Comparison Review: Betterment vs. Wealthfront vs. Personal Capital Robo Advisor Fees

Hiring a financial advisor can not only be time-consuming, but it can also be expensive, particularly for long-term investments. In contrast, a robo advisor can provide expert financial services that are both convenient and affordable, boosting investment growth over the long-term.

For many investors, choosing the best robo advisor often means finding an advisory fee schedule that is affordable, transparent, and aligned with your financial goals.

Each advisor will come with its own unique fee structure, and you’ll want to ensure that the robo advisor fee won’t significantly diminish overall returns.

What types of services come with Betterment fees? How do Personal Capital fees stack up against Wealthfront pricing or Betterment pricing?

Will your investments benefit best from Betterment fees, Personal Capital fees, or Wealthfront fees?

In our robo advisor comparison, we’ll look at robo advisor fees from three of the best robo advisors on the market today, including:

- Betterment fees

- Personal Capital fees

- Wealthfront fees

Our robo advisor comparison will show you exactly what you can expect from Betterment vs. Wealthfront vs. Personal Capital in terms of robo advisor fees, costs, and pricing plans.

See Also: Schwab Robo Advisor Reviews: Pros & Cons of Schwab Intelligent Portfolios

Comparison Review List

The list below is sorted alphabetically (click any of the names below to go directly to the detailed review section):

High Level Comparison Table

Best Robo Advisors | Account Minimum | Robo Advisor Fees | Highlighted Features |

| Betterment | $0 for Digital $100,000 for Premium | 0.25% for Digital 0.40% for Premium | 90-day Satisfaction Guarantee |

| Personal Capital | $100,000 for investment management | Tiered annual rates between 0.49%-0.89% | Comprehensive suite of free financial tools for all investors |

| Wealthfront | $500 for all accounts $500,000 for Advanced Indexing services | No fee for the first $10,000 0.25% for accounts over $10,000 | Mobile access to financial planning and investments through Path |

Table: The above list is sorted alphabetically

Don’t Miss: SigFig vs Betterment Review | Robo Alternatives & Competitors)

Betterment Review

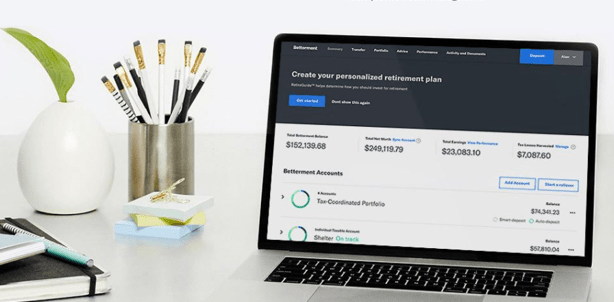

As one of the top robo advisors on the market today, Betterment applies decades of proven investment strategies and expert technology to increase long-term returns.

In fact, investors using Betterment can expect up to 2.66 percent more in returns each year through lowered taxes, lowered robo advisor fees, a diversified portfolio, and Betterment’s commitment to support positive investing choices.

If you’re considering Betterment vs Personal Capital or Betterment vs Wealthfront, however, you may want to look at the total Betterment cost of advisor services.

In the case of Betterment fees, Betterment’s pricing structure is separated into two unique categories of service: Digital and Premium, outlined in the sections below.

Betterment Fees—Digital

Investments within the Digital plan will have an annual management fee of 0.25 percent, which falls far below the national average of 1 percent.

What really makes this category of Betterment pricing stand out is that there is no minimum balance requirement, making Betterment accessible to a wide range of investing goals and financial capabilities.

Along with low robo advisor fees, investors can also benefit from:

- Personalized financial advice

- Low-cost, globally diversified investment portfolios

- Automatic rebalancing

- Advanced tax-saving strategies

- Synced external accounts for a holistic view

- Reliable customer service

- Unlimited access to financial experts

There are no Betterment fees for accounts with a zero balance, and investors can stay within the Digital plan for as long as they would like, regardless of their total account balance.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Betterment Fees—Premium

Underneath the Premium plan, Betterment costs an annual management fee of 0.40 percent. To be eligible for this Betterment pricing structure, investment accounts must be at least $100,000.

Along with all the benefits of the Digital plan, Premium investors can benefit from the following services:

- In-depth advice on outside investments, like 401ks, real estate, and individual stocks

- Unlimited access to CFP® professionals for financial guidance through life events like marriage, starting a family, equity-based compensation, and retirement

Whether an investor chooses to use Digital or Premium services, the Betterment pricing structure does not include additional Betterment fees for:

- Transaction fees for buying and selling securities

- Depositing or withdrawing from your account

Additionally, their Satisfaction Guarantee gives investors the ability to waive their Betterment fees for 90 days if they are not satisfied with their services.

This is a rarity among robo advisors, and demonstrates that Betterment is committed not just to providing manageable robo advisor fees, but also to delivering exceptional customer service.

Betterment Fees vs Personal Capital Fees vs Wealthfront Fees

In terms of fees, the Betterment pricing structure will be much more affordable for investors that want flexible robo advisor fees when comparing Betterment vs Personal Capital.

With no penalty for a zero balance and the ability to remain within the low-cost Digital plan regardless of investment balance, Betterment fees are highly beneficial for new or smaller investors.

This is particularly true when comparing Betterment vs Personal Capital—the higher account requirements and robo advisor fees from Personal Capital are simply less ideal for those with lower account balances.

At the same time, when comparing Betterment vs Personal Capital, the Betterment pricing structure is still more affordable for high net-worth investors.

Not only does the Premium plan keep robo advisor fees low, but it also provides access to crucial investment tools like tax-saving strategies, automatic rebalancing, and direct contact with financial professionals.

For many new investors, choosing between Betterment vs Personal Capital will come down to fees alone—and in this case, Betterment fees are the much more affordable option.

What about Betterment vs Wealthfront? Wealthfront fees are non-existent for the first $10,000, and although investors will pay either 0.25 or 0.49 percent in Betterment fees, both offer competitive robo advisor fees.

Ultimately, choosing between Betterment vs Wealthfront will be less about robo advisor fees, and more about comparing their unique features to determine whether Wealthfront fees or Betterment fees provide the best investment services for you.

Related: Schwab Intelligent Portfolios vs. FutureAdvisor – Rankings & Review

Personal Capital Review

Personal Capital has gained widespread acclaim for their free financial tools, making it easy to investors to see a total financial picture through net worth, retirement analytics, and investment allocation.

Anyone is welcome to sign up for Personal Capital and take advantage of their free financial tools, which makes their financial software incredibly valuable as an affordable, accessible option for all levels of investors.

If you’re considering Betterment vs Personal Capital or Wealthfront vs Personal Capital as a robo advisor, however, you may want to look at the total Personal Capital cost of advisor services.

Personal Capital Fees

While financial tools like are available free of charge, investment management services are offered separately, and have a minimum account balance of $100,000.

What type of Personal Capital fee structure can investors expect? Ultimately, Personal Capital fees are simple, straightforward, and geared to provide the best value for larger investments.

For clients that invest up to $1 million, Personal Capital fees are 0.89 percent annually. If you invest more than $1 million, the Personal Capital cost of asset management is as follows:

- First $3 million—0.79%

- Next $2 million—0.69%

- Next $5 million—0.59%

- Next $10 million—0.49%

Personal Capital fees include investment advice, asset custody, and all trade commissions, maintaining a holistic robo advisor fee structure.

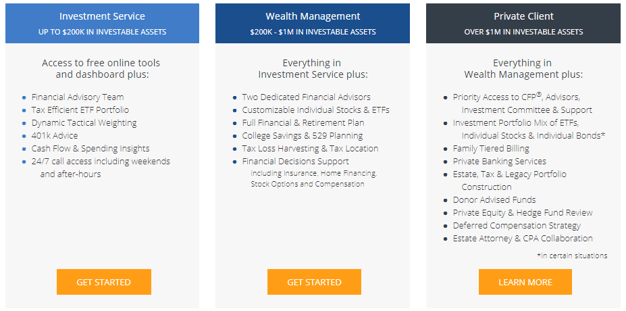

In addition to free financial tools, Personal Capital also provides three tiers of expert service plans to cover a range of investment needs: Investment Service, Wealth Management, and Private Client, pictured below.

Personal Capital Fees vs Wealthfront Fees vs Betterment Fees

For small or beginning investors, Personal Capital may not be the best choice, particularly when comparing Wealthfront vs Personal Capital.

In fact, based on account minimums and tiered Personal Capital fees, this robo advisor is best-suited for clients with more capital to invest.

Although the cost may be higher, it’s worth mentioning that Personal Capital fees come with a ton of value for investors, including their groundbreaking suite of free financial tools.

For high-net-worth investors that fit within the Private Client category, additional features like private banking services, estate portfolio construction, and family tiered billing are not only beneficial, but they are also unique services that aren’t traditionally provided by robo advisors.

With expert wealth management services and a tiered pricing structure uniquely poised to benefit higher investments, Personal Capital is the best choice for investors that can contribute up to $200,000 or more.

Popular Article: Personal Capital vs. Betterment – Rankings & Review

Wealthfront Review

With a focus on managing risk, lowering taxes, and minimizing fees, Wealthfront is a great robo advisor for all levels of investors to consider.

Recently, Wealthfront has implemented a ton of new, valuable investing features. For example, Path is a fully mobile financial planning experience that allows investors to explore their savings, investments, spending habits, and retirement plans on-the-go.

It’s worth mentioning that Wealthfront also puts a keen focus on college savings with their 529 plan, generating up to 16 percent higher in returns than traditional investment accounts.

This robo advisor offers valuable services, but what about the Wealthfront pricing structure? Will Wealthfront’s fees keep your investments sustainable—and profitable—over time?

Before choosing between Wealthfront vs Personal Capital or Wealthfront vs Betterment, you’ll want to consider the Wealthfront fee structure, outlined below.

Wealthfront Fees

The Wealthfront fee structure is uniquely poised to benefit new and smaller net-worth investors, as there are no Wealthfront fees on the first $10,000 invested.

Investors putting away any amount over $10,000 can expect a flat Wealthfront fee of 0.25 percent, regardless of account balance.

With a focus on providing affordable and accessible account management, the Wealthfront pricing structure does not include additional Wealthfront fees for any of the following:

- Opening an account

- Withdrawing funds

- Closing an account

- Trading or commissions

- Account transfers

Wealthfront Fees vs Personal Capital Fees vs Betterment Fees

For many investors, Wealthfront fees are the clear winner between these three best robo investors, despite the low Betterment cost of services.

Wealthfront fees offer investors the advantage of investing $10k free of charge, regardless of total investment amount, making the Wealthfront pricing structure uniquely attractive for new investors when comparing Betterment vs Wealthfront.

What about for higher net-worth investors? There is a substantial comparison to be made between Wealthfront vs Personal Capital, as both provide substantial rewards for larger accounts.

For example, investors with taxable account balances of $500k or more can take advantage of Advanced Indexing to minimize tax impact with no additional Wealthfront fees.

Similarly, Personal Capital clients with over $200k in assets can benefit from tax-efficient features at no additional cost, like Tax Loss Harvesting and Tax Location.

Ultimately, choosing between Wealthfront vs Personal Capital may come down to comparing Wealthfront fees vs Personal Capital fees. With a flat rate of 0.25 percent, Wealthfront may be hard to beat.

Read More: Is Betterment Worth It?| Is Betterment Safe? A Scam? Reviews of Betterment

Conclusion: Choosing Between Betterment Fees vs Wealthfront Fees vs Personal Capital Fees

Whether you are just beginning to explore the world of investing or if you are a seasoned professional, using a robo advisor can help ensure that your investments are expertly managed.

Using the best robo advisor can be a great way for any investor to successfully grow their investments with expert advice and minimal maintenance.

Of course, it’s important to find a robo advisor fee schedule that is affordable and sustainable over the long term.

As you can see by our robo advisor comparison, there are plenty of options when it comes to robo advisor fees, with each fee structure corresponding to a different level of service.

When choosing between Betterment vs Wealthfront vs Personal Capital, make sure you understand the unique benefits and requirements of each robo advisor fee structure to ensure that you can make the most out of your investments.

Image sources:

- https://www.pexels.com/photo/marketing-woman-office-working-36990/

- https://www.betterment.com/financial-planning/

- https://www.betterment.com/tax-efficient-investing/

- https://www.personalcapital.com/wealth-management

- https://www.wealthfront.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.