Intro: Fidelity Go Robo-Advisor

In the age of the Internet, nearly any financial service can be found online, including investment services.

Over the past few years, robo-advisors have experienced a surge in popularity, offering convenient, hands-off investment services for all ranges of investors.

If you’re considering using a robo-advisor to manage your investments, you’ll want to make sure that you have the best robo-advisor to fit your unique financial needs.

Could Fidelity Go be the best robo-advsior for you? How does Fidelity Go work? What do Fidelity Go reviews have to say?

In this Fidelity Go review, we’ll outline everything you need to know about the Fidelity robo-advisor, including fees, services, and highlighted features.

Is Fidelity Go the best robo-advisor for you? Read on—our Fidelity Go review will give you all the information you need to know.

See Also: Betterment vs. Wealthfront vs. Vanguard – Ranking & Review

Fidelity Go Review | What is Fidelity Go?

Fidelity Go is a best robo-advisor that seeks to make money management affordable, convenient, and simple. Fidelity robo-advisor services are managed by Fidelity, one of the most recognized names in asset management across the globe.

As an investment robo-advisor, Fidelity Go is ideal for investors that don’t have a lot of time to maintain their investment accounts on their own.

With Fidelity robo-advisor services, users don’t have to worry about constantly monitoring their accounts—instead, a team of Fidelity advisors takes care of each investment for them.

Depending on your portfolio composition, this team can include any of the following:

- Fidelity Investments

- Fidelity Brokerage Services LLC

- National Financial Services LLC

- Geode Capital Management, LLC

Along with professional money management, investors receive monthly progress reports and annual reviews to ensure that their financial goals are being met.

Don’t Miss: FutureAdvisor Review – Ranking and Reviews (Robo-Investing)

Fidelity Go Review | How Does Fidelity Go Work?

Much of the appeal towards an investment robo-advisor comes from ease of use and the ability to receive hands-off investment monitoring. With that in mind, this best robo-advisor closely embodies these characteristics.

Getting started with the Fidelity robo-advisor can be done in four simple steps, outlined below.

Investment Strategy Quiz

The first step to using the Fidelity robo-advisor is taking a short quiz to determine your own personal investment strategy and risk tolerance.

This Fidelity Go quiz will ask financial questions about your current financial health and your financial goals. Afterwards, Fidelity Go will use your responses to generate the best investment strategy for you.

For example, if you’re planning on using Fidelity robo-advisor services to generate savings for a home, your investment strategy will look much different than someone who is planning on saving for retirement.

Select an Investment Strategy

Based on your quiz responses, the Fidelity Go robo-advisor will suggest an appropriate investment strategy to help you reach your financial goals, making Fidelity Go a best robo-advisor for investors that want a unique strategy tailored to their goals.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Create & Fund Your Account

Creating an account with Fidelity Go is quick and painless—your account number will be generated within seconds, and you have a maximum of 6 months to fund your account.

The minimum amount to open an account is $5,000, and monthly deposits are optional.

Investors can choose one of three ways to fund their account:

- Move cash from an existing Fidelity account

- Electronically transfer funds from a bank

- Deposit a check via the Fidelity app or by mail

Let Your Investment Strategy Work for You

After your account is funded, the Fidelity investment team will start working to implement your personal investment strategy.

Fidelity robo-advisor services will monitor your account for you and, if necessary, make trades to ensure that your money is performing as well as possible.

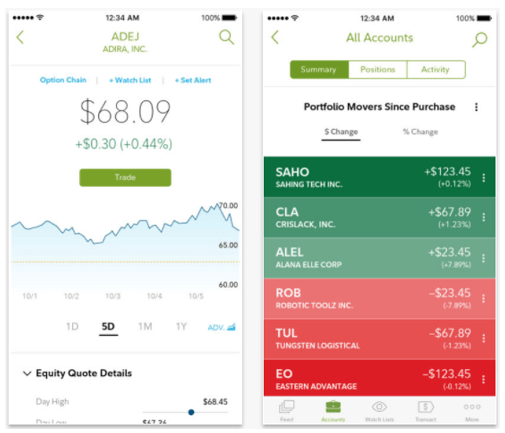

To monitor investments, you can log into the Fidelity website or download the Fidelity mobile app to see how your investments are performing.

Related: FutureAdvisor vs Betterment (Alternatives & Competitors)

Fidelity Go Review | Investment Products & Fees

Investment Products

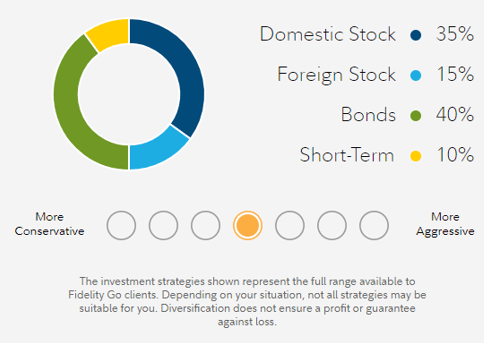

Portfolios through Fidelity Go are available in a range of conservative to aggressive compositions.

Depending on financial goals and risk tolerance, each Fidelity Go portfolio will consist of mutual funds and Exchange-Traded Funds.

These investments include a unique combination of domestic stock, foreign stock, bonds, and short-term investments.

Fidelity Robo-Advisor Fees

Before signing up for an investment robo-advisor, it’s important to consider the underlying fees and pricing.

Unlike other investment robo-advisors, Fidelity Go maintains a transparent fee structure for their Fidelity robo-advisor services, which makes them a best robo-advisor for investors to consider.

For Fidelity Go robo-advisor services, investors can expect to pay a 0.35 percent for tax-advantaged (retirement funds). For taxable funds, investors can pay anywhere between 0.35-0.40 percent.

While this is a slightly higher fee than other competing investment robo-advisors, it’s worth noting that the cost of Fidelity Go includes the net advisory fee, SEC costs, and any fund expenses.

Investors that choose Fidelity Go will not pay investment robo-advisor fees for any of the following:

- Trading commissions

- Transaction fees

- Rebalancing fees

Popular Article: How Does Betterment Work? | Allocation, Accounts, Withdrawals, How to Use

Fidelity Go Review | Fidelity Mobile App

Investors can choose to access their account through the desktop site or through the Fidelity mobile app, available on iTunes and Google Play.

Both versions of the Fidelity app come with high user ratings: The Fidelity mobile app has 4.5 stars out of 5 on iTunes and 4.4 stars on Google Play.

The Fidelity app is also available on the following devices:

- iPad

- Apple Watch

- Apple TV

- Windows Phone 8

- Amazon Devices

Using the Fidelity app provides a host of account management features, including portfolio monitoring, access to tax forms, check deposits, and access to the latest financial news.

Read More: Investing Basics – Are Robo Advisors Right For You? (Robo Investing Guide)

Conclusion: Could Fidelity Go be the Best Robo-Advisor for You?

As a best robo-advisor, Fidelity Go has a lot of advantages. Choosing a globally-recognized financial advisor certainly has its own benefits, including professional investment advice and expert account management.

Although Fidelity robo-advisor services come with transparent fees and the convenience of hands-off account management, our Fidelity review found that Fidelity Go does require a high opening deposit and comparatively high fees.

If you don’t have $5,000 to invest—or if you want lower fees—you may be better off choosing Betterment or Wealthfront.

On the other hand, if you already have a Fidelity account—or if you can make a larger initial deposit—Fidelity Go could be the best robo-advisor for you.

Take the time to consider Fidelity robo-advisor services and apply them towards your personal financial goals to determine whether Fidelity Go is the right robo-advisor for your unique needs.

Image sources:

- https://dpcs.fidelity.com/prgw/dpcs/dma/

- https://dpcs.fidelity.com/prgw/dpcs/dma/#dma–disclosure–landing–anchor

- https://itunes.apple.com/us/app/fidelity-investments/id348177453?mt=8

- https://pixabay.com/en/business-cafe-coffee-coffee-shop-2345812/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.