Top 10 Best Fixed Rate Bonds – Top Bonds for Fixed-Income Investors

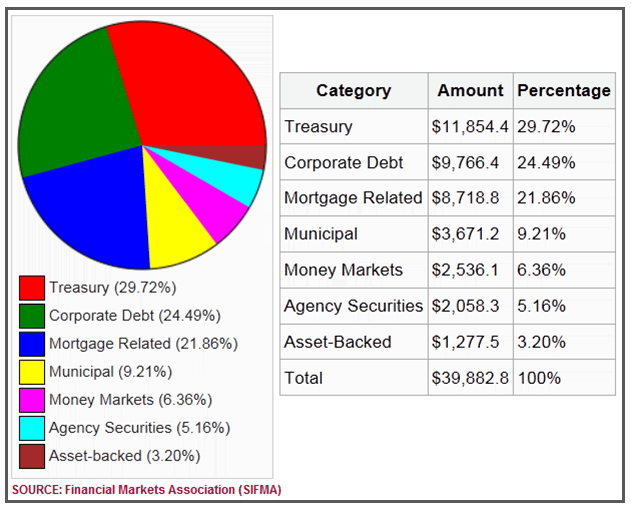

According to the Financial Markets Association (SIFMA), the size of the bond market in the US is roughly $40 trillion. With such a huge market of opportunities available to investors, fixed rate bonds investments seem to have an attraction for investors.

Size of the US Bond Market – Financial Markets Association (SIFMA)

Image Source: SIFMA

However, just because you think you’ve located the best fixed rate bonds doesn’t mean such bonds make the best investment for your portfolio.

Before diving into fixed rate bonds, you should pause and consider whether investing in bonds is right for you.

Deciding on the Best Fixed Rate Bonds

Fixed rate bond holders must decide whether they need a guaranteed fixed-rate of income or whether it’s worth investing in a variable rate of return.

Investing in the best fixed rate bonds can be rewarding for investors with a special investment philosophy.

A fixed rate bond might be right for you if you:

- Believe interest rates will not rise (at least in the foreseeable future) too far above the coupon rate of the best fixed rate bonds that you have invested in

- You are comfortable with the defined rate of return from your fixed rate bond, regardless of how high real interest rates may rise

When considerings which bonds to invest in, you might want to consider a strategy that allows you to:

- Enjoy broad diversification by holding a mix of bonds

- Receive regular and predictable income from the best fixed rate bonds that you hold

- Have the opportunity to capitalize on possible tax benefits from income/capital appreciation

- Get peace of mind knowing your principal value invested is preserved

Analyzing Issuers of Bonds

Just because a bond issuer claims its bonds are some of the best fixed rate bonds on the market doesn’t make them so!

As an investor, you must also look carefully at:

- Who the bond issuer is

- What issuer’s financial standing is

- The issuer’s track record of paying back bondholders is also a good way to determine whether the proposed bonds are really the best fixed-rate bonds offered

Investment rating agencies, such as Standard & Poor’s, Fitch, and Moody’s, often rate bonds (e.g. AAA, AA, A, BBB, Aaa, Aa, etc.) according to their grade and “invest-worthiness.”

However, even if a bond holds an AAA rating, it does not necessarily mean it is the best fixed rate bond for your portfolio.

Your investment horizon, your optimism or pessimism (as the case may be) on interest rates, and your level of risk tolerance in your investments must also be taken into account.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Finding the Best Fixed Rate Bonds for YOU

Considering all we’ve stated above, one clear conclusion that can be drawn about fixed rate bonds is this:

What might appear to be the best fixed rate bonds for one investor might not be so for another!

Why?

Precisely because of some of the points highlighted in the previous section.

For instance, when it comes to who the bond issuer is, some investors might prefer to gravitate towards US Treasury bonds, despite all the hype surrounding the US government’s debt levels.

Preference for US Government Bonds

To such investors as discussed above, safety is the most important factor when investing in fixed rate bonds.

The US government has never defaulted and is not expected to ever default.

As such, US government bonds are the most secure type of investments.

Consequently, for such investors, the best fixed rate bonds will include U.S. Treasury bonds.

Preference for Non-Government Bonds

Other investors prefer non-government bonds.

In their opinion, the private sector is a much better bet than the public sector.

For such investors, the “right product” might mean corporate fixed rate bonds.

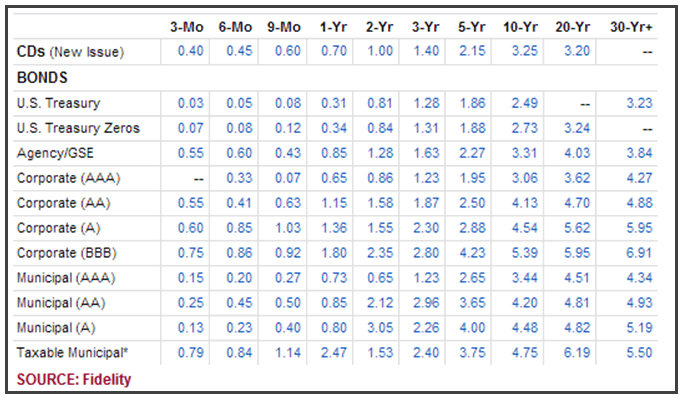

The below table provides a snapshot of yields for different types of bonds at different maturity periods at the time of this writing.

For investors looking for the best fixed rate bonds issued by a stable sponsor (e.g. government), you will note that, in general (though not always), the yield offered will be lower than other bonds of the same duration.

For instance, a 1-year U.S. Treasury bond will yield you 0.31%, but an AAA-rated corporate bond for the same maturity yields 0.65%.

Why?

The government is considered to be a lower risk than corporations, hence you’ll get a lower return.

Image Source: Fidelity

Similarly, when searching for the best fixed rate bonds issued by corporations, one can’t help but notice that the yield of a 1-year, AAA-rated bond (0.65%) is lower than that of an AA-rated corporate bond (1.15%) of the same maturity.

Again, it’s all about risk.

Within the corporate world, AA-rated companies hold a slightly higher risk profile than AAA-rated companies.

So fixed-income seekers must be aware of that difference when searching for the right fixed rate bond to add to their portfolios.

For long-term bond lovers, the best fixed rate bonds are ones that have longer maturity dates.

That’s because they offer a higher-yield-to-maturity (YTM) than bonds of shorter maturity lives.

Why?

The further out a bond matures, the greater uncertainty of risk it carries, and the riskier the investment, the higher the return it commands.

A Look at 10 US Treasury Bonds

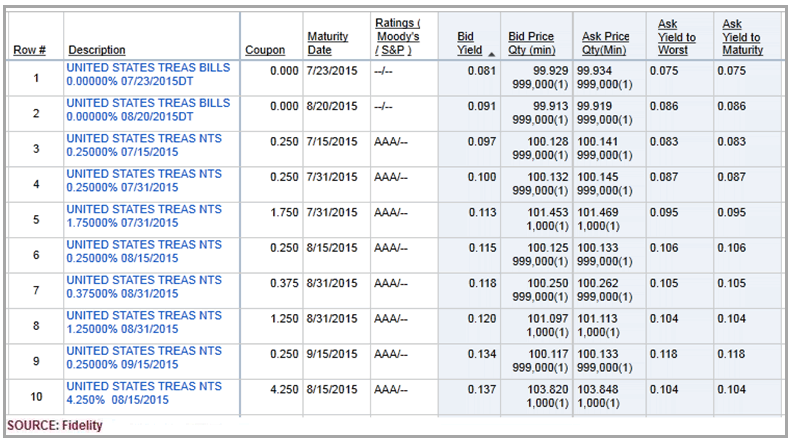

Using a resource like Fidelity’s Bond Search tool may be a great way to look for the best fixed rate bonds issued by the U.S. Treasury.

Notice how the first 2 rows in the table below have no coupon rates mentioned.

That’s because they are “zero coupon” bonds, and the later maturing bond (row 2) has a slightly higher YTM than the earlier maturing one (row 1).

Image Source: Fidelity

Also notice how bonds with the same coupon rate (rows 3, 4, 6, and 9) offer higher YTMs (0.083, 0.087, 0.106, 0.118) than each other.

Why?

Each matures slighter later than the other, and the risk of moving down the yield curve is reflected in higher YTM.

Use the tool to sort government bonds by maturity date, credit rating, YTM, and other criteria to get the best fixed rate Treasury bonds for your portfolio.

The U.S. Treasury issues series EE and series I bonds. For investors who are looking for a degree of protection from inflation, the series I bonds might be the best fixed rate bonds to look for.

While the series EE bonds carry a fixed rate of interest, their I series cousins offer a fixed rate plus an additional return based on an annualized inflation rate.

A Look at 10 Corporate Bonds

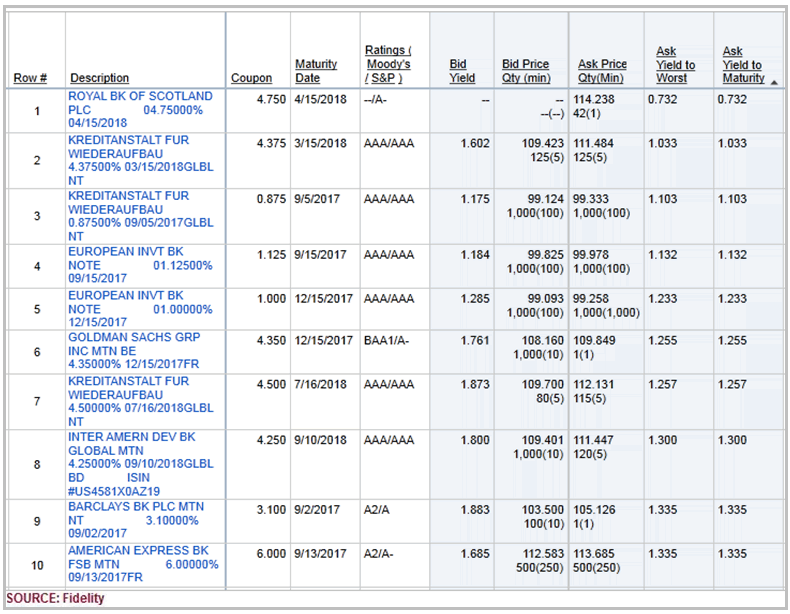

So how does one go about looking for the right corporate bond product, and where can one find the best fixed rate corporate bonds offered? The same tool will help you scan the universe of corporate investment grade bonds that you can select for your portfolio.

Image Source: Fidelity

Once again, note how the top 10 best fixed-rate corporate bonds sorted by YTM offer higher yields at maturity as the maturity date is further out.

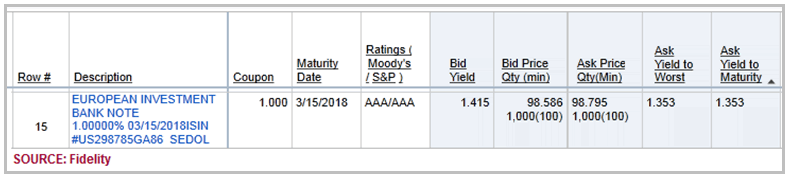

In your search for the best corporate bonds, take note of how two bonds (row 5 above and row 15 in the table below) issued by the same sponsor, with the same coupon rates, can offer differing YTMs (1.233 and 1.353), primarily because of their maturity dates.

Image Source: Fidelity

Bonding With Caution!

Generally speaking, bond markets are less volatile than the stock market, but they could become overly frothy in uncertain economic times.

While the best fixed rate bonds might screen well using tools like the ones discussed above, investors must be aware that they carry:

- interest rate risks

- credit worthiness and default risks

- liquidity risks (small retail investors may not easily be able to buy or sell them)

- inflation risk

Additionally, investors need to be aware that higher-yielding (corporate) bonds may entail higher risks than their lower-yielding cousins.

That’s because companies that cannot easily get credit on the open market (due to financial issues) tempt fixed-income investors with higher yields.

Free Wealth & Finance Software - Get Yours Now ►

However, just because they carry attractive yields does not make them the best fixed rate bonds.

Then there are high-yield bonds out there that are extremely risky.

These are often non-investment grade bonds that are often great for short-term trading or even speculative investing.

If you are looking for the best fixed rate bonds to put some of your nest egg into, then stay away from high-yield instruments at all cost!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.