Intro: Detailed Ranking & Review of Chicago Partners Wealth Advisors

Chicago Partners Wealth Advisors was recently ranked by AdvisoryHQ News as a top-rated financial advisory firm in Chicago for the fourth year in a row.

In the sections below, we provide a detailed overview, including the key factors that enabled this firm to be ranked as one of the top financial advisors in Chicago.

About AdvisoryHQ News

Searching for top independent investment advisory firms and providers can be a daunting undertaking for investors, high-net-worth individuals, and consumers, especially if such consumers are unfamiliar with the financial advisory landscape.

AdvisoryHQ is an online news media that is committed to simplifying the research that consumers conduct before choosing a top provider. Our review articles are always 100% independently researched and written.

For additional information on AdvisoryHQ’s methodologies, click here: AdvisoryHQ Methodologies. For information on AdvisoryHQ’s objectivity approach, click here: AdvisoryHQ’s Objective Process.

Overview of Chicago Partners Wealth Advisors

As an independent, fee-only RIA with a fiduciary commitment, Chicago Partners Wealth Advisors is one of the leading financial advisory firms in Chicago, managing more than $1.7 billion for ultra and high-net-worth individuals, foundations, institutions, and corporations.

Founded in 2008, Chicago Partners was co-founded by Jim Hagedorn and Anthony Halpin, both former portfolio managers at PricewaterhouseCoopers. Since then, the firm has experienced substantial growth, providing superior financial management services to over 550 clients across 30 states.

The firm also carries the distinction of being recognized as one of the FT 300: Top Registered Investment Advisers in the country from 2014-2017 by leading industry publication, Financial Times.

Built on the fiduciary relationship, Chicago Partners offers clients the full suite of financial services, including portfolio analysis and construction, investment management, tax planning and preparation, retirement, estate, education, insurance, and gift planning.

Backed by industry recognition, expert financial services, and an experienced management team, Chicago Partners is well-equipped to handle a variety of wealth management needs, earning the firm recognition as one of the top financial advisors in Chicago, Illinois.

Image Source: Chicago Partners Wealth Advisors

About the Founder, Jim Hagedorn, & Co-Founder Anthony Halpin

Jim Hagedorn, founder, and Anthony Halpin, co-founder, created Chicago Partners Wealth Advisors in 2009.

In the years prior, Hagedorn was a partner at The Mosaic Financial Group LLC and spent over five years as the practice leader in charge of PricewaterhouseCoopers investment advisory practice in Chicago and the Midwest.

His extensive experience includes over 12 years as a portfolio manager for three large global banking divisions, and has collectively spent over 20 years creating new, value-added multidisciplinary approaches to wealth management.

Similarly, Halpin also has experience working with both The Mosaic Financial Group LLC and PricewaterhouseCoopers as part of the investment team and a Senior Associate in the Personal Services Financial Group, respectively.

As a partner with Chicago Partners since 2011, Halpin brings over a decade’s worth of experience working with high net worth individuals, creating close and dynamic relationships.

Independent, Fee-Only Fiduciary

Part of what makes Chicago Partners Wealth Advisors such a notable financial advisor in Chicago is their dedication to maintaining independent, fee-only, and fiduciary commitments.

As an independent financial advisor, Chicago Partners is not tied to specific investment products, meaning that clients can benefit from a full range of products and services. Investment recommendations focus on things such as low-cost institutional class shares of mutual funds and other options that deliver the best results for clients, rather than those that best benefit the firm.

The fee-only structure at Chicago Partners Wealth Advisors serves the best interest of their clients because their advisors do not receive compensation for recommending certain investment products, like mutual funds or insurance policies.

Instead, the only form of compensation that the firm receives comes directly from their clients, encouraging unbiased advice and a focus on client success first and foremost.

Finally, Chicago Partners Wealth Advisors operates under the fiduciary standard of accountability, which is the highest standard of quality a financial advisor can meet. The fiduciary standard enforces and ensures complete transparency of compensation and demands that advisors always act in the best interests of their clients.

Not only can clients trust that all recommendations are made with their best interest in mind, but they also benefit from knowing exactly what they will pay, eliminating costly surprises down the road.

This is a great sign for any client looking to partner with an advisor in Chicago, as the fiduciary standard promotes both high levels of transparency and trust within the client-advisor relationship—two crucial factors in any successful financial planning or wealth management process.

Diverse, Experienced Team

With a large team of experienced advisors from an array of backgrounds, clients can trust that the advisors at Chicago Partners are well-equipped to handle a variety of complex financial situations.

With decades of experience within the financial industry, the team of advisors is split into three different groups: Investment Managers, Business Development, and Business Management.

Members of the Investment Management team include:

- Jim Hagedorn, Founder and Managing Partner—CFA

- Mark F. Toledo, Partner—CFA

- Anthony Halpin, Co-Founder and Partner—CPA

- John Nicholas, Partner—CAIA

- Mark Vaughn, Partner—CFA

- Mike O’Connor, Partner

- Todd Gambit, Director and Senior Advisor

- Matt Fischer, Senior Advisor

- Nicholas Guido, Senior Advisor

- Dan Toledo, Senior Advisor—CFP®

- Matt Grennell, Senior Advisor—J.D.

- Nicole Polanco, Associate Advisor

Members of the Business Development team include:

- Tom Reed, Managing Director

- James O’Gara, Managing Director

- Frank Aiello, Managing Director

Members of the Business Management team include:

- Jack Hagedorn, Marketing Director

- Bill Cummings, Operations Manager

- Teri Hagedorn, Executive Assistant

- Tom Monticello, Accounting Support

With nine senior investment professionals—and each bringing over 25 years of experience in the financial industry—clients can benefit from a strong, solid foundation of knowledge and expertise.

Financial Services Offered by Chicago Partners Wealth Advisors

For many clients, finding the best financial advisor means partnering with a firm that offers a diverse range of financial services.

This is a great way to ensure that a financial advisor can offer long-term value, providing a wide range of capabilities as the financial goals and needs of their clients fluctuate over time. Chicago Partners offers their clients a core set of financial services, called solutions:

- High Net Worth Advising

- Advising for Covered Persons

- Foundation & Institutional Advising

- Enhanced Corporate Cash Management

- Family Office Planning Services

With prior experience as in-house advisors for PricewaterhouseCoopers, the founders of Chicago Partners are uniquely positioned to help clients create compliance-friendly solutions if they are covered/restricted persons.

Based on this prior experience at PwC, the firm maintains a core competency in creating financial solutions for people with conflicts of interest, like auditing or ownership. The firm is particularly skilled at meeting compliance restrictions for:

- Big 4 executives and accounting professionals

- C-suite executives

- Lawyers

- Other designated covered/restricted persons

For clients that fit these characteristics, this core competency provides significant value, as many covered persons face challenges with policies that prohibit certain securities transactions.

Chicago Partners provides the knowledge, background, and experience to effectively navigate these challenges to create optimized, long-term investment plans, enhancing the firm’s overall value and expertise.

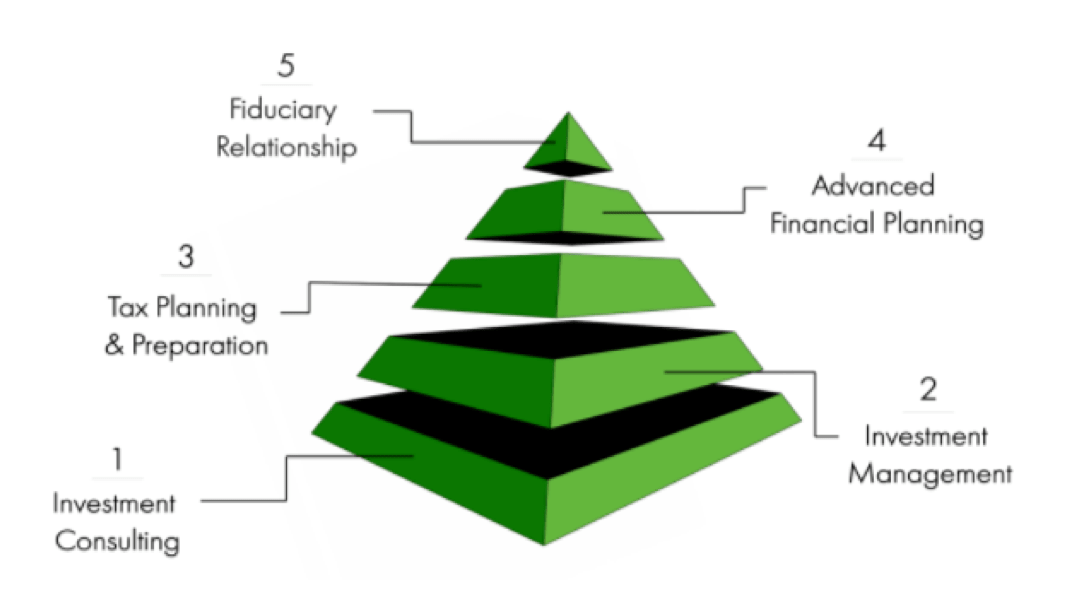

Chicago Partners’ 5-Step Wealth Optimization Process

As one of the top Chicago financial advisors, Chicago Partners offers clients a comprehensive 5-step process to wealth management and financial planning.

Each step of the 5-Step Wealth Optimization Process is tailored to create a personalized financial plan, addressing multiple dimensions of wealth for every client, detailed below.

1. Investment Consulting

Investment consulting, the first step of the wealth optimization process, focuses on understanding the client’s unique goals, risk preferences, and portfolio construction.

Integral to this step is the Portfolio X-Ray, which evaluates a portfolio’s existing strengths and weaknesses by examining the following components:

- Asset Allocation

- Taxable & Tax-Deferred Accounts

- Investment Vehicle Fees

- Advisor Fees

- Trading Costs

- Portfolio Turnover Rate

- Tax Costs

- Cash Drag

- Portfolio Yield

2. Investment Management

Investment Management, the second step in the wealth optimization process, focuses on building a diversified, efficient, and customized portfolio.

Based on the investor profile created in the first step, portfolios are created using 15 different asset classes, which include exclusive investment vehicles that often are not available to individual investors or competing firms.

To ensure that portfolios are built for long-term success, Chicago Partners will monitor fluctuations in the market and rebalance each portfolio as needed. Rebalancing is a crucial element of any successful portfolio, as this keeps investors aligned with their financial plans, regardless of how the market may perform.

Image source: Chicago Partners Wealth Advisors

3. Tax Planning & Preparation

The third piece of the wealth management process is Tax Planning and Preparation, a step which focuses on maximizing after-tax dollars through tax optimization. For Chicago Partners, creating a truly tax-efficient portfolio means:

- Tax Planning Strategies—Keeping portfolio turnover low, correctly allocating investments in the right accounts, and realizing gains at the right time to maximize their clients’ after-tax return

- Tax Loss Harvesting—Sells securities at a loss to offset taxes on income

- Tax Reporting—Chicago Partners helps each client consolidate their tax-sensitive investment documents before tax return season. Additionally, clients can work alongside accounting professionals to simplify their tax filing process

4. Advanced Financial Planning

Advanced Financial Planning provides clients with the tools they need to monitor and have plans for all financial aspects of their lives, including:

- Estate Planning—Addresses beneficiary designations, powers of attorney, wills, trusts, estate tax planning, and life insurance

- Retirement Planning – Creating cash flow plans and determining the proper time for RMDs, and when to change their asset allocation to plan for retirement

- Wealth Management Systems (eMoney)—This wealth planning tool provides real-time data on financial accounts through cash flow projections, spending and budgeting recommendations, account balances, and net worth

- Education Planning – Building high school or college funds for children or grandchildren that maximizes the efficiency of their wealth

- Philanthropy & Donor-Advised Funds—Helps clients create the optimal strategy for their charitable giving goals and maximize the tax benefits of these accounts

- Pledged Asset Line (PAL)— Credit line that allows clients to use the value of eligible assets to increase their buying power

- Mortgage Solution—Provides clients with exclusive personal service, expert advice, competitive rates, and a simplified mortgage process

5. Fiduciary Relationship

Clients have ongoing access to a Fiduciary Registered Investment Advisor (RIA) to ensure that they receive unbiased advice.

Based on the fiduciary standard of care, these advisors are legally obligated to uphold the highest standards of transparency, always acting in their client’s best interests and never selling financial products for commission or outside compensation.

Chicago Partners is also a member of The National Association of Personal Financial Advisors (NAPFA), the nation’s leading professional association of fee-only financial advisors.

As a part of NAPFA, all advisors must sign a fiduciary oath and subscribe to a strict code of ethics, which includes:

- Objectivity

- Confidentiality

- Competence

- Fairness & Suitability

- Integrity & Honesty

- Regulatory Compliance

- Full Disclosure

- Professionalism

Investment Accessibility

For new and seasoned investors alike, one of the advantages of working with Chicago Partners is the unique access they offer to their clients. For example, clients can invest in vehicles like Dimensional Fund Advisors.

This is often closed to other firms and individuals—but Chicago Partners has an established history of offering clients the opportunity to access funds not available to many other investors.

This is because the firm maintains relationships with exclusive firms and their funds— furthermore, this Chicago wealth management firm has comprehensive knowledge about each product, enabling them to act as experts.

Chicago Partners also purchases of institutional class shares of mutual funds for clients that wouldn’t otherwise be eligible for purchase by direct individual investors.

Lastly, for clients that are interested in alternative investments, RIA Biz reports that the firm also employs a great deal of alternative investing strategies, including master limited partnerships (MLP), real estate investment trusts (REITs), and similar hedge-fund-like strategies.

Additional Resources

Whether you are a seasoned investor or just starting out, the financial industry can be difficult and complicated to master. To make good financial health more accessible to investors, Chicago Partners offers the following resources:

- Movie Room—Collection of short videos that demonstrate how the firm plans, operates, and invests

- Wealth Blog—Short articles from CFPs and CFAs covering current financial theories, ideas, and knowledge

- Recommended Books—Access works from the firm’s favorite authors that provides comprehensive, practical, and applicable financial advice

- Questions to Ask Your Advisor—Provides a list of questions for potential clients and their advisors to discuss

Contact Information | Chicago Partners Wealth Advisors

Main Office

UBS Tower

1 N Upper Wacker Drive

Suite 4110

Chicago, IL 60606

Phone: (312) 767-2205

Email: [email protected]

Potential clients can also fill out a brief form with their contact information to have an advisor reach out to them with specific financial advice.

AdvisoryHQ’s Objective Standards & Our Personalized Page Service

This Chicago Partners Wealth Advisors review was independently conducted by AdvisoryHQ.

Our focus is on the everyday consumer. All of our research and publications are conducted from the end-user consumer’s perspective, and we publish our top-ranking reviews for anyone to view for free.

Both ranked and non-ranked firms can also request to have a separate personalized profile, like the one above, which incurs a charge.

For additional information on AdvisoryHQ’s methodologies, click here: AdvisoryHQ Methodologies. For information on AdvisoryHQ’s objectivity approach, click here: AdvisoryHQ’s Objective Process.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.