Getting the Best Mortgage Rates in California

Today’s California Mortgage Rates & Loans for Fair, Good, and Great Credit Scores

Are you in the market to buy a home in California? Or are you looking to refinance an existing California mortgage loan?

Refinancing or buying a home in Los Angeles, San Diego, San Francisco, San Jose, Sacramento, Riverside, Fresno, San Bernardino, Modesto, or any other city in California will be one of the most important purchases you will ever make. Not surprisingly, it also tends to be one of the most expensive.

Taking the time to find the best California home mortgage rates, before you commit to a long-term mortgage loan, is key to saving money in the long-term. As such, conducting a mortgage comparison between mortgage rate providers and lenders in California, before you purchase your home, is critical because today’s California mortgage rates are constantly changing.

Best Mortgage Rates in Vermont for Fair-Excellent Credit Borrowers

Current Mortgage Rates in Iowa for Good-Excellent Credit Borrowers

Which California City Are You Located in?

Mortgage loans for California based residents with good, great, and excellent credit scores are based on the city in which they are located, as well as on the amount of their down payment, the total loan amount, location and condition of the house (appraisal), and a wide range of other factors.

Most mortgage lenders in Los Angeles, San Diego, San Francisco, San Jose, Long Beach, Sacramento, Riverside, Fresno, San Bernardino, Oakland, and Modesto require a down payment of around 20%. Below is a list of some of the largest cities in California.

| Top California Cities | California Counties | Land area |

| Los Angeles | Los Angeles | 468.67 sq mi (1,213.8 km2) |

| San Diego | San Diego | 325.19 sq mi (842.2 km2) |

| San Jose | Santa Clara | 176.53 sq mi (457.2 km2) |

| San Francisco | San Francisco | 46.87 sq mi (121.4 km2) |

| Fresno | Fresno | 111.96 sq mi (290.0 km2) |

| Sacramento | Sacramento | 97.92 sq mi (253.6 km2) |

| Long Beach | Los Angeles | 50.29 sq mi (130.3 km2) |

| Oakland | Alameda | 55.79 sq mi (144.5 km2) |

| Bakersfield | Kern | 142.16 sq mi (368.2 km2) |

| Anaheim | Orange | 49.84 sq mi (129.1 km2) |

| Santa Ana | Orange | 27.27 sq mi (70.6 km2) |

| Riverside | Riverside | 81.14 sq mi (210.2 km2) |

| Stockton | San Joaquin | 61.67 sq mi (159.7 km2) |

| Chula Vista | San Diego | 49.63 sq mi (128.5 km2) |

| Fremont | Alameda | 77.46 sq mi (200.6 km2) |

| Irvine | Orange | 66.11 sq mi (171.2 km2) |

| San Bernardino | San Bernardino | 59.20 sq mi (153.3 km2) |

| Modesto | Stanislaus | 36.87 sq mi (95.5 km2) |

| Oxnard | Ventura | 26.89 sq mi (69.6 km2) |

| Fontana | San Bernardino | 42.43 sq mi (109.9 km2) |

| Moreno Valley | Riverside | 51.27 sq mi (132.8 km2) |

| Glendale | Los Angeles | 30.45 sq mi (78.9 km2) |

| Huntington Beach | Orange | 26.75 sq mi (69.3 km2) |

| Santa Clarita | Los Angeles | 52.72 sq mi (136.5 km2) |

| Garden Grove | Orange | 17.94 sq mi (46.5 km2) |

| Santa Rosa | Sonoma | 41.29 sq mi (106.9 km2) |

| Oceanside | San Diego | 41.23 sq mi (106.8 km2) |

| Rancho Cucamonga | San Bernardino | 39.85 sq mi (103.2 km2) |

| Ontario | San Bernardino | 49.94 sq mi (129.3 km2) |

| Lancaster | Los Angeles | 94.28 sq mi (244.2 km2) |

| Elk Grove | Sacramento | 42.19 sq mi (109.3 km2) |

| Palmdale | Los Angeles | 105.96 sq mi (274.4 km2) |

| Corona | Riverside | 38.83 sq mi (100.6 km2) |

| Salinas | Monterey | 23.18 sq mi (60.0 km2) |

| Pomona | Los Angeles | 22.95 sq mi (59.4 km2) |

| Torrance | Los Angeles | 20.48 sq mi (53.0 km2) |

| Hayward | Alameda | 45.32 sq mi (117.4 km2) |

| Escondido | San Diego | 36.81 sq mi (95.3 km2) |

| Sunnyvale | Santa Clara | 21.99 sq mi (57.0 km2) |

| Pasadena | Los Angeles | 22.97 sq mi (59.5 km2) |

| Fullerton | Orange | 22.35 sq mi (57.9 km2) |

| Orange | Orange | 24.80 sq mi (64.2 km2) |

| Thousand Oaks | Ventura | 55.03 sq mi (142.5 km2) |

| Visalia | Tulare | 36.25 sq mi (93.9 km2) |

| Simi Valley | Ventura | 41.48 sq mi (107.4 km2) |

| Concord | Contra Costa | 30.55 sq mi (79.1 km2) |

| Roseville | Placer | 5.16 sq mi (13.4 km2) |

| Santa Clara | Santa Clara | 18.41 sq mi (47.7 km2) |

| Vallejo | Solano | 30.67 sq mi (79.4 km2) |

| Victorville | San Bernardino | 73.18 sq mi (189.5 km2) |

| El Monte | Los Angeles | 9.56 sq mi (24.8 km2) |

| Berkeley | Alameda | 10.47 sq mi (27.1 km2) |

| Downey | Los Angeles | 12.41 sq mi (32.1 km2) |

| Costa Mesa | Orange | 15.65 sq mi (40.5 km2) |

| Inglewood | Los Angeles | 9.07 sq mi (23.5 km2) |

| Ventura | Ventura | 21.65 sq mi (56.1 km2) |

| West Covina | Los Angeles | 16.04 sq mi (41.5 km2) |

| Norwalk | Los Angeles | 9.71 sq mi (25.1 km2) |

| Carlsbad | San Diego | 37.72 sq mi (97.7 km2) |

| Fairfield | Solano | 37.39 sq mi (96.8 km2) |

| Richmond | Contra Costa | 30.07 sq mi (77.9 km2) |

| Murrieta | Riverside | 33.58 sq mi (87.0 km2) |

| Burbank | Los Angeles | 17.34 sq mi (44.9 km2) |

| Antioch | Contra Costa | 28.35 sq mi (73.4 km2) |

| Daly City | San Mateo | 7.66 sq mi (19.8 km2) |

| Temecula | Riverside | 30.15 sq mi (78.1 km2) |

| Santa Maria | Santa Barbara | 22.76 sq mi (58.9 km2) |

| El Cajon | San Diego | 14.43 sq mi (37.4 km2) |

| Rialto | San Bernardino | 22.35 sq mi (57.9 km2) |

| San Mateo | San Mateo | 12.13 sq mi (31.4 km2) |

| Compton | Los Angeles | 10.01 sq mi (25.9 km2) |

| Clovis | Fresno | 23.28 sq mi (60.3 km2) |

| South Gate | Los Angeles | 7.24 sq mi (18.8 km2) |

| Vista | San Diego | 18.68 sq mi (48.4 km2) |

| Mission Viejo | Orange | 17.74 sq mi (45.9 km2) |

| Vacaville | Solano | 28.37 sq mi (73.5 km2) |

| Carson | Los Angeles | 18.72 sq mi (48.5 km2) |

| Hesperia | San Bernardino | 73.10 sq mi (189.3 km2) |

Source: Wikipedia

California Mortgage Loans Above $424,100 May Have Different Home Loan Terms

If you have a good, great, or excellent credit history and you are seeking a California home loan for more than $424,100, some home loan lenders may be able to provide more favorable rates and terms. As such, you should confirm your loan terms with the lender for your requested loan amount.

Taxes and Insurance Excluded from the California Mortgage Terms

Something you should note is that the home loan terms (APR and payment info) often do not include amounts for Californian taxes or required insurance premiums in the state of California.

Your monthly home loan payment amount will be greater when Californian taxes and insurance premiums are included.

Current Mortgage Rates in Oklahoma for Good-Excellent Credit Borrowers

Best Mortgage Rates in Tennessee or Good-Best Credit | 10-15-30-Year Fixed, 5/1, 7/1 ARM

Key Requirements for Buying a House in California

Before or after you apply for a California mortgage, you’ll want to ensure that you complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit score

- Save some extra funds for your closing cost (there might be additional expenses that you’ll need to pay)

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal

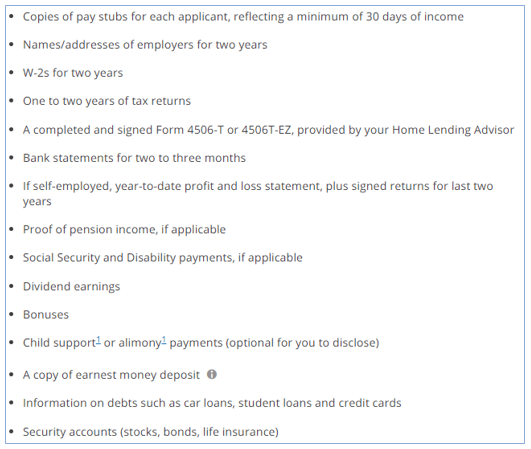

Needed Documents for a Mortgage Loan Application

According to Chase bank, below are the most common California mortgage loan documentation that you should gather together when applying for a mortgage loan in CA.

Good or Excellent Credit Score

Most home lenders that provide loans in California use a type of credit score known as a FICO score to determine if a California based borrower is creditworthy or not. FICO scores range anywhere from 300 to 850, with the higher numbers being considered the most creditworthy and the lower numbers being considered the biggest financial risk.

The range of FICO scores used by California mortgage lenders generally falls into these categories:

- 300 – 629 is considered a bad credit score

- 630 – 689 is considered a fair credit score

- 690 – 719 is considered a good credit score

- 720 – 850 is considered an excellent credit score

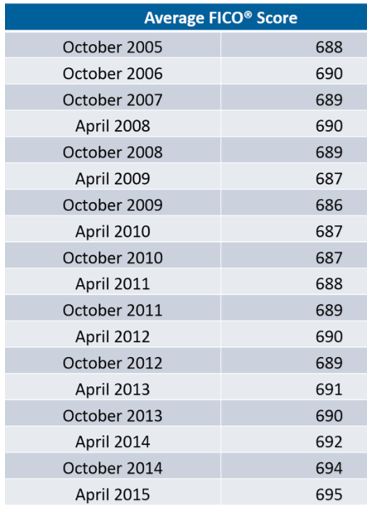

In case you are wondering what the average credit score is, see the below table from Fico. It shows the average FICO score from 2005 – 2015.

According to CNBC, as of this year, the average score is 700.

Source: FICO

Current Arizona Mortgage Rates | Best Arizona Mortgages & Refinance Rates

Current Mortgage Rates in Alabama | Best Alabama Home Loans & Refinance Rates

Conclusion – Finding a Top Mortgage Loan for a Home in California

Buying a first home is not a quick shopping experience. Average processing (from start of application to closing) in Los Angeles, San Diego, San Francisco, San Jose, Sacramento, Riverside, Fresno, San Bernardino, Modesto, or any other city in California normally takes between 30-45 days.

As such, you need to have a plan set in place for buying your first house to avoid extra expenses and unnecessary delays.

If you are in the market to buy a home, a low down payment can be an option. It is a great way to get into a home and start building equity. If you apply for a fixed-rate California conventional loan (10-year, 15-year, 20-year, or a 30-year mortgage loan), the best home loan lenders in California will often allow you to remove the mortgage insurance. But that’s only if you deposit 20% or more of the home price in the form of a down payment.

Current South Carolina Mortgage Rates | Good-Best Credit Mortgage Rates in South Carolina

Current Mortgage Rates in Missouri | Good – Best Credit Missouri Mortgage Rates

California Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image Sources:

- https://pixabay.com/en/california-usa-americana-2217654/

- https://www.chase.com/personal/mortgage/home-mortgage/financing-home/application-documents

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.