Getting the Best Mortgage Rates in Georgia for Good, Great, or Best Credit Borrowers

If you’re in the market to purchase a home in Georgia, you may be surprised to hear that the average cost of Georgia real estate is $158, 500 according to Zillow.

These rising costs mark an increase of 6.7 percent throughout the past year, with Zillow experts predicting an additional increase of 4.4 percent in 2018.

Similarly, Georgia mortgage rates are steadily increasing, averaging 1 basis point higher than the national average of 3.71 percent.

Whether you’re planning on buying property with a new Georgia home loan or looking to refinance an existing Georgia mortgage loan, you’ll want to make sure you are prepared before you start talking with mortgage lenders in Georgia.

Refinancing or buying a home in Atlanta, Savannah, Augusta, Marietta, Athens, Macon, Decatur, or any other city in Georgia represents a significant financial commitment. Georgia mortgage loans can last up to 30 years, so you’ll want to make sure you get the best mortgage rates in Georgia to keep your loan manageable and affordable over the long-term.

Mortgage rates in GA are constantly changing, so it’s important to compare your options between Georgia mortgage companies before you purchase or refinance a home.

Current Mortgage Rates in Arkansas | Best AR Mortgages for Good-Excellent Credit Borrowers

Best Refinance & Purchases Loan Rates Today | Lower Interest Rate Payments

Which Georgia City Are You Located in?

Georgia mortgage rates for borrowers with good, best, and excellent credit depend on a wide range of factors.

These include the city of residence, the amount of their Georgia mortgage down payment, the total loan amount, the condition of the home (based on the appraisal), and many more factors.

Most Georgia mortgage companies in Atlanta, Marietta, Augusta, Decatur, Athens, Savannah, Marietta, and other Georgia cities require a down payment of about 20 percent.

Key Requirements for Buying a House in Georgia

When applying for Georgia mortgage loans, borrowers will want to ensure that they complete the below list of requirements to get the best mortgage rates in GA.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing costs

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Schedule an appraisal for the home

Of course, you’ll also want to weigh your options and select the best Georgia mortgage for you: a conventional mortgage loan (10, 15, 20, or 30-year mortgage) or an adjustable rate mortgage (5/1, 3/1, 7/1 ARM).

Free Personal Finance and Investing Software

How Much House Can You Afford Today?

Mortgage Loan Types in Georgia

Lenders that provide competitive loans and mortgage rates in GA provide both conventional and adjustable rate loan types. A few examples of conventional Georgia mortgage options include:

- 10-year mortgage loans

- 15-year mortgage loans

- 20-year mortgage loans

- 30-year mortgage loans

Conventional fixed-interest rate loans are popular choices for Georgia mortgages for two reasons. First, as a fixed-interest rate Georgia home loan, the interest will stay at the same rate.

Second, this type of Georgia mortgage uses established industry and regulatory guidelines based on loan size and individual finances. Conventional Georgia mortgage loans typically fall between 10-30 years.

Georgia mortgage loans with shorter terms (10-20 years) are good ways to pay your home off faster and build equity. However, it’s important to note that the monthly payments for these Georgia mortgages will be much higher.

Mortgages with 10, 15, or 20-year terms are popular choices for Georgia refinance rates. Adjustable rate mortgages in Georgia include:

- 5/1 ARM

- 7/1 ARM

- 3/1 ARM

Good, Great, or Excellent Credit Score for a Georgia Home Loan

Most mortgage lenders in Georgia use a type of credit score known as a FICO score to determine if a Georgia-based borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with the higher numbers being considered the most creditworthy and the lower numbers being considered the biggest financial risk. The range of FICO scores generally falls into these categories:

- 300 – 629 is considered a bad credit score

- 630 – 689 is considered a fair credit score

- 690 – 719 is considered a good credit score

- 720 – 850 is considered an excellent credit score

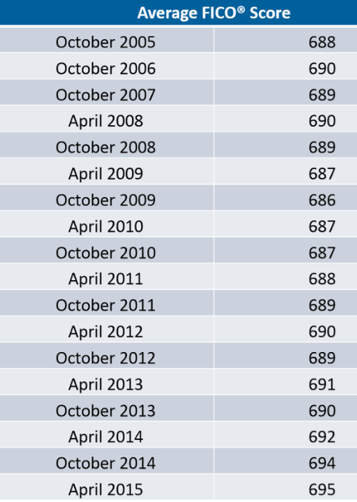

Generally, borrowers with better credit scores receive better mortgage rates in Georgia. Below, you can see the average FICO score as recorded between 2005-2015. According to CNBC, as of this year, the average score is at an all-time high of 700.

Mortgage Rates & Loans Calculator

Retirement Calculator Tool | Retirement Income Calculator

Conclusion – Finding a Top Mortgage Loan for a Home in Georgia

Buying your first home takes time, not only to find the best Georgia mortgage rates, but also to go through the purchasing process itself.

From the time you submit an application until closing, most mortgage lenders in Georgia will need between 30-45 days to complete the proper paperwork. This means you will want to have some sort of plan to avoid additional expenses or unnecessary delays.

If you’re looking at Georgia mortgage rates for your first home, you should consider applying a down payment of 20 percent or more, as many Georgia mortgage lenders will waive the costs of mortgage insurance.

If you are planning to refinance an existing Georgia mortgage, taking the time to compare Georgia refinance rates from multiple lenders can be instrumental in keeping long-term costs down.

Ultimately, finding the best Georgia mortgage rates and Georgia refinance rates will come down to understanding your unique financial situation and focusing on the long-term effects of mortgage rates in Georgia.

Personal Loan Calculator | Calculate Your Loan Payments

Best Online Brokers – Comparison | Get the Best Online Trading Account for You

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- http://nymag.com/daily/intelligencer/2016/08/could-hillary-clinton-win-georgia.html

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.