Getting the Best Mortgage Rates in South Dakota (10-15-30-Year Fixed, 5/1, 7/1 ARM)

If you’re considering out a mortgage in South Dakota, you may be happy to know that homes throughout South Dakota are much more affordable than those in other states.

According to Zillow, the median home value in South Dakota is currently $175,100, which is good news for a South Dakota first-time home buyer hoping to get good SD mortgage rates.

Although home values have increased by 1.8 percent over the past year, mortgage rates in South Dakota can still be affordable over time.

If you’re planning on taking out a mortgage or refinancing any existing South Dakota home loans, the current mortgage rates in South Dakota are optimal for new homeowners.

Current Mortgage Rates in Connecticut | Best CT Mortgage Rates for Good-Excellent Credit Borrowers

Today’s Oregon Mortgage Rates | Oregon Home Loans for Good-Excellent Credit Borrowers

Key Requirements for South Dakota Home Loans

Before you apply for South Dakota mortgages, you’ll want to complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for conventional (10, 15, 20, or 30-year) or adjustable (5/1, 3/1, 7/1 ARM) South Dakota mortgages before choosing the best mortgage rates in South Dakota for you.

Current Kentucky Mortgage Rates | Kentucky Home Loans for Good-Excellent Credit Borrowers

Best Mortgage Rates in Vermont for Fair-Excellent Credit Borrowers

Tips for Finding the Best South Dakota Mortgage Rates

Finding the best mortgage rates in South Dakota won’t happen immediately. It will take a little bit of time and research to get the best South Dakota mortgage rate, especially for a South Dakota first-time home buyer.

Below, we have compiled a few tips to help you find the best possible mortgage rates in South Dakota.

Boost Your Credit Score

It’s a simple fact of any loan—better credit scores equal better interest rates. Finding the best South Dakota mortgage rates will be influenced by your credit, so boosting your credit score is a great start.

According to myFICO, refinancing with a credit range of 760-850 can make borrowers eligible for rates of 3.5 percent.

Compare that to 5.1 percent rates for credit scores between 620-639, and borrowers could potentially be looking at savings of 1.5 percent or more.

Even if your credit score only jumps a few points, you’ll be in a much better position to get great SD mortgage rates when your credit score improves.

Save Up for a Down Payment

Putting aside extra cash for a large down payment certainly isn’t fun, but it’s a great way to boost your chances of getting a lower South Dakota mortgage rate. According to Bankrate, most South Dakota home loans require a payment of at least 3 percent.

Aside from getting a better interest rate, the size of your down payment can also determine whether you will pay additional fees or purchase mortgage insurance.

Although South Dakota mortgage lenders may have low minimums, the best way to save money over the long-term is to put 20 percent down.

Compare Prices

Shopping for South Dakota mortgage rates can be tedious, but comparing your options from multiple lenders is the best way to ensure that you get the lowest possible South Dakota mortgage rates.

If you’re working with a local real estate agent or bank, be sure to check SD mortgage rates online before making a commitment.

This is especially true if you are a South Dakota first-time home buyer, since many South Dakota mortgage lenders provide special rates and terms for new homeowners.

Current Mortgage Rates in Alaska | Home Loans in Alaska for Good-Excellent Credit Borrowers

Current Mortgage Rates in Iowa for Good-Excellent Credit Borrowers

Conclusion – Finding a Top Mortgage Loan for a Home in South Dakota

When searching for the best South Dakota mortgage rate for you, there are a few additional pieces of information to keep in mind.

If you have a good, great, or excellent credit history and you are seeking a South Dakota mortgage rate for a loan totaling over $424,100, some lenders may be able to provide different terms and different mortgage rates in South Dakota.

For this reason, it’s important to confirm any South Dakota mortgage rates and terms for specific amounts before making a commitment.

Additionally, it’s also important to keep in mind that APR and payment information does not include state-specific taxes or required insurance premiums. As such, you should expect that the total cost of South Dakota mortgages will be greater when taxes and insurance products are added.

Current Mortgage Rates in Oklahoma for Good-Excellent Credit Borrowers

Best Mortgage Rates in Tennessee or Good-Best Credit | 10-15-30-Year Fixed, 5/1, 7/1 ARM

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

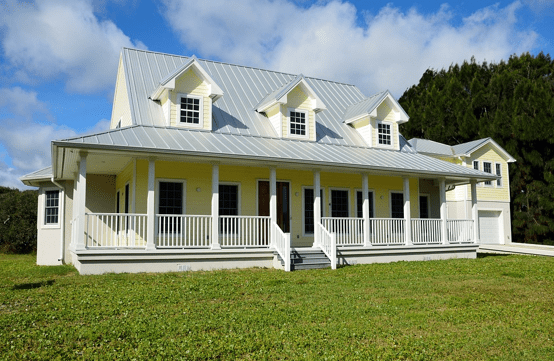

Image source:

https://pixabay.com/en/new-home-for-sale-mortgage-1540863/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.