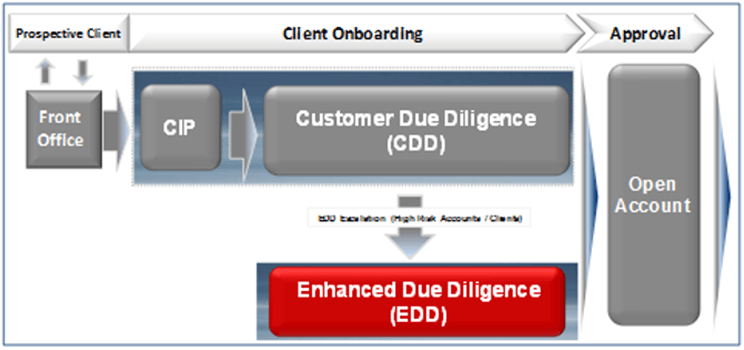

AML Enhanced Due Diligence Process Flow

The AML Onboarding process for new clients begins with the Customer Identification Program (CIP).

CIP involves collecting and validating the client’s information and is followed by CDD, which involves assessing the client to determine a low, medium, or high risk AML rating.

In cases where a client is deemed to pose a high risk, the case is escalated to the Chief AML Officer or designee in a process known as Enhanced Due Diligence.

AML Onboarding Process

EDD Processes and Procedures for High Risk Customers (Non-OFAC Matches)

In general, processes and procedures for EDD (non-OFAC positive matches) are as presented below. Click here for procedures on Positive OFAC Matches.

- Client is identified as a high money laundering risk.

- The staff performing the normal due diligence escalates the case to a supervisor for further validation.

- The supervisor/manager reviews the case and validates the high risk status or disapproves.

- If the manager disapproves a high risk status, supporting evidence and reasoning are documented and the client is downgraded to a low, normal, or medium risk status.

- In a situation of a validated, true high risk case, the client case is escalated to the firm’s Chief AML Officer using an “Escalation Form.”

- The Escalation form is normally accompanied by supporting client documentation.

- The Chief AML Officer, staff, or designee reviews the Escalation Form and any attached documentation.

- If needed, the Chief AML Officer, staff, or designee will make a request for additional information.

- The Chief AML Officer, staff or designee then conducts further investigation (i.e., reviews the account’s beneficial owners or conducts external non-documentary investigations).

- Upon completion of the enhanced investigation, the Chief AML Officer, staff, or designee provides a recommendation (to terminate the relationship or accept the client).

- If the recommendation is to accept the client, there is normally an accompanying monitoring plan for the firm to implement in order to reduce its overall money laundering risk.

See Also:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.