Missouri CD Interest Rates for 1-Month to 5-Year CDs

Are you in the market for the best certificate of deposit (CD) account rates? If you live in St. Louis, Independence, Kansas City, Springfield, or any other city in Missouri, you’ve come to the right place.

At AdvisoryHQ, we understand how important it is for consumers to conduct smart, thorough research on MO CD rates and savings accounts. Of course, not every consumer has the time to dedicate towards finding the best CD rates in MO, which is where we come in.

Below, you can find a Missouri rate table displaying some of the best financial rates in MO, including offers from top financial institutions for Missouri residents.

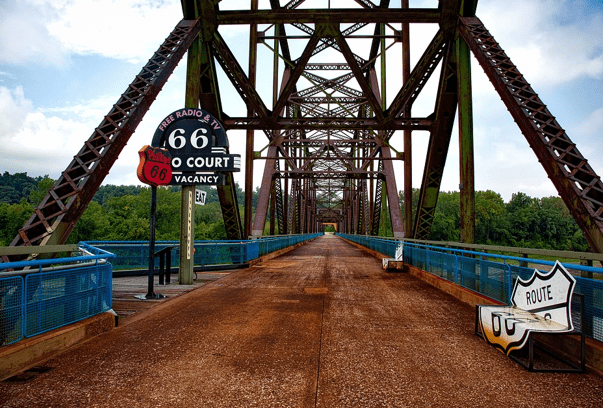

Chain of Rocks Bridge—St. Louis, MO

Best CD Rates in WA (1-Month to 5-Year CDs)

Best CD Rates in Tennessee | Nashville, Memphis, Knoxville, and Other Cities

Which Missouri City Are You Located In?

Below is a list of the ten largest cities in Missouri. Click here to go to the Missouri rates table displayed above to view available financial rates in MO.

Biggest Cities in Missouri | Population (2015-2016) |

| Kansas City | 481,420 |

| St. Louis | 315,685 |

| Springfield | 167,319 |

| Independence | 117,030 |

| Lee’s Summit | 96,076 |

| O’Fallon | 86,274 |

| Saint Joseph | 76,472 |

| Saint Charles | 69,293 |

| Saint Peters | 57,289 |

| Blue Springs | 54,431 |

Best CD Rates in Arizona for Good-to-Great Credit

Best CD Rates in Indiana | 1-Month to 5-Year Indiana CDs

High Yield Savings Rates vs Best CD Rates in Missouri

Finding the best CD rates in Missouri for you means conducting thorough research to find a savings investment that matches your unique financial goals.

Of course, depending on where you live in Missouri, you may find that high-yield savings accounts in Missouri are a better fit for your needs. Some online high-yield savings accounts offer much higher rates than even the best CD rates in Missouri.

Similarly, you may find that online banks and national financial institutions could offer higher CD rates than local banks in Missouri.

You can use the above rate table to compare options for the best rates on financial products in Missouri.

Longer-Term Missouri CDs

Something else to note is that the longer-term CDs (2-year, 3-year, and 5-year) tend to offer the best CD rates in Missouri.

Banks prefer to offer higher rates for longer-term CD rates in Missouri since they can utilize your investment for a longer time period. If you can put your money away for a longer time period, these longer-term CDs are often the best way to get great CD rates in MO.

Best CD Rates in Massachusetts | Boston, Cambridge, Springfield, & Other Cities

Best Virginia CD Rates | VA CD Rates for 1-9-Month, 1-5-Year, & Jumbo CDs

Conclusion: Getting the Best CD Rates in Missouri

No matter where you live in the state, there are plenty of offers for MO CD rates in St. Louis, Kansas City, Independence, Springfield, or any other city in Missouri.

No matter what financial institution you choose, it’s important to do your research to ensure that you are getting the best CD rates in Missouri to help your savings grow.

Best CD Rates in New Jersey | Newark, Jersey City, Paterson, & Other Cities

Current Mortgage Rates in Arkansas | Best AR Mortgages for Good-Excellent Credit Borrowers

CD, Savings and MMA Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Table source:

https://www.google.com/search?q=biggest+cities+in+missouri&oq=biggest+cities+in+missouri

Image source:

https://pixabay.com/en/chain-of-rocks-bridge-missouri-1618314/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.