How to Get the Best Mortgage Rates Today in Illinois for Conventional, Jumbo, VA, and ARM Loans

Current Mortgage Rates in IL Good, Fair, Great, and Excellent Credit Scores

Are you in the market to buy a new house in the state of Illinois? Or do you already have a mortgage, and are seeking refinance rates in Illinois?

Refinancing a mortgage loan, or purchasing a new home in Chicago, Aurora, Rockford, Joliet, Naperville, Springfield, or any other city in Illinois will be one of the most important purchases you will ever make. Not surprisingly, it also tends to be one of the most expensive.

Depending on the type of Illinois home loan you are seeking (10-year, 15-year, 30-year, 5/1 ARM, 7/1 ARM, jumbo loan, etc.), taking the time to find the best Illinois mortgage rates, before you commit to a long-term mortgage loan, is key to saving money in the long run.

Most importantly, performing your research, and comparing IL mortgage rates between Illinois mortgage lenders is an essential task because Illinois mortgage rates today are constantly changing.

Mortgage Refinance Calculator – Calculate Your Refinancing Options Today

Which Illinois City are You Located in?

Most mortgage lenders in Chicago, Aurora, Naperville, Springfield, Rockford, Joliet, Peoria, Elgin, and other IL cities require a down payment of around 20%. Below is a list of some of the largest cities in Illinois.

| Name | Population |

| Chicago | 2,695,598 |

| Aurora | 197,899 |

| Rockford | 152,871 |

| Joliet | 147,433 |

| Naperville | 141,853 |

| Springfield | 116,250 |

| Peoria | 115,007 |

| Elgin | 108,188 |

| Waukegan | 89,078 |

| Cicero | 83,891 |

| Champaign | 81,055 |

| Bloomington | 76,610 |

| Decatur | 76,122 |

| Arlington Heights | 75,101 |

| Evanston | 74,486 |

| Schaumburg | 74,227 |

| Bolingbrook | 73,366 |

| Palatine | 68,557 |

| Skokie | 64,784 |

| Des Plaines | 58,364 |

| Orland Park | 56,767 |

| Tinley Park | 56,703 |

| Oak Lawn | 56,690 |

| Berwyn | 56,657 |

| Mount Prospect | 54,167 |

| Wheaton | 52,894 |

| Normal | 52,497 |

| Hoffman Estates | 51,895 |

| Oak Park | 51,878 |

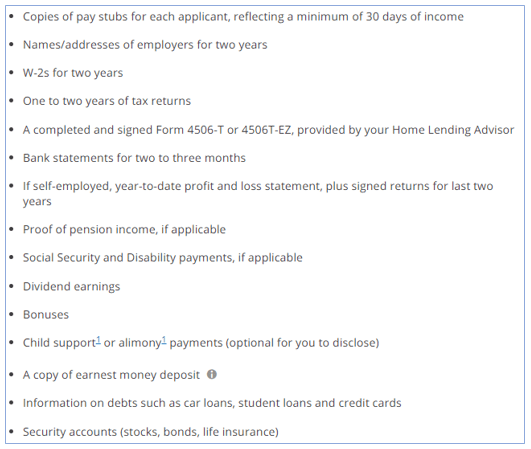

Financial Documentation for a Mortgage Loan Application in Illinois

According to Chase bank, below are the most important home loan documentation that should be prepared along with your loan application for an IL mortgage loan.

Personal Loan Rates | Interested in a Personal Loan?

Mortgage Loan Types in Illinois

Lenders that provide mortgage loans in Illinois provide a wide range of conventional and adjustable-rate loan types, including:

- 10-year mortgage loans

- 15-year mortgage loans

- 20-year mortgage loans

- 30-year mortgage loans

- 7/1 ARM

- 5/1 ARM

- 3/1 ARM

- Jumbo loans

- VA loans

Credit Card Calculator | Trying to Pay off a Credit Card?

Conclusion – Finding the Best Mortgage Lenders in Illinois

Some key questions to consider:

- Which banks provide the best mortgage rates in Illinois?

- Will today’s mortgage rates in Chicago go up by tomorrow or next week?

- Which are the best mortgage lenders in Illinois to get a loan from for a property in Chicago, Rockford, Aurora, Joliet, Peoria, Elgin, Waukegan, Cicero, Champaign, Bloomington, Decatur, Arlington Heights, Evanston, Schaumburg, Bolingbrook, and other regions in Illinois?

These are all important questions to ask yourself when you begin your search for the best and current mortgage rates in IL. You can start out by making a list of what you would like to get out of a mortgage loan.

Are you more interested in a loan with a lower rate? Or are you searching for a lender with the quickest processing time? Also, what type of Illinois home loan are you seeking? 10-year mortgage? 15-year mortgage? 30-year conventional? 5/1 ARM, 7/1 ARM, or a jumbo loan? Once you’ve assessed your own needs, you can easily match these mortgages buying needs with the Illinois mortgage lender that best matches what you want.

Lastly, choosing the best mortgage lenders and rates in Illinois is about more than special deals or offers; it’s also about looking for a financial institution that you can see yourself partnering with well into the future.

For example, a top Chicago bank or home lender can be differentiated from other banks in Illinois in many ways, including the fees they charge customers, the services they provide, the type of customers they serve, how competitive their rates are, and the quality of service they consistently deliver.

Calculate Your Budget Payments | Budget Calculator Tool

Wedding Loan Comparison | The Best Wedding Loans Today

Illinois Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Table Source:

https://en.wikipedia.org/wiki/List_of_municipalities_in_Illinois

Image Source:

https://www.chase.com/personal/mortgage/home-mortgage/financing-home/application-documents

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.