Getting the Best Mortgages for First Time Home Buyers in North Dakota

Buying a house in North Dakota can be an incredibly exciting time. For ND first time home buyers, it’s a purchase that marks financial stability, growth, and even creating future equity.

As a first time home buyer in North Dakota, you’re likely to have tons of questions about the process, including:

- How much home can a first time home buyer in ND afford?

- What kind of mortgage rates are available for ND first time home buyers?

- Can ND first time home buyers with bad credit still get a mortgage?

In the sections below, we’ll help you determine how much home you can afford and provide tips for ND first time home buyers with poor credit.

First Time Home Buyers in Alaska | Best Mortgage Rates for Alaska First Time Home Buyers

First Time Home Buyers in New Mexico | Best Loans for New Mexico 1st Time Home Buyers

How Much House can a First Time Home Buyer in North Dakota Afford?

For first time home buyers in ND, affordability is much more complicated than simply finding out how large of a mortgage you can get approved for.

ND first time home buyers will also have to take into consideration additional affordability factors, like the closing costs of purchasing a home, monthly budget, and debt-to-income ratio.

Visit any of the North Dakota first time home buyer calculators below to analyze factors like location, household income, down payment, and monthly debt.

First Time Home Buyers in South Dakota | Best Loans for South Dakota First Time Home Buyers

First Time Home Buyers in Nevada | Best Rates & Programs for Nevada First Time Home Buyers

Tips for ND First Time Home Buyers with Bad Credit

One of the biggest considerations for lenders is a borrower’s credit score, which acts as a marker for reliability and trustworthiness.

Many young first time home buyers in North Dakota find themselves with less than ideal credit, which can certainly be a source of stress when starting the mortgage process.

Luckily, it is still possible for ND first time home buyers with bad credit to get a loan, even if their credit score needs some work.

Mortgage lenders will typically offer a few different options for first time home buyers in ND with low credit scores, including:

Larger Down Payments

As a first time home buyer in ND with a lower credit score, making a larger down payment can be a great way to show mortgage lenders that you are a reliable, trustworthy borrower.

With more money invested in the home, mortgage lenders will consider ND first time home buyers to be less risky investments.

Accept a Higher Interest Rate

Even if you have to take a higher interest rate, as a first time home buyer in North Dakota, you can always build up your credit score and refinance your mortgage after a few years.

Of course, there is no guarantee that rates will be lower once you’re ready, but refinancing is certainly an option for a North Dakota first time home buyer with bad credit.

Get a Co-Signer

First time home buyers in ND may be able to get better rates—despite their credit score—by getting a co-signer to endorse their mortgage.

This way, the bank can issue a North Dakota first time home buyer loan and know that they at least have another source of income, should the borrower default on their loan.

First Time Home Buyers in Idaho | Best Rates & Programs for Idaho First Time Home Buyers

First Time Home Buyers in Arkansas | Best Loans for Arkansas First Time Home Buyers

Conclusion – Getting the Best Mortgage as a First Time Home Buyer in North Dakota

Once you know what type of mortgage for a first time home buyer in ND you need, your next step is to start evaluating lenders to find the best rates and terms.

Just as with any other shopping experience, it’s important to weigh your options and compare multiple offers for North Dakota first time home buyer loans to ensure that you are getting the best deal possible.

Affordable and manageable mortgages for first time home buyers in ND are determined not just by monthly payments, but also by interest rates and mortgage terms.

As such, don’t be afraid to shop around until you find the best North Dakota first time home buyer loan for your financial needs.

First Time Home Buyers in Hawaii | Best Rates & Programs for Hawaii First Time Home Buyers

Current Mortgage Rates in Utah | Best Utah Mortgage Rates for Good-Excellent Credit

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

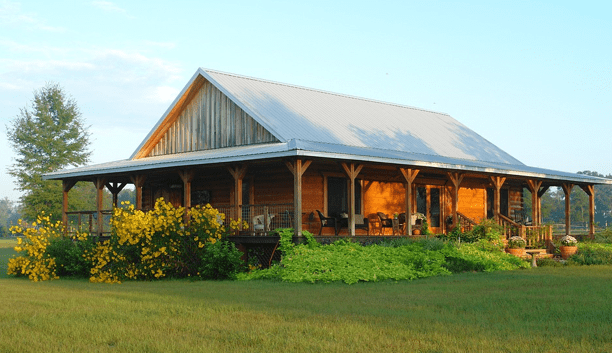

Image source:

https://pixabay.com/en/log-home-farm-home-log-wooden-old-2760175/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.