Ally Bank Review – Origin and Growth

Online banking firms like Ally Bank are in a position to offer high interest paying accounts because they don’t have expensive physical locations or hire extensive branch location employees.

Instead, they depend on advanced user-friendly automated online banking and financial transaction tools.

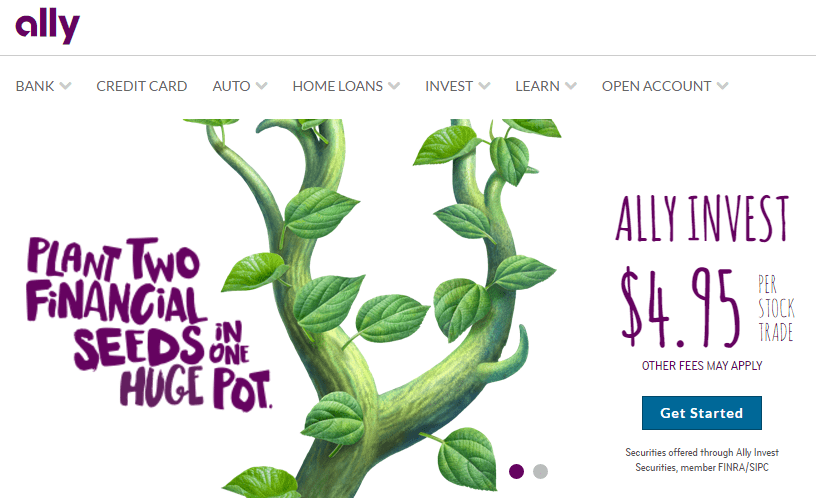

Image source: Ally Bank

Ally was originally founded as the General Motors Acceptance Corporation (GMAC) in 1919 and was a major provider of loan, credit and other financing to automotive customers.

Over the years, GMAC expanded its services to include insurance, direct banking and commercial finance.

In 2009, the firm was rebranded as Ally Bank.

About two years ago, the bank crossed its $40 billion threshold in retail customer deposits.

The firm’s customer base continues to grow, with over 850,000 customers .

Review of Ally Bank – Rates and Services

1. Ally’s high yield savings account currently pays a 1% interest rate

2. The firm’s high yield checking account pays as follows:

- Deposit of $15,000 or more earns you: 0.60% APY

- Deposit less than $15,000 earns you: 0.10% APY

3. Ally high yield Certificate of Deposit (CD) rates (3, 6, 9, 12, 18, and 36 months CD rates):

* All APYs and interest rates shown on this article are accurate as of 10/17/2015.

Benefits of Ally Bank’s High Interest Online Banking Accounts (Ally Bank Review)

Ally Bank has no monthly maintenance fees for its checking or savings accounts.

It grows your money faster by compounding interest daily, whereas many banks compound monthly, quarterly, or even annually.

Image source: Pixabay

Funding a new account is easy.

When you bank with Ally, you have the flexibility of conducting your personal or business transactions via phone, chat, or using your computer or mobile device.

Ally offers several secure options for funding your account (eCheck DepositSM from your computer or mobile device, online or wire transfers, direct deposit, and mail deposits). It also offers 24/7 customer service.

Most importantly, as an Ally customer, the deposits in your account are insured by the FDIC up to $250,000 per depositor, for each account ownership category.

Review of Ally Bank – Conclusion

Ally Bank has come a long way since its inception, and recently released data shows the bank continues to experience a high growth rate.

As stated by Barbara Yastine, CEO and president of Ally Bank: “our accomplishment represents a significant achievement for Ally Bank, and our steady growth is another testament to our customer-first approach to direct banking. Our deposit base is built from customers who want competitive and flexible products, without having to sacrifice convenience and best-in-class customer service for their banking needs.”

Ally Bank Headquarters

Ally Financial Inc.

P.O. Box 200

Detroit, MI 48265-2000

Ally Bank

P.O. Box 725

Midvale, UT 84047

Corporate Centers

- Charlotte, North Carolina

- New York, New York

Additional Ally Bank Locations

- Chicago, Illinois

- Dallas, Texas

- Duluth, Georgia

- Jacksonville, Florida

- Little Rock, Arkansas

- Pittsburgh, Pennsylvania

- Philadelphia, Pennsylvania

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.