Intro: WiseBanyan Review

Today’s Internet-centric world makes it easy to access nearly any service imaginable online. Investing is no exception, with robo-advisors like WiseBanyan becoming popular online tools for portfolio management.

This is especially true for younger investors who generally make up the cohort most comfortable doing things online.

Image Source: BigStock

Managing your investments online with limited interaction with a human advisor certainly has its merits. According to Investopedia, robo-advisors are typically low-cost and have low account minimums. WiseBanyan is one of them.

Are you a prospective investor? Curious about the world of online investing? Keep reading for information on how the company works, the WiseBanyan app, and WiseBanyan reviews, including a look at WiseBanyan vs. Betterment.

See Also: Robo Advisors vs Financial Advisors – Is It The Future of Automated Stock Trading & Investing?

WiseBanyan Reviews: Goodbye Fees

Like most other robo-advisors, WiseBanyan operates on the principle that traditional financial advisory fees are too high. WiseBanyan, however, does not charge any management, trading, or rebalancing fees – the first financial advisor to do so. Instead of fees, WiseBanyan makes money by allowing clients to choose to opt for paid services. This saves clients from paying fees for services that they don’t want or don’t use.

According to WiseBanyan, this fee-free model allows the company to focus solely on clients’ needs. Instead of trying to maximize the fees it earns from clients, it is focused on managing its clients’ wealth in the most effective way possible. Without a portion of your money going toward fees, it has the ability to earn greater returns.

Why Choose WiseBanyan? (Features and WiseBanyan Reviews)

WiseBanyan operates on the principle that investing should be free and simple. According to WiseBanyan reviews on the company’s website, new investment accounts, including Roth IRAs, traditional IRAs, and SEP-IRAs, can be set up in minutes. You can easily monitor your accounts online, view progress, deposit or withdraw funds, and update your financial plan.

Another benefit of WiseBanyan is that it does not require a minimum investment. This means that new clients can start investing sooner, no matter how modest their investment may be. In turn, clients should start reaching their financial goals sooner. A WiseBanyan review by Investor Junkie confirms that there a no hidden fees, as can be the case with other financial advisors.

A four-pillar investment philosophy is used by WiseBanyan.

- Diversification – By dispersing your investment among multiple asset classes, you can create an investment portfolio with a lower collective risk than any individual asset.

- Low fees – WiseBanyan was built on the principle that investment fees should be as low as possible. This allows investors to keep more of their money, as well as earn greater returns as the money remains in the market.

- Passive investing – Passive investments are built to withstand any type of market. By keeping buying and selling to a minimum, it aims to maximize returns in the long run.

- Starting earlier – The sooner you begin investing, the greater returns can be. Without fees or account minimums, WiseBanyan aims to help investors start seeing a return on their investments sooner.

Don’t Miss: Questions to Ask Before Choosing a Robo Advisor

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

WiseBanyan Reviews: The Online Advantage

Importantly, WiseBanyan uses an automated tool for its investing. This means that you determine a financial plan and WiseBanyan uses algorithms to make decisions that will help you reach your goals. Software works to create a faster, more transparent experience for clients, while WiseBanyan’s team conducts research and analysis in the background. Modern Portfolio Theory is used to help clients achieve the highest possible returns at any risk level.

WiseBanyan’s online approach is ideal for clients who wish to take charge of their finances by starting or growing their investments but who do not wish to be involved in the nitty-gritty of day-to-day investing. However, if you prefer a do-it-yourself approach, looking elsewhere is warranted.

Some investors may be wary of an automated approach when it comes to their savings, but accounts are still monitored by investment professionals. You can feel confident that funds will stay on track and reach their greatest potential. Moreover, one WiseBanyan review reports terrific customer service. The satisfied client said, “Talking to friendly and smart people is a rare feat in customer service these days. Any questions I had were answered quickly and to a level of detail I did not expect.”

WiseBanyan Reviews: How to Get Started

Currently, prospective clients must be invited to join. You can do so by inputting your email address on WiseBanyan’s homepage to request an invitation. Existing clients can also invite others to join.

Image Source: WiseBanyan

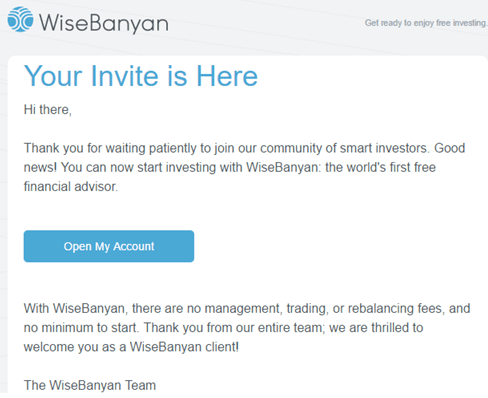

While this may seem time-consuming, it’s actually quite easy; upon entering an email address, the invitation should be waiting for you in the time it takes to refresh your inbox.

Image Source: WiseBanyan

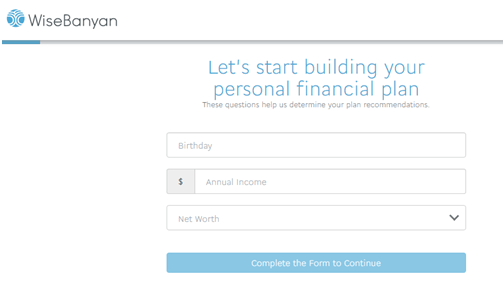

Upon choosing WiseBanyan, you’ll be asked to answer several questions to create your investor profile. These include your age, your income, and your risk tolerance. By understanding the amount of risk you’re willing to take with your investments, the company can build your tailored portfolio. You can increase or decrease your “Risk Score” at any time if you wish to see different asset allocations. WiseBanyan reviews describe the process as relatively straightforward.

Image Source: WiseBanyan

Once all the information is entered, it generally takes 5 business days to open an account with WiseBanyan.

Each investor’s profile is considered when choosing a tailored selection of stocks and bonds in which to invest your money. Domestic and international exchange traded funds (ETFs) are used to diversify and capture market returns.

One WiseBanyan review by an investor with the company walks you through the complete process of opening an account. Keep in mind that WiseBanyan clients must have a permanent U.S. address, a U.S. Social Security Number, and a bank account from a U.S. bank. Clients must also be 18 years of age or older.

Related: Betterment vs Wealthfront – Rankings & Review

WiseBanyan Reviews: WiseBanyan App

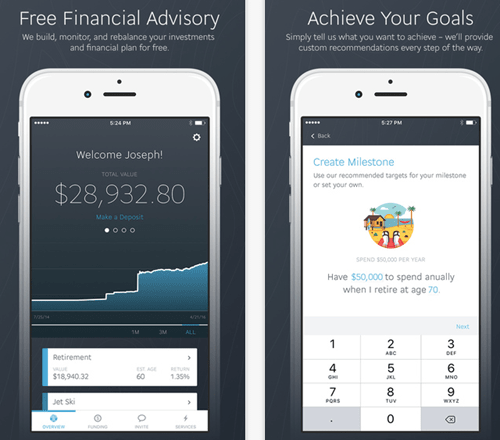

If you’re an avid smartphone user who likes to access your accounts on your mobile device, you’ll want to check out the WiseBanyan app. If you’re an existing client, the app allows you to view and update your financial plan and deposit and withdraw funds, from either your computer or mobile device. You can also set the financial milestones you want to reach, and the WiseBanyan app sets up an automated plan to help you get there. True to its mission, the WiseBanyan app is without fees.

Image Source: WiseBanyan

The WiseBanyan app is available for Apple and Android users. WiseBanyan reviews on Google Play average 4.9 out of 5 stars, making it popular among users. Of 63 total reviews, a whopping 58 WiseBanyan reviews gave the WiseBanyan app a full 5 stars. On the opposite end of the spectrum, only one WiseBanyan review ranked the app with only 2 stars, and no reviewers gave the WiseBanyan app 1 star.

One WiseBanyan review on Google Play from a satisfied user gave the following positive review, along with a 5 star ranking:

“Very easy to use application. I’ve tried a few investment companies’ apps and they’re plagued with hidden fees and confusing rules. This app is…simple and transparent.”

However, despite overwhelmingly positive reviews, technology does not always work seamlessly. A WiseBanyan review from a less satisfied would-be app user reports technical glitches that prevented him from signing up.

WiseBanyan Reviews: Can I Trust WiseBanyan with My Money?

WiseBanyan, Inc. is an SEC-registered financial advisor and FINRA-registered broker-dealer. According to its website, WiseBanyan offers bank-level security, using fully encrypted, secure, and state-of-the-art technology to store its clients’ personal information. Rest assured that your accounts are monitored around the clock by the WiseBanyan investment team, ensuring that funds perform well. A WiseBanyan review by bestcompany echoes this assertion, as does a comparison of WiseBanyan vs. Betterment.

So, What’s the Catch?

While the robo-advisor is certainly reputable, as WiseBanyan reviews indicate, there are several drawbacks that should be considered. As mentioned, if you’re the type of investor who likes picking and choosing specific stocks and bonds to invest in, WiseBanyan may not be the ideal choice for you. Instead, its automated tool executes your financial plan for you.

WiseBanyan is not accredited with the Better Business Bureau, a trusted resource that helps people find and recommend business and brands they can rely on. However, as WiseBanyan is a relatively new company that began in 2013, this is understandable.

WiseBanyan claims to operate on the principle that “Investing should be a right – not a privilege,” and following that principle, all that is required to join and start preparing for your future is an email address. You simply need to input your email address in the “reserve my spot” bar and you will immediately receive an email to get you started on the signup process. There’s no hoopla involved!

Lastly, WiseBanyan’s website is not user-friendly and lacks important details. The lack of a main navigation bar at the top of the homepage forces users to resort to the footer and scrolling through various pages to find the information they’re looking for. Moreover, the information that does exist is somewhat ambiguous.

Popular Article: Wealthfront vs Vanguard – Rankings & Review

WiseBanyan Competitors: WiseBanyan vs. Betterment

A WiseBanyan vs. Betterment comparison on credio.com ranks both robo-advisors similarly. This makes sense, because the two companies offer similar services, from investments in ETFs to fully automated account management platforms.

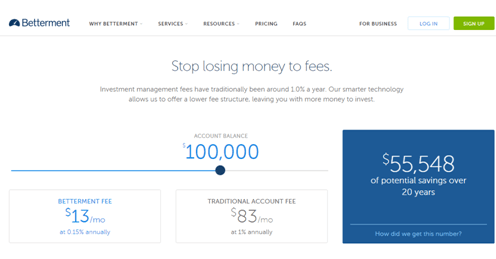

Despite their similarities, notable differences are apparent when looking at WiseBanyan vs. Betterment. Chief among these are the fees they command. While both companies pride themselves on minimizing fees for clients, WiseBanyan only charges for personalized, a la carte products and services, with all other generic services being completely free. On the other hand, Betterment uses smarter technology to keep fees to a minimum. While clients are still paying 0.15% to 0.35% out of pocket, depending on the size of their investment, Betterment undercuts the traditional investment account fee of 1.0% annually. The more you invest, the lower your fee rate.

Consider a $100,000 investment. With Betterment, you’ll pay $13/month at 0.15% annually. Compared to an $83/month account fee at the traditional rate of 1.0% annually, Betterment offers significant savings.

Image Source: WiseBanyan

Additionally, Betterment offers a one-month free trial period and a tax-loss harvesting service, while WiseBanyan offers WiseHarvesting, free to new clients for a 3-month period, which catches those small losses to help decrease your annual taxes. Once you opt-in to WiseHarvest you will see that your first 3 months are free.

Free Wealth & Finance Software - Get Yours Now ►

The Verdict

A comparison of WiseBanyan vs. Betterment reveals many similarities between the two robo-advisors, making either a suitable choice for the average investor. WiseBanyan is the obvious choice for beginner investors who do not wish to pay fees. However, the old adage “you get what you pay for” rings true when comparing WiseBanyan vs. Betterment in more detail.

For one, Betterment is a much larger firm. WiseBanyan holds an AUM of almost $50M, while Betterment holds a whopping $3 billion. This translates into more product offerings, and ultimately more value for customers.

In conclusion, WiseBanyan reviews reveal that WiseBanyan is truly a free online portfolio management tool. Similarly, the WiseBanyan app is a valuable product that is popular among its users. Given that WiseBanyan is a relatively new company, the sustainability of its business model remains to be seen. However, its overall positive online reputation earn it a good recommendation. If you’re looking for more diverse product offerings, though, it may be worth swallowing the fees and looking elsewhere.

Read More: WiseBanyan vs. Betterment – Rankings & Review

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.