Betterment Review – Overview

One of the most striking aspects about reading Betterment investing reviews is that the overwhelming majority of them are positive. An interesting plot twist is that of the few negative Betterment reviews, the majority seem to be from people who don’t understand how Betterment works.

Hopefully, by the time you have finished reading this betterment.com review, you’ll understand how its system works, and you’ll be more able to decide whether Betterment investing is right for you and your needs. We’ve also included a review section for betterment fees (How Much Does It Cost to use Betterment).

See Also:

- Best Robo-Advisors | Comparison, Ranking and Detailed Reviews

- Best Online Financial Advisors | Human Advisor, Robo-Advisor, and Hybrid

The Key: Betterment Software (Reviews)

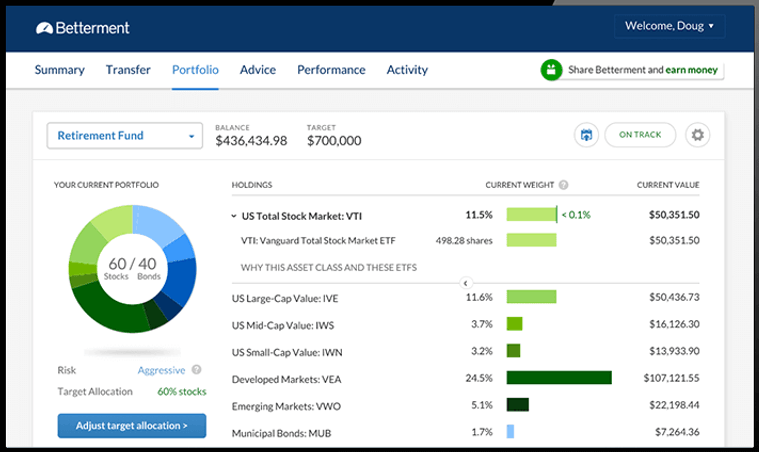

One thing betterment.com reviews demonstrate is that the company’s main selling point is its highly advanced, easy-to-use investment platform. The company has implemented some very sophisticated software on its website that is designed to create a lower-cost, highly diversified plan that is ostensibly custom-made for each individual investor.

The software constantly manages your account in a number of ways that make it easier for you to set earnings goals, automate deposits, avoid negative tax consequences, and keep each investor’s portfolio in balance.

Image Source: Betterment

The online user interface at the betterment.com website has been designed with simplicity in mind. It is very minimalistic, but it works extremely well, especially for the individual investor who simply wants to have some money automatically deposited into his/her account each month while making sure it is properly invested without having to worry about it.

Instead of each individual investor having to hire a broker to constantly maintain and tweak his/her portfolios, Betterment has automated most value-added tasks that brokers usually charge a fee to perform. There’s no need for individual investors to constantly research which investments they should purchase or how they should swap out stocks in order to rebalance their portfolios because the betterment.com software does most of that for you automatically.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Betterment Offerings

Signing up for an account at the betterment.com website is extremely easy and, according to most estimates, the entire process takes about five minutes. After that, Betterment is like many big banks in many ways, in that it deals with long-term wealth management and retirement solutions.

It offers most of the common types of accounts, including traditional and Roth IRAs, various types of trusts, and almost anything else that is offered in a typical financial institution. All investment accounts come with the following features:

- Automated goal-setting assistance: Account holders have the ability to allocate their funds into separate investment accounts with different goals. For example, you can set aside one fund for a new car, another for a down payment on a new home, and yet another for retirement. Not only can you split your contributions among all of your goals, but you can set a different risk level for each. This can be very useful for people who intend to save for a number of very important purposes and maximize returns only on some of them.

- Betterment RetireGuide: This feature helps individuals and families reach their retirement goals by using information provided by account holders, the balances in your Betterment accounts, and assets outside of Betterment. To do this, it creates an “investment timeline” to help you determine how much you will need to save to meet your retirement goals. The RetireGuide can digitally sync all of your non-Betterment retirement accounts and provide you with advice that includes your entire investment portfolio.

- Tax loss harvesting: Those investors who are only looking at tax-advantaged accounts, like IRAs and 401(k)s, don’t necessarily need this, but if you have maxed out your annual contributions to your tax-advantaged accounts and you still have assets to place into a normal investing account, the Betterment investing software can help you ensure that you capitalize on any losses you suffer in order to offset your taxable income. And, unlike a human financial advisor, this task is performed on a regular basis, not just once a year.

- Create a customized portfolio: With Betterment, your money is placed into a highly diversified portfolio and optimized for the best possible return while utilizing very low-cost, liquid ETFs. Initially, your portfolio will effectively balance risk and reward. However, you can do what you want.

- Choose your risk level: Though each portfolio will initially be balanced, regarding risk, and the initial allocation will be based on your age and retirement timeline, the investor has complete control of his/her portfolio and is free to manually adjust it based on his/her risk preference.

- Fully automated portfolio rebalancing: It is just a fact that over a period of time, the ETFs in your portfolio will change as they grow and shrink. However, the automated risk management features in the software will keep you on track. Betterment has developed a series of smart algorithms that will buy, sell, and reinvest automatically in order to keep your allocations in balance.

- Smart dividend reinvestment and fractional shares: The Betterment investment software also takes a lot of the effort out of investing in other ways. For example, when you receive a dividend from either a stock or bond fund, instead of simply adding it to the fund, the software will search for an area where you might be a bit low and automatically invest the money there. This is a big deal because it can allocate your money down to the penny since Betterment has the ability to invest in fractions of a share, down to 1/1,000,000th of a share! What this means is that all of your money is active; there is none sitting on the sidelines. You won’t see cash in your account doing anything but working for you.

All Betterment investment accounts are as safe as any other account at any other brokerage because Betterment is a SEC-Registered Investment Advisor and is a member of SIPC and FINRA. According to the company, it uses high banking industry standards for security, including 256-bit SSL data encryption on all accounts.

How Much Does Betterment Cost? (Betterment Fees)

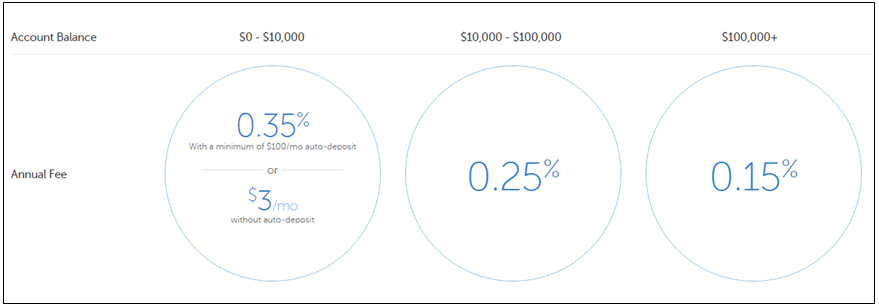

As has been noted , the fees for a Betterment investment account are really low when compared to traditionally managed portfolios at most brokerages.

On average, according to a number of sources, a managed portfolio at a mainstream broker can run as much as 1.5% per year. The three Betterment fee tiers are all based on the balance in an investor’s portfolio.

Even with a Betterment Builder account, which is an account with an investment balance of less than $10,000, an individual is only charged a 0.35% fee. Better accounts, which are those with more than $10,000, are charged 0.25%, but for accounts with $100,000 or more invested, the fee drops all the way down to 0.15%.

The only other fee applied is if someone has an account with $10,000 and he/she doesn’t set up a minimum direct transfer of $100 per month to it; that will incur an additional $3/month fee.

Image Source: Betterment

As noted previously, it’s possible to have multiple investment accounts, and these fees apply to the total balance of all of them. For example, if someone has an IRA with $25,000 and an $80,000 401(k) balance, he/she has met the $100,000 threshold and will only pay 0.15%.

It’s important to keep in mind that the Betterment fees are only for its management services, and there will be other costs, such as the expense fees for the ETFs themselves, which someone would have to pay with any other company as well. According to the betterment.com site, the added expense would be around another 0.15%.

Of course, given that the average fees elsewhere are around 1%, the total of about 0.3%–0.5% is still considerably less than most other wealth management sources.

Conclusion – Betterment Review ~ Returns, Fees, and All You Need to Know

Due to the automation that comes with the betterment.com software, the Betterment investment platform seems to be best for long-term passive investors with some financial knowledge. Put simply, it means those who can be patient with their money, don’t want to have to babysit their accounts, and understand the basic concepts of portfolio diversification and how high fees can sometimes have a negative impact when it comes to long-term returns.

Another group that would do well with Betterment is new investors who are looking for the best bang for their buck without having to know a lot. The ease at which everything works is perfect for someone who may be somewhat intimidated by investment programs or those who simply don’t want to put in a lot of their time to figure it out.

Free Wealth & Finance Software - Get Yours Now ►

The people for whom Betterment is not good for are those who need a lot of guidance and hand-holding. Those folks would probably do better to pay more and hire themselves a human financial advisor who is perfectly happy with hand-holding clients.

Of course, they’re not all like that. This system is also not for those who think they can beat the market or those want to trade individual stocks.

Everything is too automated and basic to make them happy. Saving money on fees is only useful if you actually make more money.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.