RANKING & REVIEWS

BEST ONLINE INVESTMENT COMPANIES

Highlighting the Best Online Investment Companies

The process of using investment advisors and stockbrokers to manage investments is nothing new—in fact, investors have been using them for decades. These advisors provide advice and expertise to help us make the best use of our money.

However, with the rise of the Internet in the mid-1990s, it’s now possible for anyone to start investing online. With E-Trade and Ameritrade lighting the way, other conventional brokerage firms began to offer online investing services along advice from their brokers.

This gave investors the ability to bypass the middleman and take control of their own portfolios, saving on trading commissions. By 2015, nearly $19 billion was managed by online investment platforms.

Online investing experts estimate that hybrid robo services—automated investment software combined with human advice—will constitute over 10% of total investable wealth by 2025.

As the popularity of online investing companies continues to spread, your choices for an online investment platform also continue to increase. Undoubtedly, sifting through online investing sites to find the best investment management software for your needs can be a daunting task.

This is where AdvisoryHQ comes in. Our expert review of the best online wealth management companies provides a comprehensive overview of the unique features, benefits, and disadvantages of each of the top online investing sites, guiding potential investors towards making smart investment decisions.

Award Emblem: Top 6 Best Online Investment Companies (& 1 to Avoid)

Top 6 Best Online Investment Companies (& 1 to Avoid) | Brief Comparison & Ranking

Best Online Investment Companies | Highlighted Features | Ratings |

| Betterment | Simple asset allocation & low management fees for new investors | 5 |

| Personal Capital | Intuitive, free investment management software | 5 |

| Wealthfront | Provides comprehensive planning for retirement & college expenses | 5 |

| Charles Schwab Intelligent Portfolios | No advisory fees, account fees, or commissions | 3 |

| FutureAdvisor | Focus on long-term, diversified investments | 3 |

| Motif Investing | Provides themed, professionally-created baskets of stocks | 3 |

| Motley Fool Wealth Management | Low transparency & no tax loss harvesting services | 1 |

Table: Top 6 Best Online Investing Sites (& 1 to Avoid) | Above list is sorted by rating

Best Practices for Investing Online

No matter which online investment platform you choose, there are several things to keep in mind when you embark on your journey towards online investment management.

Start Small

Before putting substantial amounts of your savings into the market, it’s best to start investing online with smaller sums.

Once you feel confident with using online investing sites, you can start adding more into your online investing account.

Take Advantage of Mutual Funds

Mutual funds are great online investing products, whether you are a seasoned professional or a beginner. They can lower risk, save you time, and will usually pay off in the long run!

Keeping some of your money in mutual funds rather than converting it all into individual stocks is a wise move for most investors, especially beginners.

Stay Informed

If you decide to use online investment management services, it’s your duty to stay as informed as possible on how each investment is doing.

Check each company’s website frequently, set real-time Google alerts, and monitor the news for any major happenings that may impact your success when investing online.

You can also take advantage of the EDGAR system, a database of publicly available filings from the U.S. Securities and Exchange Commission.

Best Investment Management Companies

See Also: Best Robo Financial Advisors in Canada | Top Canadian Online & Automated Financial Advisors

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Online Investment Companies

Below, please find a detailed review of each investment management company on our list of best online investment companies. We have highlighted some of the factors that allowed these online investing sites to score so high in our selection ranking.

Click any of the names below to go directly to the review section for that firm.

- Betterment

- Charles Schwab Intelligent Portfolios

- FutureAdvisor

- Motif Investing

- Motley Fool Wealth Management

- Personal Capital

- Wealthfront

Click below for previous years’ rankings:

- 2016 Review: Top 5 Best Online Investment Companies

- 2017 Review: Top 5 Best Online Investment Companies

Betterment Review

Betterment focuses on providing an online investing portfolio that is designed to optimize returns and minimize risk, providing an average of 2.6 percent higher returns than the average do-it-yourself investor.

As a top investment management company, Betterment provides investors with global diversification, smart rebalancing, and lower fees.

It prioritizes automation of its services to make smarter and more efficient choices – scheduling deposits, investing excess cash, and providing a holistic look at spending across all accounts.

Key Factors That Led to Our Ranking of Betterment as One of the Top Online Investment Companies

When examining the top investment management companies, below are the factors which led us to rank Betterment among the best online investing sites.

Features and Services

Betterment divides its investment management services across financial planning, retirement, IRA rollovers, trusts, tax loss harvesting, tax-coordinated portfolios, and financial experts.

Most of these features feed into its main offering of financial planning. Two notable investment management services include RetireGuide and Tax Loss Harvesting+, detailed below.

RetireGuide and Tax Loss Harvesting+

RetireGuide™ offers a consolidated view of your retirement, taking all assets and savings into account. It also handles rollovers of IRAs, pensions, and government plans as one while maintaining an optimal level of risk.

Another notable service from this investment management company is Tax Loss Harvesting+, in which securities are automatically sold to offset taxes and optimize portfolios for tax returns.

With automatic rebalancing and reinvestment, Betterment is a great option for effective, tax-advantaged, and hands-off investing, particularly for investors that are just starting out.

Best Online Investing Sites

Registration and Process

Recently, Betterment has completely overhauled their pricing structure, offering two tiers with no trade fees, no transfer fees, and no rebalancing fees.

Pricing for this online investment platform is split between two options: Digital and Premium.

Digital

Investments within the Digital plan will have an annual management fee of 0.25 percent, which falls far below the national average of 1 percent.

There is no minimum balance requirement, making Betterment accessible to a wide range of investing goals and financial capabilities. Along with low fees, investors can also benefit from:

- Personalized financial advice

- Low-cost, globally diversified investment portfolios

- Automatic rebalancing

- Advanced tax-saving strategies

- Synced external accounts for a holistic view

- Reliable customer service

- Unlimited access to financial experts

There are no fees for accounts with a zero balance, and investors can stay within the Digital plan for as long as they would like, regardless of their total account balance.

Premium

Investors that choose the Premium plan will have an annual management fee of 0.40 percent. To be eligible for this Betterment pricing structure, investment accounts must be at least $100,000.

Along with all the benefits of the Digital plan, Premium investors can benefit from the following services:

- In-depth advice on outside investments, like 401ks, real estate, and individual stocks

- Unlimited access to CFP® professionals for financial guidance through life events like marriage, starting a family, equity-based compensation, and retirement

Resources

Betterment’s bank of online investing resources is impressive. In addition to educational articles, Betterment offers several interactive tools and calculators to help clients lead smarter financial lives.

Featured on its resources page is a comprehensive guide to the 2018 tax season, providing investors with important deadlines and forms that will need to be filed.

Betterment also provides transparency into the research, data, and sources it uses to make its investment selections, as in-depth white papers take readers through the algorithms and automations that manage online investments.

Rating Summary

Betterment offers simple asset allocation and low management fees that are perfect for young investors. The simple, easy-to-use interface offers all the features needed to manage online investments for a low fee, and it is certainly among the best online investment companies today.

Though many of Betterment’s investment management services are on par with Personal Capital, it may be too catered to beginners for some higher-net-worth investors who may be looking for more sophisticated advice and can perform their own asset allocation.

Still, Betterment’s pricing structure is one of the best in the industry, providing investors with a wide range of financial tools and support, earning their investment management services a 5-star rating.

Don’t Miss: Top Consulting Firms (Review: Best Management Consulting Firms)

Charles Schwab Intelligent Portfolios Review

Intelligent Portfolios® software, created by financial mainstay Charles Schwab, markets itself as an online investing advisory service that builds and rebalances your portfolio and helps you work toward your savings and income goals.

With no advisory fees, no commissions, and zero account service fees, Charles Schwab is one of the top online investment companies to consider using in 2018.

Key Factors That Led to Our Ranking of Charles Schwab Intelligent Portfolios as One of the Top Online Investment Companies

When examining the top investment management companies, below are the factors which led us to rank Charles Schwab Intelligent Portfolios among the best online investing sites.

Features and Services

Schwab Intelligent Portfolios is designed to save you time by automating many of the things investors do on an ongoing basis – studying the market, choosing the right investments, and rebalancing.

Unlike other online investing sites, Intelligent Portfolios is fairly straightforward regarding what its services offer. Portfolios include up to twenty low-cost exchange-traded funds (ETFs), including stocks, fixed income, real estate, and commodities to diversify.

As with most other online investment sites, Intelligent Portfolios offers automatic rebalancing of underweight and overweight asset classes as long as investors keep a balance of at least $5,000.

Registration and Process

Charles Schwab Intelligent Portfolios claims that “if you have time for a cup of coffee, you have time for investing with their services”. Investors answer a few questions to determine their risk profile, review a recommended portfolio, and complete a simple enrollment process.

Notably, Intelligent Portfolios charges no advisory fees, account service fees, or commissions. However, affiliates do earn revenue from underlying assets in these accounts that they manage.

Resources

As one of the best online investing sites, Charles Schwab offers a vast range of white papers, expert articles, and videos.

Additional information on the online investment process and defining terms can be found in the white papers, while industry insights, tips, and expert processes for investing online can be found in the blog articles and videos.

Rating Summary

Obviously, the biggest draw for the Schwab Intelligent Portfolios service is no direct fees. Their investment management services will also allow you to remove up to three EFTs from the selected portfolio given to you, which is an option most online investment companies don’t offer.

However, investments include comparatively large percentages of cash assets, which earn zero interest. Investments also include smaller cap stocks.

When factoring in returns lost from cash allocation and ETF fees, Intelligent Portfolios isn’t actually cheaper than any of its competitors. Investors would be better off going with Betterment or Personal Capital, giving Charles Schwab Intelligent Portfolios an overall 3-star rating.

Related: Top IT Consulting Companies & Firms (Rankings, Reviews, and Comparison)

FutureAdvisor Review

FutureAdvisor caters to clients who already have accounts and online investments at Fidelity or Ameritrade. Its investment management services help people manage these accounts to maximize benefits and help them all work together seamlessly.

This online investment platform emphasizes automated online investment management through its proprietary algorithm, coupled with its personalized advice from financial advisors and service specialists.

Key Factors That Led to Our Ranking of FutureAdvisor as One of the Top Online Investment Companies

When examining the top investment management companies, below are the factors which led us to rank FutureAdvisor among the best online investing sites.

Features and Services

The main focus of this top investment management company is on helping investors save for retirement and college. Plans for these goals are free and include portfolio analysis and an easy-to-use interface.

Day-to-day portfolio management is done through a combination of FutureAdvisor’s recommendation algorithm and a human investment team.

Registration and Process

When signing up for FutureAdvisor, investors have two main options:

The first option is to have FutureAdvisor manage online investments, where advisors create an action plan tailored to your goals. The money stays with Fidelity or TD Ameritrade while they make trades on your behalf on an ongoing basis.

Investors are also allowed to check in on advisors’ analyses and trades at any time via FutureAdvisor’s easy-to-use dashboard.

This option has a flat annual management fee of 0.5% of assets managed, but the first three months are free. Investors must have at least $10,000 in assets that are available to invest.

The second option for investors is to receive advice on how to improve investments on their own, which they define as Retirement Advice.

Investors can connect their accounts to FutureAdvisor, and then the platform provides step-by-step advice based on their goals. The dashboard will also shift and update depending on market options. There is no fee for using this version of their investment software.

Resources

Like many other online investing sites, FutureAdvisor provides an Investing Library that contains advice and articles about online wealth management.

Topics of these articles include financial goal setting, beginner’s advice for those new to online investing, and tips for successful retirement and college saving.

FutureAdvisor also maintains active social media accounts where it shares related news and commentary.

Rating Summary

The biggest pluses for FutureAdvisor, along with many of the features and services that other online investing sites offer, are the flexibility and ability to try its service for free. Its online investment platform gives you recommendations based on your current portfolio without having to transfer assets over.

However, drawbacks include higher fees than some online wealth management sites, and its asset allocation is less flexible than Betterment, earning FutureAdvisor a 3-star rating.

When looking for investment or retirement services, FutureAdvisor is still a solid option for investment management services. However, if you’re looking for holistic daily financing and budgeting, go with Personal Capital instead.

Popular Article: Best Online Consignment Shops | Reviews | Online Consignment Clothing

Motif Investing Review

Motif Investing sets itself apart from the online investing community and the players mentioned above by positioning itself as a “concept-driven” trading platform.

With Motif, consumers are able to invest in a trend, like robotics, or an investment style. These trends and styles are turned into “motifs,” or baskets of up to 30 stocks or funds.

Motif emphasizes the fact that all investors are unique in their time horizons, risk profiles, and interests, allowing investors to customize professionally built portfolios as needed.

Since its conception, Motif has received $126.5 million in VC funding, was ranked on CNBC’s Disruptor 50 list for three consecutive years, and has built over 150 different motifs.

Key Factors That Led to Our Ranking of Motif Investing as One of the Top Online Investment Companies

When examining the top investment management companies, below are the factors which led us to rank Motif Investing among the best online investing sites.

Features and Services

True to its name, the main service of this top online investment platform is the creation and trading of its professionally created baskets of stocks, or motifs. Each reflects a particular idea, concept or trend and can be customized.

Investors can also create their own motifs and then choose to share them with the larger motif community. If this motif is picked up by another investor, the motif creator enjoys a royalty payment.

Registration and Process

To get started, investors can sign up using Facebook or their email address. Investing in a motif is as simple as researching and choosing from a list of motifs – both investor-created and professionally-created.

Even before signing up, potential investors can view examples of available motifs in their catalog. This includes a list of top stocks in the motif by weight, a chart of the diversification of segments, the index, and volatility rating.

With a minimum balance of $1,000, investing in a motif costs $9.95 – as low as $0.33 per stock. There are no management fees, which makes Motif one of the best online investing sites to consider for low-fee investment software.

Impact vs Trading

There are two different ways to start investing online with Motif: with an Impact account or with a Trading account.

The Impact account comes with the following benefits:

- Fully-automated portfolio

- Tax-aware automated investing

- Flat monthly fee of $9.95 for the first $100,000 invested

- 100 percent fee-free refund if your portfolio underperforms

Choosing a Trading account allows investors to:

- Select professional or community-built motifs

- Build their own motifs

- Trade ETFs and single stocks

- Participate in IPOs

- Trade stocks at $4.95 or motifs at $9.95

- Optional monthly subscription plans starting at $9.95

Resources

Motif offers a blog of investing insights and trading ideas similar to the previously-reviewed online investing sites.

Along with Investing Insights and Trading Ideas, it has sections for “Hardeep’s Thoughts” and an “Inside Motif” section, which take investors through commonly overlooked features of the platform.

Ultimately, Motif does a better job at humanizing its brand through these resources than most other online investing sites.

Rating Summary

Motif is an engaging option for those who are considering online investing. Its themed investments are great for diversifying assets and provide low-cost trading.

Many users will also enjoy the option to create their own motifs or sell single stocks or ETFs at $4.95 per trade – one of the lowest fees in the industry.

However, its relatively short time in the industry means that there are still some additions it could make to improve its services. Searching for features and complex orders are still unavailable on the platform.

It’s also difficult for potential investors to evaluate motifs before making a decision, since complete details are only viewable once you create an account, ultimately earning Motif a 3-star rating.

Still, Motif is one of the most unique online investment companies, and is a solid choice for those looking to diversify or who are interested in starting out with a relatively low-cost, low-risk option.

Read More: The Best Online Clothing Stores | Top Women Clothing Stores

Motley Fool Wealth Management Review

Founded in 1993, The Motley Fool is a multimedia financial outlet, reaching millions of investors through their articles, podcasts, books, newspaper column, radio show, mutual funds, and premium investing services.

One branch of these investing services is Motley Fool Wealth Management (MFWM) a largely automated investment management software that seeks to improve the automated investing model by emphasizing the human element—only Motley Fool-trained investors and analysts have access to portfolios.

Although The Motley Fool is largely considered an investing authority, our review found that investors would be much better off choosing another investment management software.

See below for an in-depth overview of why MFWM earned a 1 rating, and what the firm can do to improve their ranking.

Ratings Summary

No Automated Tax Loss Harvesting

Tax loss harvesting is a method of offsetting investment gains by selling investments that experience a loss. Many of the best online investing sites offer this service, but MFWM does not.

According to their FAQ, the online investment platform does not offer tax loss harvesting for two reasons: first, because portfolios consist of stocks that cannot be easily interchanged, and second, because tax loss harvesting leaves a portion of a portfolio uninvested for a period of time.

While it’s possible that some portfolios may benefit without this service, online investment platforms that do not offer tax loss harvesting are at a significant disadvantage, as more investors strive to ease the tax burden associated with investing.

Similarly, the automated Wealth Management service is not offering tax location strategy, which can place asset types into different accounts based on tax treatment.

Low Transparency

Understanding exactly how to sign up for Wealth Management services—and what requirements must be met—is nearly impossible, since the MFWM website does not directly address this.

In 2014, InvestmentNews reported that Motley Fool Wealth Management services were available only to subscribers of Motley Fool ONE, a newsletter priced around $7,500 for a one-year commitment.

Paladin Research & Registry echoes this relationship between a newsletter subscription and wealth management services, which raises the question: why would potential investors have to visit third-party sites to get this information?

Where is the value in signing up for a pricey newsletter service just to earn access to investment management services? Without concrete information connecting the two, it’s difficult to tell.

While MFWM does publicly advertise their annual fees in their FAQ section, their lack of transparency on eligibility and subscription requirements for their wealth management services reflects poorly on the company as a whole, solidifying their 1-star rating.

While Motley Fool Wealth Management services are currently closed to new investors, you may want to reconsider signing up for their waiting list.

Until Motley Fool can implement better tax strategies—namely, tax loss harvesting—and improve transparency, investors would be much better off investing online with another top investment management company on our list.

Related: Top Advertising Agencies & Companies |Ranking

Personal Capital Review

Personal Capital wants to “build a better money management experience for consumers” by blending objective financial advice with the most up-to-date investment management software available.

The company believes this will make online investment management more accessible to consumers, as well as more honest and transparent.

To date, Personal Capital has 1.5 million registered users and manages $5.5 billion in assets, making it one of the most popular online investment management services in the industry.

Key Factors That Led to Our Ranking of Personal Capital as One of the Top Online Investment Companies

When examining the top investment management companies, below are the factors which led us to rank Personal Capital among the best online investing sites.

Click Below to Open Your Free Account with Personal Capital

Features and Services

Personal Capital’s online investment features fall into two main camps: financial tools and financial advisory.

The financial tools section includes the dashboard: the central hub of Personal Capital’s tracking capabilities. The dashboard makes it easy to plan for retirement, set a budget, track your portfolio performance, and more.

Personal Capital also features an easy-to-use, crisp app for Android and iOS to help keep track of online investing portfolios on the go.

Fee Analyzer

One highlight of Personal Capital’s selection of investment software tools is the Fee Analyzer. This provides transparency into any hidden fees you may be incurring because of a mutual fund or retirement account.

These kinds of fees can cost you thousands and prevent you from retiring earlier, making this investment management software integral to creating retirement savings.

Investment Checkup

The Investment Checkup tool allows you to analyze your portfolio and can identify quick improvements that can save – or earn – you money.

This tool can also recommend an ideal portfolio based on your comfort level, with risk and expected rewards. Under “Financial Advisory,” Personal Capital offers several different services based on consumer needs.

Registration and Process

Each of Personal Capital’s sets of tools and services offer different registration and pricing structures.

First, Personal Capital’s online investing tools are completely free and require minimal information to sign up – just a name, email address, and password.

When it comes to financial advisory, pricing gets a little more complicated. Clients who invest at least $100,000 in assets receive licensed advisors dedicated to their account, an initial meeting with the advisors to discuss investing goals, and personalized recommendations on meeting those goals.

This service is priced at one all-inclusive fee based on the percentage of assets managed. There are no set-up fees, account opening fees, or maintenance fees.

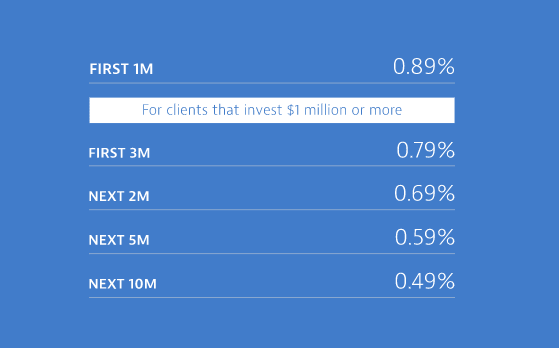

Personal Capital is very upfront about the cost structure associated with this version of its wealth investment management software, detailed in the image below.

Investment Management Company Fees

Finally, for clients that invest online at rates of $1 million or more, Personal Capital offers access to its private client group.

These clients will schedule a consultation that will provide them with expedited attention and tool personalization, access to an entire committee of investment professionals, and opportunities with private company investments (venture capital, private equity, etc.).

Private clients also enjoy a reduced fee structure:

- First $3 million—0.79%

- Next $2 million—0.69%

- Next $5 million—0.59%

- Over $10 million—0.49%

Resources

In addition to an attractive, easy-to-use website with concise, clear descriptions of its products and services, Personal Capital also offers a well-maintained company blog.

This section provides news and education on high-level topics about the state of the online investing market, all the way down to articles on whether organic food is really worth the price.

The existence of this well-maintained blog shows that Personal Capital really does believe in getting its clients the best, most transparent information possible and helping them make smart decisions to reach their financial goals.

Updated Services

As one of the best online investing sites, Personal Capital is constantly updating and enhancing the value of their investment software. A few examples of these recent updates include:

- Users can now create custom spending categories to gain a better understanding of their transactions

- New to the Dashboard, the Education Planner helps users understand and compare costs of a college education

- Users can access a comprehensive Insurance Guide to help them make better decisions when taking out various insurance policies

Not only is Personal Capital consistently looking for new innovations and features, but these additional benefits are provided free of charge, drastically enhancing the overall value of this online investment platform.

Rating Summary

Personal Capital is an easy-to-use, streamlined site for online investing but also includes the “big picture” of all your finances in one place. Its investment checkup and reporting features are also big pluses, and these features are supported by iPhone, iPad, Apple Watch, and Android.

While its budgeting tool is less user-friendly than Mint’s, it’s worth noting that the ability to create custom spending categories is a significant addition to this investment software.

Additionally, although the high minimum investment amount may be problematic for many investors, Personal Capital excels at providing a wide range of financial tools and software, all available free of charge.

All in all, Personal Capital is one of the best online investing sites and offers an excellent, comprehensive service for managing all your assets in one location, earning this investment software a 5-star rating.

Click Below to Open Your Free Account with Personal Capital

Don’t Miss: Best HR Consulting Firms This Year (Ranking and Review)

Wealthfront Review

Wealthfront has long been considered one of the best online investing sites, offering a range of valuable—and affordable—investment management services.

As one of the top online investment companies, Wealthfront has two primary goals: to simplify the process of online investing, and to level the playing field for the everyday investor.

Ultimately, this investment management company seeks to democratize access to professional services by eliminating barriers like high minimum investments and excessive advisory fees.

Currently, Wealthfront has over $8 billion in assets under management, making it one of the most popular online investing sites on the market today.

Key Factors That Led to Our Ranking of Wealthfront as One of the Top Online Investment Companies

When examining the top online investment companies, below are the factors which led us to rank Wealthfront among the best.

Features and Services

As one of the top online investment companies, Wealthfront offers a diverse range of investment management services.

Their portfolio strategy encompasses a collection of features called PassivePlus®, which includes tax-loss harvesting, direct indexing, and advanced indexing to promote tax-advantaged investments.

One of their newest offerings, Path is a fully mobile financial planning experience that allows investors to explore their savings, investments, spending habits, and retirement plans on-the-go.

Wealthfront also puts a keen focus on college savings with their 529 plan, generating up to 16 percent higher in returns than traditional investment accounts.

Registration and Process

Signing up for Wealthfront’s investment software can be one through a three-step process:

- Take a brief questionnaire, which generates a recommended portfolio and risk score

- Explore a personalized investment plan page which shows what Wealthfront would purchase for you and why

- Choose to fund your account with ACH transfers, wire transfers, 401k rollovers, or checks (only for 529 college plans)

Perhaps the most notable aspect of the Wealthfront process is that this investment software is uniquely poised to benefit new and smaller net-worth investors, as the first $10,000 invested are managed for free.

With only a $500 minimum investment requirement, all investments over $10,000 receive a flat annual fee of 0.25 percent.

Resources

Wealthfront is actively focused on helping investors make smart, educated decisions about their finances. Their blog includes topics like Investing Insights, Planning & Taxes, Retirement, Company News, and more.

Perhaps the only potential downside is that the blog is not advertised as well as it could be.

Although users can access a full listing through the “Expertise” tab, users that are specifically looking for blog posts may need to browse through the site for a few minutes before finding the correct link.

Top Investment Management Services

Rating Summary

With a comprehensive suite of investment management services and an incredibly attractive pricing structure, Wealthfront is one of the most competitive online investment companies in the industry.

Its features are advanced enough for experienced investors, while remaining accessible for newbies, making Wealthfront a great investment management company for a wide range of investors.

Even though their educational resources are not as well-advertised as competing online investing sites, Wealthfront provides investors with deep value through lower account minimums, affordable annual fees, and free account management for the first $10,000.

Popular Article: Best Economic Consulting Firms | Ranking and Comparison

Conclusion: Summary of Online Investments

When it comes to investment management services, there is no doubt that online investment companies and investment management software are quickly becoming the investing tools of the future.

Automatic portfolio rebalancing and asset allocation makes it easier than ever for investors to begin creating and diversifying their investments, regardless of experience or financial skill level.

If you’re considering using an online investment platform for investment management services, look at the top online investment management companies and see what these best online investing sites have to offer.

These online investment companies tend to be much more affordable and much more convenient than their human advisor counterparts, and can be valuable tools when making investments and planning your financial future.

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/money-finance-business-success-2696234/

- https://www.betterment.com/why-betterment/

- https://www.futureadvisor.com/content/what-we-do/retirement

- https://www.motifinvesting.com/products/impact-portfolio

- https://www.personalcapital.com/wealth-management

- https://www.wealthfront.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.