Summary: FutureAdvisor vs Betterment (Alternatives & Competitors)

Where do you stand on the Betterment vs FutureAdvisor debate? Maybe you are new to investing or have tried to make money in the stock market before, but you found it difficult or too time-consuming to manage your own portfolio.

If so, you’re not alone. The demand for online investment help is so large that multiple websites called “robo-advisors” have cropped up to meet the needs of people just like you. Two of those websites are called Betterment and FutureAdvisor.

In the Betterment vs FutureAdvisor debate, where should you fall?

Companies like Betterment, or “robo-advisors,” are an interesting and high-tech way to manage your investments. In most cases, they are less expensive than traditional portfolio management because they’re completely automated. However, they offer many of the same services as a human financial advisor.

Have we piqued your interest? How can companies like Betterment make managing your portfolio easier? Are you wondering how a computer program could possibly take the place of a well-trained and educated stockbroker?

Today, we’ll break down, compare, and contrast FutureAdvisor vs Betterment, two of the best robo-advisors that are currently available. That way, you can make a thoughtful choice about which robo-advisor is right for you.

See Also: Best Online Financial Advisors (Human Advisor, Robo-Advisor, and Hybrid)

Betterment

Our first stop is at the FutureAdvisor competitor, Betterment. According to Investorjunkie, “Betterment is a perfect starting point for young investors. They make investing easy for beginners by focusing on simple asset allocation, goal-setting features, and low-cost portfolio management.” Betterment’s offerings are a concrete place to start when debating Betterment vs. FutureAdvisor.

Companies like Betterment are tailor-made for newbie investors. There is some trick to properly allocating your assets, managing fees, and making sure your advisor is on your side, not just his own. Betterment takes all of those worries out of the investing process.

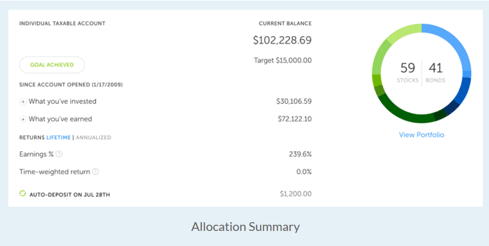

Image Source: Betterment

As far as choosing between FutureAdvisor vs. Betterment goes, you can consider the fact that Betterment boasts that getting started with them is as easy as opening a bank account. Investorjunkie, though, is quick to point out the following:

“But let me be clear, Betterment is not FDIC insured. Your returns are not guaranteed and are subject to market risk. It’s possible your investment could lose principal, though compared to other investment options that don’t have principal risk, they do have other types of risk. Betterment is an SEC registered broker-dealer and member of FINRA/SIPC.”

This is true even if you choose to work with a Betterment alternative.

How do companies like Betterment manage to do all this without the benefit of human financial advisors? Their algorithms are based on Nobel-Prize winning science called Modern Portfolio Theory (or MPT). That allows Betterment to lower your risk while maximizing your gains over the long-term.

This sounds impossible, but it’s not. It spreads your principle across a wide variety of stocks and bonds, which, according to MPT, should minimize losses and stabilize gains. This is the same no matter what you choose in the Betterment vs FutureAdvisor debate.

Betterment’s philosophy, though, is that theory doesn’t matter to a new investor. What matters is the final goal. It allows you to set a goal with a particular date, like your retirement or a Caribbean vacation.

Then, it tells you how much you’ll have to invest to meet those goals. Unlike Betterment competitors, it does this by use of a fun-to-use investment wheel.

This is how it works: Betterment has no minimum investment, although they do suggest that you deposit $100 a month into your account if you start with nothing. This can make all the difference in the Betterment vs FutureAdvisor debate if you don’t want to start out with a very high principle.

They then invest your money into a series of passive index-tracking equity and fixed income exchange-traded funds (ETFs).

According to Wikipedia, passive indexed ETFs perform better than actively managed funds about 90% of the time. In other words, a robo-advisor isn’t going to get jumpy when the market dips and move your money before it’s ready. That’s how companies like Betterment see so much success.

So, let’s talk pricing. I mentioned earlier that companies like Betterment can be considerably less expensive than employing a stockbroker. How much less expensive? Betterment happens to be one of the least expensive robo-advisors out there, which could also sway your loyalty in the debate in FutureAdvisor vs Betterment.

The cost is 0.35% annually if you set up direct deposit on your $100 a month, 0.25% annually with $10k minimum, and 0.15% annually for balances over $100k. In short, the prices are tiered based on how much you have invested with Betterment. The more you put into your account, the more you save. This tiered structure is unique to this particular FutureAdvisor competitor.

Betterment also offers many impressive features. It allows you to integrate different types of accounts, such as:

- Traditional IRA

- Roth IRA

- Rollover IRA

- SEP IRA

- Trusts

- Non-Profit

- Individual

- Joint

Don’t Miss: Betterment Review – Returns, Fees, and All You Need to Know

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Betterment also offers tax loss harvesting, portfolio rebalancing (both of which are completely automated and require no input from the user), a mobile app for both iOS and Android, 24/7 customer service, and the RetireGuide Calculator.

RetireGuide is a new feature that allows you to add your retirement accounts to your Betterment profile. Betterment then gives you retirement advice, like how much you will probably spend in retirement, how much you’re going to need to save in order to make what you need, and many other very cool features.

It will even pull reports from the Social Security Administration for you. Betterment competitors do not offer a service like this yet.

As of July, Betterment was managing $5 billion for its users. That’s a lot of people trusting this FutureAdvisor competitor with their money. Why not take a look for yourself and see what the fuss is all about?

FutureAdvisor

According to Wikipedia, “FutureAdvisor was founded by two former Microsoft engineers — Bo Lu and Jon Xu — in Seattle. The company graduated from the incubator YCombinator in 2010, took $1 million in seed funding, and raised $5 million in Series A funding from Sequoia Capital in 2012.”

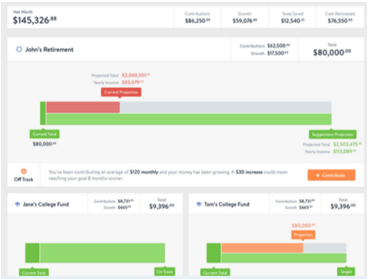

Image Source: Future Advisor

That makes it one of the newer robo-advisors, but with $600 million in managed assets, they’re making up for lost time and making big strides to catch up in the FutureAdvisor vs Betterment debate.

Unlike Betterment, FutureAdvisor asks you to link your pre-existing accounts when you sign up. If you don’t want to link your accounts, you can input them manually.

It then breaks your accounts into nine different sections for ease of use and gives you advice on things you are doing well and things you could stand to improve. Some FutureAdvisor competitors don’t make it this easy to sign up.

Related: WealthfrontvsFutureAdvisor – Rankings & Review

InvestorJunkie tells us that FutureAdvisor offers such management services as:

- Personalized diversification based on age, risk tolerance, and investment horizon

- Low fees

- Long-term growth emphasis on value and small-cap funds

- Low fee index funds, primarily with Vanguard or iShares

- Re-balancing recommendations semi-annually or quarterly

- Tax harvesting

Though it is free to sign up, the minimum to start investing with FutureAdvisor is $10,000, and there is an annual fee of 0.5% for premium service. This is higher than some FutureAdvisor competitors, though, of course, there is the argument that you get what you pay for. They offer tax-loss harvesting as well as automatic portfolio rebalancing.

There is also an article library to teach you more about investing and a chart that shows you how much you can save with FutureAdvisor versus a traditional, human advisor. Unfortunately, the chart doesn’t compare FutureAdvisor vs Betterment.

That’s still something you have to decide for yourself.

FutureAdvisor offers some free services along with their investing help. For example, the website gives you the ability to link a 529 account that will allow you to save up for you children’s college education.

Advice about 529 accounts, retirement accounts, and other types of college savings are absolutely free.

All you pay for is investment management and any 529 fees associated with ETFs. FutureAdvisor competitors don’t offer this service.

One thing you cannot do with FutureAdvisor is daily financial planning and budgeting. It is only for investments. Please bear in mind that with all companies like Betterment and FutureAdvisor, there is no option to interact with a human advisor. All of the advice you will receive is automated.

In short, the Betterment competitor FutureAdvisor is an excellent investment tool for people with a little more money with which to start investing.

Popular Article: Top Robo Advisors in Canada

FutureAdvisor vs Betterment

Betterment and FutureAdvisor are both great websites, so in the Betterment vs FutureAdvisor debate, which should you choose? That all depends on your needs. Let’s take a moment to compare and contrast so you can make the best choice for your money.

So, who should we pick in the great FutureAdvisor vs Betterment debate? Both Betterment and FutureAdvisor are online robo-advisors with many great features. They both offer fully-automated platforms with algorithms based on MPT, and they both take an investor’s risk tolerance into account.

Image Source: Future Advisor

Betterment and Betterment alternatives can roll over the same types of accounts, such as 401(k)s, Roth IRAs, SEP-IRAs, taxable Investment Accounts, and Traditional IRAs.

Both are Registered Investment Advisors (RIAs), and all are regulated by the Securities And Exchange Commission (SEC). In other words, both of these robo-advisors can help you increase your retirement funds safely and effectively. But we all know their similarities can’t help us make a choice about FutureAdvisor vs. Betterment.

When it comes to pricing, FutureAdvisor is more expensive than Betterment and other FutureAdvisor competitors, and it has a higher minimum to start investing, as well as higher fees throughout the process.

This is because FutureAdvisor is backed by Fidelity and TD Ameritrade, and Betterment acts as its own entity by using Betterment Securities. However, if you have more funds or a more complicated portfolio, you are paying a higher price for better service with FutureAdvisor.

While both websites have apps for Apple iOS and mobile platforms, only Betterment has an app for Android. For some people, this can certainly be a deciding factor when choosing Betterment vs FutureAdvisor.

If you are trying to keep track of your investments from your Google phone, this could be a very big deal to you.

FutureAdvisor, unlike FutureAdvisor competitors, gives you the option to link outside accounts for a more holistic picture. Betterment does not allow that, making it slightly less flexible for seasoned investors.

Another way to approach FutureAdvisor vs Betterment is how much experience you have with investing. A person who is still experimenting with investment might choose one of the companies like Betterment.

Only FutureAdvisor offers management of your 529 accounts, but Betterment provides greater flexibility in asset allocation. In short, there are great features to each program, and which website you choose in the FutureAdvisor vs Betterment debate depends on your personal needs.

This may help you make a Betterment vs FutureAdvisor selection: Credio rates Betterment at 100, while it only rates FutureAdvisor at 96. Investorjunkie rates Betterment at four stars, but it only rates FutureAdvisor at four stars. Maybe this is because Betterment is older.

Maybe, too, Betterment has $5 billion in managed assets while FutureAdvisor only has $600 million because it is an older program. But maybe not. If you want to decide which to pick in the FutureAdvisor vs Betterment debate, it might behoove you as a potential investor in each program to try them out and see what you think for yourself.

Read More: Vanguard Robo Advisor – Ranking | Vanguard Personal Advisor Services Review

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

In conclusion, people all over the Unites States are trusting robo-advisors with their investing because they can start with less capital and pay less in fees than they would with a human advisor — all while getting the same or better quality advice.

There is no prerequisite to be a millionaire just so you can invest like one. FutureAdvisor and companies like Betterment are, without a doubt, taking the investing world by storm. It’s an exciting time to be an investor!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.