AML Enhanced Due Diligence Checklist (Escalation Procedures)

Below is a checklist of “high-risk client escalation procedures” and enhanced due diligence activities that are normally performed by AML or Compliance officers as part of the AML KYC EDD phase.

Financial firms are required by regulators to implement well-defined processes and checks that reduce money laundering activities.

Please note that there is no industry standard EDD checklist or escalation procedure. Firms generally develop EDD or CDD checklists as per their internal processes and procedures, which are based on their specific customer type, type of financial products offered, and geographic location.

The following list has been developed to reflect the common activities and steps used across major financial services firms.

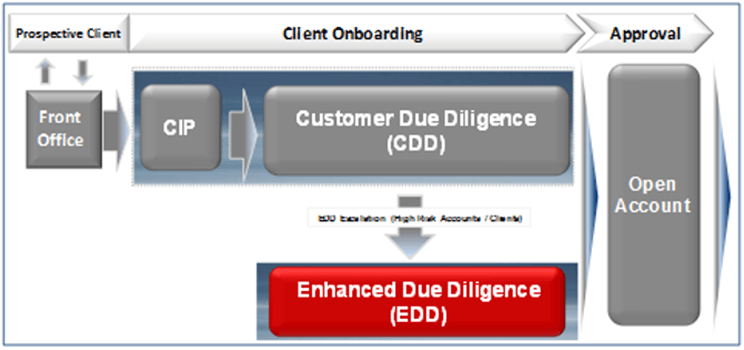

Escalation and EDD Procedures and Processes

Image Source: AML Onboarding Process

KYC Enhanced Due Diligence Checklist

# | Activity / Task | Status | Owner | Completed? |

| Client is identified as a high money laundering risk. | ||||

| The staff performing the normal due diligence escalates the case to his or her supervisor for further validation. | ||||

| The staff’s supervisor reviews the case and validates the high risk status or disapproves. | ||||

| In a situation when the manager disapproves a high risk status, supporting evidence and reasoning are documented and the client is downgraded to a low, normal, or medium risk status. | ||||

| For validated true high risk cases, the client case is escalated to the firm’s Chief AML Officer. | ||||

| The escalation is executed using an Escalation Form. | ||||

| The Escalation form is accompanied by the client’s information and documentation. | ||||

| The Chief AML Officer, staff, or designee reviews the Escalation Form, the client data, and any attached documentation. | ||||

| If needed, the Chief AML Officer, staff, or designee makes a request for additional information. | ||||

| The Chief AML Officer or designee then conducts further investigation. | ||||

| Upon completion of the enhanced investigation, the Chief AML Manager or designee provides a recommendation (i.e., the firm should terminate the relationship or the firm should accept the client as a customer). | ||||

| If the recommendation is to accept the client, there is normally an accompanying monitoring plan for the firm to implement. Monitoring plans are essential to helping the firm reduce its overall money laundering risk. |

|

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.