Is the Amazon Rewards Visa Card Better Than a Walmart Card or a Target Store Credit Card?

If you frequently shop online or at a location of a particular store, sometimes it can be a great idea to get a store-specific rewards credit card. This article will help you figure out if the Amazon Rewards Visa Card is right for you.

In order to provide a complete review, AdvisoryHQ will also be taking a look at the Target REDcard™ Credit Card™ and the Walmart® MasterCard®. We will compare and contrast these three cards, and, along the way, you may discover that one of these three store cards is perfect for you.

Image source: Pixabay

We will start with an overview of the Amazon Company and an Amazon Rewards Visa Card review. We will highlight everything the Amazon credit card offers. Then we will move to a Target REDcard™ Credit Card™ and finally a Walmart card review.

At the end, we will wrap it up by showing where the Amazon card is strong by comparing all three and then adding some additional factors that may make you consider the Walmart or Target store credit card.

Before you know it, you will have the information you need to decide which of these store credit cards will be best for you and your shopping habits. Perhaps the amazon.com credit card will be your ideal card for 2017.

See Also: The Best Prepaid Cards for Good or Bad Credit | Guide | How to Find the Best Prepaid Cards

More About Amazon.com

Before we take a peek at the amazon.com credit card or compare it to the Target REDcard™ Credit Card™ or Walmart’s MasterCard credit card, let’s take a closer look at the company Amazon.

Jeff Bezos founded Amazon in 1994, but as of 2016, it is the largest online retailer in the world. Bezos’ net worth is now 66.5 billion dollars.

Amazon is more than only an online retailer and offers the popular Kindle Fire, Amazon Prime streaming services, Music Unlimited, Amazon Digital Game Store, AppStore, and more.

These factors may play a role in whether or not you decide that the Amazon Rewards Visa Card will be the best choice for you. After all, there are endless options to what you can buy to receive your rewards points.

Comparison Review List

The list below is sorted alphabetically (click any of the card names below to go directly to the detailed review section):

High-Level Comparison Table

Store Credit Card Names | APR Ranges | Annual Fee | Credit Scores |

| Amazon.com Rewards Visa Card | 14.49%–22.49% | $0 | Fair, Good, Great, Excellent |

| Target REDcard™ Credit Card™ | 23.15% | $0 | Good, Great, Excellent |

| Walmart® MasterCard® | 17.15%–23.15% | $0 | Good, Great, Excellent |

Table: The above list is sorted alphabetically]

Amazon Rewards Visa Card Review

First up, of course, is the amazon.com credit card. The Amazon.com Rewards Visa Card is provided by Chase bank and offers the lowest annual percentage rate (APR) option on our list. If you carry a balance from month to month, this is an important aspect.

Image source: Amazon

The chip-enabled Amazon card has no annual fee, a typical 3% foreign transaction fee, and the ability to do a balance transfer or cash advance.

The Amazon Card Rewards System

- Earn 3% back on purchases from amazon.com

- Earn 2% back on purchases at gas stations, restaurants, and drugstores

- Earn 1% back on all other purchases

- Earn a $50 amazon.com gift card when you are approved for the Amazon store credit card

There are no earning caps when you are using this Amazon store credit card, so you can take advantage of this rewards system as much as you would like.

The Amazon credit card offers instant rewards usage. You can find your rewards balance and decide how much to use each time you make an amazon.com purchase. Or you can exchange your Amazon card rewards for cash, gift cards, travel, and more options.

Don’t Miss: How to Get a Debit Card | Guide on Getting the Best Debit Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Target REDcard™ Credit Card Review

Next, we are going to take a look at the Target REDcard™ Credit Card™ which is offered by TD Bank. This is the most unique card on our short list because the Target store credit card is more of a discount card than a rewards card like the Amazon Rewards Visa Card.

This chip-enabled Target store credit card does have one high variable APR, meaning the Target Red credit card may not be the best option for those who frequently carry a balance, but its free annual fee is a nice bonus.

The Target Red Credit Card Rewards System

- Save with a 5% discount on purchases made at Target locations or on target.com

- Discounts are not included for some purchases, including prescriptions, eye exams, Target gift cards, gift-wrapping services, and more.

In addition to saving 5%, the Target REDcard™ Credit Card™ offers free shipping for most of the items found on target.com. You can also get an extra 30 days for returns.

A Note on the Target Credit Card Breach

It is important to note that there has been a pretty large Target credit card breach in the past. This may be a factor in considering whether or not you want to use the Target REDcard™ Credit Card™ in the future.

In late 2013, around 40 million customers who used their credit or debit cards at Target locations in the United States had their personal information exposed in a cyber attack. Then, in early 2014, Target reported that 70 million more customers had been included in this Target credit card breach.

While this may not have a direct affect on choosing the Target Red credit card, it is important to know that a huge attack like the Target credit card breach was successfully executed within the Target system.

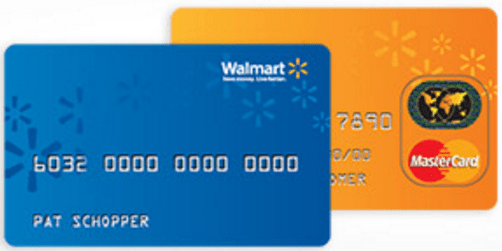

Walmart Card Review

Finally, here is a review of the Walmart® MasterCard® which is offered by Synchrony Bank. This card is the most similar to the Amazon card, but there are some important and significant differences.

Image Source: Walmart

This chip-enabled card from Walmart has a slightly higher APR range than the Amazon card, making it a worse choice for those who frequently carry a balance from month to month. However, there is also no annual fee.

The Walmart Card Rewards System

- Earn 3% back on walmart.com purchases

- Earn 2% back on gas from Murphy USA or Walmart gas

- Earn 1% back at Walmart and anywhere else the Walmart card is accepted

- Earn a $10 bonus eGift card on your first Walmart Pay purchase

The rewards you earn from this credit card are given to you as a credit to your statement.

Related: Top Best Credit Cards for Students with No Credit or Bad, Poor or No Credit History

The Amazon Rewards Visa Card vs. Walmart® MasterCard® vs. Target REDcard™ Credit Card™

Now that we have broken down the basics of each store credit card, let us begin to compare some of the highlight features:

- The Amazon card and Walmart card each have a similar rewards structure, but the amazon.com credit card wins on the 2% category. The Amazon Rewards Visa Card gives 2% back for all gas stations, restaurants, and drugstores unlike the Walmart® MasterCard® that only gives 2% back on two particular gas stations.

- Another important note about the Walmart card is that it only gives 3% back on walmart.com purchases. If you shop Walmart online, this will benefit you. However, if you only shop at the Walmart store, it gives 1% back, just like the amazon.com credit card will give you.

- The Target REDcard™ Credit Card™ has a very different rewards system than our Amazon rewards Visa card. Not only does the Target Red credit card not offer rewards for other purchases, it does not actually offer you anything back at all. Instead, this is a discount card.

- The Amazon store credit card offers the highest bonus offer with its $50 intro gift card that you can use as soon as you are approved. Since those with fair credit can still be approved for this Amazon card (though they will have a higher APR), more people can benefit from this Amazon.com credit card bonus.

What Do Online Reviewers Say About These Cards?

Here, we will take a look at what online reviewers are saying about the Amazon Rewards Visa Card. Then we will show you some reviews for the other two cards as well. Comparing the public’s response can be a great way to gain insight.

Amazon.com Credit Card

- 4 out of 5 stars on WalletHub

Target REDcard™ Credit Card™

- 4 out of 5 stars on WalletHub

Walmart® MasterCard®

- 3.5 out of 5 stars on WalletHub

The Amazon card is a clear winner when it comes to reviews. Though the Amazon.com credit card is only slightly above the Target Red credit card on Credit Karma, it is significantly above Walmart’s credit card.

Popular Article: Top Best Canadian Credit Cards | Ranking | Best Canadian Rewards and Low Interest Credit Cards

Is the Amazon Rewards Visa Card Right for You?

Also, the Amazon card offers many more rewards than the Target REDcard™ Credit Card™. Choose this Target store credit card only if you shop at Target frequently and want that 5% discount.

The Amazon store credit card may be for you if:

- You frequently shop at amazon.com

- You want a credit card option that gives you higher rewards on other purchases, like restaurants and drugstores

- You have a good credit score but may need to carry a balance from month to month. In this scenario, you can get the lowest APR rate out of any of the other cards

- You want flexibility in how to use your rewards

However, if any of the concepts below apply to you, you may be better off going with Walmart or Target REDcard™ Credit Card™:

- You frequently shop at walmart.com or at target.com/a Target store more than you do at amazon.com

- The Target REDcard™ Credit Card™ will be ideal for those who want immediate discounts instead of cash back later on

- The Target REDcard™ Credit Card™ is also the only card that offers high discounts for in-store locations. If you prefer to shop in-store, this will be the ideal card for you.

Conclusion: Choosing the Amazon.com Credit Card

We have now given you reviews of the Amazon card, Target store credit card, and Walmart card. We have compared each so you can see the pros and cons; by doing so you can best decide if the amazon.com credit card is right for you.

If you have chosen to make the Amazon Rewards Visa Card your credit card after reading our Amazon Rewards Visa Card review, you can now begin your big savings when it comes to not only amazon.com purchases but many other common purchases too.

If you are still torn between cards, keep in mind that the Amazon credit card offers 1% back on all purchases whereas Walmart only offers 1% at Walmart/Walmart card-accepted stores and Target does not offer any points system. You can apply for the Amazon card through this online link and see if you are approved today.

Read More: Top Best Travel Credit Card Offers | Ranking | Best Credit Cards For Travel (Reviews)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.