Getting the Best Mortgage Rates in Boise (10-15-30-Year Fixed, 5/1, 7/1 ARM)

Are you in the market to buy a home in Boise or refinance an existing mortgage? If so, you’ll want to pay close attention to current mortgage rates in Boise, Idaho.

Refinancing or buying a home in Idaho marks one of the most significant financial decisions you will make in your life. Of course, it will also be one of the most expensive and long-lasting decisions.

A mortgage represents a financial commitment that lasts for decades, and it’s important to ensure that Boise mortgage rates help you establish a positive lending relationship and maintain financial stability over the life of the loan.

Current Mortgage Rates in Cincinnati | Best Cincinnati Mortgage Rates & Offers

Current Pittsburgh Mortgage Rates | Best Offers, Terms, & Rates for Pittsburgh Mortgages

Key Requirements for Buying a House in Boise

Before applying for Boise home loans, you’ll want to complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options for a conventional Boise mortgage (10, 15, 20, or 30-year mortgage) or an adjustable rate Boise home loan (5/1, 3/1, 7/1 ARM) before choosing the best mortgage rates in Boise, Idaho for you.

Factors that Influence Boise Mortgage Rates

While mortgage terms will play a role in determining monthly costs, Boise mortgage rates will be the biggest factor in whether your monthly payments are affordable.

See the sections below for common elements that can impact Boise mortgages.

Credit Score

Just like any other loan, a borrower’s credit score is used as a benchmark for reliability. Boise mortgage lenders see high credit scores as proof of reliability, offering lower Boise mortgage rates as a result.

Lower credit scores are problematic for lenders, as it raises doubts on whether a borrower can financially manage mortgage rates in Boise, Idaho.

While exploring mortgage rates in Boise, take the time to examine your credit score. Look for ways to boost your score through paying off any old debts or resolving errors before committing to any Boise home loans.

Location

For some Boise mortgage lenders, the location of your home could make a difference in Boise mortgage rates.

Rates for Boise mortgages may differ when purchasing in an urban vs. a rural area, so make sure that you take note of the location while evaluating Boise mortgage rates.

Down Payment

Putting aside more money for a down payment certainly isn’t fun, but it’s a great way to boost your chances of getting an affordable loan.

Although some mortgage rates in Boise will still be affordable with a lower down payment, the best way to keep a mortgage cost-effective over time is to put 20 percent down.

Current Mortgage Rates in Tulsa | Home Loans in Tulsa for Good-Excellent Credit Borrowers

Current Minneapolis Mortgage Rates | Best Terms, Offers, & Rates for Minneapolis Home Loans

Good, Great, or Excellent Credit Score for Boise Home Loans

Most lenders that provide competitive Boise mortgage rates use a FICO score to determine if a borrower is creditworthy or not.

FICO scores range anywhere from 300 to 850, with higher numbers seen as the most creditworthy and lower numbers seen as the biggest financial risk.

FICO scores for mortgage rates in Boise, Idaho generally fall into these categories:

- 300 – 629 is considered “Bad”

- 630 – 689 is considered “Fair”

- 690 – 719 is considered “Good”

- 720 – 850 is considered “Excellent”

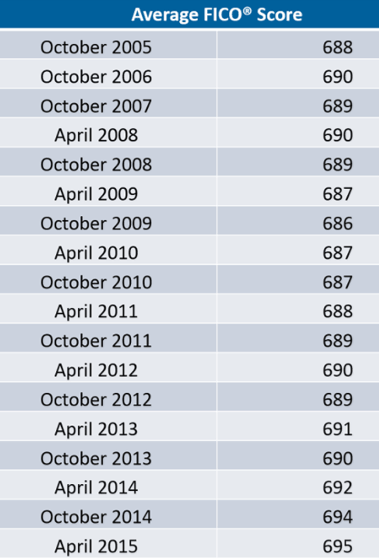

If you’re curious about the average credit score, see the table below for average FICO scores from 2005-2015. According to CNBC, as of this year, the average score is 700.

Current Minneapolis Mortgage Rates | Best Terms, Offers, & Rates for Minneapolis Home Loans

Current Mortgage Rates in Omaha | Best Rates & Terms for Omaha Home Loans

Conclusion – Finding the Best Mortgage Rates in Boise, Idaho

Once you know what type of mortgage you are interested in, your next step is to start evaluating lenders to find the best Boise mortgage rates and terms.

Just as with any other shopping experience, it’s important to weigh in your options and compare offers from multiple Boise mortgage lenders to ensure that you are getting the best deal possible.

Affordable and manageable Boise mortgages are determined not just by monthly payments, but also by Boise mortgage rates and terms.

As such, don’t be afraid to shop around until you find the best mortgage rates in Boise for your financial needs.

Current Mortgage Rates in Atlanta | Best Rates & Terms for Atlanta Mortgages

Best Mortgage Rates in Wichita, KS | Wichita Home Loans for Good-Excellent Borrowers

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://pixabay.com/en/beautiful-home-garden-1680793/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.