Meet the New Kid in Town (Aspiration Investments Review)

Word has gotten out about an investment firm that has been growing exponentially since its inception. Aspiration investments has received praise from around the financial community for its ingenious practices and values.

We have asked ourselves: who exactly, then, is Aspiration investments, and what makes them different from other investment firms? We’ve examined multiple Aspiration investment reviews as well as the products and services they offer to deliver the inside scoop straight to you.

Image Source: Aspiration

About Aspiration Investments

Aspiration investments is an online investing platform that is revolutionizing the investment strategies made available to the middle class. Aspiration investments is committed to giving and is built on trust.

In 2014, Fox Business highlighted Aspiration as “a new investment firm that is shaking things up on Wall Street.” That same year, Yahoo News reported in an Aspiration review that the company is doing “to Wall Street investment houses what Uber is doing to the taxi industry or what Travelocity and Priceline did to travel agents.”

Aspiration investing follows an unprecedented model that is changing the way middle class investors and investing firms partner together.

Customers can invest in Aspiration’s securities portfolio with a minimum investment of only $500, making it the first investment firm crafted with the middle class person in mind.

What has most rattled the world of Wall Street about the rise of the Aspiration investment firm is its fee structure. Time magazine said in an Aspiration review, “What makes Aspiration truly unique—unheard of, in fact—is its fee structure.”

See Also: Vanguard vs. Charles Schwab –Ranking & Comparison (Schwab Competitors)

Stand-Out Structure and Values

Aspiration’s fee structure allows the customer to decide what is fair as a payment fee, anywhere between 0-2 percent of their investment. This unique feature stems from the fact that Aspiration is an investment firm built around shared values and trust, whereas the world of investing is usually built on profit at the expense of customers and an “every man for himself” mentality.

Additionally, Aspiration investments are conducted with the values of transparency and honesty in mind.

The company’s practice of open, honest business dealings marks a sharp contrast with other investment firms in the financial services industry — groups accustomed to hiding fees in the fine print or contributing to the growth of corrupt organizations.

Aspiration’s tremendous growth in the past two years highlights a demand in the market for the sort of financial services they offer, or as they say themselves: “Investing. With a conscience.”

Image Source: Aspiration

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Multi-Millionaire Treatment (Aspiration Investments Review)

Wired.com offered its take in an Aspiration review on how this investment startup is meeting a current need in the market: “The wealth gap in America is an ever-expanding void. The rich are getting richer, and the middle class is all but fading away. There are infinite reasons for this inequality, but one of them, says Andrei Cherny, [co-founder of Aspiration], is the way the financial services industry operates.”

When investing at Aspiration as a small investor, you are given the same investment privileges that in the past were limited to the extremely wealthy.

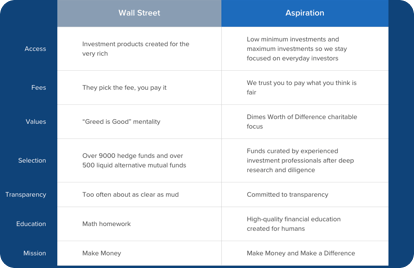

Just to put this in perspective, here’s a quick comparison of typical Wall Street practices (usually reserved for the 1%) and Aspiration’s investment services (available to the common person):

Image Source: The New York Times

As The New York Times pointed out in an Aspiration investments review, Aspiration is helping “middle class Americans by upending the customary fee structure of traditional brokerage firms and money managers.”

Aspiration Reviews: Commitment to Positive Change

Image Source: Aspiration

When they aren’t helping themselves by helping the middle class, Aspiration investments does not compromise true charity or making a difference.

Business Insider’s Aspiration investing review noted that, “Aspiration — whose motto is ‘Do Well. Do Good.’ — is focused on giving back to the community.”

Because of the value they place on paying it forward, Aspiration investments has incorporated into their policy a commitment called “Dimes Worth of Difference.”

For every dollar of Aspiration’s revenue, they donate ten cents to charitable activities that expand economic opportunity to others across the United States. Working with respected partners such as Accion U.S. Network, the largest provider of micro-loans in America, The Aspiration Opportunity Fund offers transformational opportunities to our fellow Americans who are struggling.

Image Source: Aspiration Opportunity Fund

A micro-loan may not sound like much—around $5,000 perhaps on average. However, to put this in perspective, a single micro-loan equals 4.8 jobs supported in their creation or retention by small businesses enrolled in the program.

And this is only part of what Aspiration investments contributes to. The money invested and earned by this unique company generates revenue and makes a difference both in local communities and around the world.

As a customer with Aspiration investments, you can play a part in eradicating poverty. You can provide people with clean water, an education, and access to better health care. Funds at Aspiration also help in the fight for human rights and help heal the planet through investments in environmental preservation.

Don’t Miss: Credit One Bank Reviews – Scam or Legit? All You Need to Know (Credit One Credit Card Reviews)

Decoding the Language of the Financial Services Industry

As Aspiration was developed with the common person in mind, the company provides great educational insight to their customers that deconstructs some of the confusing terminology and jargon that’s usually thrown around in the investment world.

GOOD magazine said in an Aspiration investing review that the online platform provides “a friendlier approach to financial literacy.”

Aspiration investments offers a thorough and clear explanation of everything you need to know about investments and financial planning on their website:

- Elite investments

- Sustainable investments

- Volatility

- Banking

- Retirement

If you still have questions that aren’t answered in the extensive Q&A portion of their website, Aspiration is regularly available for contact through Customer Support.

Related: LendingTree Reviews (What Is Lending Tree? Is it a Scam? Complaints, Pros & Cons)

What are Aspiration’s Products?

So, you’ve bought into the vision of Aspiration investments. What’s your next move to become a part of this unique mission? Let’s look at some of the products and services that Aspiration has to offer:

Image Source: Aspiration’s Redwood Fund

Redwood Fund

The first option you could choose is investment in the Redwood Fund. This is an example of sustainable investing, which is an investment discipline that considers multiple environmental, social, and governance (ESG) factors in searching for partnering companies.

This helps Aspiration find companies with management that understands the importance of smart, long-term administration — not just because it’s environmentally responsible, but because it’s more financially beneficial, too.

Customers who value smart, low-cost investing that makes this planet a better home for everyone would do well to choose to invest in Aspiration’s Redwood Fund.

Image Source: Aspiration’s Flagship Fund

Flagship Fund

Aspiration’s Flagship Fund is a long-term investment that provides returns buffered from the volatility of the stock market. The distancing from the roller coaster that is the U.S. stock market helps customers reach their goals for themselves and their families:

- College savings

- Home ownership

- Retirement

Vacation/Entertainment

Aspiration investments carefully selected from over 9,300 the best of the best mutual funds and exchange traded funds to create the Flagship Fund. Aspiration focused particularly on those funds with a long-standing history of withstanding the ebb and flow of the market.

It’s difficult to find the right mix of funds in which to invest, but Aspiration reviews mark their selections as well-returning.

Part of the job of the fund managers include:

- Monitoring the Fund’s performance on a daily basis

- Making adjustments to the Fund as needed

Holding regular conversations, mostly face-to-face, with various fund managers to check if they are holding true to their mission and values

Image Source: Aspiration’s Summit Account

Aspiration Reviews: Summit Account

Beyond investing in Aspiration’s funds, customers could also consider opening a Summit Account.

According to Time magazine, Aspiration investments’ Summit Account is the “best checking account in America.” You don’t need an Aspiration investment account to get access to this wonderful resource.

Aspiration Summit offers up to 100 times the interest rate provided on checking accounts at big banks. They’re upfront about their fees; just like with their investment funds, Aspiration doesn’t surprise their customers.

Some of the highlights of opening a Summit Account include:

- No minimum monthly balance required

- No monthly service fees

- No minimum monthly deposit needed

- No ATM fees regardless if U.S. or overseas

- FDIC insured up to at least $250,000 per depositor

Aspiration Reviews: Privacy and Security

Aspiration investing is proven to be dedicated to their customers’ security and privacy. Some customers may have qualms about the safety of such valuable personal information being put online.

However, if you have any concerns over the platform being online, you can rest assured when you learn that the site has bank-level security with 256-bit encryption that’s monitored 24/7, guaranteeing security of all data that passes through the site.

Furthermore, Aspiration investments’ Privacy Policy guarantees privacy of customer information. Your personal information will never be sold or given to a third party.

Who can apply to Aspiration Investments?

Aspiration investment funds require a minimum $500 to begin investing.

For the Summit checking account, any U.S. citizen or Lawful Permanent Resident over the age of 18 with a Social Security number, permanent address, and at least $10 can open an account.

Overall Summary: Aspiration Investment Review

If you desire both to invest well and to make a difference, Aspiration investments is the perfect choice for you! Multiple Aspiration investing reviews confirm that Aspiration is a company that will educate you as a customer, maintain transparency, bring about positive change, and give you good returns on your investments.

Aspiration’s online platform is straightforward and user-friendly, with tips guiding you along the process of investing in a new fund or checking on an existing one.

And if anything about the straightforward online platform still leaves you with some questions or confusion, Aspiration investments strives to provide assistance as soon as you need it.

Whether you decide to check out Aspiration investments’ Redwood Fund or Flagship Fund, or if you want to open one of Aspiration’s Summit Checking Accounts, you can rest assured knowing that you’re entering into a business relationship that’s built on trust and integrity.

In the world of the financial services industry, that’s a pretty rare find — and one that is well worth the investment.

Popular Article: Sage Reviews – Get All The Facts You Need! (Sage 50 Payroll & Sage One Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.