Overview: How to Apply for FHA Loan

Learning how to apply for an FHA loan is an incredibly important part of ensuring that you receive everything you are entitled to. Without an FHA loan, you could be missing out. But what exactly is an FHA loan, and why would you need one?

What Is an FHA Loan?

Before you apply for an FHA loan, you need to know what it is and what it does. An FHA (Federal Housing Administration) loan is a specific type of mortgage that is backed up by the FHA. This means that, should the borrower default on the loan, the lender is covered. For this reason, many banks and mortgage lenders are happy to accept applications from people using the FHA.

FHA loans were created during the Great Depression (1929–1932). At that time, so many people had difficulties in applying for a standard mortgage that the government subsidized another way: it became possible to apply for an FHA loan. As time went on, the government took a back seat and private companies took over, although the initial idea behind this kind of mortgage is still the same – it allows people who would otherwise not be able to buy a home to purchase one.

Image Source: Pixabay.com

There are some important considerations to take into account before you apply for an FHA loan. You should not rush into this kind of financial commitment. It can become exciting once you know how to apply for an FHA loan; however, do your homework first.

Although FHA loans have many advantages over standard mortgages (they have a lower interest rate, a lower down payment, and they are easier to obtain), there are downsides as well. The main one is the additional insurance premiums you will need to pay. In some cases, these can be very high and can cancel out any savings you might have made with the smaller deposit.

You also need to be sure that you can afford the mortgage repayments. If a lender determines that your current monthly outgoings are too high a percentage of your net salary, then you will most likely be turned down when you apply for an FHA home loan. The mortgage repayments added to the insurance premiums must come to less than 31% of your income.

See Also: Should I Payoff My Mortgage Early? Prepayment Penalty Definition!

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Do You Qualify?

Applying for an FHA loan may sound like a dream come true for many, especially as they have less stringent entry requirements, but not everyone is eligible. If you do not meet the requirements, you won’t be able to apply for an FHA loan at all, so make sure you meet the necessary requirements before beginning the application process.

In order to apply for an FHA mortgage, the potential borrower must have been working for at least two years – and that’s working in a job where the monthly or annual salary has either remained the same or increased. Ad hoc work, freelancing, and being self-employed– these are all potential problems when you apply for an FHA loan, no matter how much you actually earn. However, it is important to note that, in certain situations, you may still be considered for the loan, although this is rare.

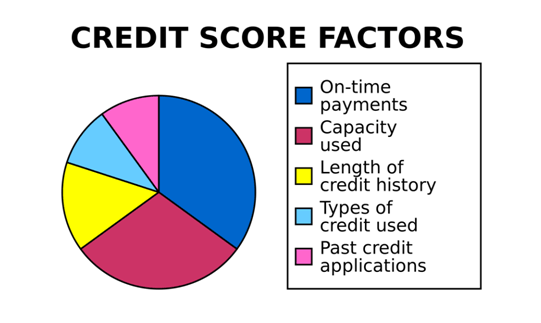

Next, you must have a good credit score. In order to apply for an FHA home loan, your credit score must be at least 620 and preferably more.

Image Source: Credit Score Factors

Applying for the FHA loan means that the home you are buying must be the one in which you will live. You can’t, for example, apply for an FHA loan to buy a property you intend to rent out to someone else. Neither can you apply for an FHA loan if you intend to sell the property on without having lived in it.

Finally, knowing how to apply for an FHA loan won’t help you unless you also have the down payment. The amount will vary, but, on average, it is 3.5% of the total cost of the house. Remember, buying a property without applying for an FHA loan could mean a down payment of up to 20%, so the FHA is a good option if you are eligible.

In summary, when applying for an FHA loan, you must:

- Have been in steady, full-time employment for at least two years

- Have a credit score of at least 620

- Have not made more than two late payments in two years

- Have not been made bankrupt

- Have not foreclosed

- Have a down payment ready

Don’t Miss: Stearns Lending Reviews – What You Want to Know (Home Loans, Complaints & Mortgage Reviews)

How to Apply for an FHA Loan

Once you determine that you meet the eligibility requirements, you need to know how to apply for an FHA loan. The first thing to do is set up a meeting with a FHA mortgage lender specialist. Not all mortgage lenders are authorized to deal with FHA applications, so research is important. When you are looking at where to apply for an FHA home loan, you can discover which lenders are FHA approved by looking online.

You will also need to ensure you have budgeted for your mortgage insurance before you apply for an FHA loan. Mortgage insurance is compulsory when borrowing on the FHA scheme since the loan is a much riskier one for the lender.

Part of knowing how to apply for an FHA home loan is about ensuring you are prepared for the application process. You will need to provide certain documents to prove you can pay the loan back and that you are eligible in the first place. There is a lot of paperwork involved. It is, therefore, key to find everything before you apply. So, when meeting with your potential lender, or when you apply for an FHA loan online, you will need:

- Proof that you are employed – employer’s details

- Proof that you have been in a job for at least two years

- Proof of earnings

- Income tax forms for the past two years

- Information regarding your savings and investments

- Details about any credit you have taken out (i.e., loans or credit cards)

- Personal information (including addresses for at least the last two years and perhaps more)

- W2 forms dating back at least two years

Once you have given all of these documents to the lender, you may be pre-approved for the loan. This doesn’t mean that you will get it. It does, however, mean that you will know how much you could borrow and how much it would cost you to pay it back.

Related: Best Banks for Mortgages – A Complete Guide (Best Mortgage Rates & Reviews)

Image Source: BigStock

The Application

There are two main ways to complete an application to apply for an FHA loan. The first is in-person with a potential lender, and the second is online. If you wish to apply for an FHA loan online, then you will need to be able to upload the required documents when they are called for. After you have learned how to apply for an FHA loan, you can decide what is best for you.

One important piece of advice: even if it is tempting to “bend the truth” a little in order to obtain the amount of credit you want or need, lying on an FHA application is a federal offense.

Property Appraisal

The property you want to buy will need to be assessed on behalf of your lender. Bear in mind that, even if you have been approved in general when you apply for an FHA loan, you could still be turned down at the end. Once the property has been appraised, the assessor will report back to the lender and give his/her findings. There are specific guidelines about the condition of the property that must be adhered to before a loan application will be fully accepted. These include:

- Determining the current market value to ensure that the loan is not too high

- A visual inspection of the property (interior and exterior)

- A comparison with similar properties for sale

- A check of the property’s health and safety requirements

Assuming the lender is happy with the report, you will be able to sign the relevant papers and obtain your FHA loan to purchase your property.

There will be costs to pay when you sign your loan documents. Some of these can be added to the monthly charge, and others will need to be paid up front. Speak to your mortgage lender to obtain a breakdown of all pending charges so that you can ensure you have the money to finalize the mortgage loan documents.

We hope that this article has provided all the relevant information regarding what an FHA loan is and how to apply for an FHA loan. Whether to apply for the loan or not is up to you; however, you should now be able to make a well-informed decision with confidence.

Popular Article: Top Mortgage Lenders – List of US Largest Mortgage Lenders (Reviews)

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.