TOP 3 BEST BUDGETING SOFTWARE: FREE & PAID

Ranking | Finding the Best Budgeting Apps & Software

Where does your money go each day, each month or even each year? Where are you spending the most money? What are you spending on that you could do without? What about your retirement? Savings? Budgeting? Investments? Portfolio? Family spending?

These are all essential questions many of us ask ourselves each day, and one of the best ways to uncover the answers is through the use of a budgeting software.

Identifying the best budgeting, and money management software based on which platform you use the most (PC, mobile, Mac, tablet, online, etc.) can be a daunting undertaking, especially due to the sheer number of finance-related software that is available today.

Top 3 Budgeting Software for All Platforms (Desktop, Laptop, Mobile, and Tablet)

Below is 2019’s best ranked money management and budgeting software tools, including two award-winning budget applications which are free for you to use.

When you’re on top of your money with a balanced budget, life is good, and these selected budgeting tools can be used in all aspects of your budgeting, financial planning, money management, and transaction tracking.

Some of these software even allow you to see a 360-complete view of your entire financial life in real time (money coming in, money going out, expenses that are coming due, your assets, and many more). It’s like having your own personal financial manager.

360-View of Your Finances

Best 3 Budgeting Software

# | Top Budget Software | Free or Paid? |

1 | Personal Capital Money Management Software | Free |

2 | Mint | Free |

3 | Quicken | Paid |

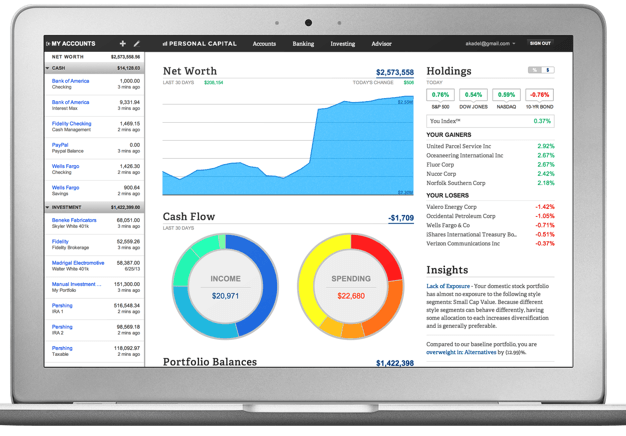

Top Ranked #1: Personal Capital Money Management Software (Free)

Personal Capital’s free personal finance budgeting software is gearing up to be one of the most powerful budgeting, and money management software that is revolutionizing how consumers manage their money today.

Founded in 2009 by Bill Harris (previous CEO of PayPal), the software was designed to be a highly advanced software for budgeting and money management for all devices and platforms (online, desktop, laptop, iPhone, Mac, Samsung, Android, Windows, iPad, tablets, BlackBerry, Nokia, etc.).

Best of all, it is free to AdvisoryHQ readers.

Key Factors Why This App is Ranked so Highly

Comprehensive Money Management & Budgeting Capabilities

The free Personal Capital software allows you to easily manage your entire financial situation – so you can reach your goals faster. From budgeting and wealth creation to planning for your retirement future, it makes managing your money a snap – directly from one secure (more on this later) platform.

Use Personal Capital’s software to develop your long-term financial goals – calculate your net worth, set a budget, and plan for retirement. This top budget software puts you in the driver’s seat of your financial future.

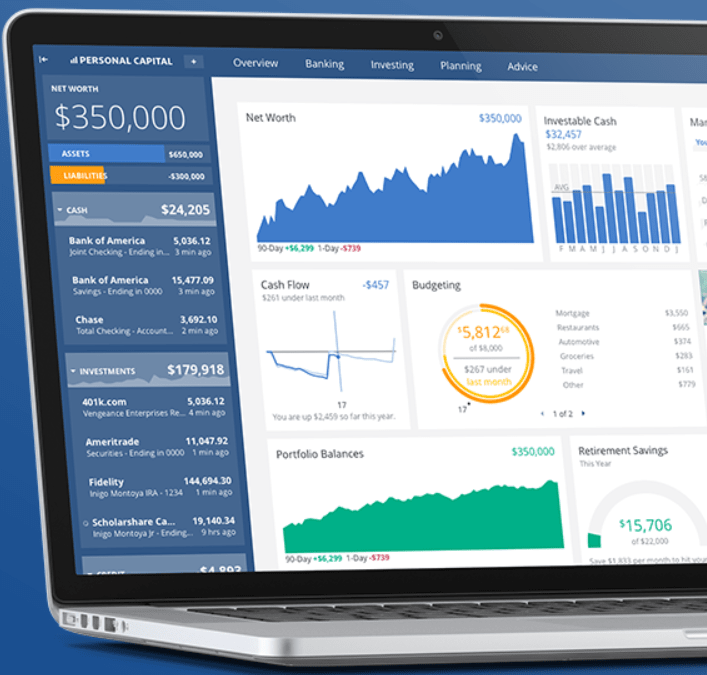

When you register for Personal Capital, you’ll have free access to these powerful wealth tools plus their award-winning budgeting dashboard.

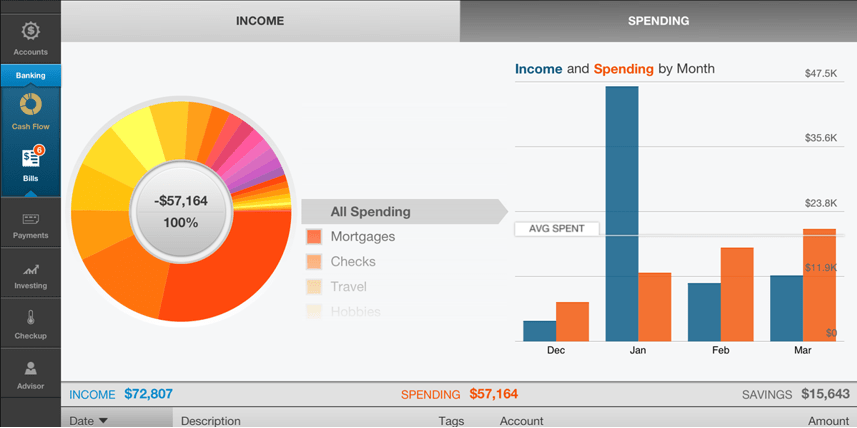

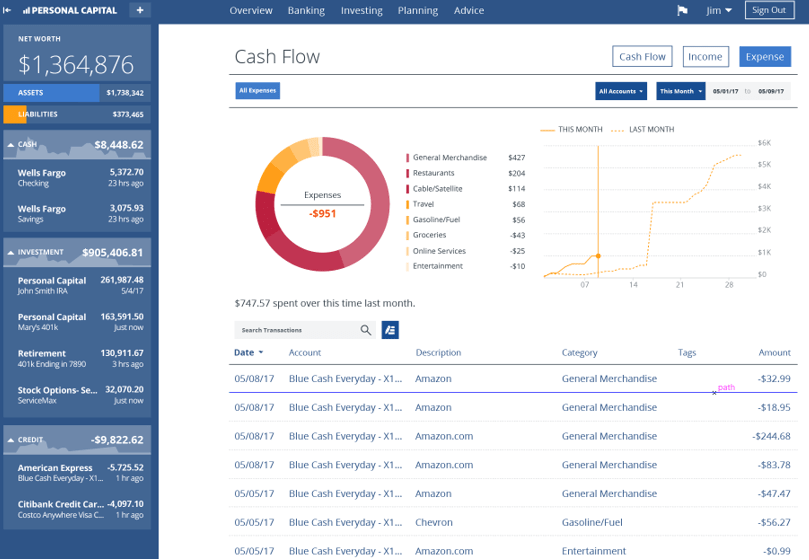

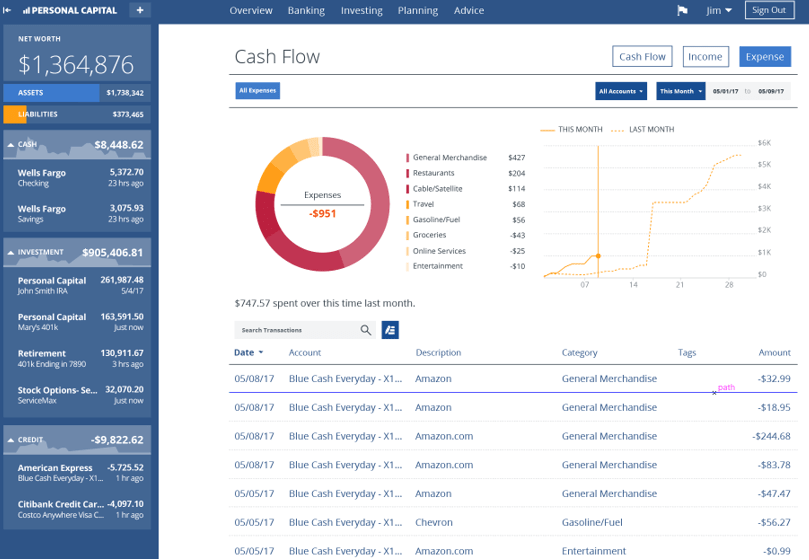

On your dashboard, you can pull up your transaction history and perform a cash flow budget analysis to see where you are spending money the most. You can also use the personal budget software to quickly and effectively generate spending and income reports, that way you can quickly identify areas where you are wasting money and where you can save.

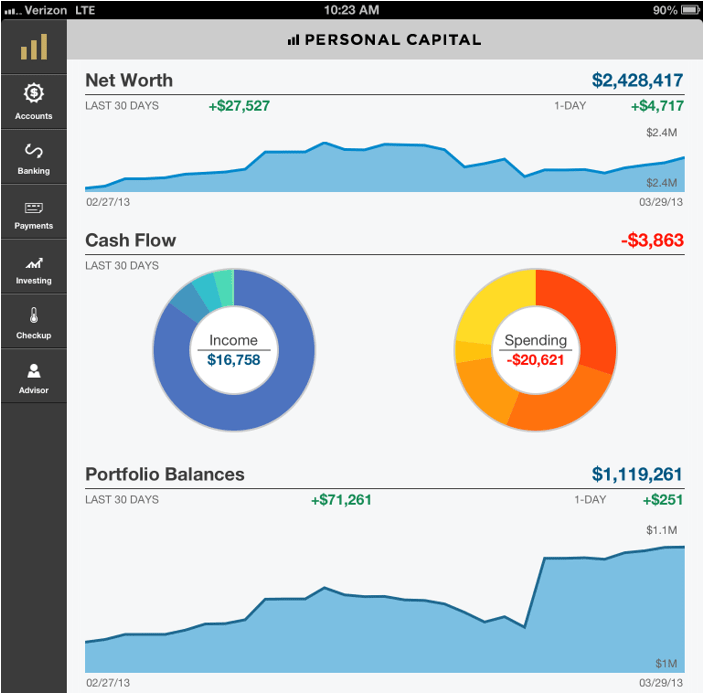

In the Personal Capital dashboard, you’ll see your:

- net worth

- cash flow

- income statement

- upcoming bills

- spending

- spending by account

- portfolio balances

- account balances and transactions

- portfolio allocations

- key financial assets

- top gainers and losers

- investment returns

- projected investment fees

- and many more

Get to Know Your Money

Over 1.4 million people use Personal Capital to track over $350 billion!

Click Here – Try Personal Capital Today (60 Seconds Sign up)

Budgeting Tools

Using Personal Capital’s Cash Flow Analyzer tool, you can easily create a budgeting plan that comes with real-time tracking features. The Cash Flow Analyzer tool also has advanced capabilities that allow you to zero in on problem budgeting areas and find places to save.

Personal Capital also allows you to stay on track when it comes to managing your budget, paying your bills, and meeting your financial goals, making it the best personal budget software to consider.

This personal finance app makes it easy to see your recently paid, pending payments, and past payment information. You’ll also see upcoming bills that are due, the minimum amount due, and the total amount outstanding.

Device Compatibility

Personal Capital is one of the best budget and money management apps for desktop, laptop, iPad, iPhone, Mac, Android, Samsung Galaxy, Microsoft devices, BlackBerry, and online users.

Using Personal Capital allows you to monitor and manage your financial transactions from anywhere, anytime.

Looking for the best free personal finance software? As a free personal finance app and your own financial manager, Personal Capital is designed to be used across all platforms and is considered the best free personal finance software for all devices and platforms.

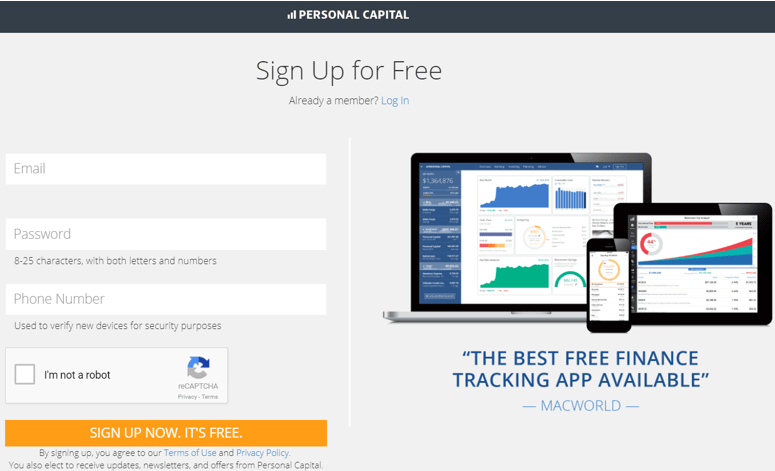

Sign Up Process

To sign up for this free and highly advanced budgeting and money management software, you’ll need to provide your email address, a strong password, and a cell phone number.

Your mobile number is used for security validation. Click to Open Your Personal Capital Account

After signing up, the next step will be to link the accounts you would like to track. To link these accounts, you’ll need to provide log-in information (see the below section on security for information on how Personal Capital protects you and your information). The log-in information you enter will be the same ones you use to log into your online bank accounts (checking, savings, etc.), credit cards, mortgages, expense accounts, and whatever financial accounts you want to track.

Linking your accounts is a very easy process. You simply click a small plus arrow, specify the account type you want to link, and enter your log-in information.

Security: How Secure & Safe Is the App?

Like most financial and personal finance apps, Personal Capital is a read-only application, which means they are unable to transfer or remove funds from your accounts.

The software basically “reads” and aggregates your financial information, and then groups the information into categories for tracking and monitoring purposes. You can’t move funds between–or out of–any account using Personal Capital. And neither can anyone else.

The website’s encryption is rated A by the world-renowned Qualys SSL Labs, a stronger rating than most major banks or brokerages have. The company uses ECDHE key exchange for Perfect Forward Secrecy and does not allow SSLv3, RC4, or other insecure protocols or ciphers. Their servers prefer to only allow highly secure TLS 1.2 protocol and also support TLS 1.1 and TLS 1.0.

Lastly, in regards to security, here is what the firm has to say about it:

- Personal Capital operates under Securities and Exchange Commission (SEC) jurisdiction and is audited for compliance with SEC cybersecurity regulations.

- We also use Verisign and other state-of-the-art security solutions and practices to protect our site.

- WhiteHat Security performs around-the-clock security testing on our site.

- Our iOS apps have passed the rigorous AppSecure certification process by NowSecure.

How Does Personal Capital Make Money?

If the software is free, how does the company make money? The personal finance software is free to use for tracking your finances and investments, budgeting, and money management.

However, the company also has financial advisors that you can choose to use for financial planning and investing if you wish. They charge fees for these financial advisory services.

Could Personal Capital Be the Best Free Money Management Software for You?

You can consider Personal Capital the best personal finance, budgeting, and investment management platform for you if you are looking for an all-in-one financial tool where you can manage your finances and budgeting, build a strong financial future, manage your portfolio and assets, and know how much you are worth in real time.

Best of all, Personal Capital is free to use. Give it a test run yourself, and make your own judgment call.

Quick Signup – Join Personal Capital Today

Top Ranked #2: Mint

Mint is a powerful and free personal finance software which allows users to create budgets, pay bills, and gain better control over their finances.

Within two years of being launched, Mint was acquired by Intuit for $170 million, bringing Mint alongside leading money management software apps like QuickBooks, Quicken, and Turbo Tax.

Key Factors That Led to Our Ranking of Mint as One of the Top Money Management Apps

Below, please find a detailed list of the features which led to our selection of Mint on this list of the best personal finance software.

Cost-Effective Personal Finance Software

Similar to Personal Capital (reviewed above), Mint is a free personal finance app that is only available to U.S. based individuals. As a free personal finance software, Mint makes it cost-effective for people to learn how to budget. This also includes free credit tracking–a notable benefit among personal financial planning software.

Mint provides a full financial picture, and offers users guidance on how to improve overall credit.

Free Personal Finance Software

If it’s free, then how does Mint make money? Mint has many revenue streams.

For example, whenever a user signs up for a credit card, checking account, savings account or account marked as sponsored on Mint, Mint earns a referral fee.

Compatible With Multiple Devices

Is Mint a great personal finance software for Mac users? Absolutely. It does not matter what device you use: Mac, PC, Android, etc.

As long as you can access the Internet, you can log in and use the Mint personal finance app to manage your transactions.

Mint also has free apps for iPad, iPhone, Android, Microsoft, and other devices.

Efficient Reporting

With excellent forecasting capabilities, Mint personal budget software allows you to see exactly how your spending decisions today would affect how much you have left at the end of the month or year.

Our Mint review found that this personal finance app provides efficient reporting through the way that data is communicated to users.

Mint uses plain English that is very easy for anyone to understand (“Spent $87.66 at Target in Chicago, IL” instead of the standard “POS TGT X89G CHIC IL 87.66” that you would see on your bank statement).

Sign Up Process

Easy to open an account? Check! Open an account in minutes. It is very easy to get started because Mint is connected to most U.S. financial institutions online.

Our Mint review found that this personal finance app can very quickly pull in your financial data and aggregate your various accounts with very little effort on your part.

Online Bill Payment Feature

As a personal budget software, Mint provides a simple and organized way to not only keep track of bills, but to pay them off, too.

The Mint personal finance app features Mint Bill Pay, which allows an unlimited number of bank accounts, credit cards, and assorted bills–all for free. Through Mint Bill Pay, users can:

- Schedule bill payments

- See bills & account balances in one place

- Save time by tracking everything in one spot

- Avoid late fees with due date reminders

As an additional benefit, payments made through Mint personal budget software often post by the next business day, making for a timely and efficient bill payment system.

Additional Benefits

Our Mint review found a few other notable features of this personal finance app that deserve recognition.

Personalized Interface

Mint has literally hundreds of naming categories that can be personalized and used to categorize your “in and out” cash flow. It is also very easy to re-categorize transactions.

Even better, this money management software allows users to add their own categories, which can be applied to future charges.

High Security

Mint is obsessive about security. Since this money management software comes from the makers of TurboTax and QuickBooks, there are strong security measures in place to protect sensitive data.

Mint uses the same 128-bit SSL encryption that is used by major banks, and it is continuously verified and monitored by VeriSign, an online security firm.

Our Mint review found that this money management software also uses multi-factor authentication to protect each account, which includes:

- 4-digit user code

- Touch ID enabled

- Security questions or code sent to email or text

Could Mint Be the Best Personal Budget Software for You?

Previously (until Personal Capital entered mainstream consciousness), Mint was the best free personal finance software to use.

With its advanced technological budgeting, accounting, and financial management features, it quickly knocked Quicken off its perch as the “best personal money management software.” Mint was (and remains) available free of charge, and has a better tracking and management algorithm than Quicken. This was a key reason it was acquired for $170m by the very same company that owns Quicken.

One key difference: Mint is an online personal financial planning software, while Quicken needs to be downloaded to your computer. Mint never has to be upgraded, while you’ll need to upgrade and maybe pay for the upgraded version of Quicken.

Mint vs. Personal Capital

Personal Capital is similar to Mint, but it comes with many more comprehensive features. If you invest or have any investments, or are interested in financial planning, wealth building and management, then Personal Capital picks up where Mint leaves off.

Like Mint, Personal Capital allows you to track your budget, spending, savings, and more. More than Mint, it provides substantially better functionality for tracking investments and stock/bonds portfolios.

Personal Capital also provides detailed information on asset allocation, income tax planning, and retirement planning, making it the best personal finance software for investors.

Personal Capital

Personal Capital (PC) vs. Mint (M) Comparison Factors

Personal Capital (PC) vs. Mint (M) | PC | M |

| All-in-one financial app | Yes | Yes |

| Does the company show ads on your dashboard? | No | Yes |

| Cleaner (less crowded) interface | Yes | No |

| Wealth management and investing interfaces | Yes | No |

| Sets alerts and thresholds – get notified | Yes | Yes |

| Easy to use and personalize | Yes | Yes |

| Conduct benchmark portfolio allocation | Yes | Yes |

| Easily see your net worth (real time) | Yes | No |

| Access to a financial planner | Yes | No |

| 401(k) and portfolio allocation | Yes | No |

| Advanced budgeting capabilities | Yes | Yes |

| Additional security (device authentication) | Yes | No |

| Secured funds (can’t move money in, out) | Yes | Yes |

| See all of your bills in one place | Yes | Yes |

| Plan for retirement | Yes | No |

| Wide range of colorful graphs and charts | Yes | Yes |

| Tracks business and/or tax-related items | Yes | Yes |

| Asset allocation | Yes | No |

Because Mint and Personal Capital are free to U.S. consumers, it is easy to sign up for both of them, and do your own personal testing to see which of the two works better for you. Let us know what you think.

Top Ranked #3: Quicken Review

For staying on top of your personal budget or maintaining your investments, Quicken has been one of the best personal finance software options since 1982. However, you have to pay a fee to use this money management app.

With powerful budgeting tools and comprehensive financial management features, Quicken continues to be a top personal financial planning software.

Key Factors That Led to Our Ranking of This as One of the Top Finance Apps

Below, please find a detailed list of the features which led to the selection of Quicken on our list of the best personal finance software.

Pricing Options

As mentioned above, Quicken is not free. However, it has six different versions, one of which is bound to meet your needs and price point.

These versions include:

- Quicken for Mac 2017 ($64.99)

- Quicken Starter Edition 2017 ($29.99)

- Quicken Deluxe 2017 ($64.99)

- Quicken Premier 2017 ($99.99)

- Quicken Home & Business 2017 ($109.99)

- Quicken Rental Property Manager 2017 ($154.99)

Note, though, that it often offers its Deluxe and Premier versions at sharp discounts.

Starter, Deluxe, & Premier

Quicken’s Premier version is designed for individuals who are interested in portfolio management (managing their investments) as well as budgeting, banking, bill payments, account aggregation, and all of the features provided by the Starter and Deluxe versions.

Quicken allows you to see all of your financial transactions in one place–including allowing users to snap and store receipts for purchases–providing a complete “end-to-end” financial solution.

Credit Monitoring

Our Quicken review found that this money management software has a new feature that allows you to get your credit score for free.

Additionally, you are provided with daily monitoring and credit watch alerts to help protect against someone stealing and using your credit.

Because credit score and personal finances often go hand-in-hand, Quicken is a great personal budget software for those who want a holistic view of their financial status.

Budgeting Tool

As a top personal budget software, Quicken provides users with valuable personal financial planning software aimed at maintaining a budget.

Users can create a customized budget plan, and the Quicken money management software will track progress over time based on unique user plans.

Budget goals are also created based on previous spending habits, making it easy to dive into implementing the tools inside this personal budget software.

Mobile Apps

Quicken’s newly revamped mobile apps give you the ability to quickly access and view your financial transactions on the go. These personal finance apps make it easy to review your Quicken account balances and track your budget plans and goals.

Mobile apps are designed for iPad, Android, iPhone, and many other mobile platforms. Data is quickly synced throughout all platforms, including your computer, tablet, and smartphone.

Desktop Versions: Mac vs. Windows

For desktop devices, Intuit provides two separate versions of this money management software: Quicken for Windows and Quicken for Macs. Quicken has been rated as a top Mac personal finance software, and is one of the best known personal financial planning software for PC and other devices.

Quicken for Windows includes a wide range of features and versions. Previously, Quicken for Mac only included the basic version, with limited features for Mac users.

However, the latest versions (Quicken 2017 for Mac) comes loaded with a lot of new features which makes managing your money easier than ever. Quicken 2017 for Mac supports bill pay from nearly 500 financial institutions. You can quickly pay any bill without leaving the Quicken for Mac platform. You can also transfer funds between accounts at the same financial institution.

Would you need to register your copy of Quicken 2017 for Mac? Yes. When you install or upgrade, you’ll be guided to enter your Intuit ID and register Quicken.

Click Below to Get Person Capital’s Free Money Management Software

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.

Additional Image Source: BigStock, Personal Capital, Pexels, and Pixabay