2020-2021 RANKING & REVIEWS

BEST CHICAGO FINANCIAL ADVISORS

Intro: Finding the Top Financial Advisors in Chicago, Illinois for 2020-2021

Chicago is home to approximately 36 Fortune 500 companies, and it has five major financial exchanges. This makes it a prime place for many Chicago asset management firms to set up shop and serve Chicago investors.

Whether you live on the South Side in Armour Square or over near Lincoln Park on the North Side, you most likely have certain monetary goals that you’re trying to reach. One of the keys to a healthy financial plan is to work with a top financial advisor in Chicago.

A trusted Chicago investment firm could help you take a look at your current financial situation and future dreams and craft a plan to help you protect and grow your wealth.

However, the search can be very time-consuming due to the sheer number of wealth managers in Chicago, IL available. How can you tell an excellent financial planner in Chicago from one that’s not so great?

You don’t want to spend all that time searching only to land on Chicago financial planners that will take your money, but not help you with the financial independence you were looking for.

AdvisoryHQ can help you save tons of research time and ensure you know which firms are the top financial advisors and wealth managers in Chicago, Illinois. We review multiple firms every two years to come up with our list of the best places to go for asset management in Chicago.

This ranking of the 12 best financial advisors in Chicago focuses on those firms that excel in terms of their reputation, level of service, and their client-first approach.

While we look primarily for fee-only firms that do not accept commissions for selling 3rd party products, there are occasionally fee-based firms with strong client commitments that also make our list.

If you’ve been wanting to know the top Chicago wealth management firms to work with for planning your financial future, these top 12 are a great place to begin your search.

Award Emblem: Best Financial Advisors in Chicago, Illinois

Top 12 Best Chicago Financial Advisors | Brief Comparison & Ranking

| Best Chicago Financial Advisors & Wealth Management Firms | 2020-2021 Ratings |

| Basil Financial Group | 5 |

| Chicago Capital | 5 |

| Chicago Partners Wealth Advisors | 5 |

| DeRose Financial Planning Group | 5 |

| Financial Solutions Advisory Group | 5 |

| FourStar Wealth Advisors LLC | 5 |

| Private Vista | 5 |

| Savant Wealth Management | 5 |

| The Mather Group | 5 |

| The Mosaic Financial Group | 5 |

| The Planning Center | 5 |

| Timothy Financial Counsel, Inc. | 5 |

Table: Top 12 Best Financial Advisors in Chicago | Above list is sorted by rating

See Also: Best Financial Advisors in Cincinnati, OH

What Criteria Should I Use to Select the Best Chicago Financial Advisors?

At first glance, each financial advisor in Chicago, IL, can look very similar. For example, they’ll offer standard financial planning and wealth management for Chicago investors.

But, if you know the criteria to use when reviewing Chicago asset management firms, it will make it easier for you to narrow down your options to the ones that fit your situation, comfort level, and needs the best.

2020-2021 Ranking of Top Financial Advisors in Chicago

The following are a few factors to consider that will help you find the best Chicago investment firm for your financial plan.

Typical Clientele

Some Chicago wealth management firms will work with Chicago investors with any level of investable assets. Other firms will only work with high-net-worth individuals, families, and organizations that meet a minimum investable assets level.

One of the first things to look for is to make sure you meet a firm’s typical clientele requirements.

Fee-Only or Fee-Based Structure

Fee-only asset management in Chicago means that the advisors of a firm do not accept commissions for selling financial products; their only compensation is through client fees.

Fee-based financial advisors in Chicago do accept outside commissions, which can create a conflict of interest. If you’re considering a fee-based firm, look for it to be a fiduciary. Fiduciaries are legally obligated to always act in the clients’ best interests.

The Depth of Services Offered

If you have generational wealth in your family, you may want to find a financial advisor in Chicago, IL that offers family office services. If you’re an entrepreneur, a financial planner that also provides tax services may be ideal.

Not all Chicago asset management firms will offer the same depth of services. This is a differentiating factor that can help you decide on one Chicago financial advisor over another.

Working Style

Not all financial advisory firms in Chicago have the same way of doing things. Some are more “by the book” and formal, while others like treating their clients like family and creating a warm, casual environment.

Reviewing the website of a financial planner in Chicago to see the type of language and imagery used can give you some insight into the firm personality and way of providing investment advice so that you can find your best fit.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2020-2021 AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Best Financial Advisors in Chicago, IL

Below, please find a detailed review of each firm on our list of 2020-2021 top financial advisors and wealth managers in Chicago. We have highlighted some of the factors that allowed these Chicago financial advisory firms to score so high in our selection ranking.

Click on any of the names below to go directly to the review section for that firm.

- Basil Financial Group

- Chicago Capital

- Chicago Partners Wealth Advisors

- DeRose Financial Planning Group

- Financial Solutions Advisory Group

- FourStar Wealth Advisors LLC

- Private Vista

- Savant Wealth Management

- The Mather Group

- The Mosaic Financial Group

- The Planning Center

- Timothy Financial Counsel, Inc.

Click below for previous years’ rankings:

- 2019 Ranking: 11 Best Financial Advisors & Wealth Management Firms in Chicago, IL

- 2018 Ranking: 10 Best Financial Advisors & Wealth Management Firms in Chicago, IL

- 2017 Ranking: Top 9 Best Financial Advisors & Financial Planners in Chicago

- 2016 Ranking: Top 10 Best Financial Advisors & Investment Firms in Chicago

Don’t Miss: Top Financial Advisors & Wealth Management Firms in Dallas, TX

Basil Financial Group Review

With a passion for helping people make smart decisions about their money, Basil Financial Group is a top Chicago financial advisor that takes a holistic, client-centered approach to wealth management.

In addition to offering financial planning and investment guidance, this top Chicago investment firm also provides tax planning services. Its founder, Lois Basil, owned her own accounting firm for 13 years.

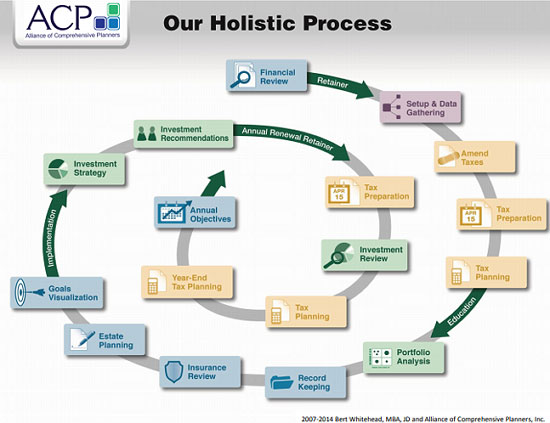

This wealth management firm in Chicago, IL is fee-only and a member of industry-specific organizations such as the Alliance of Comprehensive Planners (ACP), and the National Association of Personal Financial Advisors (NAPFA).

Key Factors that Enabled Basil Financial Group to Rank as a Top Chicago Financial Advisor

Holistic Approach

People often end up working with different providers for investments, insurance, tax preparation, estate, or retirement planning. This can lead to disconnections in its financial strategy that hurt its overall financial picture.

Basil Financial understands the advantages of a holistic approach to ensure all pieces of a client’s finances are working together and help them reach their objectives.

Rather than looking at only one area of your finances, the team at this Chicago financial advisor takes time to understand your lifestyle, what’s important to you, and all the various areas of your finances (taxes, insurance, etc.) to give you a complete and holistic strategy.

Top Providers of Asset Management in Chicago

Wide Range of Services

When working with Basil Financial, you’ll find more than just investment advice. The firm offers a full range of services that cover multiple areas of your financial life.

Following is an overview of some of the additional services you can find at this top-rated financial planning firm in Chicago.

- Risk Management: Your Chicago financial planner at Basil will review your insurance coverage needs and help you maximize your employee benefits package.

- Estate Planning: This includes assisting with addressing medical provisions for special needs dependents, minimizing estate taxes, planning for wealth transfer, and more.

- Tax Planning: Experienced tax planning guidance to help you navigate changing tax laws and avoid overpayment.

- Portfolio Analysis: Understand how well your portfolio is working for you, including tax efficiency, performance, diversification, and risk level.

- Investment & Asset Allocation: Functional asset allocation helps protect you during market downswings and take full advantage of upswings.

- Business Planning: Small business clients can gain expert advice into financial areas, like cash flow and risk, that can make a huge impact on their bottom line.

Rating Summary

For clients looking for a smaller boutique firm with a hands-on approach, Basil Financial Group is one of the financial planners in Chicago that will be of interest. The firm’s down to earth approach helps take the stress out of financial planning for many.

This wealth management firm in Chicago, IL offers multiple services and takes a holistic approach that can make your financial strategy stronger, more resilient, and more tax efficient.

With a focus on a team-based strategy and a commitment to each client’s financial well-being, Basil Financial Group earns a 5-star rating as one of the best wealth management firms in Chicago to consider working with in 2020.

Chicago Capital Review

Chicago Capital is a top Chicago investment firm that offers unbiased advice squarely focused on its clients’ financial objectives. The founding principal of the firm is to put clients first.

As one of the top financial planners in Chicago, Chicago Capital offers a wide range of services, which include investment management, financial planning, tax planning, retirement solutions, and more.

The firm is a fee-only Chicago registered investment advisor (RIA) and is also a fiduciary. It has approximately $2.6 billion in assets under management.

Key Factors that Enabled Chicago Capital to Rank as a Top Chicago Financial Advisor

Tax Planning

If you’re looking for a full-service Chicago wealth management firm that can go beyond just investment guidance, then you’ll appreciate the tax planning services offered by Chicago Capital.

The firm’s advisors coordinate with a broad range of tax, accounting, and legal professionals in order to offer clients the most helpful financial solutions for their needs.

Taxes are a big consideration for Chicago investors and can significantly impact how much of their money they’ll have working for them. This financial planner in Chicago can help ensure you’re not setting yourself up for more tax burden than you need to.

Customized Retirement Solutions

One of the things that makes Chicago Capital one of the best Chicago financial advisors is its dedication to customizing each client’s financial strategy to their distinct needs.

This tailored strategy is also used for its retirement solutions, which help those looking for top-notch asset management in Chicago plan for a comfortable retirement that will help them achieve the safety net they need.

The advisors at Chicago Capital have experience with:

- 401(k)

- 403(b)

- Profit-sharing

- Defined benefit plans

- All types of IRAs

Rating Summary

Chicago Capital makes it a priority to act as each client’s financial advocate. Its combination of comprehensive guidance and sophisticated technology help Chicago investors optimize their financial planning results.

Being founded on the principle of putting clients first makes the firm stand out among other Chicago wealth management firms. Clients can trust that each recommendation is being made in their own best interest.

With a fiduciary commitment and an integrated approach for the most cost-efficient financial planning, Chicago Capital is one of the best Chicago financial advisor to consider and is awarded a 5-star rating.

Popular Article: Rankings of Top Best Financial Advisors & Planners in Atlanta, GA

Chicago Partners Wealth Advisors Review

With a highly experienced team and comprehensive process, Chicago Partners Wealth Advisors is a leading Chicago wealth management firm that serves over 1,000 clients and has over 2.5 billion in assets under management.

Chicago Partners works with high-net-worth individuals with over $1,000,000 in investable assets, business owners, family offices, corporations, and foundations.

This top Chicago financial advisor is fee-only and also makes a fiduciary commitment to always act in its clients’ best interest. The firm works to keep its management fees low and is consistently ranked in the bottom 25% for management expenses.

Key Factors that Enabled Chicago Partners to Rank as a Top Chicago Financial Advisor

Independent Advice

Clients of Chicago Partners won’t have to wonder about conflicts of interest impacting the financial advice they’re given. This is an independent Chicago financial advisory firm That does not receive commissions for sales of financial products or any outside compensation from other firms.

The expert advisors at Chicago Partners operate as fiduciaries on behalf of their clients, making a legal commitment to put the client’s best interest at the forefront of everything they do.

This independent structure, which is entirely client-focused, ensures that all the investment advice given by this Chicago wealth manager is focused on choices that deliver the desired results to reach each client’s goals.

Top Financial Advisors in Chicago

5-Step Wealth Optimization Process

As one of the best Chicago financial advisors, Chicago Partners offers a 5-step Wealth Optimization Process that encompasses a complete wealth management approach and personally customized plan. These steps include:

- Portfolio Audit: This process, called Portfolio X-Ray, reviews a portfolio’s expense ratios, diversification, and asset allocation to find strengths and weaknesses.

- Investment Management: Your Chicago financial advisor will build a diversified portfolio and monitor progress to ensure that financial goals will be met.

- Tax Planning & Preparation: This ensures a portfolio strategy that is built upon tax efficiency.

- Advanced Financial Planning: Extending your financial strategy past just investment, including optimization of estate plans, lines of credit, mortgage solutions, and more.

- Private Banking & Reporting Services: During this step, the Chicago Partners team works with clients and their outside advisors to coordinate their overall financial plan.

Rating Summary

Chicago Partners Wealth Advisors offers a full-bodied financial strategy customized for those that are in the high-net-worth category. Its comprehensive process and coordination with other financial professionals ensure the best results for clients.

This is one of the Chicago asset management firms that has a highly experienced team. The firm’s team includes 6 Chartered Financial Analysts, 3 Certified Financial Planners, 2 Chartered Alternative Investment Analysts, 2 Licensed Attorneys, and 2 CPAs.

With a thoughtful and comprehensive process of wealth management and a wide range of services, Chicago Partners Wealth Advisors scores a 5-star rating as a top Chicago financial advisor to consider working with in 2020-2021.

Related: Best Financial Advisors in Iowa (Des Moines, Davenport, & Ames)

DEROSE Financial Planning Group Review

DeRose Financial Planning Group is a top financial planner in Chicago that provides holistic wealth management services for individuals, families, and businesses.

DeRose is a fee-based Chicago wealth management firm. To help counteract any potential conflict of interest that comes from accepting commissions, the firm is a fiduciary, upholding high standards of transparency and client commitment.

The goal of the staff at this top financial advisor in Chicago, IL is to take the burden of worrying about your financial future off your shoulders so you can enjoy your life.

Key Factors that Enabled DeRose Financial Group to Rank as a Top Chicago Financial Advisor

A Holistic Approach to Investing

Rather than focusing on only one area of your investments or financial planning philosophy, DeRose Financial Planning Group takes a holistic approach. This approach takes approximately 9 to 13 weeks, and has six separate steps:

- Begin Our Relationship: Collaborating with clients to discuss financial priorities, risks, investment, etc. to gather the information needed for a robust planning foundation

- Data Input: Compiling all your details in their E-Worth Manager system to start the initial modeling and analysis for creating an investment plan

- Design & Confirm: This top Chicago financial advisor’s team reviews your situation and designs a strategy in coordination with you

- Present Your Plan: Your advisors meet with you to present you with your plan, brainstorm ideas and alternatives, and put together an action plan

- Implementation: Once all potential financial solutions to meet your needs are discussed and agreed upon, your financial plan is put into action

- Year-Round Service & Annual Review: Your portfolio is monitored, analyzed, and adjusted on an ongoing basis to meet any changing financial goals best

Wide Range of Financial Planning Services

DeRose offers a wide variety of services, including certain specialties that you may not find at other Chicago financial advisory firms. From retirement planning to insurance and financial planning for women, many investors will find a great fit here.

Services provided by these top-rated Chicago financial advisors include:

- Retirement Planning: Keeping clients on track with retirement goals

- Education Planning: 529 plans, pre-paid tuition plans, custodial accounts, and financial aid planning

- Wealth Protection: Options like life insurance, disability insurance, and long-term care to mitigate risk

- Estate Planning: Wills, trusts, family-gifting strategies, charitable planning, and more

- Children & Money: Instilling knowledge and good financial habits in children

- Women & Planning: Empowering women to take charge and chart a successful financial future

Rating Summary

DeRose Financial Planning takes a comprehensive approach to financial planning to ensure clients have a plan that incorporates all aspects of their financial lives.

With over 24 years of experience, this Chicago wealth management firm has an expert team that understands multiple facets of finances when it comes to both individuals and businesses.

With a strong fiduciary commitment to clients and an in-depth process that’s designed to create tailored financial strategies, DeRose Financial Planning group earns a 5-star rating as one of the best Chicago financial advisors to consider working with in 2020-2021.

Financial Solutions Advisory Group Review

With a focus on balancing risk and opportunity, Financial Solutions Advisory Group is a top Chicago financial planner that is completely independent, allowing its advisors to always keep their clients’ best interest at the heart of everything they do.

The firm uses time-tested principals, a long-term perspective, and tax minimization to provide its clients with strategies to protect and grow their money.

The firm is a fee-only Chicago investment firm that upholds a fiduciary commitment to its clients. The firm’s typical clients are affluent individuals and families with $500,000 or more in investable assets.

Key Factors that Enabled Financial Solutions Advisory Group to Rank as a Top Financial Advisor in Chicago

Top-Rated Financial Planners in Chicago, IL

Client-Centric Philosophy

Financial Solutions structures its approach to center around a client’s evolving financial needs. Its advisors focus on building long-term relationships so they can support their clients’ financial dreams.

This client-centric philosophy includes:

- Balancing Risk & Opportunity: It’s important to use a disciplined platform for wealth management and financial planning to overcome emotional decision-making and mitigate excessive risk.

- Minimizing Taxes: Advisors at this financial planner in Chicago work to mitigate unnecessary tax burden, which helps clients’ grow their wealth faster.

- Exercising Independence: The firm’s advisors are independent from conflicts of interest. These Chicago wealth managers don’t earn commissions from 3rd parties, giving them the independence to choose products that fully benefit each client

- Personal Relationships: Establishing a long-term relationship with clients is key, meaning that Financial Solutions employs one-on-one service, ongoing communication, and continuous, in-person meetings

Low Client-to-Advisor Ratio

If you’re looking for a more attentive relationship with a financial advisor in Chicago, IL, then you’ll appreciate that Financial Solutions Advisory Group has a low client-to-advisor ratio.

By maintaining a manageable number of clients assigned to each advisor, these top Chicago financial advisors ensure their clients receive customized concierge-like service and attention throughout the investment process.

This personal attention also ensures that your portfolio will be managed and monitored regularly and with a high degree of customization to make sure that your financial needs are being met.

This low client-to-advisor ratio allows this Chicago wealth management firm to offer consistent, in-person meetings to keep up with any changes in your life that would impact your portfolio allocations and make necessary changes to stay on track.

Rating Summary

Financial Solutions Advisory Group offers clients a great option if they are frustrated with not getting enough attention from another Chicago financial advisor. Its commitment to keeping client-to-advisor ratios low shows that this firm’s principals put client needs first.

For both financial planning and wealth management services, this is one of the Chicago wealth management firms that takes a strategic and client-centric approach. You won’t find “cookie-cutter” solutions here.

With a goal to both build wealth and invest in relationships, Financial Solutions Advisory Group solidifies its 5-star rating as one of the top financial advisors in Chicago to consider partnering with in 2020.

Read More: Reviews of Financial Advisors & Wealth Management Firms in Florida

FourStar Wealth Advisors LLC Review

Helping clients create a strong foundation to achieve financial success, FourStar Wealth Advisors is a top option for asset management in Chicago. The firm’s advisors are directly focused on enabling their clients to achieve their financial dreams.

The firm is a fee-based independent wealth management firm in Chicago. As a fiduciary, FourStar commits to serving its clients free of any conflicts of interest and always puts its clients’ best interests first.

This Chicago financial advisor offers a full range of financial services, including asset protection planning, financial and investment planning, retirement planning, and wealth planning.

Key Factors that Enabled FourStar Wealth Advisors to Rank as a Top Chicago Financial Advisor

“Build-Live-Share” Philosophy

The core philosophy of FourStar Wealth Advisors centers around the key financial phases of life noted as “Build-Live-Share.”

By reviewing a person’s financial picture at each stage of life, the advisors at this top Chicago financial advisor help clients craft a portfolio and financial plan that evolves as their lifestyle changes.

Each area covers the following basics:

- Build: This period is when people are building their lives, and it can be a period as long as 40 to 55 years. These Chicago financial advisors help clients during their “build” phase with strategic saving and investing choices to build a strong financial foundation.

- Live: After the build phase, this top wealth manager in Chicago believes that it is time for you to “live.” This is the retirement phase when you will be living off your earnings while creating very little or no new income.

- Share: The “share” phase can happen in conjunction with the other two, and it denotes philanthropic endeavors or just a desire to share the wealth with friends and family. FourStar helps clients with plans that accomplish their giving goals.

Educational Resources

FourStar Wealth Advisors offers several unique client educational resources on its site, including a financial podcast to help keep clients informed on a variety of financial topics.

This illustrates that this top-rated Chicago wealth manager places a strong emphasis on empowering clients to improve their financial literacy and provides the tools to help do that.

Located on the firm’s website are the following resources:

- Articles

- Free Portfolio Risk Analysis tool

- News

- FSWA Podcast

Rating Summary

FourStar Wealth Advisors offers a wide range of comprehensive financial planning services and places a high priority on helping its clients reach their financial goals throughout all phases of life.

Those planning for retirement will appreciate that these financial advisors in Chicago cover multiple facets of retirement guidance, including Social Security, healthcare, and lifestyle review.

With a team of experienced advisors and an emphasis on investor education, FourStar Wealth Advisors scores a 5-star rating and is a top financial advisor in Chicago to consider partnering with in 2020.

Private Vista Review

Created in 2016 from the merger of three top financial services firms, Private Vista fosters a distinctive client-centered culture that includes tenants like listening, communicating, and being relentless about continuous improvements.

This financial planning firm in Chicago is fee-based; however, the firm upholds a fiduciary commitment to clients. This means that the firm’s advisors will always put a client’s best interests first, and they will be completely transparent about compensation.

Key Factors that Enabled Private Vista to Rank as a Top Chicago Financial Advisor

An Evolved Financial Planning Experience

One of the components that makes Private Vista one of the top financial advisory firms in Chicago is its Wealth Management EvolvedSM process. This top Chicago financial planner works with clients of all types using a comprehensive approach.

One constant of the firm’s evolved wealth management process is that it’s all about you. It’s designed to help your Chicago financial advisor fully understand your current situation, future goals, and the reality of how to get from point A to point B.

The process includes four steps:

- It’s About You: Your advisor learns about your current resources and gathers necessary documentation.

- What’s Important to You: Your current financial status is modeled, and your Chicago investment advisor develops ideas and recommendations.

- What’s Possible for You: You’re presented with a plan that connects your resources to your life goals and suggests how to get there.

- How it Becomes Reality for You: Your plan is implemented, and you receive regular communication as well as an annual meeting to stay on track.

Fiduciary Commitment

As a fee-based Chicago financial advisor, having a fiduciary commitment is important. It differentiates a firm from the competition and establishes client trust.

For many clients, it can be difficult to overlook the potential conflicts of interest that exist in the fee-based environment. They wonder how they can be completely sure if the Chicago financial advisor was choosing products solely on their portfolio needs.

With a fiduciary commitment, Private Vista allays any concerns that clients may have, as they are legally obligated to:

- Provide unbiased advice

- Exercise a high degree of care and diligence

- Disclose any conflicts of interest

Rating Summary

Private Vista has an expert team of advisors that believe every client should have an opportunity to enrich their life through solid financial planning. The firm’s approach is client-centered, ensuring that plans are tailored to each client’s objectives.

This financial advisor in Chicago sees the connection between life goals and financial goals and works to help clients achieve them both.

With a focus on learning everything possible about its clients and unique life planning tools and resources, Private Vista earns a 5-star rating and is one of the best financial advisors in Chicago to consider in 2020-2021.

Popular Article: Rankings and Reviews of Best Financial Advisors in St. Louis & Clayton, MO

Savant Wealth Management Review

Savant Wealth Management fosters a vision to help build ideal futures for its clients, employees, and the communities it serves. This is one of the top financial advisors in Chicago that has been serving clients for decades, tracing its root back to 1986.

This fee-only fiduciary wealth management firm in Chicago offers integrated investment management, financial planning, family office services, tax preparation, and other services to financially established individuals, non-profits, trust funds, and retirement plans.

Key Factors that Enabled Savant to Rank as a Top Chicago Financial Advisor

Estate Planning & Wealth Transfer

This is one of the best financial advisors in Chicago to consider if you have estate planning needs. Estate planning is one of the specialties of Savant, and its advisors understand one of the most important things, to begin with, is to formalize the process and prioritize.

Advisors at this Chicago investment firm guide families through a comprehensive process that leverages their years of wisdom and experience. This process includes:

- Determining What’s Important: Defining your values, goals, and priorities so a plan that meets those can be formulated

- Assess Default Estate Plan: A summary of assets and existing estate documents are reviewed to understand where everything currently stands.

- Design Ideal Futures Wealth Transfer Plan: Your Chicago financial advisor identifies potential risks and structures a plan to meet your defined values and goals.

- Implement & Coordinate a Plan: Your advisor will help implement your estate plan and coordinate different areas, such as legal and tax.

- Review Progress & Determine Next Steps: Estate planning is an ongoing process. Once initial implementation has happened, your plan is evaluated regularly.

2020-2021’s Best Financial Advisors in Chicago

Personalized, Team-Oriented Approach

Savant doesn’t believe in “one size fits all,” the firm’s advisors tailor their services to each client’s individual circumstances and financial goals for the future. This enables your advisor to create a comprehensive financial plan that is custom-made.

The team approach of this top financial advisory firm in Chicago, IL means you have the full benefit of a wide range of professionals, all with expertise in a different financial area.

The multiple perspectives of the firm’s financial advisory team also mean your portfolio and financial plan is as robust and as well-strategized as possible.

Rating Summary

Savant Wealth Management works to give its clients peace of mind by applying their collective wisdom and insights into each financial strategy. The firm emphasizes individualized attention, low costs, and a transparent fee-only structure.

One of the specialized programs that make Savant stand out as one of the top financial planners in Chicago is its Women’s Wealth Initiative. This initiative has a mission to inspire, inform, and empower women in their financial futures.

With a wide range of holistic financial services and a strong commitment to building customer trust, Savant Wealth Management is awarded 5 stars as one of the best Chicago financial advisors to consider partnering with in 2020-2021.

The Mather Group Review

Focused exclusively on the success of its clients, The Mather Group is a top-rated Chicago financial advisor that offers cost-efficient investment guidance without any hidden fees.

This is a fee-only financial planner in Chicago that upholds a fiduciary obligation to its clients to always act in their best interest and provide unbiased financial guidance.

The Mather Group offers a variety of comprehensive financial services, including tax planning, investment management, retirement planning, estate planning, risk management, and more.

Key Factors that Enabled The Mather Group to Rank as a Top Financial Advisor in Chicago

TMG Retirement Roadmap™

At some point, most of us would like to retire comfortably, but how that looks is very different for each person. The Mather Group’s TMG Retirement Roadmap™ is designed to craft the perfect portfolio for each person that’s flexible enough to account for both lifestyle and market changes.

This roadmap to a financially secure retirement includes four distinct steps:

- Discovery: Your Chicago financial advisor takes time to learn about you and your lifestyle goals to secure a framework for a comfortable retirement, including the inventory of balance sheets, cash flows, taxes, and insurance.

- Framework: This step includes identification and mitigation of any risks and use of a leading academic theory and collaboration with you to create the framework of a successful financial plan.

- Portfolio: Your advisor will recommend the right investment solutions to meet your goals based upon your risk tolerance and any limitations of your retirement framework.

- Income Stream: This is the point where your portfolio will begin generating an income stream to complement any other compensation you receive, such as Social Security.

Expat Services

This top-rated Chicago financial planning firm stands out because it offers a very specialized type of financial guidance, Expat Services. These services are designed to help Americans living abroad make the most of their finances.

Your advisors at The Mather Group offer expert guidance throughout the expat journey, which can include moving abroad for work, retirement, or just a life-changing experience.

These financial services for those living abroad include guidance before, during, and after your move, whether you choose to stay overseas or come back to the U.S.

This Chicago wealth management firm helps expats with:

- Wealth management

- Optimal banking management

- Tax services

- Retirement planning

Rating Summary

The Mather Group offers a variety of financial solutions that go farther than you’ll find with other Chicago asset management firms. Beyond its expert retirement and financial planning, clients can find executive and expat financial services

Another benefit of working with this top Chicago financial advisor is that it’s dedicated to keeping fees low so clients can keep more of their money and reach their financial goals sooner.

With a dedication to understanding each facet of a client’s life and client-first philosophy, The Mather Group is awarded 5-stars as a top financial advisor in Chicago to consider working with in 2020.

Related: Best Financial Advisors in Lexington & Louisville, Kentucky

The Mosaic Financial Group Review

The Mosaic Financial Group is a top-rated firm providing financial planning and asset management in Chicago. The firm’s advisors are committed to being proactive and responsive to their clients’ needs.

This fee-only financial advisor in Chicago is also a fiduciary, upholding a strong commitment to clients for conflict-free and unbiased guidance.

The Mosaic Financial Group is a Registered Investment Advisor (RIA) that works with individuals, families, business owners, and corporate executives. The firm prides itself on creating a caring and supportive environment for its clients.

Key Factors that Enabled The Mosaic Financial Group to Rank as a Top Financial Advisor in Chicago

A Complete Service Package

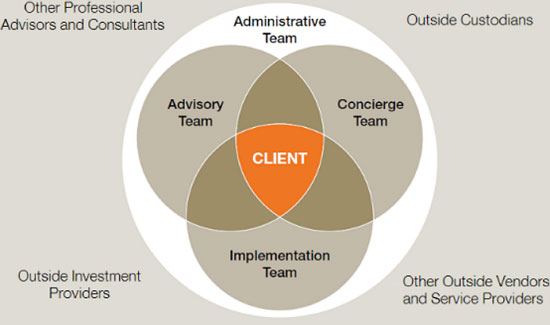

One thing that makes Mosaic stand out from other top financial advisory firms in Chicago is the complete approach it takes to wealth management. The firm’s advisors act as your “personal CFO,” coordinating all facets of your financial and tax strategies.

These Chicago financial advisors offer each client a well-rounded service package engineered for each client’s financial situation and future goals. These services are designed to complement and strengthen each other.

For example, Mosaic considers the tax implications of your estate planning, succession planning, and retirement planning, which tie into services designed to lessen your tax burden by making your overall strategy more tax efficient.

Advisors at this top-rated Chicago wealth management firm look at all aspects of a client’s finances, including family concerns, financial planning, and insurance needs. By utilizing as many of these services as possible, they can strengthen your wealth management plan across the board.

Ranking the Best Financial Advisors in Chicago

Unified Team Approach

As a best Chicago financial advisor, Mosaic has a team of financial experts on staff with qualified designations to their name. Some of these include investment specialists, Certified Public Accountants, and Certified Financial Planners, among many others.

Mosaic leverages the unique talents of its team members to create a dynamic group management approach. More than one set of qualified eyes review each individual portfolio, with every team member contributing their own expertise. This provides you with a well-rounded financial strategy.

Rating Summary

The team-based approach and welcoming atmosphere at Mosaic Financial Group is one that many Chicago investors find a perfect fit for their needs. This top financial advisor in Chicago offers clarity and a low-stress atmosphere when it comes to wealth management.

Another thing that makes this Chicago financial advisor stand out is that it offers multiple resources for investors on its website. These include news articles, calculators, stock quotes, and financial briefs.

With a caring and experienced team and a finger on the pulse of the financial world, The Mosaic Financial Group is awarded 5 stars as one of the best financial advisors in Chicago to consider partnering with in 2020-2021.

The Planning Center Review

Helping to clarify the complicated when it comes to money management, The Planning Center is a top financial advisor in Chicago that understands the importance of having a trusted and objective financial partner.

The firm is a fee-only fiduciary Chicago financial advisor dedicated to offering a safe place to discuss your life, money, and future dreams and goals.

The Planning Center is one of the larger financial planners in Chicago on our list. In addition to serving Illinois investors from offices in Chicago and Moline, the firm also has offices in Louisiana, Minnesota, California, Oklahoma, and Alaska.

Key Factors that Enabled The Planning Center to Rank as a Top Financial Advisor in Chicago

Talented & Experienced Team

The Chicago financial advisors at The Planning Center encompass a broad range of collective knowledge. The team also holds several professional credentials and affiliations. These include:

- Certified Financial Planner (CFP®)

- Certified Financial Transitionist (CeFT®)

- Chartered SRI Counselor (CSRIC™)

- Certified Public Accountant (CPA)

A unique aspect of this Chicago team of financial advisors is that their team includes a psychologist, allowing clients to benefit from an approach that incorporates psychology and behavioral finance.

Dealing with finances and how they impact life can naturally cause people to experience anxiety, frustration, or depression about financial matters. The Planning Center offers emotional support and an unbiased view to assist clients with making the best financial decisions.

Wide Range of Services

You won’t be disappointed with the wide array of services offered by this top financial advisor in Chicago. Whether you’re interested in debt management or have philanthropic interests, The Planning Center has you covered with several financial areas to choose from.

Focused on of helping clients feel confident in their financial future, these services include:

- Asset & Debt Management

- Cash Flow & Income Management

- Investment Management

- Asset Protection & Preservation

- Estate Planning

- Philanthropy

- Tax Management

- Accumulation & Retirement Planning

Rating Summary

For clients feeling apprehensive about the financial planning process and what it might mean for them and their families, The Planning Center provides a unique, care-centered perspective that is designed to make clients feel secure and safe through the entire process.

The firm’s large and experienced team covering multiple states is another factor that makes it one of the best financial advisors in Chicago. It provides a depth of experience that’s unique.

With a focus on the emotional side of financial management and an uncomplicated approach, The Planning Center earns a 5-star rating as one of the best financial advisors in Chicago to consider partnering with 2020-2021.

Timothy Financial Counsel, Inc. Review

With a style all their own, Timothy Financial Counsel is unique among other financial advisors in Chicago because it offers a team-based approach combined with hourly services.

For those new to financial management, the hourly option provides an opportunity to enjoy expert wealth management for a manageable rate.

Timothy Financial is a fee-only firm that was founded two decades ago to serve those who weren’t being well-served by traditional asset management firms. Its advisors believe that every penny counts and this philosophy resonates in everything they do.

Key Factors that Enabled Timothy Financial Counsel to Rank as a Top Chicago Financial Advisor

Unique Hourly Rate

Timothy Financial Counsel stands apart from other Chicago financial advisors due to its unique model that allows clients to pay only for the time they use. Many firms will charge a retainer and/or a fee-based upon assets under management.

Hourly fee rates are determined according to the number of services you will be utilizing, the type of services, and the specific advisor to whom you are assigned.

This approach makes financial planning services more affordable to a wider variety of investors. This approach illustrates this Chicago wealth management firm’s continued commitment to supporting people from all wealth ranges with expert financial advice.

Additionally, the firm’s fee ranges and hourly rates are easily found on its website and are divided into six different categories of service, which range from rates of $220-$400 per hour.

A Full Team Working for You

Not all financial advisors in Chicago dedicate an entire team to crafting your portfolio and investment plan. Many advisory firms assign you to a single advisor.

Timothy Financial Counsel purposely has a low client-to-advisor ratio that allows it to include each of its expert advisors in the process of crafting your unique financial roadmap.

This gives your portfolio the benefit of several points of view and areas of expertise to tap into to ensure a strategic approach that reflects your distinct financial needs and future goals.

Rating Summary

Timothy Financial Counsel is an excellent financial advisor in Chicago to consider if you’re new to investing or are worried that your investable asset level might to too low for other traditional investment firms.

Its one-of-a-kind hourly rate fee structure is easy for Chicago investors to understand and allows a diverse range of individuals to benefit from expert financial planning and guidance.

With a strong commitment to helping people strengthen their finances and a dynamic team-based approach, Timothy Financial Counsel earns a 5-star rating as one of the top financial advisors in Chicago to consider working with in 2020.

Don’t Miss: Top Financial Advisors in Boston, MA

Free Wealth & Finance Software - Get Yours Now ►

Conclusion – 2020-2021 Top 12 Best Financial Advisors in Chicago, Illinois

Whether your investable assets total $1,000 or $1,000,000, there is a top Chicago financial advisor that understands how to help you grow your money.

While they may differ in the services offered and type of clientele served, one thing that all these wealth management firms in Chicago have in common is that they’re dedicated to putting the client first in everything they do.

A good next step in your search for the best financial advisors in Chicago to consider would be to choose 3-4 firms on this list that are best suited to your needs. Then, set up an initial “get to know you” consultation – many firms offer these for no charge, and some will also provide a free portfolio review.

Once you choose a financial planner in Chicago that fits you best, you’ll find out just how helpful having a financial expert on your side can be when it comes to laying a solid financial foundation for the future.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://unsplash.com/photos/XXA8PTuLD1Y

- http://aca-site-misc.s3.amazonaws.com/acp-holistic-2014.pdf

- https://pixabay.com/photos/architecture-buildings-business-1853632/

- https://www.fsadvisorygroup.com/

- https://www.savantcapital.com/about-savant/who-we-are

- http://themosaicgroupllc.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.