Intro – Anheuser-Busch Employees Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in Cincinnati & Columbus, Ohio, a list that included Anheuser-Busch Employees Credit Union.

Below we have highlighted some of the many reasons Anheuser-Busch Employees Credit Union was selected as one of the best credit unions in Cincinnati & Columbus, Ohio.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Anheuser-Busch Employees Credit Union (ABECU) Review

Anheuser-Busch Employees’ Credit Union (ABECU) is based in St. Louis, Missouri, but maintains locations in Ohio, including in Columbus. In 2015, this Columbus credit union had 31% growth in assets under management, and credit union revenue growth of 63% over the previous year. This credit union has also been named as one of the best places to work by the St. Louis Post-Dispatch.

ABECU has more than 120,000 members, $1.5 billion in assets, and 30 branch offices located around the country. ABECU works from the premise of assisting members with their financial needs and goals, while building relationships, sustaining those relationships, and supporting the communities served.

Image Source: Anheuser-Busch Employees’ Credit Union (ABECU)

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Anheuser-Busch Employees Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

ABECU Review: First-Time Homebuyers

Buying a home can be stressful and difficult to navigate for anyone, but this is especially true for first-time buyers. ABECU is not just a lender of mortgages offered at excellent rates and with desirable terms; this Columbus credit union also focuses heavily on the needs of first-time homebuyers.

For example, you can find information and guides online that explain the process of buying a home and obtaining a mortgage.

ABECU is a complete mortgage lending solution, and members can even begin the application process online, log in to finish an application at a later time, or check the status of an application that’s already been submitted.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

ABECU Review: Member Merits

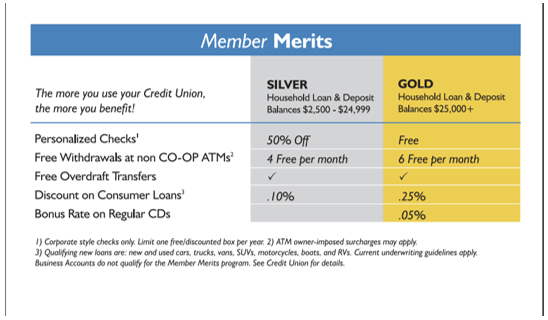

This credit union in Columbus, Ohio, offers a program called “Member Merits.” Member Merits gives members an even greater level of benefits over what’s part of their general credit union involvement. This program is a package of complimentary services, discounts, and benefits.

Member Merits is offered to members with household loan and deposit balances of at least $2,500.

Silver Member Merits participants receive discounts on personalized checks, four free withdrawals at non-CO-OP ATMs every month, free overdraft transfers and a 0.10% discount on consumer loans. Gold members receive six free withdrawals at non-CO-OP ATMs every month, as well as a higher discount on consumer loans and a bonus rate on regular CDs.

Image Source: ABECU

ABECU Review: Purchase Rewards

Purchase Rewards is a free program available to members of this Columbus credit union that gives the opportunity to earn cash back on qualifying purchases made with an ABECU Visa debit card.

Also, if you’re a checking account holder at the credit union and have an active online or mobile account, Purchase Rewards opportunities are automatically presented to you. As a member participating in this program, all you need to do is activate the offers that you’re interested in.

Once you click to activate exclusive cash back offers at the places you shop, you can then make purchases online or in stores, redeeming your offers by paying with your card. Cash back is deposited directly into your account at the end of every month, and there is no limit to the cash back you can earn.

ABECU Review: Business Banking

For members who want the convenience and advantages of combining their personal and business finances at one institution, ABECU offers this opportunity. This Columbus credit union features a full line-up of business services and products, in addition to personal banking.

Some of these business services include:

- Working capital and equipment financing

- Business savings and investments

- Commercial real estate loans

- Business checking

- Business Premium Platinum Visa

In addition to the above Anheuser-Busch Employees Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top rated banking firms & credit unions:

Top Rated Banks

Top Banking Firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.