Getting the Best Mortgage Rates in Vermont (10-15-30-Year Fixed, 5/1-7/1 Adjustable, Jumbos, and 3/1 ARM)

Best-known for its colorful fall foliage, winter snowfalls, and mountainous terrain, the state of Vermont has plenty to offer its residents.

Named the “Safest State in America” by U.S. News & World Report and NerdWallet, it’s no wonder that young and old homeowners alike are flocking to Vermont.

If you’re considering moving to Vermont, or if you’d like to explore options for refinancing an existing Vermont mortgage, you’ll want to have up-to-date information on current Vermont mortgage rates.

Best Mortgage Rates in Washington (WA) for Good Credit

Current & Best Mortgage Rates in Michigan for Good Credit

Where in Vermont Are You Located?

When it comes to finding the best Vermont mortgage rates, there are plenty of factors to consider, like the total loan amount, how much you can afford for a down payment, property value, and even where the home is located.

For many Vermont mortgage companies in Essex, Burlington, Rutland City, Brattleboro, Essex Junction, Colchester, Hartford, and other cities in Vermont, location will play a large role in Vermont mortgage rates.

Thus, homeowners may find varying Vermont mortgage rates based on the individual city, neighborhood, and the condition of the home itself.

While searching for the best mortgage rates in Vermont, you may want to check neighboring cities to explore other Vermont mortgage rates that could potentially be more affordable over time.

See the table below for a list of some of the largest cities in the state to explore Vermont mortgage rates.

| Top Vermont Cities | Population (2016) |

| Burlington | 42,260 |

| Essex | 19,587 |

| South Burlington | 18,971 |

| Rutland City | 17,292 |

| Colchester | 17,067 |

| Bennington | 15,764 |

| Brattleboro | 12,046 |

| Essex Junction | 10,412 |

| Milton | 10,352 |

| Hartford | 9,952 |

| Springfield | 9,373 |

| Barre City | 9,291 |

Source: Google

Key Requirements for Obtaining Vermont Mortgages

Before you apply for a Vermont mortgage loan, you’ll want to complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for Vermont mortgages before choosing the best mortgage rate in Vermont for you.

Church Street—Burlington, VT

Best CD Rates in PA | Pittsburgh, Philadelphia & Other Pennsylvania Cities

Best CD Rates in Ohio for People with Good & Great Credit

Fair, Great, or Excellent Credit Scores for Vermont Mortgages

Most Vermont mortgage companies that provide competitive Vermont mortgage rates will use a FICO credit score to determine whether a borrower is trustworthy.

FICO scores range between 300-850, with lower scores associated with higher financial risk. A mortgage rate in Vermont will typically use the following range of FICO scores:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

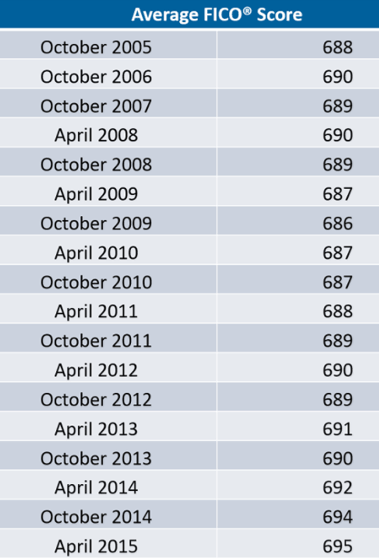

See the table below for the average FICO score from 2005-2015. According to CNBC, as of this year, the average score is at an all-time high of 700.

Best CD Rates in California for Good Credit (1-Month to 5-Year CDs)

Best CD Rates in Texas for Good-to-Great Credit

Conclusion – Finding the Best Vermont Mortgage Rates

Finding great mortgage rates in Vermont may take time, but the payoff is certainly worth the effort.

As you search for affordable Vermont mortgage rates, consider the following questions:

- Can I use local banks or credit unions for Vermont mortgage rates?

- Can I get better Vermont refinance rates from online-only lenders?

- Which lenders offer the most competitive Vermont mortgage rate for homes in Burlington, Essex Junction, Middlebury, or Colchester?

Ultimately, finding the best mortgage rate in Vermont comes from long-term affordability and partnership.

No matter what type of Vermont mortgage rate you choose, it’s important to partner with a lender that you trust and are comfortable working with throughout the length of your Vermont mortgage.

Best CD Rates in Houston and Dallas, TX

Best CD Rates in Florida for Good-to-Great Credit

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/church-decoration-night-648430/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.