner who goes well beyond just investments, this North Carolina wealth management is an excellent match.

With a specialty in financial planning for women, a proactive approach, and a fully integrated financial planning philosophy, SFG earns a 5-star rating as one of the best financial advisors in Chapel Hill, NC, and Greensboro, NC to consider working with this year.

Triad Financial Advisors Review

For over three decades, Triad Financial Advisors has been committed to helping clients and colleagues in the Greensboro, NC area live, invest, and retire with intention.

This fee-only financial planner in the Piedmont Triad region also makes a fiduciary commitment to their clients, promising to always put their best interests first with completely conflict-free advice.

Key Factors that Enabled Triad Financial Advisors to Rank as a Top Financial Advisor in Greensboro, NC

Fee-Only Firm

As an independent, fee-only investment advisory firm, Triad Financial Advisors offers a solid foundation of trust and transparency upon which to build a long-term client-advisor relationship.

These Greensboro, NC financial advisors embrace client-centered values that include always acting in their clients’ best interests and not having any competing conflicts of interest that can come from accepting commissions or incentives.

Triad Financial Advisors’ fee-only model offers peace of mind to clients who want to know that their advisor is managing their money with a strong financial future in mind.

Greensboro, NC Top-Rated Wealth Management Firms

Holistic Wealth Management Services

When you work with a financial advisor that offers multiple services, it provides you with convenience and integration.

The team at Triad boasts an array of personalized, goal-based services to help clients, arranged according to client needs:

- Asset & Debt Management

- Cash Flow & Income Management

- Investment Management

- Asset Protection & Preservation

- Estate Planning

- Philanthropy

- Tax Management

Rating Summary

Triad Financial Advisors takes a personalized approach to financial management and does not believe in being compromised by commission, affiliations, or product sales goals. Instead, the team works solely in the interests of their clients.

With multiple industry recognitions, an experienced team, and a client-centric attitude, Triad Financial Advisors scores 5-stars as one of the best financial advisors in Greensboro, NC to partner within 2021-2022.

Related: Top Financial Advisors in Oklahoma City & Tulsa, OK

Woodward Financial Advisors Review

Offering personalized financial planning services in Chapel Hill, NC, Woodward Financial Advisors believes clients are more than just a pie chart. They get to know your hopes, dreams, fears, and concerns so they can help with targeted financial advice.

This independent, fee-only North Carolina financial advisor charges a flat annual fee and does not accept any commissions or referral fees, ensuring that the advice they give comes with no hidden costs.

Key Factors that Enabled Woodward Financial Advisors to Rank as a Top Financial Advisor in Chapel Hill, NC

Core Values and Comprehensive Planning

Woodward Financial Advisors’ guiding principles are reflected in how they operate, make decisions, and serve clients.

These core values are:

- Integrity

- Intellectual Curiosity

- Humble Confidence

- Passion

- Warmth

Woodward believes that by taking a proactive role, clients can have more control over their financial future. Comprehensive planning is a key component of this approach and makes working with this North Carolina financial advisor easy.

During the planning process, this team of Chapel Hill wealth managers assesses all areas of a client’s financial situation, including income, expenses, debt, insurance, and taxes.

By taking the time to understand each client, this team of financial advisors is able to craft targeted, coordinated financial strategies with a better chance of success.

This thorough approach also puts the firm in the best position to give spot-on recommendations for issues such as tax planning and cash flow.

Wealth Management Firms in Greensboro, Chapel Hill, and Winston-Salem, NC

Clear Wealth Management Process

Clients benefit from a team of three financial advisors that will work together to help them succeed.

This North Carolina wealth management firm’s goal is to help its clients save time, energy, and money while reducing stress and uncertainty.

Woodward Financial Advisors’ wealth management process begins with the creation of an investment policy statement. This statement is essentially the map by which the firm will help clients reach a variety of financial goals. It contains the following elements:

- Clear articulation of goals and dreams

- Investment time horizon

- Diversification among asset classes and securities

- Cash flow needs

- Asset allocation targets

- Tax issues and efficiency in investing

- Estate planning

- Risk tolerance assessment

Rating Summary

The dedicated team approach of Woodward Financial Advisors offers a valuable asset to clients who can be assured they will always be taken care of by an available team member when they need one.

With a straightforward financial planning process, an experienced team, and a fee-only status, Woodward Financial Advisors earns a 5-star rating as one of the best financial advisors in Chapel Hill, NC to work with in 2021-2022.

Blue Rock Wealth Management Review

With a seasoned team and over 100 years of collective experience, Blue Rock Wealth Management works to simplify finances and shepherd clients through life transitions by keeping them on the right financial path.

This fee-based Winston-Salem, NC financial advisory firm uses a holistic collaborative planning process to lead its clients through life transitions such as the sale of a business, change of careers, divorce or loss of a spouse, inheritance, etc.

Key Factors that Enabled Blue Rock Wealth Management to Rank as a Top Financial Advisor in Winston-Salem, NC

Holistic Financial Planning

Blue Rock works to cut through the clutter and connect all the pieces of your financial life. In this way, they can better provide a clear direction that includes all parts working together in order to help you reach your financial goals.

These Winston-Salem, NC financial advisors provide a full range of services, including things like financial assessment, advice about 401Ks, and more.

Their holistic financial planning integrates the following to better serve your needs:

- Retirement

- Investments

- Insurance

- Cash Flow

- Estate Planning

- Tax Planning

Top-Rated Wealth Management Firms in North Carolina

Financial Education Resources

One of the hallmarks of a top North Carolina financial planning firm is a focus on financial education and on helping their clients gain more knowledge of multiple financial management topics.

Blue Rock offers a robust set of educational tools on its website for clients and non-clients alike. This shows that they go out of their way to help individuals make better financial decisions by fostering financial literacy.

This financial advisor in Winston-Salem, NC offers the following educational resources:

- Blogs

- Helpful Websites

- Podcasts

- Whitepapers

- Ebooks

Rating Summary

Blue Rock Wealth Management team upholds a fiduciary standard and is legally bound to always act in their clients’ best interests. Their client-centric, holistic approach ensures that portfolios are fluid and integrate all facets of a client’s financial life.

While Blue Rock has a lot to offer clients, we found that the firm’s website is still being served over HTTP which is an insecure protocol. Trust and security are both major factors in any client’s decision, therefore providing a safe HTTPS (SSL certified) website is extremely important for any business.

In addition to site security issues, BRWM’s website also seems to be lacking a good description of the firm’s services and how they help clients achieve their financial goals. This could make it more difficult for a potential client to fully evaluate the firm, and thus we’ve rated them with 3-stars.

By adding more detail on the firm’s financial planning and wealth management services, and enabling an SSL website certificate, Blue Rock Wealth Management could easily improve its value proposition to clients and its ranking as a top North Carolina financial advisor.

Don’t Miss: Best Wealth Management Firms in Kansas City, Leawood & Overland Park

DMJ Wealth Advisors Review

Providing financial planning services for 70 years, DMJ Wealth Advisors, LLC is a full-service financial advisory firm based in Greensboro, North Carolina. This team of advisors maintains an environment that values education, competence, and integrity.

DMJ is a fee-based wealth management firm in North Carolina that’s committed to providing a high level of independent financial advice to its clients.

Key Factors that Enabled DMJ Wealth Advisors to Rank as a Top Financial Advisor in Greensboro, NC

Focus on Women

DMJ Wealth Advisors believes that women should have the confidence to make smart life decisions that are backed by financial literacy.

This Greensboro financial advisory firm seeks to foster that confidence by offering educational opportunities as well as advisors that understand the surprises life can bring. The team can help women manage life events including divorce, the death of a spouse, and children returning home.

Services for women provided by DMJ Wealth Advisors include:

- Financial Plan Development

- Investment Placement & Management

- Estate Conservation

- Long-Term Care

- Qualified Retirement Programs

- Personalized Investment Tracking Website

- Tax-Efficient Investing

- Life Insurance Assessment & Policy Acquisition

Additionally, the firm hosts Women in New Friendships and New Experiences (WN2). This program gives women the chance to take advantage of fun activities such as yoga and painting with the purpose of making new connections for mentorship, encouragement, and fellowship.

Extensive Resources

DMJ Wealth Advisors provides clients with an extensive range of resources to build up their financial knowledge. These educational resources fall under six main categories:

- Retirement: Focuses on the accumulation of wealth so that clients can attain the retirement lifestyle that they desire.

- Investment: Designs strategies to fit clients’ goals, time horizon, and risk tolerances.

- Estate: Helps ensure that a client’s wealth is distributed equally after passing.

- Tax: Educates clients on the variety of ways they can make tax-efficient decisions.

- Money: Helps clients discover better ways to manage their money.

- Lifestyle: Focuses on helping clients envision and create a lifestyle that suits their desires and financial targets.

Rating Summary

As a top-rated Greensboro financial planner, DMJ Wealth Advisors offers a full range of integrated financial planning and wealth management services. It also offers value through its focus on financial education.

However, we could not find a statement of a fiduciary commitment, which is a vital element of any financial planning relationship. For this reason, we’ve scored DMJ with a 3-star rating.

By adopting a fiduciary commitment and clearly stating its fee structure, DMJ Wealth Advisors could easily improve both its value proposition to new clients and its rating as a top financial advisor in Greensboro, NC.

Eton Advisors Review

With a goals-based framework, Eton Advisors is a boutique financial advisory firm in Chapel Hill, NC that serves ultra-high-net-worth clients and offers sophisticated multi-generational wealth management and family office services.

Eton does not specifically state whether they are a fee-only or fee-based North Carolina wealth management firm. The firm’s ADV does make note of “sponsorship fees” but is not completely clear about commissions.

We advise readers to always verify compensation structures before working with any financial advisor.

Key Factors that Enabled Eton Advisors to Rank as One of the Best Financial Advisors in Chapel Hill, NC

Goal-Based Framework

While the methods may vary, a solid financial plan that’s tied to your goals is a crucial element of any successful financial strategy.

The Chapel Hill, North Carolina team of financial advisors at Eton uses their goals-based investment framework to assist clients with the following:

- Identifying risk tolerances

- Identifying nature and size of financial goals

- Determining the priority of different goals relative to each other

- Determining the respective time horizon for individual goals

- Conducting a cash flow analysis that prioritizes these goals

- Categorizing of goals into Needs & Obligations, Priorities & Expectations, and Desires & Aspirations

- Creating sub-portfolios with different levels of risk based on the goal category (i.e.low-risk assets in Needs & Obligations with higher risk assets in Desires & Aspirations)

Wealth Structuring & Family Office Services

This branch of Eton provides experienced support and services for individuals who want to proactively manage their family’s wealth. These services are divided into 3 categories:

Estate Transfer & Tax Planning

- Integration of investment and tax planning

- Wealth transfer strategies

- Gifting and philanthropic strategies

- Integration across different households and generations

Reporting and Administrative Services

- Compliance with regulations

- Cash flow and budget management

- Trust and partnership administration

- Oversight of fiduciaries, consolidated reports, statements, and record-keeping

- Accounts payable

- Foundation management

Private Wealth Education and Special Projects

- Family meeting, retreat planning, and administration

- Planning for post-sale liquidity

- Leadership succession planning

- Vendor network library, management, and referrals

- Private foundation overview and recommendations

Rating Summary

For those with generational wealth and more sophisticated wealth management needs, Eton offers boutique services that can maximize the probability of achieving specific financial goals over generations.

The firm also offers a large team that ensures clients can benefit from a wide range of financial expertise, enhancing the overall investment management experience.

While the firm is a fiduciary, they are unclear about their fee structure, which makes it difficult for potential clients to fully evaluate them. For this reason, Eton Advisors ultimately earns a 3-star rating among the top financial planners in North Carolina.

By clearly stating their fee structure, Eton Advisors could easily improve both their value proposition to new clients and their rating as one of the top financial advisors in Chapel Hill, NC.

Popular Article: Top Financial Advisors in Cincinnati, OH

Free Wealth & Finance Software - Get Yours Now ►

Conclusion — 2021-2022 Best Financial Advisors in Greensboro, Chapel Hill, and Winston-Salem, North Carolina

The top financial advisors in Greensboro, Winston-Salem, and Chapel Hill, North Carolina each take a personalized approach and have much to offer potential clients looking to start working toward their financial management goals.

Now that you’ve had a chance to learn more about these top 10 firms, your next step would be to choose 3 to 5 firms that you would consider working with and would like to learn more about.

Use qualifiers to help narrow down the list, such as:

- Types of asset levels they work with

- Specialties they offer

- Investment approach and philosophy

- Whether their services match your needs

- Fee structure and fiduciary duty

Next, set up an initial consultation with your top contenders. Most top North Carolina wealth management firms offer free initial consultations. This will allow you to get a feel for the advisors and whether or not they’re a good fit for your financial needs and goals.

Once you’ve found the best advisor that checks all the boxes for your financial needs, you can rest easy knowing you’ve taken an important step towards a brighter financial future.

Image sources:

- https://pixabay.com/photos/north-carolina-autumn-fall-trees-2809875/

- https://delegateadvisors.com/what-we-do/

- https://maestrowealth.com/contact/

- https://oldpeakfinance.com/real-financial-planning/

- https://saleminvestment.com/

- https://stearnsfinancial.com/

- http://www.triadfa.com/

- https://woodwardadvisors.com/

- http://www.bluerockwealthmanagement.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.