Types of Business Loans – Overview

Funding, cash, and credit are the lifeblood of a business. Most cannot grow without it and many would fall apart in a matter of days or weeks without it.

Despite the significance, many business owners do not realize the various types of business loans that they have at their disposal. Some of these loans could transform a business or bring it back from the brink of bankruptcy.

Whether you are in desperate need of financing or just ready to take your business to the next level, you should consider the following types of business loans:

7 Types of Business Loans for Your Business

1. Conventional Loans

2. Line of Credit Loan

3. Equipment Loans

4. Working Capital Loan

5. Franchise Start-Up Loan

6. Small Business Administration (SBA) Loan

7. Private Loans from Friends and Family

Brief Overview of the Various Types of Business Loans

Conventional Loans

Conventional loans are one of the most common types of business loans that you can pursue when you are in need of funding, and this is typically the first stop for most businesses looking for money.

The terms can sometimes be very strict since the loans are not backed by the government. The banks and institutions offering the money will often want to see a history of success as well as assets that can be used as collateral in the event that the loan is not paid back.

Line of Credit Loan

Business line of credit loans are very similar to consumer credit cards in that they are offered ahead of time and can be used again and again depending on your needs.

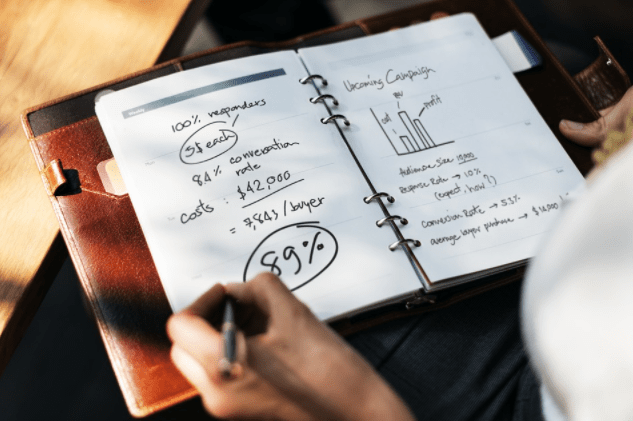

Image Source: Business Loans for Your Business

The payment of these loans is proportional to the amount borrowed and the interest rate is typically calculated based on your payment history, credit score, and other business factors. These are a great way to cover operating expenses and ensure that you do not get into a negative cash flow predicament.

Equipment Loans

Another type of business loan on the list is an equipment loan. Equipment loans are just as they sound – business loans that can be used specifically for equipment and/or vehicles.

These are a great option for businesses that require machinery as part of their operations or for companies that need to add a vehicle under their ownership.

Equipment can be a huge cost for many start-ups, so these loans are a great way to get past that barrier to entry.

Working Capital Loan

When considering the various types of business loans, we don’t want to forget about working capital loans.

Working capital loans are extended to small businesses to help them get through short-term periods of low cash flow that may result from a high accounts receivable, payment due for large inventory purchases, emergency renovations, or any other situation that may tie up a large amount of cash temporarily.

Because these loans are short-term, they are usually have higher interest rates, but since they offer refuge during a time of crisis, they are often worth it.

Franchise Start-Up Loan

Franchise start-up loans are specific types of loans on our list of the 7 types of business loans available to your business

When you are opening a franchise you will face a wide range of new business hurdles. However, you also get the advantage of a strong and normally well proven brand name behind you. This advantage can usually help when it comes to funding.

Most banks have special loans for franchises, so depending on the brand you choose; you may have an easier time getting a loan (or will be eligible for more).

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Small Business Administration (SBA) Loan

If you have exhausted all of the standard options for financing and are still unable to qualify for a loan, you can turn to the SBA for a SBA loan.

SBA loans are some of the most popular types of business loans available. These loans will technically be coming from a private institution, but they will be backed by the government, so banks are more likely to offer the money.

These types of business loans can be used for various reasons so they are an attractive option, but they are only extended to small businesses that can prove they are struggling to receive funding from traditional sources.

Private Loans from Friends and Family

It is a very tricky situation to be borrowing money from family and friends, but if you have the opportunity it can be one of the best type of business loans available.

Depending on the size of the loan and your agreement, the loan could end up being completely interest-free.

Before you go through with this type of arrangement though, you should talk to a lawyer to make sure an official contract is drawn up and tax implications are considered.

You do not want to ruin an important relationship over money and neither of you will want to be caught off guard when it comes time to file taxes.

With the various types of business loans out there, companies and entrepreneurs have huge potential to start and grow their businesses.

Depending on your industry and needs, you should consider different options to build up the financial foundation of your business.

In fact, many businesses have more than one loan at any given time. While debt does carry some risk, if you manage your finances properly these types of business loans could end up being very smart financing options.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.