Best Mortgage Rates in Virginia for a New Home Purchase or Refinancing

Are you in the market to buy a home in Virginia? Or are you looking to refinance an existing Virginia mortgage loan?

If so, this may be the right time to do it—according to Zillow, mortgage rates in VA represent one of the lowest average mortgage rates across the entire country.

Refinancing or buying a home in Alexandria, Virginia Beach, Norfolk, Chesapeake, Richmond, Hampton, Roanoke, or any other city in Virginia is one of the most important financial decisions that you will make. Of course, it’s almost surely going to be one of the most expensive.

The best way to ensure that a Virginia mortgage remains manageable over time is to find the best Virginia mortgage rates.

Not only will you save money over the long-run, but you can even pay off your loan sooner by taking advantage of great Virginia mortgage rates.

Best Mortgage Rates in New Jersey | New Homes & Refi Rates

Best Mortgage Rates in North Carolina | New Homes & Refinance Rates

Which Virginia City Are You Located in?

Virginia mortgage rates will depend on a variety of different factors, including credit score, home location, down payment amount, the total loan amount, whether the home is in good condition, and more.

Most borrowers find that the best way to increase their chances of getting great mortgage rates in Virginia is through making a larger down payment.

Most mortgage lenders in Roanoke, Richmond, Chesapeake, Norfolk, Virginia Beach, Portsmouth, and Alexandria require a down payment of around 20%.

Below is a list of some of the largest cities in Virginia where residents can find a variety of mortgage lenders in Virginia and the best Virginia mortgage rates.

Top Virginia Cities | Population (2015) |

| Virginia Beach | 452,745 |

| Norfolk | 246,393 |

| Chesapeake | 235,429 |

| Richmond | 220,289 |

| Newport News | 182,385 |

| Alexandria | 153,511 |

| Hampton | 136,454 |

| Roanoke | 99,897 |

| Portsmouth | 96,201 |

Source: Google

Key Requirements for Buying a House in Virginia

Before you apply for a Virginia mortgage, you’ll want to ensure that you complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost (there might be additional expenses that you’ll need to pay.)

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

- Choose your Virginia mortgage type: a conventional mortgage loan (30, 10, 15, or 20-year mortgage) or an adjustable rate mortgage (5/1, 3/1, 7/1 ARM)

Additional Considerations for Virginia Mortgages

If you have an excellent credit history and are seeking a Virginia home loan for more than $424,100, some lenders may be able to provide more flexible mortgage rates and terms.

While looking for the best mortgage rates in Virginia, make sure to confirm your loan terms before committing to a Virginia mortgage loan.

It’s also worth noting that the APR rate and payment information for Virginia mortgage rates do not offer a holistic view of your expenses. There will also be Virginia taxes or required insurance premiums to consider when looking for the best mortgage rates in Virginia.

Best Mortgage Rates in Washington (WA) for Good Credit

Current & Best Mortgage Rates in Michigan for Good Credit

Good, Great, or Excellent Credit Score for a Virginia Home Loan

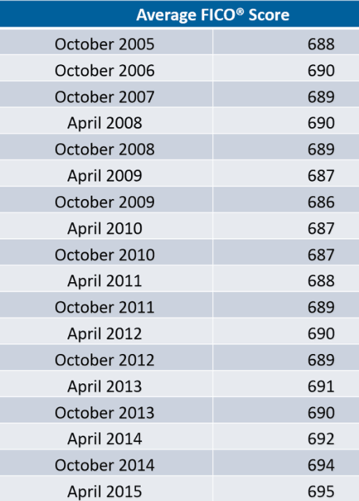

Most mortgage lenders in Virginia refer to a borrower’s FICO score to determine how much they can borrow, and what types of Virginia mortgage rates they will get.

FICO scores range between 300-850, with higher numbers representing creditworthiness and lower numbers representing financial risk.

The range of FICO scores generally falls into these categories:

- 300 – 629 is considered a bad credit score

- 630 – 689 is considered a fair credit score

- 690 – 719 is considered a good credit score

- 720 – 850 is considered an excellent credit score

See the table below for a list of average scores from 2005-2015. Surprisingly, CNBC reports that the average score this year is 700.

Best CD Rates in PA | Pittsburgh, Philadelphia & Other Pennsylvania Cities

Best CD Rates in Ohio for People with Good & Great Credit

Conclusion – Finding the Best Virginia Mortgage Rates

When it comes to buying a new home, finding the best mortgage rates in Virginia is crucial. Short-term costs from insurance, fees, and closing can quickly add up, and it certainly helps to know that you have the best Virginia mortgage rates to carry you through the next few decades.

If you’re considering refinancing, it’s equally as important to find great Virginia refinance rates to ensure that refinancing the loan is worth it over time.

Not only will a great rate make the loan more manageable over time, but purchasing or refinancing a home with lower mortgage rates in VA can help set borrowers up for financial success.

Best CD Rates in California for Good Credit (1-Month to 5-Year CDs)

Best CD Rates in Texas for Good-to-Great Credit

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image sources:

- https://www.virginia.gov/recreation/

- http://www.fico.com/en/blogs/wp-content/uploads/2015/08/April-2015-Average-FICO-Score.png

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.