Hard Hitting and Informative Allianz Annuity Review

Planning for your future often means taking a good hard look at the realities of where you are and where you are headed. Unfortunately, saving up the necessary funds to sail through your golden years in comfort is a big task.

We hope that this Allianz annuity review will arm you with the information that you need to weigh Allianz annuities against other investment strategies while planning for your future.

Image Source: BigStock

Just who are the people behind Allianz Annuities? Allianz Annuities has been in business since 1896. Allianz annuity reviews often touch upon the long history of this company and the fact that, even through ever-changing market conditions, they have consistently received top marks from financial rating firms globally. And with that kind of longevity, they must be doing something right.

Still, we want to help you weigh the pros and cons of trusting your retirement years at least in part to Allianz annuities. In this Allianz Annuities review, we’re going to discuss Allianz annuity rates and customer service.

We will also take an in-depth look at the experiences of other investors by considering the word of mouth of Allianz annuity reviews and some Allianz annuity complaints.

See Also: Sofi Reviews (What Is Sofi?). Should You Use it? Is Sofi Legit?

The Driving Forces Behind Allianz Annuities

Integral to any Allianz annuity review is understanding the investment methodology that drives Allianz annuities.

Allianz annuities has always pursued an investment strategy of diversification, cost savings via in-house management, and pushing toward long-term results.

When you purchase an Allianz annuity, you know that you are buying a piece of your future from a company that will still be around to pay it out.

What Are Allianz Annuities Anyway?

An annuity is basically a pension that you fund yourself throughout your career. You’re quoted a rate that you pay directly to Allianz annuities each month until you reach retirement age.

That money is then invested, and upon retirement, Allianz annuities will start to pay you out a predetermined monthly dollar amount. There are many different Allianz annuities available and different types of funds that you can put your money into.

Nothing in Life Is a Sure Thing

Even the most solid financial decisions can be wrought with potential pitfalls. Any investment strategy that relies on the compounding growth of investing is not guaranteed to perform.

Both fixed and variable Allianz annuities are subject to market volatility. In fact, Allianz annuities are not FDIC insured, but they are backed by 115 years of financial stability.

Allianz Annuities Can Be Key to Supplementing Your Future

It takes a well-informed and well-executed strategy to have enough money to live on in your retirement years. The days of every company offering a pension are fast disappearing, and with the future solvency of Social Security benefits rapidly coming into question, it is likely that you will need a diversified strategy to fund your future.

If you are already investing in an IRA and maxing out your 401(k) contributions, purchasing Allianz annuities can be a powerful means to further supplement your later income.

As mentioned at the outset of this Allianz annuity review, the overall investment strategy of Allianz annuities is conservative and designed to produce long-term growth throughout changing market conditions.

While you might have a more aggressive 401(k), rental real estate, or risky investments, an Allianz annuity can be an oasis of calm, reassuring you with its generally slow but steady growth.

Don’t Miss: OptionsHouse Review – Fees, App, Commission, Services, Speed, Trading

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Education Is Paramount to Effective Planning

Image Source: Allianzlife.com

If you prefer to take a more active part in your retirement planning and investing, Allianz annuities offers many educational options for you to teach yourself more about retirement planning, growth, and interest rates throughout your saving years, and withdrawal rates necessary to succeed later in life.

If you find that your overall mindset aligns with the conservative investment strategy of Allianz Annuities, then you will likely find that their fixed index annuities align with your own leanings.

How Do Fixed Index Allianz Annuities Work?

A fixed annuity is a little more complex than it may sound at first. Though you are eligible to meet fund benchmarks based upon market performance, you are not actually engaging your money in the market itself.

Because your money is never actually in the market and is only held in reserve, earning tax-advantaged interest, you do not run the risk of losing any of your investment money. Allianz Annuities calls this “principal protection” from market downturns, and it is the cornerstone to their success with fixed index annuities. Again, it is very similar to paying toward your own pension.

Sometimes Changing Times Call for Changing Strategies

If you prefer to take matters into your own hands and are educated sufficiently to make informed investment decisions, then Allianz annuities also offers more than 50 very popular variable annuity options.

The variable Allianz annuities allow you to choose how and when to change which funds you invest in. There are also options available that offer death benefits and minimum growth rates.

How Do Variable Index Allianz Annuities Work?

Allianz Annuities has designed their plans to be as user-friendly and concise as possible. Once you’ve funded or paid your annuity with your first payment, you will be able to begin to customize your annuity contract.

With or without the guidance of expert money managers provided by Allianz Annuities, you can weigh your tolerance for risk versus your object accumulation rate and select any combination of index options and traditional variable options.

Taxes are deferred on Allianz annuities until the payment date of the agreement. Once you start receiving benefits, the taxes become payable, so though taxes are still due on your initial investment, the growth therein remains tax-advantaged.

Allianz Annuities Offers Advanced Retirement Options

Some of the cooler products offered by Allianz annuities are not commonly discussed in Allianz annuity reviews. For example, Allianz annuities offers the MasterDex X Annuity, which is similar to their standard fixed index annuities, just with a few differences.

For starters, with the MasterDex X, you get a 4% bonus on the premium payments that you make in your first three years.

For the high earning professional or someone dedicated to swiftly paying down their annuity premium, you can make a sizable impact in your overall balance quickly. While subject to a 10-year vesting schedule, the 4% bonus is effectively earning free money. It’s akin to doubling down on a company match 401(k) but on your own account.

MasterDex X Lump Sum Benefit

Even cooler than the 4% bonus on premium payments is the fact that after your 10-year vesting period with the MasterDex X Allianz annuity, you are eligible for withdrawals of up to 10% annually of your paid premium free from any penalties.

The flexibility and liquidity that having access to your retirement savings early provides makes it that much easier to invest in yourself freely in your younger years.

After all, the more money that you set aside and start working on your behalf now, the more money you’re going to have available to yourself in your twilight years.

How Is Allianz Annuity Customer Service?

In combing through customer experiences and Allianz annuity reviews online, we witnessed many errors in account routing, payment receipt, fund adjustments, etc. being resolved by the Allianz annuity customer service team.

Looking at these, you could become discouraged by the complaints about the company, or you could see that the company is quick to correct issues as they arise.

And what about security? Allianz Annuities requires four different pieces of confidential and personally identifiable information prior to making any adjustments on an account, so their process is very secure.

In addition, in some Allianz annuity reviews the Allianz annuity customer service team was able to fully fund an account that had been drained in an identity theft attack.

What Are Allianz Annuity Rates Like?

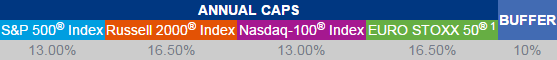

Image Source: Allianzlife.com

Allianz annuities offer great rates on both fixed index and variable index annuities. Their many options are set up to be tax deferred to maximize growth, and they come standard with death benefits. For example, the basic Allianz annuity Index Performance Strategy entails:

- 13% Standard and Poor’s 500 Index

- 16.50% Russell 2000 Index

- 13% NASDAQ-100 Index

- 16.50% Euro Stoxx 50

- 10% variable buffer

A performance credit is issued into your account if ever the index return is negative.

Related: IdentityForce Reviews – What You Should Know Before Using Identity Force

Is It Easy to Get My Money Out?

There are several types of investment strategies available to the discerning planner. Some of these funds are easier to withdraw money from than others.

However, the Allianz annuity withdrawal form is simple and straightforward. As mentioned, many of their advanced retirement savings products offer the opportunity to withdraw money early and without penalty.

The details will depend on your contract, but when compared to funds with many tax penalties for early withdrawals, an Allianz annuity is relatively simple to get your money back out of.

What Do Rating Agencies’ Allianz Annuity Reviews Say?

Particularly for a relatively small investment and financial planning firm, Allianz Annuities distinguishes themselves by being a very solid company to work with. In recent decades, Allianz annuities have been consistently rated well.

- AA and AA- by Standard and Poor’s

- A+ and A by A.M. Best

- and A1 and A2 by Moody’s

For a storied firm like Standard and Poor’s, which has been in the business of rating solvency for over 150 years, to declare Allianz annuities a strong and secure investment is a powerful endorsement.

Free Wealth & Finance Software - Get Yours Now ►

Overall Findings of Our Allianz Annuities Review

It’s good practice to take planning for your future seriously. We’re often told that we need diverse investment strategies to help ourselves out down the road, but it can often be hard to figure out what exactly that means.

The bottom line is that as long as you start saving as much as you can as early as you can, you’re going to be in the best position possible when your retirement age arrives. While you certainly want to put your money into a 401(k) or IRA, it can be worth taking a look at Allianz annuities and the flexible options they provide to supplement your savings.

If you want to dig deeper, Allianz Annuity contact information is available here.

Popular Article: Lexington Law Reviews – Get all the Facts before Using Lexingtonlaw.com

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.