Intro: Schwab Robo Advisor Reviews

Schwab Intelligent Portfolios is an online investment advisory service, also known as a Schwab robo advisor, that helps investors keep track of their financial portfolios through unique monitoring, balancing, and building features.

Schwab Intelligent Portfolios reviews explain that the program is marketed towards new investors who need more guidance at a low cost.

Image Source: Schwab Intelligent Portfolios

Robo advisors have become a trend in the finance world due to the convenience that they provide for the experienced investor as well as necessary help and advice for the new investor.

There are many robo advisors on the market today, but Schwab robo advisors come with the name of Charles Schwab, a seasoned company with a great reputation. With Schwab robo advisors, you know you are dealing with a company that is an expert in its field.

See Also: Top Robo Advisors (Reviews) | A Changing Trend in the Robo-Investment Field

History of Charles Schwab (Schwab Robo Advisor Reviews)

The Charles Schwab Corporation was founded in 1971 as a small, traditional brokerage firm in San Francisco, California. Over time, Schwab quickly grew into a nationwide American brokerage and banking company.

In 1996, Schwab began an online trading platform for investors, which became one of the most affordable options to date for buying and selling stocks.

In March 2015, Schwab jumped onboard with the new financial trend and launched its first Schwab robo advisor – also known as an automated wealth management service. Schwab Intelligent Portfolios reviews show that Schwab’s robo advisor stood out to consumers due to it being marketed as a free service.

Signing up for Schwab Intelligent Portfolios

Similar competing robo advisors on the market include Wealthfront and Betterment. Schwab Intelligent Portfolios has not been on the market as long as these competitors; however, Schwab’s strong reputation has helped it grow quickly.

Schwab Intelligent Portfolios has some comparable features to its competitors. Opening an account with Schwab Intelligent Portfolios is free, but you must have at least $5,000 to deposit.

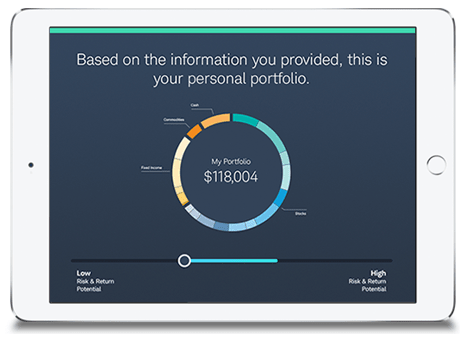

The sign-up process includes 12 questions that help gauge each investor’s goals, timing, and risks with his/her finances. These questions give you a personalized asset allocation. Schwab Intelligent Portfolios reviews agree that the sign-up process is easy and requires no fees other than the minimum deposit amount.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What It Provides – Schwab Intelligent Portfolios Review

In this Schwab Intelligent Portfolios review, we will explain the many different things that this Schwab robo advisor can provide for the beginner investor.

Schwab Intelligent Portfolios has 54 exchange-traded funds covering 20 asset classes. Stocks, bonds, commodities, emerging markets, and REITs are all available through this program. When it comes to having a wide range of diversity, Schwab Intelligent Portfolios really outshines its competitors.

Image Source: Schwab Robo Advisor Reviews

Schwab Intelligent Portfolios: Unique Features

Along with its diversity in options, Schwab Intelligent Portfolios provides many great features such as an automatic rebalancing feature that helps investors reduce market risk. There is also a tax-loss harvesting feature for accounts with $50,000 or more, which is helpful for taxable accounts.

Another unique feature shown in this Schwab Intelligent Portfolios review is the customizability of the investor’s portfolio. Investors can choose to eliminate up to three ETFs on their portfolios and replace them with other investments.

Also, Schwab Intelligent Portfolios has a built-in goal tracker to help investors see, on a daily basis, how their portfolio is measuring up to a savings or income goal.

The goal tracker uses a complex Monte Carlo simulation, which will tell you each day if you are on target, off target or at risk. “On target” is defined as having a better-than-50% chance of reaching your savings goal. “At risk” means that you have a 25%-to-50% chance of reaching your goal, and “off target” is when you have a less-than-25% chance of reaching your savings goal.

Don’t Miss: Best Online Financial Advisors (Human Advisor, Robo-Advisor, and Hybrid)

Schwab Robo Advisor Fees

Many Schwab Intelligent Portfolios reviews agree that the hidden fees of the Schwab robo advisor are one of its big downfalls. While the program has no advisory fees, commission fees or account service fees as promised, customers do pay the operating fees on ETFs in their portfolios. Most investors are aware of these fees, which range from 0.04% to 0.48% depending on the investments chosen.

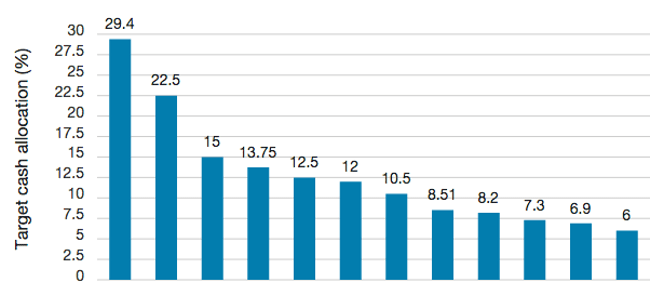

Image Source: Schwab Intelligent Portfolio

The real hidden fees that cause some Schwab Intelligent Portfolio reviews to be somewhat negative involve cash allocation. Between 6% and 30% of total portfolio holdings are allocated to cash. In other words, this cash is taken away to sit in an account where Schwab makes money on it and investors are unable to use this cash in other places. Many customers are unhappy about this less-than-obvious fee within the program.

Downfalls of the Schwab Robo Advisor

As mentioned above, the cash allocation requirement is, by far, the biggest downfall seen by all Schwab Intelligent Portfolio reviews.

There are a few other downfalls as well. While tax-loss harvesting is a feature provided for customers with $50,000 or more invested, the limited tax-loss help for customers with less than that amount is an unattractive reality of Schwab Intelligent Portfolios.

Other competitors do provide tax-loss harvesting for smaller investors, so this can be a deciding factor for many. Lastly, Schwab Intelligent Portfolios reviews explain that the program has a lack of account options. While it provides investors with the traditional account types – such as trusts, joint accounts, custodial accounts, and Roth IRAs – there are no 529 or 401(k) plan account options.

Other features that Schwab Intelligent Portfolios lacks, which other programs might provide, include single stock diversification, direct indexing, fractional shares, and real-life advisors to accompany the robo advisor platform.

Related: Betterment vs. Wealthfront vs. Vanguard – Ranking & Review

Schwab Intelligent Portfolios Review: Accessibility

Schwab Intelligent Portfolios does provide a very accessible program with an iOS and Android mobile application as well as around-the-clock customer service from Schwab investment professionals. The convenience of the mobile application is great for investors on the go who want to be able to track their portfolio daily from wherever they are.

The platform itself is easy to use and self-explanatory both on the desktop and the mobile application. This is necessary for a robo advisor to be successful because it is attractive to new investors who are still trying to find their way.

Schwab Intelligent Portfolios Review: Insurance

The Federal Deposit Insurance Corporation (FDIC) does not insure investments with Schwab Intelligent Portfolios; however, this is not unusual because the FDIC does not insure most automated investment programs.

However, the Securities Investor Protection Corporation (SIPC) insures Charles Schwab. SIPC insurance keeps most of your assets protected.

The Fine Print (Schwab Robo Advisor Reviews)

The fine print on Schwab’s website for Schwab Intelligent Portfolios will spell out its cash allocation process that most people complain about; however, it makes sure not to advertise this loudly as it is an unattractive feature.

You must pay attention to the details when choosing a robo advisor because, although the Schwab robo advisor is advertised as a free service, the hidden fees can end up being significant.

Popular Article: Best Online Investment Companies | Review and Ranking for Online Investing

Schwab Robo Advisor Success

In the third quarter of 2015, Schwab Intelligent Portfolios grew 37% in earnings. Investmentnews.com suggests that this is due to existing Charles Schwab clients switching over to the automatic platform.

Schwab Intelligent Portfolios has soared above its competitors in average client assets, even though it has been on the market for a much shorter period of time. The name Charles Schwab is a trusted one and has proven to be worthwhile.

Schwab Intelligent Portfolios is expected to continue to grow throughout the years because of the many existing investor clients of Charles Schwab that are switching over to robo advisors. Investmentnews.com expects that other big brokerage firms will follow in Schwab’s footsteps and jump on the robo advisor trend.

Free Wealth & Finance Software - Get Yours Now ►

Is the Schwab Robo Advisor Right for You?

While there are definitely some negatives that can be seen through many Schwab Intelligent Portfolios reviews, Schwab’s robo advisor is still a good choice for some. For new investors and IRA investors who want a well-known company to trust with their finances, Schwab Intelligent Portfolios could be the right choice.

Also, Schwab Intelligent Portfolios provides a much wider range of asset classes and ETFs for those investing a lot of money in many different places. Though hidden fees are present, it is true that Schwab Intelligent Portfolios has no advisory fees, commission fees or account service fees, which could prove financially beneficial to the right customer. What you can be sure about with Schwab Intelligent Portfolios is that you will be dealing with a company who knows what it is doing.

Schwab Intelligent Portfolios Review: The Lowdown

When it comes to choosing a robo advisor that is right for you, choosing between the many platforms on the market can be a difficult task. In order to find the best one, you must consider your own personal financial situation.

If you are a new investor who needs a trusted name and some helpful guidance, Schwab Intelligent Portfolios might be the perfect pick. With a small investment requirement of $5,000, Schwab Intelligent Portfolios is a great place to start.

However, the cash drag that comes with Schwab’s not-so-obvious cash allocation policy can be a big downfall for more experienced investors. Other than the cash allocation, which will be a deal breaker for many, Schwab Intelligent Portfolio reviews agree that Schwab provides a trusted firm and the most diverse amount of asset classes and ETFs.

Schwab Intelligent Portfolios is a huge contender in the competition for the best and most successful robo advisor on the market today. Make sure to consider it in your robo advisor selection as an investor.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.