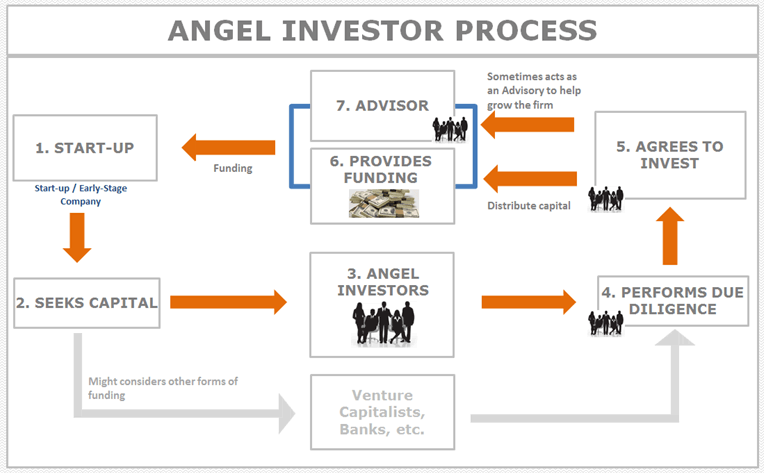

What is an Angel Investor? Definition and Overview of the Investing Process

Image source: AdvisoryHQ

An angel investor is an individual who invests his or her own money in a start-up or early-stage company.

The typical angel investor has a net worth of at least $1 million, and a high degree of entrepreneurial experience.

An unexperienced but affluent friend or family member who invests in a startup company is also considered an angel investor.

Professional or accredited angel investors sometimes form angel investor groups, pooling their capital and connections to drive a company.

Benefits of Getting Capital from an Angel Investor

While an angel investor typically provides capital in exchange for equity in the company, her or she will often agree to terms that are more friendly to the company.

Unlike venture capitalists whose sole motive is maximizing profit through an IPO or acquisition, the angel investor is often a personal friend or family member of someone involved in the company, or simply believes in the company’s vision and social purpose.

Image source: Pixabay

Since this type of investment typically carries more risk and a lower potential return, the majority of an angel investor’s portfolio is usually comprised of lower-risk, higher-return investments.

Recent studies have shown that a typical angel investor will invest in the following types of companies more readily: internet, healthcare, telecommunications, energy, and electronics. Silicon Valley in Northern California attracts more angel investors than any other geographical area.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.