Intro: Detailed Ranking & Review of Rowling & Associates

Rowling & Associates was recently ranked by AdvisoryHQ News for the fourth year in a row as a top-rated wealth management firm in San Diego, California.

In the sections below, we provide a detailed overview, including the key factors that enabled this firm to be ranked as one of the top financial advisory firms in San Diego.

About AdvisoryHQ News

Searching for top independent investment advisory firms and providers can be a daunting undertaking for investors, high-net-worth individuals, and consumers, especially if such consumers are unfamiliar with the financial advisory landscape.

AdvisoryHQ is an online news media that is committed to simplifying the research that consumers conduct before choosing a top provider. Our review articles are always 100% independently researched and written.

For additional information on AdvisoryHQ’s methodologies, click here: AdvisoryHQ Methodologies.

Overview of Rowling & Associates

Rowling & Associates is an independent, fee-only San Diego financial advisor that specializes in investment management, tax planning, and financial planning services.

Whether a client is exploring sustainable investing or creating a customized retirement plan, Rowling & Associates aims to consistently provide understandable, applicable, and unique financial advice that can easily be applied to any personal situation.

The firm employs a team of dedicated and experienced financial planners and accountants to help their clients attain comprehensive, effective, and successful wealth management.

With a wide range of expert financial services, a fee-only structure, and unique expertise in tax planning, Rowling & Associates stands ready to address a variety of financial challenges, earning the firm as one of the best financial advisors in San Diego.

Image courtesy of: Rowling & Associates

About the Principal & Owner, Sheryl Rowling

A well-recognized and highly esteemed advisor, Sheryl Rowling has been committed to providing fee-only tax and financial planning advice since 1979. Sheryl also created, co-founded and later sold her proprietary trading software, Total Rebalance Expert, to the independent investment research giant, Morningstar, Inc.

She carries both the Certified Public Accountant (CPA) and Personal Financial Specialist (PFS) designations, allowing her to work closely with clients to establish positive relationships and ensure that a variety of long-term financial goals are met.

As an active industry expert, Sheryl is often sought-after for local and national publications, and regularly writes financial columns for InvestmentNews, San Diego Jewish World, Morningstar, and Advisors4Advisors. In 2006, CCH published Sheryl’s book, Tax and Wealth Strategies for Family Businesses. In 2017, Sheryl and her team wrote a book that provides critical advice and guidance people need, tailored to their specific stage in life; the book is titled, Your Financial Travel Guide To Life: 30 Years on the Road with Rowling & Associates.

Sheryl maintains memberships in a number of key industry associations, including:

- American Institute of Certified Public Accountants (AICPA)

- Financial Planning Association (FPA)

- California Society of Certified Public Accountants

- National Association of Personal Financial Advisors (NAPFA)

- All-Star Financial Group

Image courtesy of: Rowling & Associates

In the sections below, we have outlined a few notable features to summarize the services, approach, expertise, and unique value offered to clients by Rowling & Associates.

Fee-Only Fiduciary

Investment management and financial planning services offered by Rowling & Associates are provided strictly on a fee-only basis.

This means that clients can trust that their advisor truly has their best interests in mind, as neither the firm nor its advisors receive additional compensation or commissions from selling financial products.

Not only does this significantly decrease conflicts of interest, but it also encourages transparency, ultimately supporting trust within the client-advisor relationship.

Financial planning services are offered through a fixed fee, determined by complexity, while investment management services are billed based on a percentage of assets under management. Tax preparation services are also offered and billed as a separate fee. Potential clients can easily find details on these rates through the firm’s ADV, supporting a client-facing commitment to transparency.

Rowling & Associates is also a member of The National Association of Personal Financial Advisors (NAPFA), the nation’s leading professional association of fee-only financial advisors.

As a part of NAPFA, all advisors must sign a fiduciary oath and subscribe to a strict code of ethics, which includes:

- Objectivity

- Confidentiality

- Competence

- Fairness & Suitability

- Integrity & Honesty

- Regulatory Compliance

- Full Disclosure

- Professionalism

Value-Driven Financial Services

As a top financial advisor in San Diego, Rowling & Associates maintains a core mission “to provide clients [with] financial security through sound advice and a commitment to exceptional service.”

To fulfill this mission, the firm maintains a set of foundational values, including:

- Knowledge—Continuous education and experience provides invaluable knowledge, skills, and experience. All service and advice are based on facts, perspectives, and concrete information.

- Integrity—All actions are motivated by truthfulness and honesty.

- Trust—Rowling & Associates strives to create and sustain trust with clients and amongst all team members.

- Teamwork—The firm acts as one, cohesive team, with all members actively engaged in cooperation and sharing ideas, information, and opinions.

- Accountability—As trusted individual advisors and as a firm, Rowling & Associates accepts responsibility for all actions and decisions.

- Respect—The diverse cultures, races, languages, and backgrounds of team members and clients are respected equally.

Not only do these values foster an effective and supportive company culture, but they also create a welcoming, supportive, and trustworthy atmosphere for clients, setting both clients and advisors up for long-term success.

Talented Advisory Team at Rowling & Associates

For clients that need investment management, tax planning services, and comprehensive financial planning, Rowling & Associates is a great fit. With a team that includes a Personal Financial Specialist, and multiple CERTIFIED FINANCIAL PLANNER™ and Certified Public Accountant designations, the advisors at Rowling & Associates are well-prepared to tackle a variety of financial challenges. This team includes:

- Sheryl L. Rowling, CPA/PFS—Principal

- Steve Doster, CFP®—Financial Planning Manager

- Tara Weisinger, CPA—Tax Manager

- Lorenzo Sanchez, CFP®—Financial Planner

- Juan Aguilar—Financial Planning Associate

- Shalmali Kulkarni—Financial Planning Associate

- Nick Geraci—Accounting Associate

- Joshua Clavell—Operations Manager

- Sanda Ljubovic—Client Service Manager

- Jeff Ortega—Client Service Administrator

- Sylvia Fitzgerald—Office Manager

- Melvin Miller—Accounting Manager & Assistant Compliance Officer

- Erika Fettner—Executive Assistant

With a wide range of professional experience, CFP® and CPA candidacies, and multiple MBAs and bachelor’s degrees, the team at Rowling & Associates demonstrates a clear commitment to ongoing industry education, supporting the firm’s core values.

Image courtesy of: Rowling & Associates

Tax Planning Advantage at Rowling & Associates

Having a team of CPAs and financial planners at their disposal, clients can benefit from a wealth of knowledge when it comes to intricate tax matters. Rowling & Associates incorporates tax planning as a natural element of retirement planning and investment management.

As a part of tax planning, the CPAs at Rowling & Associate will review both your current financial situation and your tax return to:

- Ensure that your tax withholding has been appropriately calculated

- Evaluate whether contributing to a donor advised fund could maximize both tax deductions and charitable giving goals

- Determine whether a charitable remainder trust could significantly reduce tax liabilities for future life events

- Create a plan to strategically utilize employer stock options to minimize taxes

Through both year-end and long-range tax planning, clients can avoid unnecessary taxes and significantly improve their overall financial health. Individual tax planning opportunities include:

- Year-end planning to lower taxes

- Roth conversion analysis

- Retirement plan options

- Taking advantage of tax law changes

- Fringe benefit planning

- Choosing the most tax-efficient business entity

- Coordinating transactions to save money and taxes

- Structuring quarterly estimated tax payments

This wide range of tax planning expertise makes Rowling & Associates a great option for clients that want to streamline financial management and tax challenges by working with the same San Diego financial advisor for multiple facets of their financial health.

Flexible Investment Management Options

Successful wealth management comes down to tailoring a portfolio that suits the unique preferences, goals, and financial health of each client. This also includes factors like age, risk tolerance, income tax bracket, and required rate of return.

To meet the varied needs and preferences of their clients, Rowling & Associates provides two options beneath the umbrella of investment management: Intricity and Wealth Management services, detailed below.

Rowling & Associates Intricity Fees

Intricity combines professional guidance with a “do-it-yourself” mentality for one flat, monthly fee. Ideal for young professionals or for those who simply prefer to maintain independence in their financial health, the Intricity program comes with:

- An annual review to update your financial plan and rebalance your portfolio

- One free, basic tax return

- Access to a team of San Diego financial planners

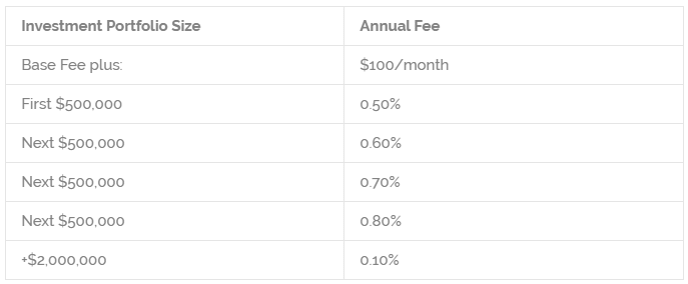

With Intricity, Rowing & Associates will make annual investment recommendations, but clients are ultimately responsible for implementing the recommendations to their respective portfolio. Fees for Intricity use a monthly base fee plus a percentage of assets, as shown in the table below.

Rowling & Associates Intricity Fee Structure

Image courtesy of: Rowling & Associates

Rowling & Associates Wealth Management Fees

For clients that prefer a more in-depth process, Wealth Management services at Rowling & Associates provide fully managed portfolios utilizing Sheryl’s proprietary trading software (Total Rebalance Expert). Rowling & Associate’s Wealth Management service is ideal for professionals, business owners, retirees or executives. Services included within portfolio management put tax efficiency at the forefront, and include:

- Location Optimization—Specific asset classes are placed in accounts to take advantage of preferential tax treatment

- Tax-Loss Harvesting—The strategic use of market down turns to offset investment losses with future gains, thereby minimizing (or eliminating) capital gains taxes

- Capital Gain Minimalization—High cost lots are sold to limit capital gains

- Capital Gain Distribution Avoidance—Strategic mutual fund movements help avoid taxable capital gains

Along with expert, ongoing portfolio management, Rowling & Associates will help clients decide whether a Roth conversion is appropriate, how to create a charitable remainder trust, the best ways to save for college, how to organize an estate plan, and more.

For investors seeking an alternative approach to traditional investing, the firm also provides Sustainable Investing, which values companies based on their Environmental, Social, and Governmental characteristics (ESG).

As opposed to Socially Responsible Investing, this approach utilizes analysis and documented standards to identify and align economic value with sustainable investments.

Financial Planning at Rowling & Associates

For Rowling & Associates, the first step towards creating a successful financial plan is articulating and prioritizing your long-term financial goals. Because financial planning encompasses a wide range of approaches and aspects, these may include:

- Retiring early

- Starting a business

- Staying in your local home

- Moving to another part of the country or the world

- Remodeling your home

- Saving for a child or grandchild’s tuition

- Traveling overseas

Once your financial goals have been established and prioritized, the advisors at Rowling & Associates can create a financial plan that covers:

- Retirement Planning—Focuses on the most important goals while considering inflation, investment returns, personal cash flow, tax rates, and more

- College Funding—The team will explain, recommend, and create a savings schedule for a 529 Plan

- Estate Planning—While the firm cannot create documents for you, they will refer you to a trusted attorney and help you identify what documents you will need in relation to the rest of your financial plan

- Life Insurance Needs—This service helps you identify the type of insurance you will need, and connects you with low-cost, independent insurance brokers

For those that are unsure about what their financial planning needs may be, Rowling & Associates also offers a book to help people improve their financial literacy and feel empowered in making smart financial decisions.

Accessibility & Approachability

One of the most stand-out features of Rowling & Associates is the way that the firm’s personality and dedication to client service is communicated. While the financial industry may not traditionally be energetic or engaging, clients will find an overall refreshing and welcoming atmosphere at Rowling & Associates.

Their website is bright, engaging, and easy to navigate, making the firm stand out among competing San Diego financial advisors as a welcoming and personable option.

Even the bios for individual staff members are creative, professional and approachable, allowing potential clients to get to know their advisors on both a professional and personal level before even stepping foot into the office.

This also includes the straightforward manner in which financial services themselves are described, which helps demystify the financial management process and makes the prospect of partnering with a financial planner into a much more approachable experience.

Rowling & Associates Contact Information

8889 Rio San Diego Drive

Suite 202

San Diego, CA 92108

Phone: 619-295-0200

Fax: 619-295-0210

Email: [email protected]

You can also fill out a brief online comment form with your contact information to get in touch with Rowling & Associates, ask questions, or to schedule a consultation.

Social Media Links:

AdvisoryHQ’s Objective Standards & Our Personalized Page Service

This Rowling & Associates review was independently conducted by AdvisoryHQ.

Our focus is on the everyday consumer. All of our research and publications are conducted from the end-user consumer’s perspective, and we publish our top-ranking reviews for anyone to view for free.

Both ranked and non-ranked firms can also request to have a separate personalized profile, like the one above, which incurs a charge.

For additional information on AdvisoryHQ’s methodologies, click here: AdvisoryHQ Methodologies. For information on AdvisoryHQ’s objectivity approach, click here: AdvisoryHQ’s Objective Process.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.