RANKING & REVIEWS

BEST ONLINE FINANCIAL ADVISORS

Finding the Best Online Financial Advisor

Gone are the days where a face-to-face meeting was required in order to evaluate your investment strategy. Most individuals are now opting for a far more convenient method when it comes to handling their wealth management: online investment companies.

Because this method of investing still tends to be what most would call “nontraditional,” how do you choose an online financial advisor? What are the best online or robo financial advisor companies in the industry?

There are so many considerations to be made when it comes to selecting an online financial advisor. Just as with traditional services, you have to weigh in customer service alongside expected pricing and performance to determine if you will have a good return on your investment.

Many of these online investment companies promote easy online wealth management that allows you to sit back and watch your money grow with any good fortune.

Award Emblem: Top 6 Best Online Financial Advisors

Finding an online financial planner that can meet your expectations for customer service, fees, and performance can be a challenge, especially with so many online investment companies flooding the market.

No matter which online financial advisor you choose, you want to be certain that your money is invested somewhere worthwhile to make the most of your initial investment.

In the sections below, we have provided a detailed overview of which companies made our list of the best online financial advisors to consider partnering with this year.

Top 6 Best Online Financial Advisors (+ 1 to Avoid) | Brief Comparison & Ranking

Top Online Financial Advisors | Highlighted Features | Ratings |

| Betterment | Affordable pricing structure & wide range of financial planning services | 5 |

| Personal Capital | Wide range of free financial advisory services & tools | 5 |

| Vanguard Personal Advisor | Focus on affordable fees & personalized service | 5 |

| Wealthfront | Low account minimum & diverse range of services | 5 |

| FutureAdvisor | Free retirement advice on securities & investments | 3 |

| Wealthsimple | Socially Responsible Investment portfolios | 3 |

| Motley Fool Wealth Management | Low transparency & no tax loss harvesting | 1 |

Table: Top 6 Best Online Financial Advisors | Above list is sorted by rating

Why Choose an Online Financial Advisor?

Before diving too deep into which of the online investment companies are ranked as the top online financial advisors, it’s imperative to understand why you might consider making the switch to an online financial advisor in the first place.

These online investment companies come with a number of advantages, increasing the value of online financial advisory services.

Best Online Financial Advisory Services

Of particular importance are the fees that are charged by online investment companies. When compared with traditional brokerages and wealth management services, online financial planning can save you a bundle.

Traditional wealth management and investment services can run around one percent of the assets under management each year. With an online financial planner, you could be looking at rates as low as 0.25 percent each year—or less.

In addition to saving money, the art of trading using specific algorithms based on Nobel Prize–winning formulas can boost your return on investment.

The best online financial advisors take the emotional and behavioral impulses away from consumers, as these tend to inhibit growth when you invest online. Instead, they focus strictly on the numbers and long-term projections of each fund and asset they invest in.

Online investment companies also give your portfolio more attention to near-constant monitoring and rebalancing of your assets. Top online financial advisors rebalance your accounts often, especially in comparison to the more traditional services that may only be able to look at your specific portfolio once in a while.

Rebalancing and automatically reinvesting your dividends can increase the value of your investments, as well as minimize taxes on capital gains.

Consider taking advantage of the numerous benefits of one of these online investment companies for your online financial planning.

See Also: Best Online Investment Companies | Ranking & Reviews | Online Investing

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review—Top Ranking Best Online Financial Advisors

Below, please find a detailed review of the best online financial advisors. We have highlighted some of the factors that allowed these top online financial advisors to score so highly in our selection ranking.

Click on any of the names below to go directly to the review section for that firm.

- Betterment

- FutureAdvisor

- Motley Fool Wealth Management

- Personal Capital

- Vanguard Personal Advisor

- Wealthfront

- Wealthsimple

Click below for previous years’ rankings:

2017 Ranking: Top 6 Best Online Financial Advisors

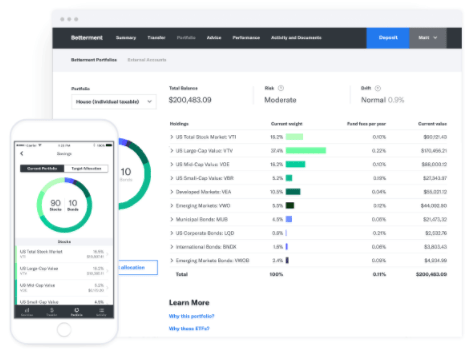

Betterment Review

Betterment combines technology with an online financial advisor to create portfolios that are designed to outperform the usual do-it-yourself investor.

Their fees for their online financial advisor come in substantially lower than those of traditional brokerages and wealth management firms, making them one of the top online financial advisors in the industry.

Key Factors that Enabled this Company to Rank as One of the Best Online Financial Advisors

Find out more details on what allowed AdvisoryHQ to list Betterment as one of our choice online investment companies in the sections below.

Services

As with many of the new online investment companies, Betterment increases the return on your investment with a strategy that focuses on taking impulsive or emotional behavior out of the mix.

Your profile includes your savings goals and plans, age, the length of time you plan on utilizing online investment companies, and more. They will then customize a portfolio specifically for you.

While many of the top online financial advisors do not allow clients to make adjustments to portfolios, Betterment allows users to alter their portfolio allocation. Their framework calculates an appropriate beginning mixture, but you can make adjustments as needed, and even receive suggestions on accounts that are maintained with a different online financial advisor.

Once you officially invest online, you can expect Betterment to take care of a number of services on your behalf, including:

- Rebalancing: As your online financial advisor, Betterment routinely reviews your investments to determine whether your portfolio needs to shift. By rebalancing your portfolio and automatically reinvesting your dividends, it keeps your capital gains low.

- Tax Loss Harvesting: When security within your portfolio is considered a loss, Betterment sells it to help offset taxes on the rest of your gains and incomes. Your online financial advisor will then purchase a new but similar security to replace it and keep your portfolio more diverse.

With the combination of rebalancing, portfolio diversification, low fees, and better online investment performance, Betterment claims that customers can expect 2.66 percent higher returns than those from a do-it-yourself approach.

Best Online Financial Planning Services

Pricing

Of course, one of the biggest draws of using online financial planning is the reduced cost. An online investment advisor has significantly lower fees than a traditional financial advisor.

The fees for their online wealth management are relatively minimal and are split between two plans: Digital and Premium.

Digital

Investments within the Digital plan will have an annual management fee of 0.25 percent, which falls far below the national average of 1 percent.

There is no minimum balance requirement, making Betterment accessible to a wide range of investing goals and financial capabilities. Along with low fees, investors can also benefit from:

- Personalized financial advice

- Low-cost, globally diversified investment portfolios

- Automatic rebalancing

- Advanced tax-saving strategies

- Synced external accounts for a holistic view

- Reliable customer service

- Unlimited access to financial experts

There are no fees for accounts with a zero balance, and investors can stay within the Digital plan for as long as they would like, regardless of their total account balance.

Premium

Investors that choose the Premium plan will have an annual management fee of 0.40 percent. To be eligible for this pricing structure, investment accounts must be at least $100,000.

Along with all the benefits of the Digital plan, Premium investors can benefit from the following services:

- In-depth advice on outside investments, like 401ks, real estate, and individual stocks

- Unlimited access to CFP® professionals for financial guidance through life events like marriage, starting a family, equity-based compensation, and retirement

Rating Summary

Betterment offers simple asset allocation and low management fees that are perfect for helping new users manage their online investments.

Their simple, easy-to-use interface offers all the features needed to manage investments for a low fee, and it is certainly among the best online investment companies today.

Of course, it is worth noting that Betterment may be too catered to beginners for some higher-net-worth investors who may be looking for more sophisticated advice and can perform their own asset allocation.

Still, Betterment’s pricing structure is easily among the best in the industry, earning their financial advisory services a 5-star rating.

Don’t Miss: Top Marketing Consulting Firms This Year (Detailed Comparison Review)

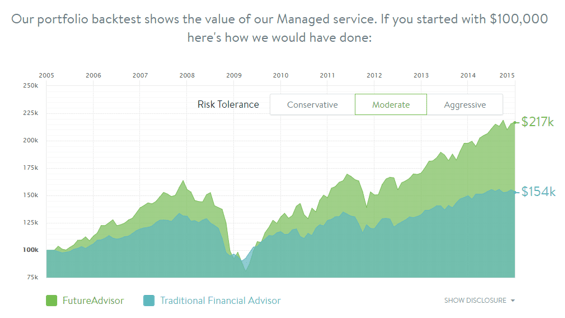

FutureAdvisor Review

FutureAdvisor is unique among the top online financial advisors because they offer to manage your online investment through a third-party service.

Created in 2010, FutureAdvisor has been working to develop their financial advisors online to provide superior financial advisory services to their clients.

With a wide team of financial analysts, data scientists, and prized technology, FutureAdvisor has much to offer in the realm of online investment companies.

Key Factors that Enabled this Company to Rank as One of the Best Online Financial Advisors

Want to know more information about what qualified FutureAdvisor to rank as one of the best online financial advisors? Find out more in the sections below.

Services

FutureAdvisor is unique among other online investment companies because it invests your funds and manages them as a fiduciary.

While Betterment and Personal Capital create portfolios and invest funds through their own online investment platforms, FutureAdvisor requests that you link your accounts from TD Ameritrade and Fidelity so they can manage them and maintain them.

Though your investments are not funneled directly through FutureAdvisor, they do monitor them 24/7 using algorithmic trading.

Most of the best online financial advisors will use the same strategy, allowing formulas and algorithms to determine the best times to buy and sell within your portfolio. This takes emotional impulses out of the mixture to focus more on tax-saving strategies and, ultimately, better returns.

Top Financial Advisor Companies

Pricing

Another consideration that makes FutureAdvisor one of the top online financial advisors is their fee structure. Receiving advice through their online investment advisor is free after you make an account and fill in your personal information.

Beyond this, you can expect to pay an average cost of 0.65 percent annually for FutureAdvisor’s Investment Management services. This typically covers their 0.50 percent management fee, fund expense ratios, as well as any necessary trading commissions.

While more than 90 percent of the funds are commission-free, you may still find your account being charged with trades executed on Fidelity or TD Ameritrade.

If you decide to discontinue your online wealth management through FutureAdvisor, this online financial advisor simply removes their name from your Fidelity or TD Ameritrade accounts.

The investments remaining within your portfolio return to your control, and you can decide how to proceed with your online financial planning and other online investment companies as you see fit.

Rating Summary

One of the biggest advantages offered by FutureAdvisor is the ability to receive retirement advice free of charge. This is a great way to test out using a financial advisor online before transferring assets over and committing to full financial advisory services.

However, it’s worth mentioning that the complete version of FutureAdvisor does have higher fees than other online financial advisory services. Their asset allocation is also less flexible than that of Betterment, earning FutureAdvisor a 3-star rating.

Despite the higher pricing to manage online investments, when looking for guidance on investments or retirement readiness, FutureAdvisor provides solid, reliable online financial advisory services.

Related: Best PR Firms | Ranking | Top PR Agencies & Companies

Motley Fool Wealth Management Review

Founded in 1993, The Motley Fool is a multimedia financial outlet, reaching millions of investors through their articles, podcasts, books, newspaper column, radio show, mutual funds, and premium financial advisory services.

One branch of these services is Motley Fool Wealth Management (MFWM) a largely automated online financial planner software.

Although The Motley Fool is largely considered an authority for those who invest online, our review found that investors would be much better off choosing another online financial advisor.

See below for an in-depth overview of why MFWM earned a 1 rating, and what the company can do to improve their ranking.

Rating Summary

No Automated Tax Loss Harvesting

Tax loss harvesting is a method of offsetting investment gains by selling investments that experience a loss. Many of the best online financial advisors offer this service for portfolios, but MFWM does not.

According to their FAQ, this financial advisor online does not offer tax-loss harvesting for two reasons: first, because their portfolios consist of stocks that cannot be easily interchanged, and second because tax loss harvesting temporarily leaves a portion of funds uninvested.

While it’s possible that some portfolios may still see financial gains, financial advisory services that do not offer tax-loss harvesting are at a significant disadvantage, as more investors strive to ease the tax burden associated with investing.

Similarly, the automated Wealth Management service is not offering tax location strategy, which places asset types into different accounts based on tax treatment.

Low Transparency

Understanding exactly how to sign up for Wealth Management services—and what requirements must be met—is nearly impossible, since the MFWM website does not directly address this.

InvestmentNews reports that Motley Fool Wealth Management services are available only to subscribers of Motley Fool ONE, an investing newsletter priced around $7,500 for a one-year commitment.

Paladin Research & Registry echoes this relationship between a newsletter subscription and wealth management services, which raises the question: why would potential clients need to visit third-party sites to get this information?

More importantly, where is the value in signing up for a pricey newsletter service to earn access to financial advisory services? Without concrete information connecting the two, it’s difficult to tell.

While MFWM does publicly advertise their annual fees in their FAQ section, their lack of transparency on eligibility and subscription requirements for their wealth management services reflects poorly on the company as a whole, solidifying their 1-star rating.

While Motley Fool Wealth Management services are currently closed to new investors, you may want to reconsider signing up for their waiting list.

Until Motley Fool can implement better tax strategies—namely, tax-loss harvesting—and improve transparency, investors would be much better off choosing to invest online with another online financial planner on our list.

Popular Article: Top Online Shopping Sites for Women (Ranking & Reviews)

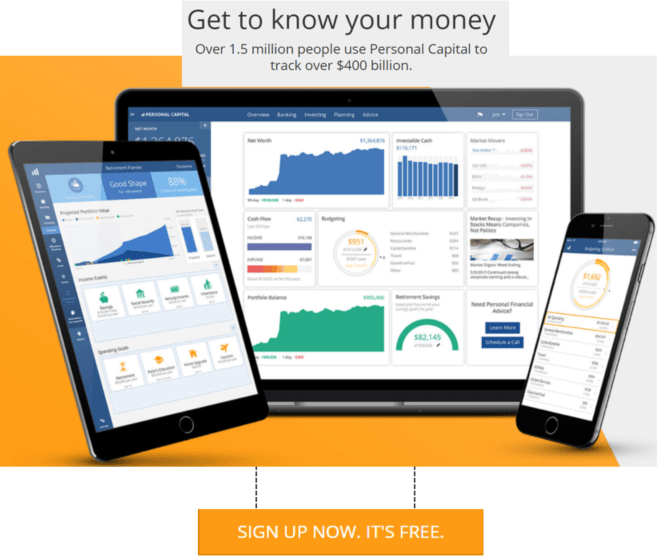

Personal Capital Review

Personal Capital as created with the intention of building a “better money management experience for consumers.”

More than one million users have already committed to Personal Capital with a combined total of $400 billion in tracked accounts and $5.5 billion in assets under management.

With their combination of advanced technology and top online financial advisors, Personal Capital is attempting to shift the way people have traditionally invested, redirecting them toward online investment companies instead.

Top Financial Advisor Companies

Key Factors that Enabled this Company to Rank as One of the Best Online Financial Advisors

See below for a few of the primary reasons that Personal Capital made our list as a top online financial advisor.

Services

While many options for an online financial advisor are heavily focused on online wealth management, Personal Capital takes a slightly different approach, collecting realistic insight into your spending habits by monitoring your cash flow.

Merchant and vendor transactions are compiled into handy graphs that can show you how to better manage your money on a regular basis, leaving extra room for this online financial advisor to help grow your wealth.

Once this online financial advisor creates a personalized portfolio and accounts from other online investment companies are synced, the Fee Analyzer shows any hidden fees you may be incurring from mutual funds or retirement accounts.

Another feature unique to Personal Capital’s online financial advisor service is the Net Worth Calculator.

If you’ve ever wondered how much you’re really worth, you can link up all your accounts (mortgage, home equity loans, credit cards, etc.) to get the fullest picture of your net worth at any time. This allows the online financial advisor software to determine if there is any room for improvement from a comprehensive standpoint.

Lastly, top online financial advisors are readily available when you need them via phone, web conference, chat, or email.

If you need to ask questions regarding investments or how the platform works, this online financial advisor can quickly and expertly assist you with making wise decisions when you invest online.

Click Below to Open Your Free Account with Personal Capital

Best Online Financial Advisors

Best Online Financial Advisors

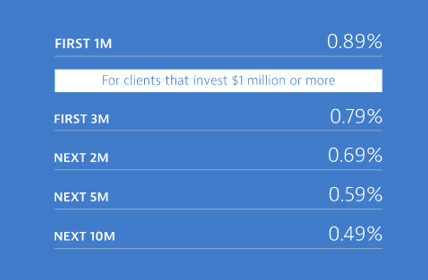

Pricing

One of the features that allows us to rank Personal Capital as one of the top online financial advisors is their clear-cut and transparent fee system.

Opening an account is free, as is using many of their budgeting and financial advisory services, like budgeting, monitoring cash flow, Investment Checkup, Fee Analyzer, Retirement Planner, and more.

When using Personal Capital’s investment management services, you can expect not to be charged with any service, maintenance, or trading fees apart from one flat annual rate, pictured below.

Best Financial Advisory Services

Rating Summary

Personal Capital is an easy-to-use, streamlined site for online investments, while also including the “big picture” of all your finances in one place. Its investment checkup and reporting features are big pluses, and these features are supported by Android and Apple devices across the board.

Although the high minimum investment amount may be problematic for some investors, Personal Capital excels at providing a wide range of free financial tools and software to support successful online financial planning.

All in all, Personal Capital is one of the best online investment companies and offers an excellent, comprehensive method to manage all your assets in one location, earning this online wealth management company a 5-star rating.

Read More: Best Cheap Online Shopping Sites | Ranking & Reviews

Vanguard Personal Advisor Review

Long recognized as a leader in the online wealth management division, Vanguard Personal Advisor now makes it even easier to invest online.

Catering more towards individuals who have been investing for some time or have a great deal of wealth available for an initial investment, this division of Vanguard combines personalized service along with low fees for a meaningful online investment experience.

Key Factors that Enabled this Company to Rank as One of the Best Online Financial Advisors

Curious to know what features Vanguard Personal Advisor has that warrants labeling it one of the top online financial advisors? Discover the reasons for yourself below.

Services

Like many of the best choices for an online financial advisor, Vanguard Personal Advisor takes your personal financial situation and goals into account to craft an investment strategy specifically for your needs.

As they begin to plan your online investment, Vanguard Personal Advisor will allow you to be as active in managing your portfolio as you desire to be.

At any time, you can access a financial advisor online to discuss your goals and receive additional advice regarding your investment strategy. If something unexpected comes up that makes you reconsider your investing plans, their financial experts online can provide comprehensive, personalized suggestions.

This personalized service available through Vanguard Personal Advisor is a key feature that sets it apart from other online investment companies in the industry.

Your portfolio is constructed of low-cost funds that cover a variety of assets for the most diversification. Rebalancing your portfolio and managing it on a regular basis to help minimize your taxes is a given with this online financial advisor.

Their primary draw is that their online financial planning, coaching, and portfolio management adds a layer of “meaningful value when compared to the average investor experience.”

Pricing

Vanguard Personal Advisor emphasizes the advantage that online investment companies pose over traditional advisory services.

The industry average, according to Vanguard, for a traditional financial advisor comes to 1.02 percent annually. In comparison, fees for assets under management with Vanguard are one-third of that average, at 0.30 percent annually.

Over the course of a 30-year online investment with Vanguard, you could have an estimated $96,798 more in your portfolio than in an average portfolio as a result of these lower fees.

Unfortunately, the downside to the pricing of their online investment advisor is that you have to plan on investing a significant amount of money in order to begin.

While many of the online investment companies listed in our review of the best online financial advisors require small minimum investments of less than $1,000, Vanguard Personal Advisor requires an up-front investment of at least $50,000.

Rating Summary

As an online financial advisor, Vanguard has a long history of success and continues to be ranked highly among financial advisory services.

Annual fees are well below average, and maintain Vanguard as a competitive option among the best online financial advisors. Additionally, their focus on providing personalized service is a significant advantage, particularly when considering the hands-off nature of online financial planning.

Although their minimum investment is significantly higher than most, Vanguard earns a 5-star rating for their focus on affordable fees and personalized service, placing them among the top online financial advisors in the industry.

Related: Top Clothing Brands | Ranking | Popular Men Clothing Brands in the World (Reviews & Comparison)

Free Wealth & Finance Software - Get Yours Now ►

Wealthfront Review

Wealthfront is an online financial planning service that centers on creating an automated service for individuals who prefer to be hands-off in their approach to investments.

This online financial advisor is perfect for millennials and younger investors who are looking for a great starting place among top financial advisors.

Additionally, Wealthfront’s nonexistent fees on certain accounts makes them an incredibly appealing choice for online investment companies, regardless of investing experience.

Key Factors that Enabled this Company to Rank as One of the Best Online Financial Advisors

See a handful of the compelling facts regarding Wealthfront that enabled AdvisoryHQ to rank it as one of the top online financial advisors.

Services

Wealthfront’s goal to save time, money, and frustration over traditional wealth management services is well thought out. Among online investment companies, the convenience factor of setting up an investment strategy and forgetting about it is a huge advantage over face-to-face meetings and phone calls.

After determining what the appropriate risk tolerance and category is for your financial goals, their online financial planner software can assist with finding ETFs that match up with well-performing asset classes and allocate your investments accordingly.

Like many of the other top online financial advisors included in our ranking, Wealthfront offers an attractive service for individuals who want to save for the future but prefer to take a more hands-off approach to doing so.

Their software allows an online financial advisor to monitor your accounts and investments 24/7, making the nominal fee they charge seem that much smaller.

Wealthfront’s online financial advisor software can rebalance your accounts in an instant to optimize your taxes and increase the returns on your investment, whereas a traditional service could only apply a small portion of their time to your individual account.

Beyond just rebalancing your account, Wealthfront can also reinvest your dividends automatically and keep an eye on tax-loss harvesting.

Pricing

While Vanguard Personal Advisor and Personal Capital may cater to wealthier individuals looking to invest, Wealthfront offers valuable services at a surprisingly affordable price.

It requires only a $500 minimum deposit to get started, and the first $10,000 you invest with Wealthfront is managed for free with no hidden fees. This makes it a great service for individuals who don’t plan to invest much or who are concerned about the long-term effect of fees on their initial investments.

Fees do increase to 0.25 percent annually after this amount, but it’s possible to make those fees even lower. With their Invite program, you can invite your friends to invest online with this online financial advisor and benefit from waived fees on an additional $5,000 once they fund their own account.

Even better, your friend also receives an additional $5,000 managed free of charge on their own account for online investments.

This unique take on lowering fees to promote more customer loyalty is one of the reasons that Wealthfront was chosen as one of the top online financial advisors. Their fee structure is already low, but the Invite Program makes it that more attractive.

Rating Summary

With a comprehensive suite of investment management services and an incredibly attractive pricing structure, Wealthfront is one of the most competitive financial advisory services in the industry.

Its features are advanced enough for experienced investors while still remaining accessible for newbies, making Wealthfront a great online wealth management company for a wide range of investors.

Ultimately, Wealthfront provides investors with deep value through lower account minimums, affordable annual fees, and free account management for the first $10,000, earning this online financial planner a full 5-star rating.

Don’t Miss: Best Kids Consignment Shops | Reviews | Online Kids & Children Consignment Stores

Wealthsimple Review

Wealthsimple promises to provide “investing on autopilot,” allowing users to create an account and invest money online in as little as five minutes.

There are currently over 50,000 clients across the globe using Wealthsimple’s online financial planning services, contributing over $1 billion in assets under management.

Although Wealthsimple may have less to show in comparison to giant online investment companies, their premise is simple and extremely valuable—to provide affordable, no-hassle, and effective financial advisory services.

Key Factors that Enabled this Company to Rank as One of the Best Online Financial Advisors

See a handful of the compelling facts regarding Wealthsimple that enabled us to rank it as one of the top online financial advisors.

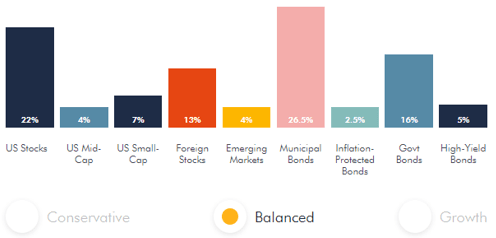

Services

Portfolios through Wealthsimple are created and diversified using global ETFs. Their financial advisory services will help clients determine their own personal risk level and create a customized portfolio to match.

This top online investment advisor offers many of the features that help give portfolios optimum performance over time, including automatic rebalancing, dividend reinvesting, and tax-loss harvesting.

Wealthsimple also allows users to set up auto-depositing, sending funds to their investment account on a schedule of their choosing.

One big draw of Wealthsimple’s online wealth management is that it provides options for socially responsible investing. A Socially Responsible Investments (SRI) portfolio can include:

- Companies with low carbon emissions

- Companies that support gender diversity

- Securities that promote affordable housing

For some, the ability to create a diversified portfolio while supporting the causes they believe in will be a significant advantage when using Wealthsimple to invest online.

Best Online Investment Companies

Pricing

There are two pricing tiers for Wealthsimple’s online investments: Basic and Black. Both come with zero fees for trading, account transfers, or rebalancing, with specific details described below.

Wealthsimple Basic is for accounts up to $100,000 and comes with an annual fee of 0.50 percent. Basic online wealth management services include:

- First $5,000 managed for free

- Auto deposits and rebalancing

- Tax-loss harvesting

- Dividend reinvesting

- Personalized portfolio

- Financial advice from advisors

In contrast, accounts over $100,000 are eligible for Wealthsimple Black, which provides all of the Basic features and more:

- Annual fee of 0.40 percent

- Increased tax efficiency

- VIP airline lounge access

- Goal-based planning

Wealthsimple does not have a minimum account balance for the Basic service, meaning investors can benefit from online financial planning regardless of what they keep in their account.

Rating Summary

For consumers that simply want an effective, hands-off way to invest money online, Wealthsimple is a great fit. Their Socially Responsible Investments are particularly unique, setting Wealthsimple apart from other top online financial advisors.

However, Wealthsimple does have higher account management fees than competing financial advisor companies and provides limited personal finance tools, earning this online financial planner a 3-star rating overall.

Popular Article: Top Cheap Online Shoe Stores | Ranking | Largest Popular Online Shoe Store Reviews

Conclusion: Top Ranking Best Online Financial Advisors

If you’ve been searching for an online financial planner, this list of the online financial advisors should be a great starting point to evaluate your online investment needs.

However, while you can find an abundance of options for a financial advisor online, but that doesn’t necessarily mean that each one of them will be right for you or your family.

Before you make the commitment to one of these online investment companies, you should consider a few aspects of your current financial status.

Your initial investment should be one of the first concerns to address. Having an up-front investment that is too low for some online investment companies can make the decision a little easier. You may prefer depositing a smaller payment initially and building up your online investment portfolio through monthly contributions.

Also consider how much you are willing to spend in fees, according to your account balance. An online financial advisor who overcharges can take serious cuts out of the performance of your portfolio in the long run.

Find a platform and investing style that matches up with your personality and expectations. No matter what type of financial advisory services you need, this list of the top online financial advisors should give you an excellent set of online investment companies to investigate as you prepare to hire your own online financial advisor.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://www.bigstockphoto.com/image-53194807/stock-photo-financial-management-on-mobile-devices

- https://www.betterment.com/why-betterment/

- https://www.futureadvisor.com/content/what-we-do/retirement

- https://www.personalcapital.com/wealth-management

- https://www.wealthsimple.com/en-us/details

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.