Financial Advisor Jobs – Overview

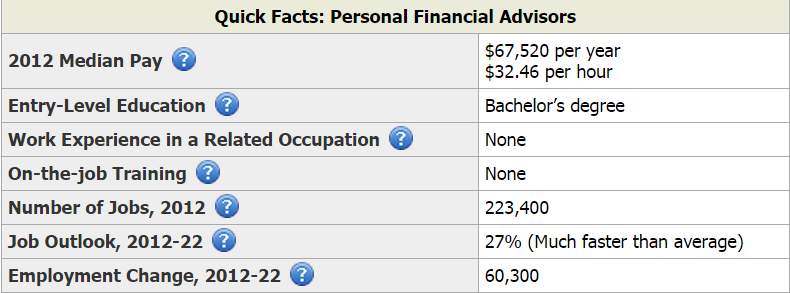

According to the U.S. Bureau of Labor Statistics (BLS), the average rate at which all (major) occupations in the U.S are expected to grow, over the 10 year period 2012-22, is 11%.

However, Financial Advisor jobs are expected to fare much better.

At a 27% growth, Financial Advisor jobs are expected to grow at a far quicker pace than the average.

And over that same 10-year period, the BLS expects that over 60,300 men and women will have entered into the profession.

These are encouraging statistics indeed. But with the U.S. economy only just rebounding from many years of stagnant growth, how do you go about finding these financial advisor jobs?

What do Financial Advisors do?

In general financial advisors provide financial advice and support to individuals, families and companies. They advise clients on financial related matters including financial management, tax strategies, investing, insurance, real estate, budgeting, and wealth management.

Image Source: Financial Advisor Jobs

When taking on new client, a financial planner normally reviews the client’s savings, investments, assets, debt, liabilities, cash flow (cash coming in vs. cash going out), and financial objectives.

If you are interested in becoming a financial advisor, here are 6 tips that will help you land a great financial advisor job.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

6 Tips to Finding Financial Advisor Jobs

1. Stay current with the times

If it’s been a while (a year or more) since your last job, then you must ensure that you get up to speed with all that’s happened in the industry since then.

And even if you are recent graduate from a financial planning course, it doesn’t hurt to stay current with the fast-paced changes in the industry.

Financial Advisor jobs were created to advise people on financial matters. If your own knowledge is stale or outdated, then you will likely be a misfit in the position.

2. Get certified

While the BLS indicates only a Bachelor’s degree is required for entry level financial advisor jobs, the reality is far different.

Individuals looking to become advisors often compete with a lot of other potential advisors, who are equipped with credentials higher than just a bachelor’s degree.

To increase your chances of landing a top financial advisor job, you should consider completing

- The American Bankers Association conferred Certified Trust and Financial Advisor (CTFA) course

- A Personal Financial Advisor (PFA) designation from the National Association of Personal Financial Advisors

- The Certified Financial Planner Board of Standards sponsored Certified Financial Planner (CFP) certification.

Any one of the above financial advisor certification will give you a definite leg up during interviews for financial advisor jobs.

And if your work requires you to have federal or state licence to practice, make sure your licenses are up-to-date and current too.

3. Be open to any roles offered

The industry generally offers financial advisor jobs under 4 different compensation models:

- Commissions

- Fee-only

- Fee-based

- Salary

You may aspire for a salaried position with all the perks, but you should be open to taking what comes your way – more so if you are just trying to break into the industry as your first career move.

4. Be active in your community

If you are a certified advisor and are between financial advisor jobs, or whether you are qualified but still looking for your first position, it is recommended that you offer your services (free of cost) to local groups that help underserved community members with financial advice.

Image Source: What do Financial Advisors do

Doing so will not only will that help you stay connected with your profession while you look for a “day job”, but it will also resonate well with an interview panel when you do get that call.

5. Practice being a “people-person”

Regardless of which compensation model you job finally offers you, financial advisor jobs are all about people. You’re expected to meet people. You’ll talk to people. You’ll be listening to people. And ultimately, you’ll be advising people.

When you interview for a job, that’s the first thing that a panel will likely ask: Are you a people person! Hone your people skills by attending workshops, seminars and events – not just via tele-presence, but in person!

6. Join fellowships

Organizations like the Financial Planning Association or National Association of Personal Financial Advisors are great places to fraternize when prospecting for financial advisor jobs.

That’s because their members are well connected with the industry, and often know someone, who knows someone, that’s looking for good advisors.

Become a member of such organizations, attend their networking events, and pass out copies of your resume, experience profile and contact details unashamedly. Your thick-skinned approach is what will give you much needed leads for open positions that are never even advertised!

Free Wealth & Finance Software - Get Yours Now ►

Stay the course

It’s a tough world out there for all professions, and finding financial advisor jobs is no more/less difficult than searching for jobs in many other professions. Downsizing, off-shoring, Mergers & Acquisitions – they have all have played a role in mass layoffs in the financial industry.

But as the economy turns around, many of those jobs are bound to also make a comeback.

Clients will need financial advice, and investment firms will need professionals to deliver that advice. Your perseverance and tenacity in the job search will ultimately meet with success in landing that elusive job.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.