Intro: Review & Ranking of Janiczek® Wealth Management

Janiczek® Wealth Management has been reviewed by AdvisoryHQ News and was ranked as one of the top financial advisory and wealth management firms in Denver, Colorado (and in the nation) five years in a row.

In the sections below, we provide a detailed overview, including some of the key factors that enabled Janiczek® Wealth Management to rank as a top 2017 wealth management firm and financial advisor in Denver, Colorado.

Financial advisors and wealth management firms on our top rated lists are selected after they have successfully passed AdvisoryHQ’s ground-breaking “Top-Down Advisor Selection Methodology” that is based on a wide range of filters, including fiduciary duty, independence, transparency, level of customized service, history of innovation, fee structure, quality of services provided, team excellence, and wealth of experience.

About AdvisoryHQ News

Searching for top rated financial firms and services can be a daunting undertaking, especially if you are unfamiliar with the landscape. AdvisoryHQ is committed to simplifying the research that consumers conduct before choosing a top financial advisor or product.

Our goal is to give consumers, investors, high-net-worth individuals, and business owners exactly the information they need, without any hype or jargon. This allows them to make their own decisions effectively.

AdvisoryHQ’s reviews and rankings are always 100% independently researched and written.

Overview of Janiczek® Wealth Management

Janiczek® Wealth Management is a Denver-based wealth management firm that has been advising high-net-worth and ultra-high-net-worth clients for over 25 years.

Although headquartered in Denver, Janiczek® Wealth Management works with clients across the U.S. and the world, but with a particular concentration in the high- and ultra-high-net-worth investor segments in the Rocky Mountain region.

The firm traces its roots to Chicago, Illinois, where its founder, Joseph Janiczek, saw firsthand how the contrast between those extremely resourceful and successful stewards of wealth compared to those who depleted wealth and/or were overcome by fear, complexity, greed, or some other weakness that negatively impacted their results, family and/or life.

Deeply moved by how the biases of the conventional financial industry (commissions, sales quotas, high expense ratios, poor value-add, poor advocacy) in combination with the less than optimal skills and approaches offered to the typical high-net-worth investor during a life-changing liquidity event (such as selling a business, receiving a substantial inheritance, etc.), Mr. Janiczek set out to make a difference by launching Janiczek® Wealth Management.

Joseph Janiczek

The firm’s goal back then, as it continues to be to this day, was to help clients preserve, protect, and grow their wealth through a partnership with an impartial financial advisor in Colorado. Janiczek puts it like this: “to unleash people from the complexity of wealth so they can soar with their good fortune.”

Being independent offers the firm and its team of highly experienced advisors a unique opportunity to provide clients with a broad array of wealth and investment management solutions.

Review and Selection Highlights | Janiczek® Wealth Management Review

Below are some key selection factors that enabled Janiczek® Wealth Management to be ranked a 2017 top-rated Colorado wealth management and financial planning firm.

Highly Specialized Services:

Janiczek® Wealth Management specializes in serving a niche client group: high-net-worth (portfolios of $2- to $20-million) and ultra-high-net-worth (portfolios $20-million+) individuals and families. As such, the firm’s team of advisors has developed expert insight to the needs of clients in this particular niche. This includes a specialty in life-changing liquidity events and multi-generational wealth issues/solutions.

Independent Services:

Janiczek® Wealth Management serves its clients as an independent wealth management firm by offering “whole market” financial and wealth management solutions. Tremendous academic research, some authored by Nobel Prize winning experts, is solidly behind the Evidence Based Investing process.

From index investing to seeking out premiums above index returns where reliable evidence illustrates sizeable opportunities to enhanced performance, the firm’s approach can be characterized best as “fishing with a net for a school of desirable fish” instead of the prevalent and expensive single-line fishing attempted by so many, but with poor statistical results behind the approach.

Fee-Only Advisory Solutions:

As a fee-only advisory firm, Janiczek® Wealth Management does not sell any financial products for a commission or other form of incentive by others.

All of its revenue comes from delivering independent, personalized, and unbiased advice and solutions to its clients. This structure ensures that Janiczek® Wealth Management is free to choose the type of investment vehicles that will best suit its clients’ needs, without any conflicts of interest.

Here is what the firm has to say about its approach:

Image Source: Janiczek® Wealth Management

Here is some additional information on financial advisory firms that have a fee-only structure: Fee-only financial advisors do not accept any commission for recommending a product or service that is provided by a bank, broker dealer, investment firm, mutual fund, insurance company, or from any other source other than the fees they receive from you, the client.

Being that the sole compensation for fee-only financial advisors, financial planners, and asset managers comes directly from clients, their only loyalty is to clients and making sure the advice provided is the best for each client’s unique financial situation.

Fiduciaries to Its Clients:

Janiczek® serves its clients on a fiduciary basis. This means that the firm’s advisory team is legally and professionally bound to put its clients’ best interests above all other interests.

The result: clients receive unbiased, conflict-of-interest-free advice.

Proprietary Approach:

Through many years of serving clients as a top-ranking financial advisor in Colorado, the Janiczek® team has developed and perfected its approach to serving high-net-worth and ultra-high-net-worth clients in protecting and growing their wealth.

Image Source: Janiczek® Wealth Management

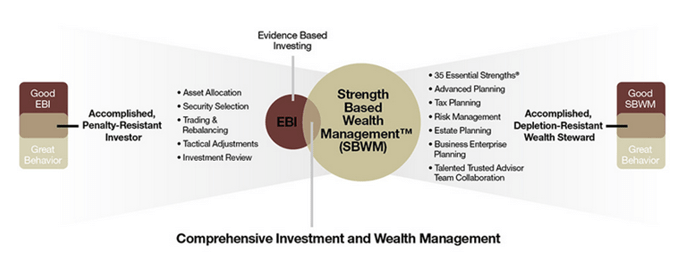

The company’s proprietary methodology is based on one patented discipline – Evidence Based Investing (EBI) and Strength Based Wealth Management (SBWM) – which no other Colorado financial advisor follows.

Using these tried and tested approaches helps the firm’s advisors make informed investment decisions that remove the emotions and hype around the entire investment process.

Image Source: Janiczek® Wealth Management

The History & Story Behind Janiczek® Wealth Management

Today, Janiczek® Wealth Management is a recognized exclusive wealth management firms for ultra/high-net-worth individuals, but to provide additional information on the firm’s driving factors, we need to go all the way back to the early 1980s, to the city of Chicago, IL.

It was during the 80s in Chicago that young Joseph Janiczek watched with fascination as his relative’s restaurant franchise business grew rapidly across the city.

When his relative finally sold the business, it was seen as the perfect American dream come true. After many years of consistent hard work, things had finally paid off.

Now, his relative and extended family members could enjoy the rest of their lives enjoying the epiphany of the American dream.

But that didn’t happen…

… two years later, the wealth was gone. Poor money management had wiped out his relative’s massive wealth in an extremely short amount of time. It was a shocking experience for Joseph, and he kept asking himself, “How could this have happened? What went wrong? How could this be?” All the many years of hard work and serving their family-owned business should have created wealth that would serve the family for the rest of their lives.

It was a stunning lesson that stayed with Joseph, especially after he realized that it wasn’t just his relative who had suffered the consequences of poor wealth management.

It was happening to others across the U.S. and around the world. In March of 1989, he launched Janiczek® & Company, Ltd. with a goal of “helping to protect wealth for those who created it, but more importantly, to make it grow and serve them.”

Janiczek® is a wealth management firm that exclusively specializes in serving high-net-worth individuals (those with up to $15 million worth of assets) and ultra-high-net worth individuals (those with $15 million+ in assets).

What makes the firm unique from other exclusive wealth managers is that, in addition to being a top ranking wealth advisor, Janiczek® & Co. is also a market leader in the “life-changing liquidity event” specialty niche within the high/ultra-high-net-worth wealth management segment.

A life-changing liquidity event within the ultra-rich space is a situation where a high/ultra-high-net-worth individual or family is experiencing, has experienced, or will soon experience a life-changing liquidity event (such as selling a high-valued business or property, exercising stock options, transitioning to retirement, receiving an inheritance, or any other substantial lump sum transaction or settlement).

Such individuals find themselves needing a special type of wealth management firm. One that knows how to manage the unique investment, tax, estate, retirement, and other advanced planning that is associated with life-changing liquidity events.

Janiczek® Wealth Management Contact & Key Team Info

Readers can contact Janiczek® Wealth Management via the contact information below.

To contact AdvisoryHQ News directly about Janiczek® Wealth Management, see the “Contact AdvisoryHQ News” section below.

Key Janiczek® Wealth Management Team Members

- Joseph J. Janiczek, MSFS, ChFC | Founder & CEO

- James B. Callahan, CFA | Managing Director of Investments & Chief Investment Officer

- R. Brady Siegrist, CFP® | Managing Director, Wealth Management

- Pamela S. Dorn | Manager, Client Operations

- Kyle Kersting, CFA | Director, Investments

- Brian O’Neil, CFP® | Director of Wealth Management

Click below for the firm’s full and most updated team member/staffing information:

http://janiczek.com/who-we-are/

Janiczek® Wealth Management Contact Information

Janiczek® Wealth Management Disclosure

Please see below for Janiczek®’s corporate disclosure. Financial advisors and investment management firms often disclose important disclosures like the one below on their website.

Here is where you can find the full disclosure on Janiczek®’s website: Important Disclosure.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Janiczek & Company, Ltd.), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Janiczek & Company, Ltd. Please remember to contact Janiczek & Company, Ltd, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Janiczek & Company, Ltd., is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Janiczek & Company, Ltd.’s current written disclosure statement discussing our advisory services and fees continues to remain available upon request.

Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if Janiczek & Company, Ltd. is engaged, or continues to be engaged, to provide investment advisory services, nor should it be construed as a current or past endorsement of Janiczek & Company, Ltd. by any of its clients. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser.

Sources: Barron’s March 2016, 2015, 2014 AdvisoryHQ March 2016 Financial Times June 2015 Five Star Professional November 2015, 2013, 2012,2011, 2010, 2009 Mutual Funds Magazine January 2001 NABCAP September 2010, 2011, 2013 Worth Magazine July 2002, January 2004, October 2004, October 2008 Wealth & Finance International, October 2014

Contact AdvisoryHQ News

If you have questions, comments, or tips about this Janiczek® Wealth Management review publication, kindly send us an email by clicking below:

AdvisoryHQ’s Objective Standards & Our Personalized Page Service

This Janiczek® Wealth Management review was independently conducted by AdvisoryHQ. Firms do not pay for their ranking. In fact, most firms do not even realize that they are being reviewed and ranked by AdvisoryHQ until after our ranking publication has been completed and made public.

Our focus is on the everyday consumer. All of our research and publications are conducted from the end-user consumer’s perspective, and we publish our top ranking reviews for anyone to view for free.

However, after we’ve published our top ranking publications to the general public, firms can request to have a separate personalized profile, like the one above, which incurs a charge. Click here for more information on AdvisoryHQ’s Personalized Page service.

Click below for information on AdvisoryHQ’s objective and independent standards:

AdvisoryHQ’s Objective & Independent Approach

__________________

Copyright © 2017 AdvisoryHQ News